HyperCapital Review: HyperCash resurrection Ponzi scheme

HyperCapital’s website provides no information about who owns or runs the company.

HyperCapital’s website provides no information about who owns or runs the company.

A HyperCapital marketing presentation claims the company is “founded by crypto industry giants”. Ryan Xu, founder of HyperCapital, is the only HyperCapital executive named.

Although Xu is presented as a “crypto giant”…

…in reality I couldn’t find anything other than a few failed cryptocurrency company launches. You know the deal, blockchain this, blockchain that – launch after launch and nobody cares.

I’m not going to follow every Ryan Xu rabbit hole (because there’s no point), but with respect to HyperCapital you have HyperTech Group:

Inside HyperTech Group you have Blockchain Global, HCash (HyperCash), CollinStar and Digital X.

Blockchain Global claims it’s “funding the future of blockchain”. The company’s website currently has an Alexa ranking of 1.9 million (#RIP).

HyperCash (HC), “formerly known as Hcash” according to CoinMarketCap, is an altcoin launched mid 2017.

HC pumped to $43.17 in August 2017. The typical shitcoin dump followed and HC is currently trading at $1.22 (#RIP).

CollinStar bills itself as a “venture capital company in the City of Melbourne, Australia”.

The company’s website (as per their official Facebook page), appeared to be down at the time of publication (#RIP).

I had difficulty tracking down information on Digital X. Here’s a snippet from Blockchain Global’s Wikipedia entry;

In August 2016 Bitcoin Group rebranded as Blockchain Global to reflect a broadened focus including management consulting and business incubation.

The company later developed the blockchain exchange platform ACX.io; in February 2017 it reached an agreement with Digital X to take over the function of that company’s blockchain exchange platform, Digital X Direct.

Unless I’m missing something neither Digital X or Digital X Direct exists today. So I’m assuming they were rolled into ACX.

ACX is an Australian focused cryptocurrency exchange. ACX’s website has a current Alexa ranking of 947,611 (almost #RIP).

Ryan Xu’s connection to HyperCash appears to be through HCash Tech, of which he is a co-founder.

Hcash Tech Pty. Ltd. is an Australian technology company which provides technology consulting services, provided technical assistance in developing the parallel dual-chain & dual token ecosystem to, and is an investor in Blockchain giant, HCASH.

They have been working closely with HCASH for development, and will continue to do so in the future.

The exact nature of Xu’s involvement in HyperCash is surrounded in typical layers of bullshit associated with cryptocurrency.

Is he a mere “advisor” or something more?

A 2017 SteemIt post by author gobbleguts reveals HyperCash was then going by “HCash” – and there’s a link to seemingly now defunct CollinStar.

Back then Ryan Xu was also going by his actual name, Zijing Xu.

An announcement by CollinStar America dated December 2017 reveals Ryan Xu is/was Collinstar’s Chairman:

With that in mind, two months earlier this press-release ties CollinStar to the development of HCash, now known as HyperCash (HC).

CollinStar Capital is the lead manager of the Hcash project, one of the most advanced blockchains that took advantage of many technological breakthroughs that were not available to early blockchain developers.

So to summarize, although he’s not working alone, Ryan Xu == Zijing Xu == Collinstar == Hcash == HyperCash (HC).

But alas, you won’t find that in any of HyperCapital’s marketing documents.

Late 2017 was evidently a busy year for Xu. As he was launching HyperCash, his Media Chain scheme was also coming to an end.

Media Chain was a MDC shitcoin ICO that appears to have primarily targeted Chinese investors.

Upon raising “nearly 100 million yuan from investors” ($14.4 million USD), Xu and his co-conspirators purportedly did a runner.

And that might not be the only ICO scam Xu had a hand in:

More absurdly, Ryan XU, or Zijing Xu, serves as an adviser for this project.

Many blockchain projects backed by Mr.Xu are labeled as scams, like HPS, HRS. MediaChain follows suit.

So uh yeah, “cryptocurrency giants” hey.

As HyperCash circled the gurgler in 2019 and continues to do so in 2020, the cynic in me believed HyperCapital is a desperate attempt to resuscitate the shitcoin.

Read on for a full review of HyperCapital’s MLM opportunity.

HyperCapital’s Products

HyperCapital has no retailable products or services, with affiliates only able to market HyperCapital affiliate membership itself.

HyperCapital’s Compensation Plan

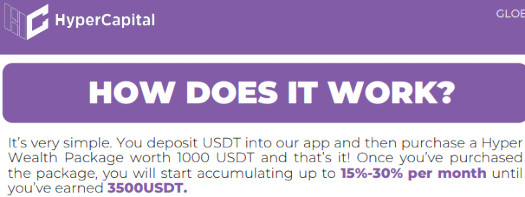

HyperCapital affiliates invest 1000 USDT on the promise of a 3500 USDT ROI.

You deposit USDT into our app and then purchase a Hyper Wealth Package worth 1000 USDT and that’s it!

Once you’ve purchased the package, you will start accumulating up to 15%-30% per month until you’ve earned 3500USDT.

Rather than pay out in USDT however, HyperCapital pays returns and commissions in HyperCash (HC).

Rewards are converted to HCash (HC) upon withdrawal.

Residual Commissions

HyperCapital pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

HyperCapital caps payable unilevel team levels at twenty.

Residual commissions are paid out as a percentage of daily returns earned across these twenty levels as follows:

- level 1 (personally recruited affiliates, must recruit at least one affiliate to qualify) – 20%

- level 2 (must recruit two affiliates to qualify) – 15%

- levels 3 (must recruit three affiliates to qualify) – 10%

- level 4 (must recruit four affiliates to qualify) – 5%

- level 5 (must recruit five affiliates to qualify) – 5%

- level 6 (must recruit six affiliates to qualify) – 5%

- level 7 (must recruit seven affiliates to qualify) – 2%

- level 8 (must recruit eight affiliates to qualify) – 2%

- level 9 (must recruit nine affiliates to qualify) – 2%

- level 10 (must recruit ten affiliates to qualify) – 2%

- level 11 (must recruit eleven affiliates to qualify) – 2%

- level 12 (must recruit twelve affiliates to qualify) – 2%

- level 13 (must recruit thirteen affiliates to qualify) – 2%

- level 14 (must recruit fourteen affiliates to qualify) – 2%

- level 15 (must recruit fifteen affiliates to qualify) – 2%

- level 16 (must recruit sixteen affiliates to qualify) – 1%

- level 17 (must recruit seven affiliates to qualify) – 1%

- level 18 (must recruit eighteen affiliates to qualify) – 1%

- level 19 (must recruit nineteen affiliates to qualify) – 1%

- level 20 (must recruit twenty affiliates to qualify) – 1%

VIP Reward

HyperCapital’s VIP Reward is a bonus qualified for via total unilevel investment volume, excluding the largest unilevel leg (based on investment volume).

- 1 Star VIP Bonus is 5% and to qualify an affiliate must have $1 million in total unilevel team investment volume

- 2 Star VIP Bonus is 6% and to qualify an affiliate must have $3 million in total unilevel team investment volume

- 3 Star VIP Bonus is 7% and to qualify an affiliate must have $5 million in total unilevel team investment volume

- 4 Star VIP Bonus is 8% and to qualify an affiliate must have $10 million in total unilevel team investment volume

Note that while the VIP Bonus is calculated based on USDT investment volume, it is paid out on daily returns.

I.e. You are paid a percentage of daily returns earned by your entire unilevel team, excluding the largest leg (based on investment volume).

Global Reward

HyperCapital takes 4% of company-wide investment volume each month and places it into four Global Reward Pools (split 1%).

Each 1% is paid out based on VIP Bonus Star ranks (see “VIP Rewards” above for qualification criteria)

- 1 Star VIP Bonus ranked affiliates earn a share in a 2% pool

- 2 Star VIP Bonus ranked affiliates earn a share in a 1% pool

- 3 Star VIP Bonus ranked affiliates earn a share in a 0.5% pool

- 4 Star VIP Bonus ranked affiliates earn a share in a 0.5% pool

Commission Withdrawal Restrictions

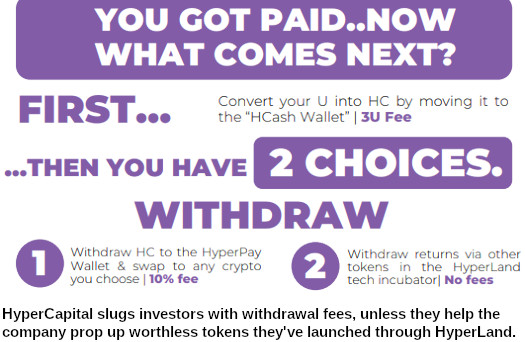

HyperCapital withholds 20% of earned commissions (excluding the daily ROI).

This withheld balance must be invested in shit tokens HyperCapital pushes through their “HyperLand tech incubator”.

Joining HyperCapital

HyperCapital affiliate membership appears to be free.

Full participation in the attached income opportunity requires a minimum $1000 USDT investment.

Conclusion

Ryan Xu is no doubt sitting on a ton of HyperCash coins. HyperCash has pretty much nothing going for it and will continue to decline in value over the long-term.

That brings us to the typical MLM shitcoin launch scenario:

Herp derp I launched a shitcoin and it went nowhere. Now I’m sitting on a ton of this worthless rubbish.

Oh I know, I’ll start my own MLM shitcoin Ponzi scheme to get rid of them.

HyperCapital represents it generates external revenue via (quoted verbatim):

- proprietary market making system through HyperLand, our blockchain tech incubator

- through fees from HyperPay wallet and spread from HyperCash (HC) on exchanges

- through mining and staking of our HyperCash (HC) token

- commission & swap fees on our platform

In other words, there is no external revenue generated. HyperCapital simply generates HC out of thin air, in addition to what they already hold, and uses that to pay out an imaginary ROI.

The aim of this is to inject a bunch of new suckers into the HyperCash ecosystem. That drives trading volume, which in turn (at least theoretically), might resurrect HyperCash’s public value.

Under all the bullshit, that’s all HyperCapital is – a desperate attempt to resurrect HC from the shitcoin graveyard.

Being a passive investment opportunity, HyperCapital needs to register itself with securities regulators in every country it solicits investment in.

In researching this review, general consensus is that Ryan Xu is based out of Australia. Through his business dealings though, he also has strong ties to China.

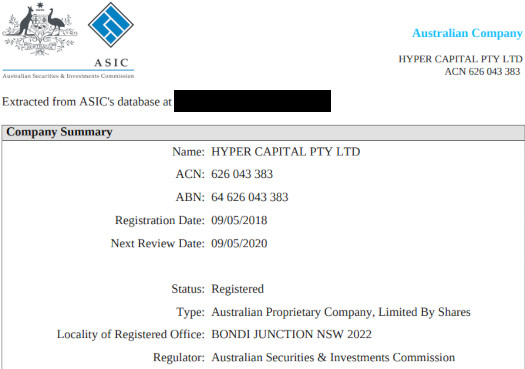

There is a HyperCapital registered with ASIC:

However to date (since May 2018), the only filings made are the initial registration (May 2018), and two change of details filings from February 2019.

HyperCapital’s investment opportunity is not disclosed to ASIC. Not that it matters, as ASIC is not known for active regulation of MLM related securities fraud.

I couldn’t find any disclosure by HyperCapital that it had registered elsewhere with a financial regulator, so outside of Australia HyperCapital is also committing securities fraud.

The Ponzi nature of the business exists by way of cashing out HyperCash. Public demand clearly isn’t there so however they’ve set it up, any returns are paid out by HyperCash are going to recycled funds.

HyperCapital has no other form of verifiable revenue other than USDT investment.

Funneling HyperCapital investors into worthless HyperTech shit tokens is also something to be wary of.

Like the resurrection of HyperCash, withholding commissions is a desperate attempt to prop up HyperTech’s garbage token ICOs.

HyperCapital’s exit-scam will play out by the company and Xu doing a runner. Media Chain 2.0 if you will.

While Ryan Xu stashes invested USDT who knows where, HyperCapital’s affiliate investor will be left holding worthless HyperCash.

We obviously can’t predict when HyperCapital will collapse, so losses are yet to be determined. Please stop falling for this nonsense.

Update 10th April 2021 – HyperCapital has collapsed. HyperTech has rebooted their Ponzi scheme through HyperFund.

Good article, but before speak use your fucking mind…

Your just liar and for some visitor you share this fake info! Go to Hong Kong and see what is going on, then talk… Nice job my friend.

A Ponzi scheme is a Ponzi scheme. No need to travel to Hong Kong to see the scamming first hand.

Love the butthurt though.

Yeah, if is ponzi scheme why Forbes Interview Ryan Xu, Sam lee own a no-profit company and they are affiliate with a Bank? want to make millions with a scam when they already have billions? don’t you think it’s stupid?

then the Australian and Chinese states are also corrupt for a scam? Do you realize what you’re saying?

Your blog will be reported directly to those in duty and you will surely receive a complaint for defamation from those you consider multi millionaire scammers.

I don’t know if you should leave it to get some views or retract analyzing the project for what it really is … don’t shoot bullshit.

so the HyperTech group that launched coins like MONERO, TRON, NEM together with collinstar … are all these scams? so they created them just to make a ponzi then? absurd hahahahah

o maybe you think forbes is corrupt too… yeah is all a piramid and everyon want your money.. yeah yeah…

I sincerely think that you are a poor fellow who fills his spam advertising sites to raise some money and I am just as sure that with all the smart things you say you do not even get to the end of the month. have a good life and hope 🙂

I sincerely doubt that

These cryptocurrencies don’t have anything to do with HyperTech and Collinstar.

Simple Google search busted your desperate attempts to defend a well-known scammer.

Here come the angry HyperCash bagholders. And their weapon of choice is… legitimacy by association (groan).

A search of “Ryan Xu” and “forbes” brings nothing up. Anyway assuming this wasn’t BrandVoice, i.e. a paid advertisement, whether Xu was or wasn’t interviewed by Forbes has nothing to do with HyperCapital being a Ponzi scheme.

Whether Sam Lee is or isn’t affiliated with “a bank” has nothing to do with HyperCapital being a Ponzi scheme.

Nope. You just made that up.

Yep. Yet here we are.

PS. holding billions in worthless crypto tokens doesn’t make you a billionaire.

1. HyperTech didn’t launch any of those coins.

2. Whether they did or din’t has nothing to do with HyperCapital being a Ponzi scheme.

Legitimacy by association doesn’t work. You’re wasting your time.

SCAM!! PAY ATTENTION!

This is one of the most poorly written articles I have ever seen in my life. So much miss information, manipulating the story to try and dis credit and factually incorrect. Key, very creditable bits of important information are missing.

You just have sour grapes about something. Even fundamental basics such as pointing out the price drop which every crypto in existence has experienced similar tanking figures, some even much worse.

I suppose that’s why all you could come up with is “but muh crypto price drop!“, which has nothing to do with HyperCapital’s Ponzi scheme.

Sorry for your loss.

Except no such drop was ever mentioned, as this was a review of the business, not the crypto.

At least bark up the right tree please.

It’s embarrassing how bad this ‘review’ is. Amateur at best. Information from 3rd part websites and make it look totally one sided.

Longest running scam in history then…. (Ozedit: conspiracy theories removed)

LOL really?… it was mentioned in the 4th paragraph…. how about you look there?

Oh you did not even read that far into it. Don’t blame you, it’s a garbage review. How about you READ before you comment.

3rd party websites? Try HyperCapital’s own business model. I personally research each and every review published here.

The 4th paragraph references Ryan Xu’s past cryptocurrency related failures. It has nothing to do with “the price drop which every crypto in existence has experienced”.

Not all cryptocurrencies are equal. A lot are pump and dump scams, which HyperCash was.

I get it, you’ve invested and your shitcoin is going nowhere. If you’ve got nothing constructive to add however, you’re done.

HyperCapital’s website Alexa ranking is 4.2 million. It’s over. Another shitcoin to throw on the pile.

Again, sorry for your loss. You want to get angry at someone? Try Ryan Xu and the rest of the gang that scammed you.

So you have read all the information available, 95% is not in English? Based a review on poorly translated articles in English?

Alexia ranking? Shows how little you know as website stands for very little in the scheme of things when a lot is integrated on online social networks not web sites so ‘Alexia’ will never pick it up.

No i did not lose anything, just blown away how poor this review is, as many are biased reviews are here. wrong facts, trying to make stories out of nothing to drive traffic.

One line out of of the whole review. You got me on that one. Yet you can’t seem to point out any inaccuracies, yes?

Right, so I think we’re three or four comments in and all I’m seeing is ad-hominem whinging. Not one example of the review being inaccurate.

I read enough to put together a review, as presented here (included screenshots, in English).

HyperCapital’s comp plan and Ryan Xu’s failures are what they are – in any language.

By no means perfect, nonetheless it’s a suitable measure of how well an MLM shitcoin is or isn’t doing.

Case in point, HyperCash has further dumped to 96 cents since I published this review (lololol).

If you’ve got nothing to contribute further other than hysterics, I’ll be marking your comments as spam.

I am an hc investor and the Vietnamese community was scammed on March 22, we did not receive daily interest and was transferred to a new ghost project.

I hope investors from all over the world please boycott this ponzi project.

You’ve been scammed all along. You only just realized (or chose to stop pretending) on March 22nd.

Sorry for your loss.

Sam Lee and Ryan Xu are serial scammers.

ACX.IO another of their ‘blockchain projects’ has run off with several million of users coins / $’s yet Xu and Lee carry on with the scam projects keeping one step ahead of law and regulation.

Sam Lee is behind the HyperCapital/HyperCash scam.

Proof: twitter.com/HcashOfficial/status/1232860922105954310

Image: imgur.com/a/KvA0lc6

Mirror: postimg.cc/xJBY1ZhF

They also scammed millions of coins from the ACX.IO scam.

Stay away from these scammers.

Sam lee and his wife Layla Dong are scamers. They founded blockchain centre together and runaway now..

@layla_dong: twitter.com/layla_dong?s=09

Check out BTCEXA, CCX, ACX.IO are under Blockchain Global/Blockshine Technology. The wily hare has three holes to his burrow.

There is English below.. sam lee and Blockchain centre..

mp.weixin.qq.com/s/joE6CN_KbS8rkMapjUtn8w

I wonder what Ryan and Sam will change their names to next?

If these criminals are in Australia they will either be arrested by authorities or hunted like pigs on farmland.

If you are reading this Zijing Xu we’re coming for you and until you return all the money you stole we won’t stop.

What stolen money, have they stopped paying already?

Serial scammer and convicted criminal Rodney Burton is pitching hypergroup:

youtube.com/watch?v=IkpH-_56evo

Hypercommunity Corporate Trainer is Kalpesh X Patel, another serial scammer. AcrionFraud and Met Police are informed in written complaint.

So much fun when they publicise three “corporate” webinars per week and you are offered zoom links to listen in… so easy.

Judging by the hyper aggressive comments to this article, Hyper Capital definetly, definetly has CCP involvement in it, my suggestion is stay away!

Oh there’s a surprise the video with convicted criminal Rodney Burton has been removed. I guess someone didn’t want anyone else to see that. LOL

This ponzi is being pushed in the United States…

How do they get away with it without registering to sell securities? Who can you report them to? These pricks need to go to prison!!!

The SEC regulates securities in the US. Not much they can do unless you provide them with who’s promoting it in the US though.

I see a cashfx scammer promoting this noncense. Never been a victim of these utterly ugly scams yet I wish Facebook and hotels/ conference rooms stop This theater.

Why no colleboration between financial authoroties and (mental) health authoroties to stop This? Its a crime with addict behaviour…

The company is a Membership Club that is paying Rewards.

Like Cisco, Walmart, Safeway, Macy’s, Amazon, Facebook, any successful business creating community base of customers.

Neither of these companies have are running MLM crypto Ponzi schemes. They are nothing “like” HyperCapital.

This also has nothing to do with HyperCapital or its HyperCash Ponzi scheme.

This is a Ponzi scheme and has now been placed on the UK FSA unauthorised list.

Its clever way to get around existing legislations by calling it a membership scheme that pays rewards! Why would anyone pay upfront £10,000 or more for a membership of a nothing Club?

You get rewarded for introducing people (most people recruit family and friends) but it is made clear that they shouldn’t put money in if they are not prepared to lose it.

This suppose to cover them when things go bad. Of course, like most get rich quick schemes, it’s pure pyschology. Because they know despite the warning people are going to be greatly influence by the fact that a friend or family member is introducing it.

Especially when they see those introducing it making money! What they don’t know is that the owners have a ‘backdoor escape’ and when a particular region is exhausted of people joining they will activate their escape with all of some people’s money.

Check this out: Most of the men at the top are Chinese/Asian. Why are they not operating in China? Because they are banned!

I’m assuming you’re referring to the FCA. I ran a search for “hypercapital” and “hyper capital” on the FCA’s website and nothing came up?

HyperCapital pops up on the FCA list under “HyperFund”:

fca.org.uk/news/warnings/hyperfund

Ah thanks for that. I only searched HyperCapital and HyperCash.

The below was copied from Investopedia. Does the model describe seems familiar to Hyperfund members?

“rug pull” = exit-scam

I don’t understand how a lot of people on here are referring to this as a Ponzi scheme?

My understanding was that In order to make money on a Ponzi scheme you have to refer people when in fact this isn’t the case at all.

You can get money out of this without referring a single person (speaking from a one year personal experience).

For similar reasons listed above, having no past experience in this kind of thing I chose not to recommend anyone for fear of being conned and allowing friends and family to also fall victim but I can hand on heart say I wish I had of introduced people to it to allow them to also reap the rewards as I’ve done for the past year.

If the company shut shop and ran off now then I, along with a lot of others I know who joined around the same time as me have already received more than we put in to begin with.

Rewards (with not a single referral) pay approximately 0.5% of your initial membership per day!!

False. A Ponzi scheme is such when subsequently invested funds are used to pay returns to previous investors.

Whether you personally recruit the investors you steal from or not is neither here nor there.

Hello, l read all the article and various comments.

As of today the Hyper Fund is still alive and growing fast, people is regularly convert HU into MOF (not HC as stated in the article) and convert them in fiat… can you explain that??

Never heard of MOF before today. HyperCash was a pump and dump shitcoin. MOF sounds like its replacement.

This isn’t surprising seeing as HyperFund is a Ponzi shitcoin factory. There will be more scam tokens after MOF collapses.

You invest in HU Ponzi points, and eventually get dumped on bagholding worthless MOF. That works until it’s time to Ponzi dump (see HyperCash).

Also this is a HyperCapital review, we’ve covered HyperFund reboot separately.

…MOF was launched in Jan 2018 and in the last year has gained 163% as of today. It had its ups and downs like all the cryptos but seems to be quite stable.

Members of Hyper Fund are regularly converting their HU credit to MOF and MOF to whatever else they like (USDT, BTC, ETH, fiat). MOF are exchanged on 3 exchanges currently.

I know personally (friends of mine) several members who have joined over a year ago and as of today they are withdrawing funds daily without any issue, some are even making a living out of it.

The community is growing and is well connected through a Telegram chat with over 5.000 people connected, there are a lot of zoom presentations and training and so far l didn’t see any complains about fund withdrawals and with that many members connected if the ‘shit hits the fan’ it would spread fast.

I agree that it may look like a scam but so far all runs smoothly… time will tell if you are right or not…

I went and looked up MOF. It had a relatively pathetic pump and dump debut in Jan 2018.

MOF sat in the crypto shitcoin graveyard until HyperCapital in mid 2019. This was its biggest pump.

And HyperCapital’s collapse brought on its biggest dump.

Now there’s another pump corresponding with HyperFund’s launch (and forced use through the attached Ponzi scheme). Try harder scammers.

No time for your brand of stupid today. Go back to your circlejerking cave and come crying when the scam collapses.

You’ve been warned but decided to continue stealing from others.

Hey OP.

Just wanted to thank you for your hard work and the info you share with us related to these crooks. Clearly anyone who posts about you being a liar or fake news is someone who’s investing in what you’re talking about.

I agree with everything you’ve posted about on this website; clearly you’ve been right more often than not on these shitcoins, ponzi / pyramid companies, and morons spearheading the operations.

Cheers!

Thanks Steven, appreciate the support!

As a member you do not need to refer anyone to generate money for yourself or for anyone else, which means it’s NOT a ponzi scheme.

And the business is in existence. Those who talk smack about HyperFund, have not gone through the experience.

Too bad you talk out of your ASS without any knowledge. Get the experience first, then talk about it. Anyone can do your stupid complaint.

False, and it’s literally right there in the Ponzi definition you quoted.

A Ponzi scheme exists when new investment is used to pay existing investors. Whether you personally recruited the new investors is neither here nor there.

You don’t need to lose money to Ponzi scammers to identify a Ponzi scheme.

You should avoid reproducing so the gene pool can be minus this level of stupid continuing.

People get sucked into Ponzi schemes such as these by the totally unrealistic claims such as this. If they did some simple financial analysis they would understand that this is just not possible.

Take a simple example of $1000 “investment” with a ROI of 0.5% per day. This investment will double (assuming the principal is retained in the fund) every 4.8 months.

So, after 1 year it has compounded to approximately $8000. After 2 years this would be about $64000.

After 3 years it would be about $520000 and after 5 years would be approximately $33,000,000.

People have the greed dollars before their eyes and don’t look at simple logic. The old saying “that if it looks too good to be true it probably is”.

I don’t know who is telling the truth but here is a link I found relating to Mr. Xu and his company affiliations.

For me and my hard earned money, this is enough to not trust it with these people and companies with questionnable affiliations and track records.

Thank you for taking the time to write this article. It was very informative and only time will tell but you’ve probably saved me money I can’t afford to loose.

news.8btc.com/martian-ryan-xu-backed-media-chain-ico-scammed-investors-for-100million-yuan-and-the-team-disappears-%E3%80%80

steemit.com/cryptocurrency/@gobbleguts/hcash-hsr-china-australian-shell-companies-and-the-useful-idiots

You can verify the US is HyperFund’s largest source of website traffic through Alexa.

You can verify HyperFund is not registered with the SEC as the Edgar database is public.

MLM + securities fraud = Ponzi scheme.

if there is no verifiable revenue generated then where the money come from? stealing from many and giving to few.

Bingo.

@ Oz

Good Job!

There is no doubt at all that Hyper Group is Total Fraud.

Thanks for the support!

My partner invested over $50,000.

I am not a believer. They call it a membership not an investment.

He made $60,000 in 2 months. But where is the money? Apparently in a wallet.

Not good!!!!

These guys are now operating and promoting their product in South Africa as Hyper Fund Global. I sat in a presentation yesterday at work.

The presenters were soooo pissed with me when i pointed out this was a ponzi scheme.

They immediately packed up and left the place.

Ive put in US $300, however seeing so many negative comments it makes me wonder why hasn’t the the founders put up to date videos explaining where funds are coming from, instead of leaving it more or less as a guessing game whereupon others can say that the money comes from new comers.

If funds are coming from other projects as its been stated why haven’t they personaly explained this to the consumer. But alas i cant find any such videos!

Another sticking point is where is head office? Surely there must be one! Even a small business has an office so if these chaps are said to be worth billions through there companies.

surely endeavouring to capture 30 million clients to release an IPO one would think founders would be more visible. to consumers.

So for the present I shall not be recomending.

Because obvious Ponzi is obvious.

Valid points,and massive red flags. I’d withdraw if I were you – participation in illegal schemes is a crime in most places i’m aware of.

That’s because in ALL their material THERE IS NONE!!!

I’ve seen these type of scam since 1993. Promise of high returns, they all collapse or so called get hacked.

Ninety % of digital Currency will be eliminated very shortly if the are not regulated and backed by Gold and Precious Metals once Nesara/ Gesara is implemented.

My cousin in South Carolina is so excited about Hyper Fund and is trying to get me invest in this shit token.

He took a trip to Florida to get on huge yacht for the pre-launch of Hyper Fund with several celebrities attending, its all Hype.. thanks for the info on this shit hole token..

Coming from the UK here, you have to understand, certain people have been struggling to get by for decades, working a bullshit job and not really going anywhere, then bang, this comes along, you may well be correct in calling it a ponzi scheme, but what is it that the banksters do? (Ozedit: derails removed)

Like I said you are most probably right in that its a ponzi and will one day collapse, but it also cannot be ignored that there is a lot of activity in the hyper community and literally half a billion people are now registered and it does appear that projects are indeed running.

So again trying to convince members that are already witnessing these changes first hand, is a touch task – i think if it were the case that any legal proceedings were launched, or criminal investigations etc, then it would be a bit more concerning for members.

But for now, money talks, and since this article started, some peeps have made a serious amount of doe and have not lost their investment.

Catch 22 if you ask me, the risk takers will go for it, the cautious will not, simple.

good article nevertheless and thanks for doing it, your replies are also quite hilarious, peace out.

What tHe BaNkStErs do or don’t do has nothing to do with HyperCapital and HyperFund being Ponzi schemes.

Neither does it justify their fraudulent business models, or promotion of them.

1. Of course it can. How many people a Ponzi scheme sucks in is irrelevant to it being a Ponzi scheme.

2. TelexFree had over a million email address accounts in its database, this is nothing new.

Not here to convince anyone of anything, just presenting the facts.

BehindMLM is littered with hOw Do I gEt My MoNeY bAcK? sob stories.

Every Ponzi collapses – case in point HyperCapital. We’ll be here when HyperFund inevitably does too.

Good article and analysis of a ponzi scheme. Honestly speaking, most people we go there seeing the features of it as ponzi scheme.

But as you know, the earlier you join the more chances of benefiting. these are bad times. Unemployment rate is high worsened by covid. This world belongs to risk takers.

my believe is that, if you join knowing then you have a space for dissapointment and you wont complain. I agree with u to me its a ponzi scheme but if it can make me some quick cash why not.

My principle is that dont recruit to avoid noise of people you have recruited.

Its all about risk. I have lost a lot in buying shares from credible registered financial institutions here in South Africa, for example, the public shares offfered by African Bank (ABIL).

Do a reserach on that (Ozedit: derail removed)

Like someone said, its all a catch 22 situation. We are adults and we can make our decisions. Some are rich with these ponzi schemes, some they left them poor.

(Ozedit: derail removed)

My principle is, as long as I know ( and see) the features of ponzi scheme, I decide to go for it, I leave a room of dissapointment because I may make money, I may lose and I have no one to blame hence I do not recruit.

I peacefully thank you.

1. There is no justification for stealing money from people through Ponzi schemes.

2. Stealing money from people through Ponzi schemes doesn’t make you a rIsK tAkEr, it makes you a thief.

Ultimately that’s what it comes down to. You’re a thief.

Own your thievery and spare us the sob story next time.

I don’t care if I steal from strangers is all I got from this guy.

What a stand-up individual. You’re as guilty as the scammers themselves when it implodes.

I had a friend contact me about Hyperfund at the end of August. He had a friend who got him started in Hyperfund who told him that he had made mega-money with Hyperfund.

I have read all of your information, documentation, and comments: I can only agree with you that where there is smoke, there is fire.

If Ziing {Ryan} Xu has absconded with funds from other crypto ventures, then he will do it again.

Thank you for the fair warning to your readers … it is appreciated.

Ahh guys, a quick google search reveals that as of Nov 3;

Courtesy of the Australian Financial Review.

Ponzi scam. Checkmate.

Thanks Oz and anyone else that contributed in showing this is a Ponzi, I read this page top to bottom to get informed.

I felt it was a Ponzi too, but, as most, I don’t want to miss out on the next big thing like Bitcoin has become.

That feeling makes it easy to let your guard down, which I did a bit when considering joining hyperfund.

My friend put a few thousand into it recently, and offered me to join, no pressure, not pushy, just trying to help.

I’ve told him no as you’ve confirmed my suspicions.

Thanks again! I’ll be sending him this website link to see facts, especially about that POS, Ryan Xu!

✌

With latest… now they have shifted all their members to … HYPERVERSE from HYPERFUND .. to make it more afresh approach and get some more life..

as they entering in metaverse world..by creating a new hype and by assuring their members,that technologically they are not less then … FACEBOOK META WORLD.

With New makeovers.. while keep creating shitcoins .. they Have launched one more coin called “HVT” …

These all are for retaining member’s FIAT money by not paying or creating Max. Obstacles to cash out, including heavy fees, as well compulsory transfers of that so called profits in their shitcoins and exchanges… who charges heavily for withdrawals.

SO … IN OTHER WORDS … THEY HOLD AND USE YOUR MONEY …WITHOUT ANY REWARDS.

Its NOT Hyperfunds fault. Basically individuals like Kalpesh Patel with bugger the system up for everyone else.

Kalpesh is responsible for all of the problems by manipulating the fund for his own benefit – then he leaves

businessforhome.org/2021/12/kalpesh-patel-the-nr-1-top-scammer-in-the-world/

Don’t be jealous he’s a smarter thief than you are.

The only system there is is stealing from the next sucker.

“The system” is an MLM Ponzi scheme mathematically designed to funnel money from suckers to the company’s owner and top recruiters.

Patel is a Ponzi scammer but he didn’t create Hyper*. Legal liability on the corporate side rests with Ryan Xu and Sam Lee.