ArbiStar Review: Trading bot Ponzi scheme run by serial scammer

ArbiStar operate in the cryptocurrency MLM niche. The company is headed up by CEO Santi Fuentes, who is based out of Spain.

ArbiStar operate in the cryptocurrency MLM niche. The company is headed up by CEO Santi Fuentes, who is based out of Spain.

In his ArbiStar corporate bio, Fuentes claims to be

one of the most experienced people in the world of Referral Marketing.

He has led teams of thousands of people with great success.

Fuentes (right) first popped up on BehindMLM’s radar in 2014, as a top investor in Global Unity.

Fuentes (right) first popped up on BehindMLM’s radar in 2014, as a top investor in Global Unity.

Global Unity was a scam tied to the WCM777 Ponzi scheme.

In 2015 Fuentes emerged as a top investor in MoneyBox TV, another Ponzi scheme.

Fuentes’ Arbistar corporate bio addresses his involvement in fraudulent investment schemes;

He has also known as team leader the failure of some projects where companies were not transparent and cheated their sales teams.

For this reason he is the ideal person to lead Arbistar 2.0.

Prior to getting involved in Ponzi schemes, Fuentes was an Organo Gold distributor.

A marketing video circa 2013 cites Fuentes as an Organo Gold Ruby.

Of note is the current iteration of ArbiStar appears to be a reboot. This is denoted by the “2.0” added to the company logo.

It seems the first ArbiStar model collapsed, although I wasn’t able to find specific details.

Read on for a full review of the ArbiStar MLM opportunity.

ArbiStar Products

ArbiStar has no retailable products or services, with affiliates only able to market ArbiStar affiliate membership itself.

The ArbiStar Compensation Plan

ArbiStar affiliates invest €100 to €50,000 EUR in bitcoin on the promise of an advertised weekly ROI.

ArbiStar affiliates can also invest €5000 EUR in a “personal bot” product, which is also commissionable.

Referral Commissions

ArbiStar pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

ArbiStar caps payable unilevel team levels at ten.

A 2% referral commission is paid on returns paid to unilevel team affiliates. Another 2% is paid on unilevel team reinvestment.

A separate one-time 6% referral commission is paid on unilevel team personal bot sales.

Note that upon signing up and investing, ArbiStar affiliates are limited to five unilevel team levels.

To unlock levels six to then they must personally convince others to invest at least €30,000 EUR.

Recruitment Bonus

If an ArbiStar affiliate manages to personally convince others to invest €100,000 EUR, they are paid a €10,000 EUR recruitment bonus.

This is a recurring bonus, paid each time €100,000 in personal referral investment volume is generated.

World Club Bonus

ArbiStar sets aside 5% of company-wide investment volume and places it into the World Club Bonus.

The World Club Bonus is paid to equally to ArbiStar affiliates who’ve generated €1 million in downline investment volume (min €30,000 EUR on level 1 of the unilevel team).

Joining ArbiStar

ArbiStar affiliate membership is free.

Participation in the attached income opportunity however requires an investment of €100 to €50,000 EUR.

Note that all payments in ArbiStar (both paid and received) are made in bitcoin.

Conclusion

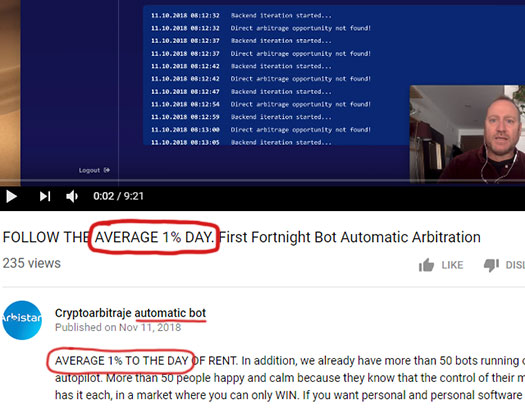

How did Santi Fuentes, someone with no verifable trading history, stumble across a trading bot that generates, in his own words, up to 1% a day?

No idea. Neither ArbiStar or Fuentes explains that.

What we do know is Fuentes’ launched ArbiStar following involvement in a series of Ponzi schemes.

And even if we give Fuentes the benefit of the doubt, ArbiStar is still committing securities and pyramid fraud.

At the time of publication Alexa estimates Italy (31%), Spain (27%) and Mexico (11%) are the top sources of traffic to ArbiStar’s website.

In Fuentes’ native Spain, securities are regulated by the National Securities Market Commission. In Italy it’s the Italian Companies and Exchange Commission and in Mexico, the National Banking and Securities Commission.

ArbiStar provides no evidence of having registered itself with either of these regulators, meaning the company is operating illegally.

Pyramid scheme commissions are also a problem, because ArbiStar neither sells nor markets anything to retail customers.

As it stands the only verifiable source of revenue entering ArbiStar is new investment.

Either Santi Fuentes woke up one day and worked out how to generate 1% a day on autopilot, or ArbiStar is a Ponzi scheme.

The former fails the Ponzi logic test.

If Fuentes had a bot that was able to legitimately generate up to 1% a day, why not run it himself and pocket 100% of the profit?

ArbiStar are selling access to the bot to anyone, so surely Fuentes would be able to deploy the bot multiple times?

That’d what, easily make him the richest person on the planet within no time?

Yet here we are, with Fuentes whoring out the golden goose for as little as €100 EUR a pop.

As with all Ponzi schemes, once affiliate recruitment dies down so too will invested funds.

This will starve ArbiStar of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of investors lose money.

Need confirmation? Hit up Fuentes about his victims in all the Ponzi schemes he previously promoted.

While you’re at it, be sure to also ask what happened to ArbiStar 1.0.

Update 15th September 2020 – ArbiStar collapsed on September 14th.

As part of his exit-scam, Santi Fuentes is dangling a sixteen-month long refund process.

Update 23rd October 2020 – Spanish authorities have arrested Santi Fuentes.

I’ve sent money to this company and I’ve tried receiving my money back 2 days later after learning about the 60 days where they lock up your bitcoin on the community bot.

They’ve refused to return my funds. Anyway to get these funds back or file a lawsuit? I’ve been duped.

B-b-b-bitcoin. Not much you can do after the fact.

Sorry for your loss.

Thank you for your warning, i actually considered to invest 5K into this system. It’s being heavily promototed online, and i got that feeling when i saw the sales page.

In addition they base it on affiliates just like every HYIP out there at the moment. I will save my money for sure..

Alex … it looks like you didn’t saw the rules and you talk without knowing how they operate.

First of all i am not sure if you ever read their rules, it clearly says before you invest that there is 60 days hold period, after that you can withdrawal your initial investment.

Arbistar 2.0 is working well i have a lot friends there and they show actual proof of the arbitrage trades.

Everyone decide for himself but in my opinion this is not like most Ponzi’s like Cloud Token , iCenter etc ..

Social media photos of random trading activity is not proof of trading revenue being used to pay affiliates.

If ArbiStar was legit they’d have registered with financial regulators and provided the legally required accounting filings.

The fact of the matter is ArbiStar is a Ponzi scheme, exactly the same as those other scams.

Your opinions and the rules of a Ponzi scheme are neither here nor there. When ArbiStar withdrawals strip new investor recruitment, it’s over.

I know Santi personally and he gave me a written agreement even before Arbistar 2.0.

When you invest in the company they charge a 1% fee of your deposit. Before having to register myself to Arbistar he was giving me a 40% monthly interest in bitcoins.

If those numbers are real it means that arbistar is earning 20% a month for each deposit plus the one time 1%.

Last but not least, it was not Santi who developed the bot, it was another guy.

You can check that on any call they are doing. The personal bot is not yet working, although it did for a short period of time.

I cannot proof it but it is your decision to trust me or not.

Anyway, I don’t really know if it is a Ponzi scheme, but it has work very well for me so far.

I hope he is not lying because I would be really disappointed.

They’re not.

Numbers on a screen != actual returns.

And what, the creator of some bullshit bot that can apparently generate 40% monthly returns just gave it to Fuentes because he’s a swell guy?

No thanks. Santi Fuentes’ history speaks for itself.

Sorry for your loss.

If the guy that created the bot has the technical knowledge to do so, he would become rich by using it himself, without getting involved in any multilevel company or whatever it is.

Also, if the bot is legit, the more people that uses it the less arbitrage opportunities it could find and profit from. So there’s no *ing way that the guy would share it!

I mean, seriously people, do you really believe this crap? Who in earth shares a machine that automatically generates a 40% monthly returns?

The ones who are involved in the “business”, I just can see two options: either you are stupid or you don’t give a shit about scamming others.

Proof? LOL!

Copy pasting logs from different exchanges is showing proof? OMG!

And they claim that you can find the logs one hour after the operation, because they don’t want other bots/traders to copy their strategy, hilarious!

An arbitrage opportunity (if there’s one) lasts seconds! One hour is the time they need to ensure that all the logs they post have logic.

Maybe you still have time to get your money back.

It’s realy sad to hear all of these accuse against arbistar but no proof for what you are puplish here.

I am with arbistar for several month as well as many of my friends since arbistar 1.0 as also mentioned why 2.0 now. I can tell you exactly why and not just post what i asume.

Arbistars developer by the way is located at Station F Paris (feel free to inform yourself) developed the software and distrubited it under his startup and thats why 1.0 changed to 2.0 as they where growing fast and every company has changes in such a process.

I would realy like to hear a updated statement of @Alex post from 24 april, i am curious to hear what he’s got to report several month later.

Even after he was unable to read and understand the terms before investing, and you have to agree that your funds will be invested minimum for 60 days before you are able to request a withdraw.

So please Alex let us know did you request your withdraw or still happy compounding and earn money like 25k happy others ???

And to Mr Oz where do you get your information from? All just asumed accuse?

Did you ever buy the software spend 5000$ and know what you are talking about,or are you just throwing dirt arround ?

And to al these rumors going arround there is no real software, guess what not just one there are FIVE for you to purchase try and then tell the world what you think and feel.

Next rumor no real company, not regeristed and so on, all wrong take action get a plane and visit the office, with real people working in it. Go ahead and call the goverment at Teneriffa and check for yourself at registro mercantil Teneriffa.

By the way i dont work for them but before i invested i did all this research, and i am tired of all the dirt being thrown without any proof just accuse made out of assumptions.

Santi got confronted with these accuses and instead of talking arround he had the balls telling the community the truth about his mistakes in the past and explained how and why previous projects failed. And who of us has not had failure with a project? Are you free of failure and ready to throw the first stone?

Now everyone can draw its own picture and decide with what you are comfortable with. Happy investing to all.

That’s not how due-diligence works. ArbiStar and its affiliates are running around making claims, the onus is on you to provide evidence to back up those claims.

As it stands it’s a fact that the only revenue entering ArbiStar is new investment. Using new investment to pay existing investors is a Ponzi model.

Prove it. Where are the financial regulator filings? Why is ArbiStar operating illegally?

From the source; ArbiStar’s own business model.

I don’t need to invest in a Ponzi scheme to confirm I’m mathematically guaranteed to lose money, any more so than I need to take a hammer to my forehead to accept it’s not good for my health.

Prove it. Where are the financial regulator filings? Why is ArbiStar operating illegally?

Shell company incorporation isn’t the same as registering a securities offering with financial regulators. Where are ArbiStar’s financial regulatory filings? Why is ArbiStar operating illegally?

Naw, you’re just a shill making excuses for a serial-scammer because you made a quick buck. Own your thievery.

Well done Oz Same accuses and again not a single proof. (Ozedit: Snip, see below)

As previously stated, all the proof you need is in ArbiStar’s compensation plan. We’ve dissected that proof in this review and, based on that proof, concluded that ArbiStar is another Ponzi scheme from a serial scammer.

Feel free to provide evidence to back up any of ArbiStar’s claims – by way of financial regulatory filings.

Oh and if you’re having trouble with English (because you’ve ignored my last comment), hire a translator.

Also let’s save some time. You complain about your comment being snipped, I tell you this isn’t a one-way rant platform and you have to actually engage with responses, and you storm off and threaten to tell Santi Fuentes about this great injustice.

Don’t care. Have a nice weekend.

How legit is it to remove post #12 all the explanations on the who is who of the arbistar structure got delete.

That is very objective. To me that is proof enaugh to trust only my own research.

I don’t read posts when I see offtopic derails. Snip and delete.

You were crapping on about proof, when there’s been plenty provided.

I mean really, ArbiStar is run by serial scammer Santi Fuentes. Does coming up with a “who is who” list change that?

As for your own research, of course that should be something you primarily trust. But, as is the case here, scammers often turn their “research” into a marketing tool.

Been a few days now and you haven’t delivered any financial reports or audited accounting. Thank you for confirming ArbiStar is a Ponzi scheme.

Best of luck with the scamming.

Now they just launched 4 more bots! They cost between 1000-2000€ and operate in the forex market.

Seems that they are also experts in forex, and quite good and fast at creating bots for a company that has only 4 employees!

They are also willing to sell 5000 personal bot licences (the main product) and become a private club without accepting new members in the future.

The licenses cost 5000€ and the money is mainly used to pay early investors.

He was involved too in the Finanzas Forex Scam, one of the biggest scams in Spain. I recommend you to search that too.

(Ozedit: derails removed)

Im into arbistar for a year , got amazing results and withdrawls , also using arbistar products and enjoy them , real products with api connecting and finding my tradings on the exchanges on real time.

so all this review is just a bs with no expiriance , it would be nice to know what is the real ponzi reason behind this site called behind mlm cuse trancperant its not.

Whether you personally steal money from people who join after you or not doesn’t change the fact that ArbiStar is a Ponzi scheme.

Got ArbiStar’s financial regulatory documents, or evidence of external revenue being used to pay returns? Yeah, didn’t think so.

Also it might be too late for school but please use some of your stolen money to buy a dictionary for next time.

Rule Nr 1

Whenever someone else gets a good cut from your money being invested into marketed as very profitable opportunity, you are tricked into an adventure where either you (most likely) and/or other people (guarantee) will lose money. It is always OBVIOUS, but not always seen (by some).

Rule Nr 2

Your stupidity (not addressing any particular person) is driven by the greed, what constitutes main ingredient for fraudsters.

There is no other reason or explanation why would otherwise intelligent person hand over its hard earned money to obvious fraudsters.

Rule Nr 3

Even if some easy and fast money may happen to some participants statistically it is never continuous or safe or at least transparent.

It is worse than gambling in its final outcome and originators truly deserve straightforward route to the jail or grave.

Arbistar is obviously illegal and criminal undertaking. It might not look so, as thief prefers not to look as the thief.

Without shadow of doubt Mr. Santi Fuentes is a thief using modern technology to steal your money. Arbistar 2.0 is money stealing tool, call it Ponzi if you wish, set up with one clear objective – TO GET YOUR MONEY.

When and how it will end up will be seen, but for sure it will collapse in pain for its investors.

It is time to inform financial authorities and legal enforcement in Spain or/and elswhere that any formal existence of incorporated Arbistar entity, providing even the slightest credibility for such fraudster, should be banned.

Thank you for these warnings. I was just about to join with €300 as I know many people have made a lot of money from Arbistar, but I think it’s too late for me.

As with any ponzi, those in at the beginning will make money. The longer it goes on, the less chance you have of getting your money back.

This is what happened to me with Mutual Real Estate Funds – I joined too late and lost 70% of my money. Longer life is NOT a guarantee for the longevity of a ponzi scheme, it’s quite the opposite.

I think I’ll stay out and keep my money. Thanks also to Alexei who posted above.

Perhaps try robbing banks, as it would solve your issue with joining a Ponzi too late. You could then dictate the timing when stealing money from others.

Grabbing old lady purses would work too, but it might take longer to acquire the same amount. Thoughts?

Well I am into arbistar 2.0 with around 310 euro and I have to say it works for me so far, and my friend where I got it from did actually cash out 7k.

I think its not a ponzi scheme like his last failures. But thats my opinion.

“I stole 7000 EUR so ArbiStar isn’t a Ponzi scheme guyz.”

Ponzi logic++

I’ve used arbistar for the past year, I’m am worried if it’s a scam but I’m doing ok out of it, nothing massive.

Everything about the website and support doesn’t fill you with confidence!

I’m happy to take my money out of you think it’s a good idea!

Not here to give personal investment advice. Still, I’m puzzled that, knowing ArbiStar is a Ponzi scheme, you have to ask…

I’ve been using Arbistar for about 8 months now, i cautiously paid in approx 100 euros worth of BTC and have made in excess of that back during that time.

The daily interest rate has dropped to approx 0.5-06% daily using the community bot, possibly to create an incentive to subscribe to paying bots. The monthly return is still 10+% which is a good return in my eyes.

I’ve not had any issue with withdrawals and the recent KYC process is now completed without any major hitch.

Given the history of the company and creators I try to keep an open mind and If it does turn out to be a ponzi then the way i see it is that i have not lost anything as i have already made more than i invested in the time I’ve been with them.

I was thinking to investing in this company but I’m glad I read this comments. I don’t field confortable to investing now.

@Gen – Good. Because G-Funk and Big Bo would still happily steal your money, because they’ve already made their money back. Ya know?

Hi guys I see that the same people who criticise most of the positive things are the same and tell the same negative opinions.

Facts: I am member of Arbistar 2.0 since 1 year.

I invested 300 EUR in it, I took out 2 times money one time 2000 euro and another time again 2000 euro.

I do have still 1 BTC on my account and end of the moment I will take out 25% of it.

It works. Proofs can be given via BTC direct/Bitpay wallet.

(Ozedit: derails removed)

See for yourself.

With regards.

Marc J. de Turck

So YES one can earn good money.

Nobody is disputing scammers such as yourself can steal people’s money through Ponzi schemes.

The issue is Arbistar is a Ponzi scheme.

But let’s be honest, you don’t care because you’re a morally bankrupt thief.

It would be a pretty stupid scam if SOMEBODY didn’t make a profit, wouldn’t it ?

That’s how ponzi frauds work.

A few morally bankrupt people such as you “win” while the majority lose

I thought the name Marc De Turck, and the picture that goes with it, were familiar, and my memory proved to be correct.

With the disclaimer that this could of course be a case of identity theft:

De Turck is one of the leading lights of Scientology in Belgium. “Leading light” as in: one of the few Scientology adherents who occasionally dares, or is allowed by the “Church”, to show his face in the media – what his role in the Church of Scientology corporate structure is, I have no idea.

This appears to be his current company:

ideas-freeboss.com/who-we-are/

In the ‘News’ section, the most recent entry is dated March 18, and claims De Turck appeared on Bulgarian TV:

See, there’s more to Bulgaria than just OneCoin, they have Scientology, too! Perhaps that TV channel he appeared on is the same one that’s going to show that new reality TV show about Veska Ignatova, which we’re all so looking forward to.

(Note how people like him are so deeply steeped in the cult, that they no longer notice that “become more and more effect of” is ungrammatical gibberish, incomprehensible to anyone not familiar with Scientology’s ridiculous argot.)

Reading through the review and the comments below, reminded me of Ponzi schemes in my country back in 1997 that led to chaos, although unlike many, I do feel and believe that money laundry was involved at the core of the whole thing.

Anyway, though Arbistar may seem like a lucrative way of investment for the majority, it also looks shady.

I appreciate the OP’s review, but I also sense a bit of bitterness against those that took the plunge and invested.

It seems that the OP poses it on the public’s moral to safeguard everyone by not investing, however, I see no comment in blaming regulators or the responsible entities, who have let Ponzi schemes flourish to the demise of the people.

Aside from this, people are not always to blame, since everyone to his own is taking a risk when they invest. And after all, people are people, can’t expect everyone to be knowledgeable enough or dedicate all the time to conduct all the due diligence prior to investing.

Remember, whatever you invest into, be it Forex, stock, crypto, sports trading, gambling, robbing banks and what not, it is a zero sum game, one’s gain is another one’s loss.

Having said that, trying to raise public’s awareness while calling them morally bankrupt in order to condemn those arising schemes won’t be effective since in the existing ‘capitalist’ system, we are a society, but we rather are separated and prone to individualistic benefits.

For instance, if ones family is starving, nowadays would the public care or condemn the fact???

I would hardly believe that based on my experience, then why expect people to withhold themselves from making a quick buck, despite the fact that other may lose later.

Do not get me wrong, I am not a promoter of Ponzi schemes, just saying that I appreciate the post, as everyone should do as much as he/she can towards what he/she believes is righteousness, but calling people our names to people who are admitting that they have invested in Arbistar and the likes but haven’t yet fallen victim to loosing their investment or at best got back what they initially put in…, is probably not the best approach in making people more aware and put a stop to financial fraud.

Thanks again for your review, I hope it makes people more cautious in general as it did shed some light for me!

Believe me when I say I couldn’t give a toss what people invest in on an individual level.

1. Regulators aren’t responsible for scammers running Ponzi schemes.

2. This review literally lays responsibility for ArbiStar being a Ponzi scheme at the feet of its owner, Santi Fuentes.

Couldn’t care less about the “capitalist system”. If you run and promote Ponzi schemes you are morally bankrupt.

I get where you’re coming from (making excuses for fraud) but in my mind ignorance or desperation do not justify financial fraud.

This is also true for regulators and law enforcement.

Hello again,

I didn’t and do not mean to start a debate and it does not matter where I come from, but that’s not the point here.

I am not making excuses for fraud, nor do I promote anything, and neither do those people involved in investing in Arbistar purposefully do, but just because you state and provide a logical explanation why it is a Ponzi scheme would not suffice to refrain them from trying to earn a quick buck.

Just being harsh to everyone who has fallen for it or being momentarily satisfied for earning something, rather than consulting, won’t cut it, but that’s just my opinion…

Capitalism or not… I do care about the reality and circumstances because they define human behavior; however, when it comes to authorities vs individuals, it would be the same as saying that criminals are the sole responsible body for the crime committed and no one is responsible for not trying to stop them, and even the victims are promoting crime because they were too ignorant, too careless or too gullible which caused them to be victims??!! Are we at that level of awareness and reasoning yet??

Bottom line: your review is definitely worth reading and doing some good, otherwise I wouldn’t take my time to comment here, so please keep up the good work.

I would follow more reviews of yours to come. Peace!

You can’t speak for every Arbistar affiliate.

You’ll find I come down harsh on those who deny scams are scams. I have no reason to be hostile to genuine victims.

Be it white collar crime or the other variants, criminals are solely responsible for their actions.

I personally have about 2 months inside arbistar, it was recommended by my friend. First i put 500e i waited about 5 weeks and after that i put 0.65 btc more at the price of 6k euro at that time.

Since 30 may the weekly gains are not compounding anymore, are sent directly to your wallet every week on saturday afternoon.

i saw some posts here people saying the gains are 40%, that’s a lie, i have a roughly 10-14% gains per month, witch is also good, no bank is paying that kind of money.

So far i took from this bot around 800 euros(im my bank account in spain), also i need to mention since i bought the btc till now i have added to my initial investment around 1800 euro because of the increment of btc price from 6k to 8400k

i think the so called skeem people say they running is not more then a tool to get more ppl involved. some are investing and some are gaining money only by recruiting others.

arbistar saying they are gaining around 30% of total gains by bot, but i have inside information and actual gains are a lot higher, and the reason they cut the %(because 2 years ago was a lot higher) is they fear people get wild and they dont want too much attention.

sincerely speaking for someone who put 100k inside is 10k/month witch is crazy like hell.

dunno if in the future this will work or not, but in my case i will withdraw all the gains to recover the initial investment, then i will be free of risk (on this rhythm in 6 months i will be free of risk)

it should work because the BOT is doing the simple thing to sell and buy between 2 exchanges(sell high and buy low)

i will keep you informed with the evolution.

peace.

(Ozedit: recruitment spam removed)

Feel free to provide legally required audited financial reports providing ArbiStar has any external revenue.

Until then the only verifiable source of revenue entering ArbiStar is new investment. Recycling new investment = Ponzi scheme.

OZ mate I’m not defending them but at least so far I bring facts on the table, you just asume your facts.

Tell you what, I get you, you don’t trust them, then have the balls, pay 5 grand and put the BOT on your computer, no risks… No affiliation with nobody… No scheme… You handle your money… When to sell.. When to buy..

You don’t think is weird this “scheme” running for 3 years now and nobody came forward to say “I was scammed”?

And about their revenew… Is so simple like water… They take your money, they do hundreds of operations between exchanges each day, they make a shit load of money and each Saturday they trow you few scrumble.

What facts? I asked your audited financial reports to prove your claims (not facts) and you failed to provide them.

It’s got nothing to do with trust. MLM companies that offer securities are legally required to provide audited financial reports to regulators.

The only reason they don’t do this is because they aren’t doing what they claim to be.

Nope, because whether people complain about getting scammed or not is neither here nor there.

ArbiStar is a Ponzi scheme because of its business model. That is using new investment to pay existing investors.

For what it’s worth the original ArbiStar Ponzi collapsed. The current iteration is a reboot, which will also eventually collapse.

So why fail to register with financial regulators and operate illegally then?

You know why, I know why. Best of luck with the scamming.

If it’s too good to be true then it usually is. A fool and his money are soon parted.

I was just approached to ‘invest’ in this and my first instinct was, ‘this is all wrong’. Investing in crypto since 2015, so guys I’ve seen alot, got approached because I’m a known early investor.

Guy’s appreciate people like the person willing to put the time and effort into warning you about unscrupulous scum like the people running this scam.

The gangsters can easily justify robbing you. They just think it was your greed that got you robbed so you deserve it.

Don’t be a greedy mug, and don’t be a party to robbing your family and friends.

I’ve seen this many times. Greed is a terrible thing and you’re responsible for bringing people in if you introduce them to this especially after seeing the writing on the wall. Stay safe.

Your article is full of greed and purpose, personally I spoke to Spain ambassador and his economic consular session of embassy went through to research about Arbistar 2.0 company and then officially send me an email and said company is Legal and have all license from Spain Gov Nd you can invest with them.

Some more base on 1 year experience Arbistar always committed and working very well.

Who ever didn’t mistake in the paste?! all of us we have had that but once good project come up you can’t bring up the paste mistakes to make a trouble in perosnal purpose.

People now smart and can understand and research themselves, instead of reading your article they can go and ask officially from Spain Gov or and Spain embassies around the world.

That’s a funny description of the facts.

That’s nice. Securities in Spain aren’t regulated by an ambassador though, they’re regulated by the CNMV.

ArbiStar isn’t registered with the CNMV because it’s a Ponzi scheme. Not withstanding ArbiStar not being registered to offer securities anywhere else in the world either.

Whether you’re currently stealing money through ArbiStar is irrelevant. Ponzi schemes pay until they don’t.

I have this weird pain in my chest… difficult to breathe… like an elephant sitting on me…

PLEASE, I NEED HELP. IS THERE A SPANISH AMBASSADOR IN THE HOUSE??

I’m calling your bluff. Give the name of the Spanish Ambassador you personally spoke with and his/her contact information. If you can’t, it didn’t happen.

Sorry, the Spanish ambassador can’t come to the phone right now. He (or she) is busy fetching my dry-cleaning.

Rest assured my dry-cleaner is legal and has all required licenses from the Spanish government.

@ Lynn

It’s Manuel. He used to work at Fawlty Towers

So ArbiStar collapsed. Has anyone let the Spanish Ambassador know?

He’s busy cleaning up after the dinner guests at Fawlty Towers.

We’re sorry, he’s from Barcelona.

Actually I learned that the person Manuel spoke to was the night bellman at the Ambassador Hotel in Spain. He just got confused thinking he was the Spanish Ambassador. I think it was a simple translation error.

But Manuel was right. ArbiStar did get all the approvals and licenses to hold a meeting at the Ambassador Hotel.

But I did speak with the Spanish authorities Manuel and they said you were full of it. Who to believe??????

Funny how Manuel has not been back isn’t it.

Manuel says:

Manuel really spoke to the “Spain ambassador”.

Unfortunately…it was in the incurable wing of the madhouse.

Manuel also spoke to Napoleon Bonaparte and Elvis who also “said company is Legal and have all license from Spain Gov Nd you can invest with them”.

This Ponzi System is over…. the CEO Santi Fuentes, its involved in a criminal complaint , already police & authorities are going with criminal trial process

I would like to know if this company will ever give any money back.

Ponzi schemes take your money, they don’t give it back.

Sorry for your loss.

Judgment in the National Court of Spain: Arbistar Ponzi scam Start on Monday, March 10

poderjudicial.es/cgpj/es/Poder-Judicial/Audiencia-Nacional/Actividad-de-la-AN/Agenda-de-senalamientos/Senalamientos-en-la-Audiencia-Nacional-del-10-al-14-de-marzo-de-2025

youtube.com/@AN_S2