Fundwise Review: Smart Desktop AI pyramid with addons

![]() Fundwise fails to provide ownership or executive information on its website.

Fundwise fails to provide ownership or executive information on its website.

Fundwise’s website domain (“fundwise.com”), was first registered in 2004. The private registration was last updated on January 10th, 2024.

From BehindMLM’s recent Smart Desktop AI review however, we know Fundwise is run by Corey Price.

According to his LinkedIn profile, Price is based out of Utah in the US.

Prior to launching Smart Desktop AI Price was promoting Local City Places and TranzactCard.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

FundWise’s Products

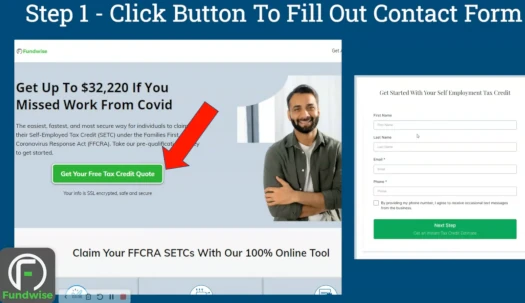

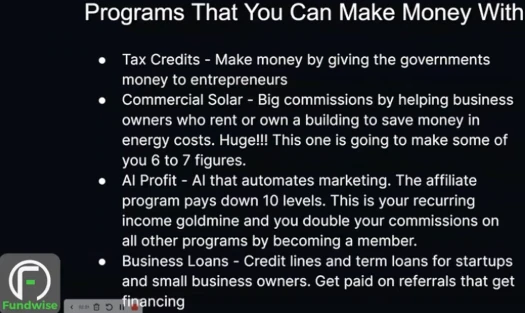

Fundwise markets loans, solar services and and commissions on getting self-employed taxpayers to apply for the Self-Employed Tax Credit (SETC).

No pricing or disclosures about which third-parties are used are provided on FundWise’s website.

Corey Price’s other MLM business, Smart Desktop AI, is also marketed through Fundwise. Note there is no retail offering through Smart Desktop AI.

Fundwise’s Compensation Plan

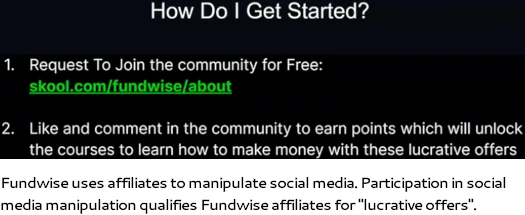

Fundwise pays commissions when affiliates sign up customers to any of their offered third-party services.

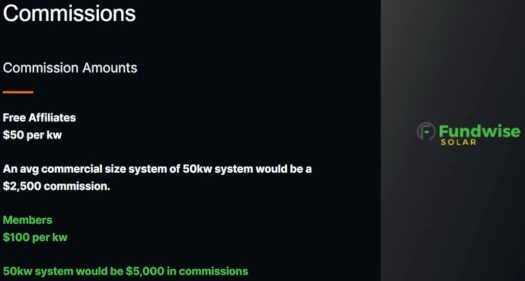

No specifics are provided on Fundwise’s website. Marketing provides estimates for Fundwise’s solar energy scheme:

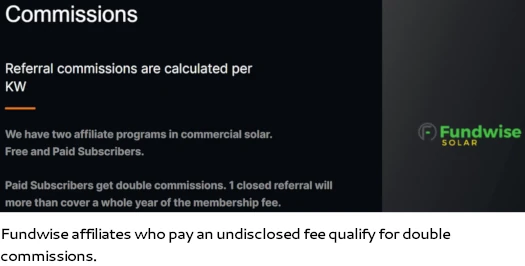

What we do know specifically is if Fundwise affiliates pay a fee, they qualify for double commissions on signed up solar energy customers.

Smart Desktop AI is offered through Fundwise. As per BehindMLM’s published Smart Desktop AI review, the company operates as an MLM pyramid scheme.

Joining Fundwise

Fundwise is free to sign up. Fee pricing for double commissions on solar energy customer signups is not disclosed.

Access to Smart Desktop AI is currently $27 a month.

Fundwise Conclusion

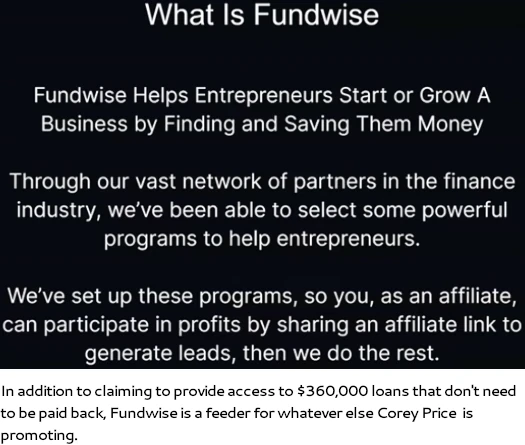

Although it started off pushing business loans, today Fundwise as an MLM company is basically a feeder into Smart Desktop AI.

This is problematic as Smart Desktop AI operates as an MLM pyramid scheme.

Although it’s not MLM, from a regulatory perspective the rest of Fundwise is also problematic.

- Fundwise does not disclose company ownership and/or executive information

- Fundwise does not provide consumers with a clear breakdown of its offered third-party retail products and services (including pricing)

- Fundwise does not provide consumers with clear compensation details on any of its offered third-party services (including Smart Desktop AI)

These are all potential violations of the FTC Act with respect to disclosures.

Fundwise’s marketing is also likely a violation of the FTC Act with respect to false, misleading, or deceptive representations.

Fundwise markets its loans services as getting “360K in funding you don’t pay back”.

Fundwise pitching this to the general public as achievable is obviously nonsense. Yet the company claims “this works for everyone”.

An FTC investigation into this marketing representation would see the regulator request information on the number of $360,000 loans Fundwise was able to obtain for clients that didn’t have to be paid back.

Unless the percentage was 100% of enquiries or close to (“everyone” and “worldwide”), Fundwise would be in violation of the FTC Act.

Fundwise originally started off with its loan scheme some years ago. This means there’d be plenty of data for the FTC to determine whether Fundwise’s marketing claims are deceptive or not with.

That Fundwise doesn’t provide this data themselves on their website is telling.

Four years on from the start of the COVID-19 pandemic, signing people up for tax credits is a bit long in the tooth. It’s not impossible but you’re unlikely to find anyone who qualifies who hasn’t already applied (Fundwise is far from the only business hoping to sign people up for COVID-19 tax credits for a commission).

Solar energy is another competitive industry. Its inclusion in Fundwise’s offering is likely to be complimentary as opposed to something you can build steady income around.

Offering double commissions to paid affiliates is also another potential violation of the FTC Act (“pay to play”). How much you pay for access to any income opportunity should never dictate commission rates.

That leaves us with Corey Price hoping to jump on the AI grift bandwagon, and subsequent launch of Smart Desktop AI earlier this year.

As stated three times now, Smart Desktop AI operates as a pyramid scheme and is most definitely a violation of the FTC Act.

Outside of paying a fee for double solar service commissions and access to Smart Desktop AI, Fundwise isn’t likely to cost you anymore than time.

Once you factor in joining Smart Desktop AI however, the fact that the majority of participants in pyramid schemes lose money comes into play.

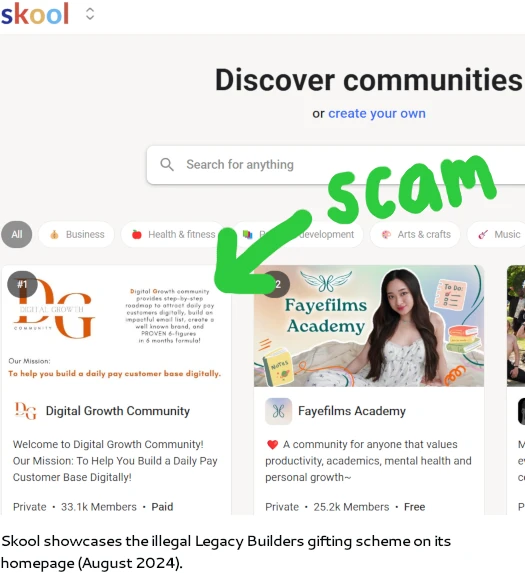

As per Fundwise’s marketing above, I’ll briefly touch on Skool. Skool is a third-party platform on which users can create public/private and free/paid groups to communicate through. Think of it as the “groups” section of FaceBook on its own platform.

We don’t typically bring up social media platforms that allow scammers to communicate but Skool is a little different.

As of August 2024, this is Skool’s homepage:

It’s not the biggest group on Skool but for some reason Skool’s “number one” group is Digital Growth Community.

Digital Growth Community is attached to the Legacy Builders gifting scheme.

Two recent dodgy MLM companies using Skool as a communication platform isn’t a trend. If I keep seeing it pop up though I might start flagging Skool as an incubator for illegal MLM companies defrauding consumers.

If Skool is willing to showcase an illegal gifting scheme on its homepage, they’re clearly not doing any due-diligence into who is using their platform.

Getting back to Fundwise; I guess the obvious consumer-side litmus test is taking Fundwise’s $360,000 loan marketing at face value.

No matter who you are (“everyone”) and where you are in the world (“available worldwide”), if Fundwise can’t provide you with $360,000 in funding “you don’t pack back” (“works for everyone”), cease communication and report to the FTC for false advertising.