Juubeo Review: A co-op MLM penny auction?

![]() There is no information on the Juubeo website indicating who owns or runs the business.

There is no information on the Juubeo website indicating who owns or runs the business.

The Juubeo website does have an “about us” page, however only the following vague marketing spiel is provided.

Juubeo is a global co-operative founded by and for its members.

The company claims to be “registered in the United Kingdom”, with an address in the UK provided.

Further research reveals a number of businesses operating out of this exact same address, indicating that it is little more than a rented mailbox.

Juubeo would appear to exist in the UK in name only.

The Juubeo website domain (“juubeo.com”) was registered on the 14th of May 2013, listing only “Admin Juubeo” as the domain owner.

Why Juubeo are secretive about their management is a mystery, with details of who is running the company freely available from third-parties.

As per a Juubeo affiliate marketing presentation from mid 2014, the Founder and original CEO of Juubeo is Iver Nergaard (note the marketing spiel has been removed from the below slide to preserve space):

Nergaard seems to have been replaced with Soeren Eriksen as of February 1st, as per a press-release issued in December 2014:

Juubeo has announced the appointment of Soeren Eriksen as their new CEO.

Soeren Eriksen, 47, has an extensive background in the Danish banking and finance industry and a Graduate Diploma in Business Administration from Handelshoejskolen in Aarhus, Denmark.

In the early stage of his career he commenced working as a Derivative Market Maker Trader in one of the largest banks in Denmark, and progressed to a management position in a Commodities Trading Company, leading to Investment Advisor in Europe.

Not sure what the story is there.

In any event, it’s worth noting that while Juubeo aren’t interested in providing information about their management on their company website, for some reason they’re fine with issuing corporate press-releases containing this information.

Nothing suss.

In the slideshow image above, Nergaard’s name appears next to a Norwegian flag. However on his LinkedIn Profile, Nergaard claims to be based out of London in the UK.

This is supported by company registration documents, listing Iver Nergaard as the Director of Juubeo Limited. Curiously, the company registration documents available all list Nergaard’s country of residence as Norway.

Juubeo itself however seems to have a strong presence in Norway, with Alexa estimating that 37.4% of the company’s website traffic originates from there.

Given this, I’m tempted to say Juubeo is likely being run out of Norway, with any connection to the UK being superficial at best.

On the MLM history side of things, the only company I was able to connect Nergaard to was Kyani (health and wellness). Whether Nergaard is still a Kyani affiliate is unclear.

On the MLM history side of things, the only company I was able to connect Nergaard to was Kyani (health and wellness). Whether Nergaard is still a Kyani affiliate is unclear.

I wasn’t able to track down an MLM history for Soeren Eriksen, with Juubeo appearing to be his and Nergaard’s first MLM venture as corporate executives.

Read on for a full review of the Juubeo MLM business opportunity.

The Juubeo Product Line

There is a penny auction attached to the Juubeo MLM business opportunity, but it doesn’t appear to have much to do with it.

At the time of publication, the link titled “go to auctions” that appears on the Juubeo website was disabled.

Nonetheless, Juubeo affiliate marketing presentations advertise the auctions credits can be purchased for 0.20 EUR each.

The Juubeo Compensation Plan

Juubeo do not provide a copy of their compensation plan on their website.

Instead, visitors are presented with vague statements about income earning potential through summarized descriptions of Juubeo’s MLM business model.

As such, the following Juubeo compensation plan material has been put together from various Juubeo affiliate marketing presentations (based on official Juubeo compensation plan material).

The core of the Juubeo compensation plan sees affiliate invest in Coop Pool Units and recruit other affiliates who do the same.

Coop Pool Units are first awarded when a Juubeo affiliate signs up with the company, based on how much money they spend on their Juubeo affiliate membership:

- Small Bundle (100 EUR) = 10 Coop Pool units

- Medium Bundle (250 EUR) = 25 Coop Pool units

- Large Bundle (500 EUR) = 50 Coop Pool units

- X-Large Bundle (1000 EUR) = 100 Coop Pool units

Recruitment Commissions

Juubeo affiliates are paid to recruit new paid affiliates via a unilevel style compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any of these level 1 affiliates go on to recruit new affiliates, they are placed on level 1 of the original affiliate’s unilevel structure.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Juubeo cap payable unilevels at four, with commissions paid out when a newly recruited affiliate pays for their bundle pack.

How much of a commission is paid out depends on how much the newly recruited spends, how much the affiliate receiving the commission spent on their own membership and what level of the unilevel team the recruited affiliate falls on.

- Small Bundle – 12 EUR on level 1, 6 EUR on levels 2 and 3 and 16 EUR on level 4

- Medium Bundle – 30 EUR on level 1, 15 EUR on levels 2 and 3 and 40 EUR on level 4

- Large Bundle – 60 EUR on level 1, 30 EUR on levels 2 and 3 and 80 EUR on level 4

- X-Large Bundle – 120 EUR on level 1, 60 EUR on levels 2 and 3 and 160 EUR on level 4

Note that an affiliate can only earn as high as the level they themselves buy in at.

Eg. If a Small Bundle affiliate recruits an X-Large Bundle affiliate, they still only earn as per the Small Bundle payouts (12-16 EUR).

This worsk in reverse too, with an affiliate only paid as per the bundle a newly recruited affiliate buys in at.

Eg. If an X-Large Bundle affiliate personally recruits a Medium Bundle affiliate, they are paid 30 EUR. They have to recruit an X-Large Bundle affiliate to earn 120 EUR.

Auction Credit Commissions

Auction credits are required to participate in Juubeo’s penny auctions, with commissions paid on the purchase of credits.

The same four-level unilevel as int he recruitment commissions is used, paying out 20% of the credits purchased.

This 20% is then split over the four payable levels of the unilevel, with each affiliate paid a percentage of the 20% allocated to the level of the unilevel the credits were purchased on:

- level 1 – 30% of the 20% credit commission

- levels 2 and 3 – 15% of the 20% credit commission (15% each level)

- level 4 – 40% of the 20% credit commission

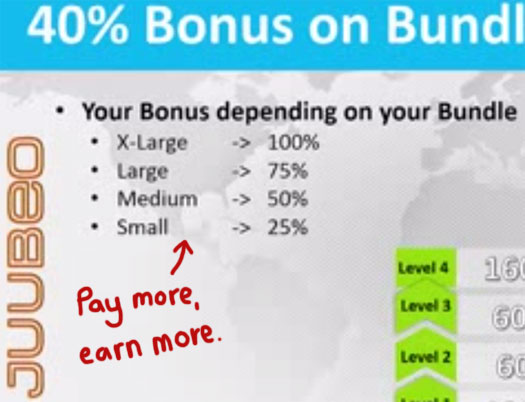

Note that only X-Large Bundle affiliates receive the full commission payable, other Bundle affiliates are paid out a percentage of the above percentage amounts (at each unilevel level):

- Small Bundle – 25%

- Medium Bundle – 50%

- Large Bundle – 75%

If you’re confused, think of the above percentages as a fraction of what is otherwise paid to an X-Large Bundle affiliate (the full payable commission).

Auction Product Bonus

If an affiliate’s upline wins an auction (up through four levels of recruitment), they qualify for a 10% bonus of the retail value of the product won.

This is again paid out via the same four-level unilevel team.

- level 1 – 30%

- levels 2 and 3 – 15% each level

- level 4 – 40%

Again, the above percentages are the 100% commission paid out to X-Large Bundle affiliates.

Affiliates at the lower bundle levels will only receive 25%-75% of this payable amount.

Coop Unit ROIs

Juubeo Coop Units are tied to a revenue-sharing pool that is made up of 3% of the total revenue Juubeo takes in each month.

Juubeo Coop shares are awarded when an affiliate signs up with a Bundle (based on how much they spend), and can be purchased directly from the company and traded between affiliates.

Juubeo do not disclose how much Coop Units cost individually.

Each Unit qualifies a Juubeo affiliate for a share in the monthly pool, with each share receiving an equal portion of the 3% revenue-share each month.

Joining Juubeo

Affiliate membership with Juubeo is tied to the purchase of one of the following three bundles:

- Small Bundle – 100 EUR

- Medium Bundle – 250 EUR

- Large Bundle – 500 EUR

- X-Large Bundle – 1000 EUR

The primary difference between these affiliate membership levels is income potential through the Juubeo compensation plan.

Conclusion

I don’t why people keep thinking they can re-invent the MLM penny auction Ponzi wheel, but here we are again with yet another dubious auction-centric opportunity.

Juubeo’s compensation plan reads like someone wanted to continue the penny auction Ponzi trend pioneered by Zeek Rewards, but figured calling it a co-op would fool people into thinking it was legitimate.

The Juubeo website and presentations are filled with references to a “co-op”, with the company obviously believing that calling their opportunity this negates it from being a pyramid and/or Ponzi scheme.

How wrong they are.

Before we get into the nuts and bolts of the Juubeo compensation plan, I’ll preface by pointing out the strong “pay-to-play” element that exists within it.

Every level of Juubeo’s commissions paid out are directly tied into how much an affiliate spends on their Bundle membership, along with how much their recruited affiliates spend too.

An identifiable “pay-to-play” element in an MLM company’s compensation plan is one of the hallmarks of a pyramid scheme.

Juubeo is no exception, with the company rewarding affiliates for recruiting new affiliates, payable down four levels of recruitment.

There’s no justification or wriggle-room here, Juubeo are paying on the recruitment of new affiliates and there’s no two ways about it.

That’s not a hallmark of a pyramid scheme, that is a pyramid scheme.

The Coop Units add a Ponzi layer to the model, seeing affiliates invest in units on the expectation of a >100% ROI. This appears to be managed through some sort of pseudo-stock component of the compensation plan, which sees affiliate buy and sell units as if they were trading on a legitimate market.

That Juubeo hold no license to conduct such trading, nor make offers to their affiliates (in the US or otherwise) goes without saying.

The one point Juubeo and its affiliates will cling to as evidence of some legitimacy are the auctions, specifically the purchase of auction credits by retail customers.

History tells us retail activity in MLM penny auctions is non-existent. I’ve reviewed what must 10 to 20 MLM penny auctions by now and retail has never taken off.

The only players here are the affiliates purchasing bundles, in order to qualify on recruited affiliates who do the same. And if that’s not enough for you, then there’s the coop unit investment scheme to play around in.

If Juubeo really was about selling penny auction bids to retail customers, there’d be no reason to have affiliates pay up to a thousand EUR for basic affiliate membership.

But it’s not, and so we have what is little more than a 100-1000 EUR Ponzi/pyramid hybrid scheme. And I’m not going to even delve into the apparently non-working penny auctions, some four or five months after Juubeo launched (October 2014).

As with all of these schemes, once affiliate recruitment dies down Juubeo will collapse. Recruitment commissions depend on constant recruitment, as do the Coop Unit payments.

Without continued new affiliate investment, each unit holds a value of $0. The company claims to pay “dividends” on each unit, which will also drop to $0 if no new affiliate funds are being pumped into the system.

With the evident Norway connection between Juubeo, the site’s main visitor demographic and its founder Iver Nergaard, the cynic in me is having a hard time overlooking that this is probably the work of someone who thought Bidify was a great idea and wanted their own crack at it.

We’ve been down the Norwegian penny auction Ponzi scheme road before, and it doesn’t end well.

And if you’re still not convinced, march up to any Juubeo affiliate and ask them how much they’ve made in auction credit commissions versus everything else.

In every instance you’re like to find the ratio massively lop-sided towards “everything else” (recruitment commissions, coop investment ROIs, blahblahblah).

I imagine in a month or so somebody at Juubeo corporate will announce they’ve just been informed of compliance regulations they need to adhere to, and we’ll get to watch the Bidify/MyCenterBid fiasco play out all over again.

Portugal, fresh from getting scammed by TelexFree and GetEasy, seem to have an interest in this one too (Alexa puts them a quarter of the site’s traffic behind Norway), so that might be an interesting twist in the recipe.

Otherwise, same old… same old…

MLM penny auction Ponzi schemes – Can we let them die already please?

I had a quick look at it, but it doesn’t look very active. It does however have a planned Mega Auction on February 22 2015, according to the internal “banner slideshow”.

“Visitors” counter was frozen on 33,270 visitors. Most auctions seemed to have been frozen too (or maybe they were faked right from the beginning?).

The Alexa ranking wasn’t very impressive, 266,270 Global rank and 4,711 Local rank (Norway).

Countries (Alexa):

Norway 37.4% 4,711

Portugal 25.4% 6,482

United States 5.1% 667,759

I don’t see any reinvestment options mentioned anywhere, so it’s primarily about recruitment.

Are you crazy comparing juubeo’s auctions to penny auctions? This auction system is completely different.

The counter you are refering to is not a visitor counter. That counter is similar to a jackpot counter in a casino counting upwards to the jackpot. You should investigate things more clearly before commenting on things.

You say pyramid? Paying back a percentage of each sale in a refereal system is hardly a pyramid.

Lowest unique bidder? It’s the same thing.

Do you even know what a penny auction is?

Yeah so I never referred to a counter. Not sure what you’re talking about. (Edit: Alright so you were talking to Norway. I suppose the clarification is welcome seeing as Juubeo are incompetent enough as to not bother labeling the counter).

Paying commissions on the recruitment of affiliates over four levels of recruitment is most definitely a pyramid scheme.

@M_Norway

I’ve seen Zeek Rewards style income calculators floating around.

You don’t think affiliates will reinvest back into Coop Units?

There’s a 3% dividend pool, but then there’s the whole stock market trading thing on top of that. The value of the units has to come from somewhere (and it’s not coming from retail customers, who have no interest in the units).

Given that this company uses computers extensively there is NO reason why they can’t track referrals and credit any sales commissions through referral codes or cookies and such.

Thus, any sort of “bundle purchase” by affiliates can only be “pay to play”, and thus, smells of pyramid scheme.

The main point was that the website didn’t look very active. The counter seemed to be completely frozen.

I clearly wrote that I only had a quick look at the website. There wasn’t much to look at in terms of activity.

this is dubli all over again.

Are they ripping off the Jubirev name?

That thought did cross my mind, but I don’t think that’s the case.

It isn’t completely frozen. Current jackpot is 33,430 (up 160 from last time I checked).

The “Iver Nergaard” LinkedIn profiles seem to be fake.

Or at least the photo seems to be fake. It looks like a stock photo, and “Iver Nergaard” plus that photo can only be found in LinkedIn Spain and UK (if you try to search with the photo).

The web designer seems to be Norwegian, but with an Italian sounding name (whois for juubeo.no).

My overall impression here is “lack of experience” = that it has been organized by people with high ambitions but low real skills.

It looks like “different components randomly glued together” rather than as a whole project, what you can expect if people have tried to copy ideas from many different sources but without understanding those ideas.

And that “lack of experience” was partly confirmed by some company information / director information. It identified the birth date of Iver Nergaard to be May 1992 (22 years of age).

NOLINK://www.endole.co.uk/company/08973581/juubeo-limited

“Lack of experience” can explain why it looks more like “different components randomly glued together” than a real business project. Some components are out of proportion, so it doesn’t really work.

“If it looks like a penny auction, works like a penny auction”, then that component probably can be compared to one?

It actually looks like a Ponzi / pyramid scheme hybrid with a “unique bid auction” front. But the Ponzi component is under dimensioned and doesn’t work, so the pyramid scheme component doesn’t work either (none of them will attract many people, and neither will the auction).

Correct. Paying referral commissions isn’t enough in itself to make it become a pyramid scheme. But I haven’t solely looked at that component either.

“Sale” in the context of MLM or network marketing is about commercial activity. Selling bids to consumers can qualify as commercial activity. Selling an income opportunity to income opportunity seekers doesn’t qualify, e.g. World Ventures was banned in Norway in 2014 (even if it actually had some products or services).

It isn’t enough to HAVE products or services. It will need to be the primary function of the business, the core of the business.

In World Ventures, the recruitment system was the core of the business. It dwarfed the retail function (selling travels) by a factor of 12:1 (people spent 12 times more on memberships than they spent on travels).

In Juubeo, retail sale doesn’t seem to exist. The auction component doesn’t really seem to work as a business component. But the rest of the components don’t seem to work either.

I could find 2 spreadsheets (XLS) when I searched for “Juubeo income calculator”. I didn’t look at them, I only looked for the “spread around” factor.

Juubeo doesn’t seem to have any “VIP Point” component. Its primary commissions seem to be the unilevel commissions 4 levels deep.

The investment here is about the right to earn a higher commission from recruitment or sale:

As I understood it, the units are the points. Same idea, although they’ve broken it up into penny auction (recrutment) and stock game (Ponzi) components.

That component isn’t very understandable.

3% revenue sharing can be either 3% monthly ROI on the investment (a substantial interest rate, but not compared to other Ponzi schemes), or 3% of the revenue (just some peanuts).

One of them is a fixed rate ROI (depending solely on the invested amount), the other one is a variable one (depending more on the sales activity than on the investment).

The first type isn’t attractive enough to attract Ponzi players. Other schemes will offer much higher ROI.

The second type isn’t very attractive either, people will be more interested in selling those shares than they will be in buying them.

Like I said, it looks like they have copied various components from other programs and have randomly glued them together” in a new program. That new program doesn’t seem to work very well.

BUSINESS ENGINEERING

“Business engineering” is like any other engineering projects. It’s about selecting the right components, the components that actually have a function in the project.

“Right component” isn’t solely about the type. Components of the same type may come in a variety of shapes and sizes, e.g. an over- or under-dimensioned component may not work properly.

That’s the difference between a working business and “different components randomly glued together”. A business will usually have the right components in the right places, where each component have a function as a part of the whole.

You will need experience to know the difference. These people don’t seem to have that experience.

The auctions:

“33 kg Gold” seems to be heavily over-dimensioned for that type of auction. The other prizes gave that same impression. It will actually make it look more like an auction scam than a real auction.

The auction component doesn’t seem to be a “working component”. It looks more like something else, but I haven’t identified exactly WHAT it looks like.

“Working component” is about having an important function in the business as a whole. It’s not about whether the component actually does work / doesn’t work as a component (hypothetically).

3% monthly ROI even just added can be 36% yearly ROI. This is pretty much a ponzi.

We got used to 200%-1000% ROI ponzies recently, but low rate Ponzis are still at thing.

Try to use a spreadsheet to simulate the ROI. It won’t be very attractive for experienced Ponzi players. Investors will first start to make a profit after 33 or 34 months.

Yes, 33 month is eternity for Ponzi games. How many Ponzis survive past three years? Very, very few. So you have about 90% chance of losing money and you have to wait 3 years to find out.