Movve Wallet Review: Dubai MLM crypto Ponzi

Movve Wallet operates in the MLM cryptocurrency niche.

Movve Wallet operates in the MLM cryptocurrency niche.

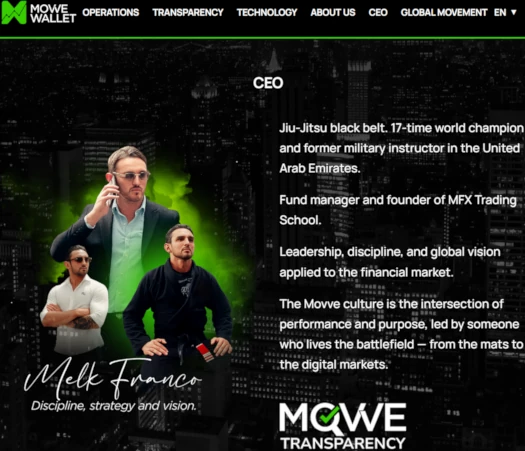

The company is headed up by CEO Melk Franco:

Franco has a martial arts history but at some point reinvented himself as a forex bro.

As per Franco’s Movve Wallet corporate bio, he’s also the “found manager and founder” of MFX Trading School.

MFX Trading School was a Dubai-based trading scheme targeting Portuguese speakers:

Operating from the now-defunct domain “mfxcorporation.com”, MFX Trading School appears to have completely flopped following its 2019 COVID-19 era launch.

MFX Trading School’s Instagram profile was the last social media account to be abandoned in January 2023.

Movve Wallet’s website domain (“movvewallet.com”), was privately registered on August 9th, 2025.

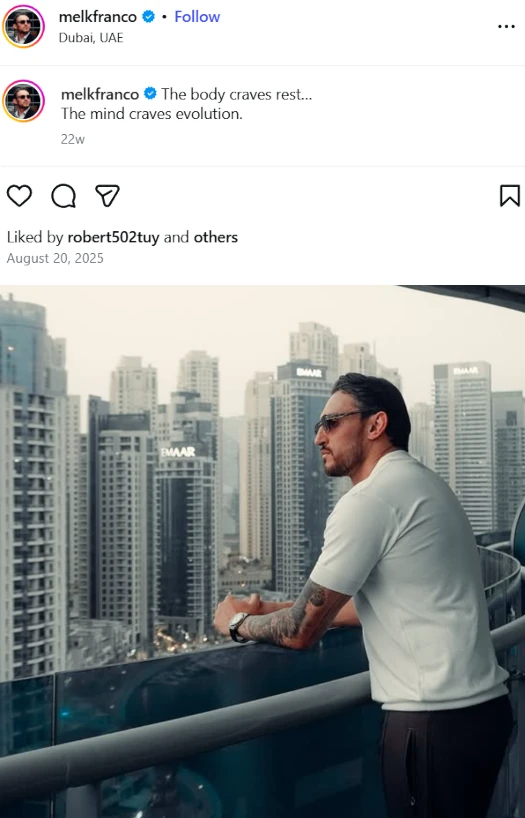

Based on his own social media posts, Franco himself appears to still be based out of Dubai:

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Movve Wallet, read on for a full review.

Movve Wallet’s Products

Movve Wallet has no retailable products or services.

Promoters are only able to market Movve Wallet promoter membership itself.

Movve Wallet’s Compensation Plan

Movve Wallet promoters invest a $35 minimum amount in cryptocurrency.

This is done on the promise of a Monday through Friday daily passive return of up to 1.5% a day.

Movve Wallet returns are capped at 300%. This cap includes the original invested amount and MLM related commissions and bonuses.

Once the 300% ROI cap is reached, reinvestment is required to continue earning.

Note Movve Wallet charges a 7% fee on all withdrawals. Movve Wallet discourages ROI withdrawal by offering a 7% a month rollover “savings account”, into which ROI payments can be deposited.

The MLM side of Movve Wallet pays on recruitment of promoter investors.

Referral Commissions

Movve Wallet pays a 7% referral commission on cryptocurrency invested by personally recruited promoters.

Residual Commissions

Movve Wallet pays referral commissions via a binary compensation structure.

A binary compensation structure places a promoter at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of promoters. Note there is no limit to how deep a binary team can grow.

At the end of each day Movve Wallet tallies up new investment volume on both sides of the binary team.

Residual commissions are paid as 7% of new investment generated on the weaker binary team side.

Once paid out on, investment volume is matched against the stronger binary team side and flushed. Leftover volume carries over.

Note that to qualify for residual commissions, a Movve Wallet promoter must maintain an active $100 minimum investment and recruit two promoters who also have an active $100 minimum investment (placed one on both sides of the binary team).

Joining Movve Wallet

Movve Wallet promoter membership is free.

Full participation in the attached income opportunity requires a minimum $100 investment in cryptocurrency.

Movve Wallet does not specify which cryptocurrencies is solicits investment in.

Movve Wallet

Movve Wallet presents a typical AI trading bot ruse:

Our machine learning-powered bot analyzes patterns, continuously learns, and executes orders with precision in the Forex, Cryptocurrency, and Indices markets.

Despite only existing for around six months, on its website Movve Wallet falsely claims it has “2 years of consistency and profitability”.

No verifiable evidence of Movve Wallet generating ROI revenue from any external revenue source is provided.

Furthermore, Movve Wallet’s business model fails the Ponzi logic test.

If Melk Franco actually had an AI trading bot capable of legitimately generating up to 1.5% a day on a consistent basis, what does he need your money for?

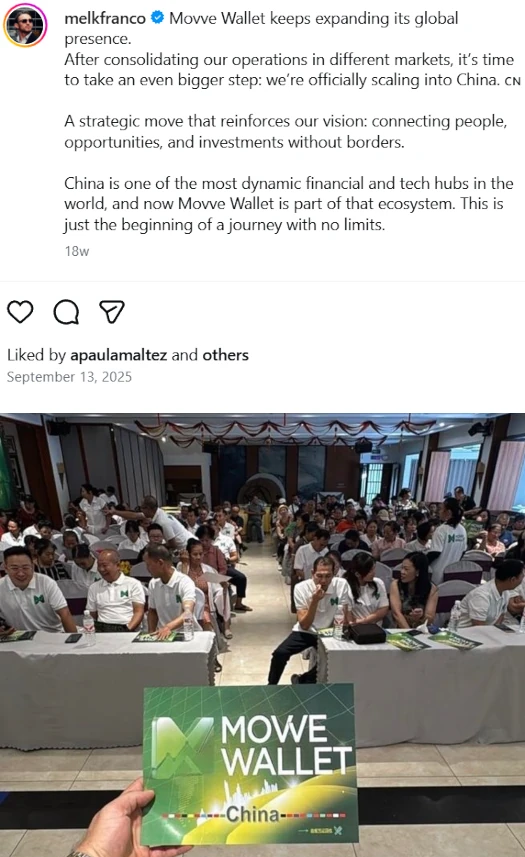

Additional Movve Wallet red flags include promotional efforts in China and Sann Rodrigues.

Recent social media posts from Melk Franco suggest Movve Wallet is targeting China:

Securities and commodities fraud aside, MLM is outright illegal in China without a license. Movve Wallet fails to provide evidence it has obtained a license to operate from Chinese authorities.

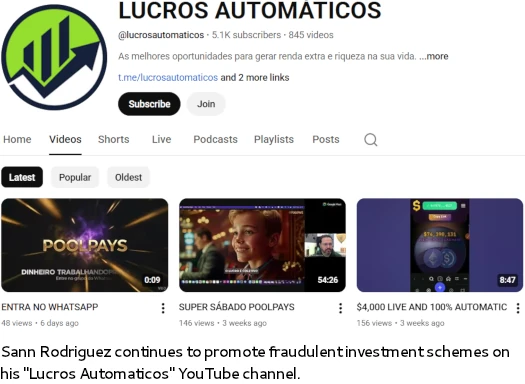

Sanderley Rodrigues de Vasconcelos, better known as Sann Rodrigues, is a serial fraudster.

Rodrigues is best-known in the MLM industry as a top net-winner in the $3.6 billion TelexFree Ponzi scheme.

Rodrigues wasn’t criminally charged in the US but did settle with the SEC for $1.7 million in 2017. Rodrigues was criminally charged in Brazil but is believed to have fled the country for Portugal.

BehindMLM last came across Rodrigues in 2022, as a promoter of the collapsed Binaxx MLM crypto Ponzi.

As it stands, the only verifiable source of revenue entering Movve Wallet is new investment.

Using new investment to pay ROI withdrawals would make Movve Wallet a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve Movve Wallet of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.