Jaa Lifestyle now a crypto Ponzi through Eehhaaa ad platform

A reader reached out to let me know Jaa Lifestyle doesn’t look much like our June 2020 review.

A reader reached out to let me know Jaa Lifestyle doesn’t look much like our June 2020 review.

Back then Jaa Lifestyle was headed up by Shain Hymon. Initially Jaa Lifestyle solicited investment in virtual shares at 18 cents a pop.

That quickly disappeared and was replaced by magazine subscriptions.

Today Shain Hymon is nowhere to be found on Jaa Lifestyle’s website.

Jaa Lifestyle’s public-facing website is nothing more than a portal for affiliate recruitment and/or logging in.

There’s nothing substantial disclosed about Jaa Lifestyle’s business operations or management.

With a bit of poking around however a page showing Jaa Lifestyle’s current executive team can be found:

- Sathia Narayan (aka Arun Narayan) – Chief Operations Officer

- Nicolas Duchemin – Head of Social Media

- Christelle Caillet – Head of Digital Content

- Simon Ingmala Anchu – Company Director, Nigeria

- Johny KV – Company Director, India

- Nadir – Company Director, Indonesia

- MD Atiar Rahman – Company Director, Bangladesh

- Susana Ferreira – Head of Support

If Shain Hymon is still running Jaa Lifestyle, he’s keeping a low profile.

As COO, Sathia Narayan (right) is presented as the person running Jaa Lifestyle.

As COO, Sathia Narayan (right) is presented as the person running Jaa Lifestyle.

According to Narayan’s Twitter profile, he’s based out of Selangor in Malaysia.

Possibly due to language-barriers, I was unable to put together an MLM history on Narayan.

Based on Alexa traffic estimates, the majority of recruitment of Jaa Lifestyle affiliates is taking place in India (45%), Bangladesh (12%) and Egypt (8%).

Jaa Lifestyle provides a corporate address in the UK on its website but doesn’t appear to have any actual ties to the UK.

In other words your typical UK shell incorporation by scammers.

From all of this we can surmize Jaa Lifestyle is a Malaysian company, with possible ties to the US through Shain Hymon, targeting mostly Indians.

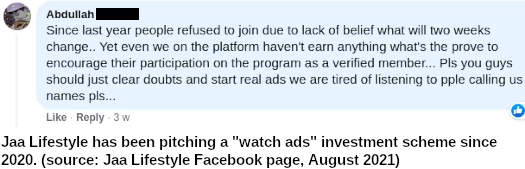

Jaa Lifestyle’s advertising Ponzi scheme appears to have been a carrot dangled in front of affiliates since late 2020.

Jaa Lifestyle’s official Facebook page is full of missed launch dates:

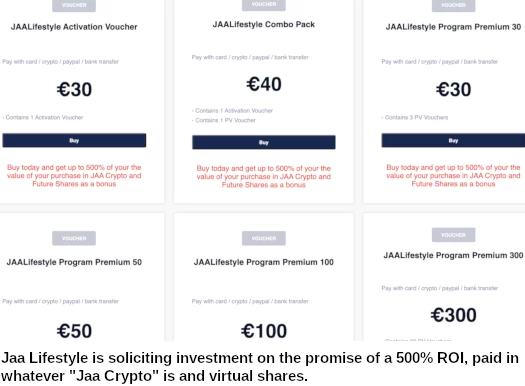

The company has also resurrected its initial virtual share investment scheme:

Jaa Lifestyle isn’t registered with financial regulators in any jurisdiction. So if they’re selling virtual shares or plan to, that’s securities fraud.

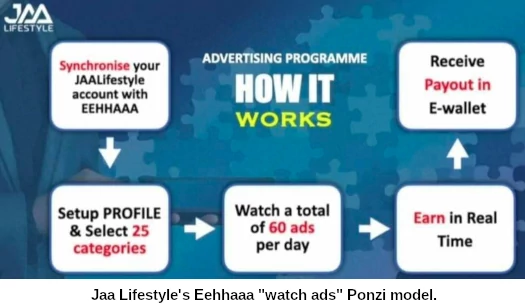

The meat and potatoes of Jaa Lifestyle’s current MLM offering is the old “watch ads, get paid” Ponzi model.

Again, you won’t find any of this on Jaa Lifestyle’s website, but promotional material sees Jaa Lifestyle soliciting investment on the promise of a 500% ROI.

As you can see, investment is made in euros on cryptocurrency. Returns are paid in “JAA Crypto”, which I assume is either Ponzi points or a yet to surface shit token.

“Future shares” would be part of the already addressed resurrected virtual shares scheme.

As to how returns are paid out, it’s the usual daily returns Ponzi model:

I couldn’t find specifics, but presumably there’s also MLM commissions paid on “voucher” investment.

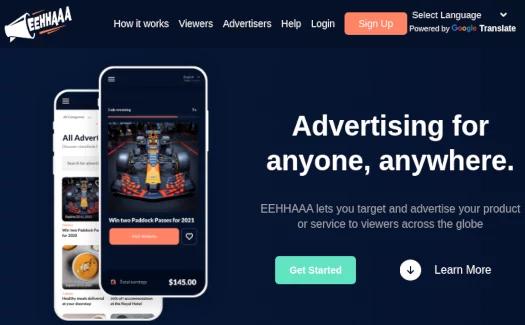

The ruse behind Jaa Lifestyle’s Ponzi scheme is external revenue provided by advertisers.

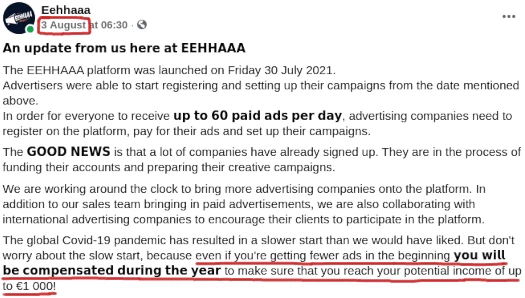

To that end the company has set up the terribly named “Eehhaaa” platform.

Eehhaaa’s website domain was privately registered in September 2020, which tracks with ad marketing appearing in late 2020.

Eehhaaa’s domain lay dormant until May 2021. On or around May 2021 the current Eehhaaa website, a quick Squarespace template (like Jaa Lifestyle’s own website), was uploaded.

Eehhaaa’s official Facebook page was created in July 2021. The page is managed from South Africa.

At first I thought this was odd but then I realized Jaa Lifestyle’s web developer (and evidently social media manager), Empire State, are based out of South Africa.

The notion that legitimate advertisers are willing to pay Jaa Lifestyle enough that they can pay out 500% to affiliates is silly.

Even if you believe the marketing, regulation requires Jaa Lifestyle to register with financial regulators. This would require Jaa Lifestyle to file audited financial reports, confirming advertising revenue is being used to pay returns.

Jaa Lifestyle will of course never register with financial regulators or provide audited financial reports, because it’s a Ponzi scheme.

They confirm as much by promising affiliates a guaranteed returns of up to €1000 EUR annually, regardless of advertising revenue (which doesn’t exist anyway).

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Jaa Lifestyle of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.