Elysium Network Review: Elysium Capital securities fraud

Elysium Network operates in the “money management” MLM niche.

Elysium Network operates in the “money management” MLM niche.

The company provides three corporate addresses, in Hong Kong, Estonia and Sweden.

Heading up Elysium Network is founder, CEO and Chief Legal Officer Fred Pascal Stege.

As per Stege’s Elysium Network’s corporate bio;

As per Stege’s Elysium Network’s corporate bio;

Fred is an experienced C-level executive with a law enforcement background.

An entrepreneur and tech investor with a demonstrated history of working in management consulting roles in the affiliate marketing industry, he has a proven track record of success in Operations, Finance, Financial Markets, Trading, Marketing, Management and Sales in multi-billion US$ ventures.

According to Stege’s Facebook profile, he’s based out of Malmo, Sweden. Thus it appears Elysium Network exists in Hong Kong and Estonia in name only.

The earliest record of Stege’s involvement in the MLM industry I was able to find dates back to 2005. Stege was a co-owner of Vemma’s European, African and Israeli markets.

In 2010 Stege left Vemma. A year later he founded Origin Pure, a nutrition based MLM company.

BehindMLM came across Stege in our April 2014 review of Origin Unite.

On the executive side of things, Fred P. Stege appears to have been primarily involved in MLM lead generation and marketing.

By 2016 Origin Pure and Origin Unite had collapsed, prompting Stege to sign on as General Manager for Northern Europe at Jeunesse.

According to Stege’s LinkedIn profile, he held the position until May 2019.

Elysium Network was founded a few months ago (website domain reg last updated March 2020). Other components of the company appear to have been put in place starting mid to late last year.

Read on for a full review of Elysium Network’s MLM opportunity.

Elysium Network’s Products

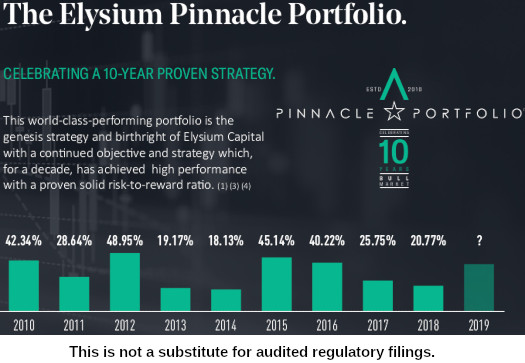

Elysium Network offers an investment scheme through the Elysium Capital Pinnacle Portfolio.

This world-class-performing portfolio is the genesis strategy and birthright of Elysium Capital with a continued objective and strategy which, for a decade, has achieved high performance with a proven solid risk-to-reward ratio.

Elysium Network claims to generate return revenue via

currency trading, manual & via EA. Complex mathematical and statistical modelling. High Frequency Trading (HFT).

Investments of €500 EUR or more are solicited. No specific information on returns is provided.

Elysium Network’s Compensation Plan

Elysium Network’s compensation plan primarily revolves around paying affiliate fees, and then getting paid to recruit others who do the same.

Investment commissions are paid only on generated returns, through a unilevel compensation structure.

Elysium Capital Affiliate Ranks

There are thirteen affiliate ranks within Elysium Capital’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- IB – sign up as an Elysium Capital affiliate

- 1-Star IB – refer one client and recruit three affiliates

- 2-Star IB – refer two clients and recruit six affiliates

- 3-Star IB – refer three clients and recruit nine affiliates

- 4-Star IB – refer six clients and recruit twelve affiliates

- 5-Star IB – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher), and be earning 25+ binary cycles each month

- 6-Star IB – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher), and be earning 50+ binary cycles each month

- 7-Star IB – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher), and be earning 100+ binary cycles each month

- 8-Star IB – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher, two recruitment legs must have a 5-Star IB in them), and be earning 200+ binary cycles each month

- 9-Star IB – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher, four recruitment legs must have a 5-Star IB in them), and be earning 400+ binary cycles each month

- Diamond IB Presidents Team – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher, six recruitment legs must have a 5-Star IB in them), and be earning 800+ binary cycles each month

- Diamond IB Chairmans Team – maintain six referred clients and twelve recruited affiliates (six must be 1-Star IB or higher, eight recruitment legs must have a 5-Star IB in them), and be earning 1200+ binary cycles each month

Note that clients refer to customers who have invested. These can either be retail clients or recruited affiliates.

For more information on binary cycles refer to “Residual Recruitment Commissions (binary)” below.

Direct Recruitment Commissions

Elysium Capital affiliates are paid to recruit new affiliates.

- earn €25 EUR on the recruitment of a €179.90 EUR affiliate

- earn €100 EUR on the recruitment of a €548.95 EUR affiliate

Residual Recruitment Commissions (unilevel)

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Elysium Network caps payable recruitment commissions at seven unilevel team levels.

A €25 EUR residual recruitment commission is paid on the recruitment of €548.95 EUR affiliates.

- IB ranked affiliates earn residual recruitment commissions on two unilevel team levels

- 1 Star IB ranked affiliates earn residual recruitment commissions on three unilevel team levels

- 2 Star IB ranked affiliates earn residual recruitment commissions on four unilevel team levels

- 3 Star IB ranked affiliates earn residual recruitment commissions on five unilevel team levels

- 4 Star IB ranked affiliates earn residual recruitment commissions on six unilevel team levels

- 5 Star IB and higher ranked affiliates earn residual recruitment commissions on seven unilevel team levels

Residual Recruitment Commissions (binary)

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Sales volume is generated across the binary team as affiliates are recruited into it, and when they pay their monthly affiliate fee.

200 GV matched on both sides of the binary team generates a €20 EUR cycle commission.

Elysium Network caps cycle commission earnings based on rank:

- IBs can earn 3 cycles a week

- 1-Star IBs can earn 5 cycles a week

- 2-Star IBs can earn 10 cycles a week

- 3-Star IBs can earn 15 cycles a week

- 4-Star IBs can earn 25 cycles a week

- 5-Star IBs can earn 50 cycles a week

- 6-Star IBs can earn 75 cycles a week

- 7-Star IBs can earn 100 cycles a week

- 8-Star IBs can earn 150 cycles a week

- 9-Star IBs can earn 250 cycles a week

- Diamond IB Presidents Team can earn 500 cycles a week

- Diamond IB Chairmans Team can earn 750 cycles a week

Matching Bonus

Elysium Network pays a Matching Bonus on residual recruitment binary commissions (see above).

The Matching Bonus itself is paid out on nine unilevel team levels:

- 1-Star IBs earn a 20% match on level 1 (personally recruited affiliates)

- 2-Star IBs earn a 20% match on level 1 and 15% on level 2

- 3-Star IBs earn a 20% match on level 1, 15% on level 2 and 5% on level 3

- 4-Star IBs earn a 20% match on level 1, 15% on level 2 and 5% on levels 3 and 4

- 5-Star IBs earn a 20% match on level 1, 15% on level 2 and 5% on levels 3 to 5

- 6-Star IBs earn a 20% match on level 1, 15% on level 2 and 5% on levels 3 to 6

- 7-Star IBs earn a 20% match on level 1, 15% on level 2 and 5% on levels 3 to 7

- 8-Star IBs earn a 20% match on level 1, 15% on level 2, 5% on levels 3 to 7 and 2.5% on level 8

- 9-Star IBs and higher earn a 20% match on level 1, 15% on level 2, 5% on levels 3 to 7 and 2.5% on levels 8 and 9match

ROI Match

Elysium Network pays a match on ROI payments via the same seven-level deep unilevel team residual recruitment commissions are paid on (see above).

ROI match payments are paid as a percentage of returns paid to unilevel team affiliates and retail investors as follows:

- 16% on level 1 (personally referred retail customers and recruited affiliates)

- 1% on level 2

- 0.5% on levels 3 to 7

Note that from level 2 the ROI match is only paid on recruited affiliates within the unilevel team.

5 Star and PFC Quarterly Bonus Pool

Elysium takes 2.5% of company-wide calculated returns and places it into the 5 Star + PFC Quarterly Bonus Pool.

5-Star IB and higher ranked affiliates receive an equal share in the pool, paid quarterly.

Diamond Bonus Pool

Elysium Network takes 3% of company-wide sales volume and places it into the Diamond Bonus Pool.

Diamond IB President and Chairman ranked affiliates can qualify for shares in the Diamond Bonus Pool as follows:

- one share per month an affiliate ranks at Diamond IB Presidents Team

- two shares per month an affiliate ranks at Diamond IB Chairmans Team

Shares reset every quarter upon payment of the Diamond Bonus Pool.

Joining Elysium Network

Elysium Network affiliate membership is €548.95 EUR and then €79.95 EUR a month

There is a cheaper affiliate option for €179.90 EUR but I’ve mostly ignored that as it’s not part of the MLM opportunity.

Conclusion

The two primary concerns regarding Elysium Network are securities fraud and pyramid recruitment.

Elysium Capital states it generates ROI revenue via

authorised prime brokers and liquidity providers registered with the Swedish Financial Supervisory Authority (FSA) in full transparency and with segregated accounts in highly reputable European banks: Swedbank, Nordea Bank, SEB and Barclays.

That’s great for the brokers, but Elysium Network is the one offering the passive investment opportunity.

Elysium Capital therefore needs to be registered with securities regulators, and as far as I can tell they aren’t. Not in Sweden, or anywhere else in the world.

Why would an MLM company opt to operate illegally? Well usually it’s because they aren’t doing what they say they are.

Without legally required audited third-party accounting filings, it’s impossible to confirm Elysium Network is indeed paying returns with external revenue.

This is a regulatory failing on Elysium Network’s part, and charts like the one below are not a substitute:

With respect to pyramid recruitment, the only retail side of the business appears to be a mysterious €500 EUR minimum passive investment opportunity.

Affiliates are given access to backoffice software, which is what the MLM opportunity primarily focuses on.

Elysium Capital fails to go into detail regarding standalone investment, emphasizing its irrelevancy within the MLM opportunity.

What you’re left with is paying affiliate membership fees and getting paid to recruit others who do the same.

Elysium Network pseudo-compliance split membership fees into “admin fees” and “software licenses”, but at the end of the day this is how you sign up as an affiliate.

Paying commissions on affiliate membership fees constitutes recruitment commissions, and any MLM company in which this is the primary source of commissions paid out is operating as a pyramid scheme.

Also if Elysium Network’s trading software is all that it’s cracked up to be, why is it only available to affiliates?

And why is there literally zero detailed information provided about Elysium Network’s trading bots? This is another regulatory compliance fail.

The last thing I want to touch on is Elysium Network’s corporate structure.

There’s Elysium Network, Elysium Capital and Elysium Social. Why?

There’s literally nothing about Elysium Network that couldn’t be condensed into one simple website.

Elysium Capital’s website is useless. You can’t actually do anything on it except read vague investment promises and the team’s corporate bios.

No idea if Elysium Social has its own website. I did note there’s an Elysium Social operating out of Maryland in the US, so there’s a potential trademark dispute in the works there.

If you’re still hell-bent on joining Elysium Network I suppose you could ask your potential upline what their own ROI earnings have been and how much they’re making through the ROI match.

Level 1 pays out an 16% match so if there’s nothing there you can put two and two together.

At a minimum Elysium Network needs to address securities regulatory concerns.

Fleshing out an actual retail investment opportunity can come next, but there’s no point while what you’re offering is illegal anyway.

Update 14th August 2020 – As at the time of this update Elysium Capital has failed to address securities fraud concerns.

The company has however named the broker it will be committing securities fraud through.

Update 8th September 2020 – I was sent in a copy of Elysium Network’s current compensation pan.

Based on that I’ve updated the compensation section of this review with a few percentage changes, rank qualification criteria and the 5-Star pool bonus.

I’m also noting this “disclaimer” from the compensation plan:

Elsyium Capital Limited does not accept clients from the U.S.

This in and of itself is a red flag but also ties into Elysium Capital’s securities fraud and pyramid recruitment red flags.

Update 22nd July 2021 – BehindMLM revisited Elysium Network for an updated review in July 2021.

The Malmö connection is interesting. There is no sign of anyone by that name being resident in Malmö or indeed in Sweden. There are only 6 people in Sweden with last name Stege.

Looking at his FB profile, he does have some friends in the Malmö area. One that sticks out is Daniel John, COO of Elysium Capital Ltd, also listed as from Malmö in FB. He does not seem to have a real presence in Malmö either.

There is no sign of Elysium Network or Elysium Capital being registered as a Swedish company. The only address I found is to the Malmö landmark Turning Torso. Mostly residential, I doubt this is more than a letterbox or false front.

If Stege is lying about living in Sweden on his FB profile, I believe he was previously living in Belgium.

That’d mean Elysium Capital doesn’t physically exist at any of its provided corporate addresses then.

On Facebook, he gives his “Current city” as Malmö, but his “Home Town” as Palma de Mallorca, Spain.

He also claims that his job as founder of Elysium Capital Ltd. only started in August 2019.

However, on LinkedIn, his location is the strangely vague “Antwerp Area, Belgium”. There, he also claims that his job as “principal” of something called “ELYSIVM | MUTUAL Stege – Beaufort office” started in 2010.

From other stuff, the “Stege – Beaufort office” bit is what he refers to as his “family office” (and spelling “Elysivm” with a V is just a ridiculous affectation).

The claim that Elysium has actually been around since 2010 fits with the graph for the Elysium Pinnacle Portfolio. So why does his FB profile say 2019?

His education is also oddly different between the Facebook and LinkedIn versions.

On Facebook, he claims to have been a student of the “Royal Netherlands Police Academy”. This fits with his other claims to have been a police officer.

In particular, the story that he got into MLM after having been involved in an investigation of someone who was making huge amnounts of money, which his bank thought was suspicious and reported to the police.

The police discovered he was making it legally through MLM. Afterwards Stege of course quit his police job, and asked the man he’d investigated to teach him how to become rich through MLM as well.

That’s what police officers always do, when in the course of their duties they encounter someone who makes more money than they do.

The name of that academy he attended in Dutch would be “Koninklijke Nederlandse Politieacademie”. No such institution exists (allowing of course for the “Netherlands” bit possibly being a clarifying addition for the benefit of foreigners).

The Dutch police academy is simply called “Politieacademie”, without an added “Koninklijke” honorific.

For the sake of completeness: there is only one Dutch law enforcement agency which has that predicate, the Koninklijke Marechaussee. But while doing a lot of policey stuff, they’re a branch of the military, are therefore never referred to as “police”, and they don’t have anything called “academy” of their own.

Their officers train at both the police and defence academies, neither of which have “Koninklijk” in their name, and also at a school of their own, which isn’t called “Academie” but “Centrum”.

So, either he’s made it up entirely, or he’s aggrandizing what was nothing more than job training.

On LinkedIn, the supposed Dutch police academy goes unmentioned. Instead, he has an additional degree: a Bachelor’s in law from the university of Leiden.

It seems odd to completely forget about a law degree from a prestigious university, in a Facebook profile in which you do bother to include the unremarkable secondary school you went to.

One last fun fact: he uses the same profile picture on Facebook and LinkedIn which he already used in 2011, as can be seen here:

businessforhome.org/2012/03/origin-pure-review-2012/

Continuing to look into the Malmö connection, Stege actually shares photos of the Turning Torso office on several occasions since December 2019, and uses the characteristic image of the building in presentations.

Turning Torso is the major landmark of Malmö, a twisted 54fl tower in a seaside location overlooking Copenhagen and the bridge to Denmark.

There is actually an “office hotel” on the 9th floor. You can rent small furnished offices with shared facilities. This is where Stege’s pictures seem to come from.

Most are generic, but there is actually a picture from Feb 7 which shows a corner office with a big TV with Elysium logo, and an outside signboard with companies including Elysium.

In general, to rent an office like that on any longer term, you would need to have a registered company with a company ID#. There is one Elysium AB in Malmö, but that’s an existing ad agency.

So in short, there are indications that Stege is actually hanging out in Malmö and Turning Torso, but in that case he is not leaving a lot of traces, personally or the company. You can suspect he is using someone as a go-between.

And it’s a laugh he is referring to Swedbank as highly reputable. They have been heavily fined for money laundering.

Remember that Stege has been using the same portrait photo of himself for a decade, so he’s not exactly above lying with pictures.

A TV screen and a spot on a signboard are usually just about the easiest things to photoshop your own logo onto.

They’re perfectly flat, perfectly rectangular, with sharp edges, and it’s very easy to match perspectival distortion when pasting in a rectangular picture of your own.

They’re also normally positioned so there’s nothing obstructing the view, so nothing in the way of pesky surrounding bits and pieces in front of it to reproduce.

Plus, they’re normally put in good light (for a screen, internal lighting), so no annoying, difficult to match shadows, always the bane of the image manipulator.

It’s also one of those typical things scammers show to pretend that an office is really theirs, not just something rented for a few hours (or perhaps someone else’s).

Why would a real company feel the need to have its own logo permanently showing on a screen inside its own offices? Logos are meant to be seen by outsiders, not your own staff.

This kind of pasting-in is of course also how stock photographs of the type “man/woman with a screen behind them giving a presentation to a large, rapt audience” are adapted – such photographs are deliberately set up to make that easy.

If you take some care, and at the low resolution of most pictures on social media, it can be undetectable. But it cannot hurt trying one of the online “photo forensics” tools on the pictures.

Pasting bits of JPGs into other JPGs with different compression rates often leaves tell-tale artefacts, and amateurs almost always use JPGs.

If you’re dealing with total amateurs, they may even have been stupid enough to leave the metadata tags on the underlying picture intact, which often include the location.

“ELYSIVM”

What prentiovs crap.

Their hk address is fake. I was there to check it out.

What makes it not just pretentious but somewhat distasteful is that he chose this ridiculous “ivm” misspelling less than a year after a creepy cult with the same affectation had made the headlines, when its leaders were arrested.

It was called Nexium, but they wrote that as “NXIVM”.

They’re the nice people who ran a “secret sisterhood” whose members, referred to as “slaves”, were branded with the initials of the cult leader.

I certainly immediately had to think of that when I saw another MLM using the same misspelling.

Another MLM, because that is what the cult actually was.

The leader, Keith Raniere, had started out running two more conventional MLM/pyramid schemes, Consumers’ Buyline Inc. (pretend product: discounts through group purchases), and National Health Network (vitamins).

The first one ran into trouble for being an obvious pyramid scam and was banned, the second one apparently failed before that could happen.

With his third business venture, the cult, he not unexpectedly also went for the MLM model, this time with business skills/self-improvement courses as the pretend product.

The leaders have been convicted and are in jail, but there is an ongoing civil lawsuit (filed January 2020), which specifically claims that “the company actually acted as a multilevel marketing pyramid scheme with a secret society”, and “functioned as both a Ponzi scheme and a coercive community”.

The corporate address in Estonia has been removed from their websites.

May have something to do with this investor alert from the Estonian Finantsinspektsioon: fi.ee/en/alerts/elysium-capital-ou-elysiumcapitalio

Thanks for that. Was just about to knock off for the evening though, doh!

Elysium’s HK address is fake. I was there a few months ago.

How exactly do you mean “fake”? I don’t suppose they have an actual physical office there, but might they have a letterbox at that address?

hkcorporationsearch.com/companies/2865940/ shows that a company with that name is registered in Hong Kong.

Why is that so many people wright things here if they dont know the facts.

i have personaly meet fred in his office in sweden malmö, so it exists, and in his presentations he clearly says that they are no security so how can you say its a security freud??

And everybody is welcome to visit him in person and get the real facts instead of writing bullshit here.

So Fred has an office in Sweden. Doesn’t change the fact that Elysium Network is committing securities fraud through Elysium Capital.

Because what Fred says in his presentations doesn’t matter. I’ve laid out exactly why Elysium Capital is a securities offering in this review, it is what it is.

You ignoring the facts doesn’t make them bullshit. It makes you a scam apologist.

But, but, but…

How can it be securities fraud if the fraudster clearly states it’s not a security?

Wait, I think I just answered my own question.

Well he has an office you see. It’s in Sweden.

Did he regale you with the story how he sold his payment processing firm to Deutsche Bank at the end of 2010 which gave him enough money to retire a 2nd time?

That then enabled him to go into wealth preservation; he started a family office, within that he set up a mutual fund which, once the 50th accredited investor joined (anyone ever heard of that rule or law?), he had to mould into a hedge fund.

Which is of course how he met all these CIO’s, quants, hedge fund managers and other experts.

Though Elysium is “not a hedge fund”, and they also don’t give you access to a hedge fund (because retail clients can’t access hedge funds), but their software will enable you to “bypass the hedge fund” linking you to a “professional trading desk”. (Though they are not a hedge fund, which they probably should tell some of their IB’s, who keep claiming just that)

Did he show you audited reports of the alleged Pinnacle Fund?

Did he show you corporate details of whatever firm might be trading the amazingly profitable Aurum Digital fund?

Did he explain to you why they don’t need a securities regulation, even though comparable service providers like duplitrade.com or zulutrade.com do?

Or why avatrade.com goes to such great lengths to mention all regions where they are compliant?

Does nobody at those firms understand that they can just use the magic word “LPOA” and everything is nice and legal?

The English FCA regards auto-copying as portfolio or investment management, in line with MiFID. (fca.org.uk/firms/copy-trading)

In other words, Elysium as a software provider needs a securities regulation as they offer auto-copying.

The brokers, liquidity providers and alleged professional funds probably all have one; just a shame that they themselves don’t.

Mind you, we’re all misunderstanding them and they keep having these unfortunate software niggles. Just you wait until they open and then we’ll all see.

If his current story is that he’s been independently wealthy since 2010, and has really only been engaged in managing his fortune, he hasn’t even bothered to make the information he provides on his own LinkedIn and Facebook profiles match it (let alone facts easily documented from other sources).

From 2010 to 2019, he first tries setting up his own MLM, Origin Pure. After that has failed, from January 2016 to May 2019, he works for Jeunesse Global, as far as one can tell as an employee, he’s not just an affiliate.

Why the hell does he do that, when since 2010 he only needs to manage his huge personal fortune?

This supposed payment processing company he sold to Deutsche Bank in 2010 is also curiously lacking in his own profiles. It must certainly have become very big very quickly, because in 2007 he’s still forced to apply for bankruptcies for the two small companies he owned in Belgium (which are also not to be found in his own current profiles, but for whose existence we do have actual proof).

If by then he’d already been making lots of money through a new venture, it would have been perfectly normal to shut them down if he no longer needed them – but he applied for bankruptcy, instead of going through a normal liquidation procedure.

So between 2007 and 2010 he’s built up this new financial services company, which a major bank is willing to pay so much money for he can retire on it. Yet according to his own bio, between 2005 and 2010 he’s also working as “CFO – CEO Vemma Europe Ltd.”

Even if he replaced those profiles with ones matching his newly made-up stories about what he did during the past two decades, there’s more than enough stuff documented elsewhere on the internet which he cannot change.

That’s odd, facebook.com/groups/programreview/permalink/3785892604816412/; someone who is (according to linkedin) an introducing broker at Elysium explicitly referred to Elysium as a “Forex hedgefund that goes retail” on December 24th, 2019.

On April 18, 2020; that same IB mentions a “total serious and legal Forex Hedgefund project”, the “Product (Pinnacle Forex Hedgefund)” and the “company is from Sweden & MIFID 2 Complient”.

I guess we’re all reading too much into these little misunderstandings.

Do Swedish offices legally overtrump Hong Kong offices?

Apparently, no trace of Elysium Capital is visible at Bonham Trade Centre, 50 Bonham Strand, Sheung Wan, Hong Kong.

facebook.com/groups/programreview/permalink/4167145956691073/

Fred is clearly a freud, whether his pretend office is in Sweden or Hong Kong. You don’t have to be Sigmund Fraud to see through his façade.

(Note to pedants: see comment #13 before you spell-check me.)

It was a Fraudian slip!

Sorry, I’ll get my coat…

Yes, people are too hard on the poor affiliates and brokers. Under wetransfer.com/downloads/b173624fd7dd96f2f557938b98442b2020200730131456/74fa11e148163196d7418a0f1fc7aa9620200730131714/c33f3d, Fred is kind enough to tell at least 3 times that they’re not a hedge fund; they provide copy-trading which “by-passes the hedge fund”. You have to understand that and don’t bother asking for details.

Anyone could get confused though, “Fred Stege, a company in Sweden”; asked for a “logo for Fintech / hedgefund” on jobs.designcrowd.com/job/3663274.

He does talk about how you have the money traded by a group of 17 people that they have right now; so are they a signal provider, a software company, a private trading desk, a mutual fund, asset or portfolio managers,…?

Even these two poor introducing brokers from Norway (www.sparsmartere.no/copy-of-nor-1) are a bit confused on their site – which was registered on June 19th, 2020 – by boldly underlining that you get access to hedge funds.

A part of what Elysium Network will provide is the SoHo Software (“our social media management tool helps Introducing Brokers, IB’s, reach more clients, generate more income and ensure brand compliant social media promotion”).

It’s a bit unfortunate that this software still isn’t operational after all these months, leading some affiliates and introducing brokers to speak out of turn.

But as Elysium promised once the Estonian warning was published here

“Once we launch they will see what we really are about.”

Then their brand compliant information will end all this confusion.

Attended another webinar…turns out he was in the army, went into policing, studied and graduated law, was one of the first to discover the networking potential of the internet, got a financial degree somewhere along the line, went to live in the US for 9 years, built a downline with over 200,000 people, retired at 31, came back to Europe, went into consultancy, did the legal groundwork for US Inc 500 companies coming to Europe, took a stake of 50% in a company worth USD 1.6 billion, sold that off together with his payment processing firm, retired again late 2010, started that family office turned private mutual fund turned hedge fund, learnt trading at the Goldman Sachs commodities prop desk in the City, took a course in DLT & Blockchain in 2013-2014, started trading bitcoin privately, bought futures in Bitcoin as soon as that was possible in 2017 and made a killing by shorting it.

Friends started asking him if they could help him invest money, which wasn’t possible because they weren’t accredited. Which were the first seeds of the idea which will now become Elysium, to help the retail clients.

Not once were Vemma, Origin or Jeunesse mentioned.

According to docplayer.nl/841346-Getuigenissen-voordelen-van-nwm.html; he went to law school for 1 year and was a police inspector for 7 years. Born in 1969 (companycheck.co.uk/director/916918049/MR-PASCAL-STEGE/summary), one year of conscription, one year of law school, 7 years as an officer, 9 years in America and retirement at 31. When do they graduate high school in the Netherlands?

He was the Vemma CEO for Europe, Israel & Africa (vdocuments.mx/dxn-obtainermagz.html) from 2006 (not 2005 as per LinkedIn) until Nov 2010. Around that time, Oiggio (another Belgian company he was involved in – registry number 0892.190.063) was declared bankrupt after a summons on October 21, 2010.

After which he starts with Origin on November 30, 2010 (opencorporates.com/officers?q=pascal+stege&utf8=%E2%9C%93).

I suppose it’s not impossible he was bought out at Vemma in November 2010 and cashed a truckload of money before the whole Vemma pyramid came crashing down and used that money to start his own MLM.

The elysiumcapital.io website was updated, now also contains information about their portfolios. Containing disclaimers why Elysium allegedly “is not required to be authorised by the regulatory authority.”

So they have an office in Sweden, unfortunately elysiumcapital.io/legal/terms-of-supply still carelessly states “our office is located at No.5, 17/F, Bonham Trade Centre, 50 Bonham Strand, Sheung Wan, Hong Kong.”

youtu.be/w6ut-W7alNY does seem to suggest otherwise.

Pretty popular address on offshoreleaks.icij.org/ as well.

@Jonas

Stege has run into a standard problem for liars and fabulists: they make up so much amazing stuff they’ve done in their lives, they run out of years they’ve lived to fit it into.

Actually, his biographical timeline can be put together in a quite consistent way, from publicly available sources, combined with some of his own less-implausible claims.

First, we know that he was born on May 8, 1969. One can lie about such things to Companies House in the UK, but because he’s registered several companies in Belgium, and that requires certification by a notary, we know the date given in those incorporation documents (all easily found online – I looked at company numbers 0478.985.208 and 0865.344.819, both bankrupt) is reliable. (We therefore also know with certainty his legal name is indeed Pascal, not Fred, Stege.)

After school, he first went to university with his eye on a law degree, but that try only lasted a year. Then, there was compulsory military service, which was 14 months at the time.

After that, he claims he was with the police for 7 years. So, 1969 + 18 years, + 1 year of university, + 1 year and a bit of military service, + 7 years puts us somewhere around late in 1996 at the earliest, or in 1997.

In a crapola book he self-published in 2002, he describes what he presents as part of his early days in MLM: cold-calling people in the US, from somewhere unspeficied in Europe, without specifying what it is he was trying to sell them. He puts the start of this particular activity in October 1997.

At least from 1998 onwards, he leaves an online footprint showing him trying to run a succession of MLM schemes of his own, with names like MLM Dynamite, Traffic Oasis, Ezine Blaze, and Madison Dynamics, all of which fizzle out.

Clearly, he can’t make it on his own, and in 2006 he gets a job with someone else. He works for Vemma until 2010. The little companies he set up for his earlier efforts (for some reason these are registered in Belgium, even though he always gives his own address as being in the Netherlands), he lets go bankrupt.

Then, he decides to give it another go with a company of his own, Origin Pure/Unite. That again doesn’t work out, and in 2016 he once again abandons his own company to get a job with someone else, and goes to work for Jeunesse.

Then in 2019, the pattern repeats itself: he once again leaves that job, and tries to set up a new company of his own, Elysium.

It’s all perfectly consistent, with no gaps in the timeline.

What there isn’t any room for is any significant time spent in the US (all of his documented activitity firmly puts him in Europe, most of it in either Belgium or the Netherlands), a successful career allowing him to retire (for the first time) at 31, or any of the other stuff he’s now apparently claiming.

He’s a man with nothing but a string of long-forgotten failed little MLM businesses of his own behind him, plus two stints of about four years each working for someone else’s more successful MLM companies (only one of which, Vemma, was shut down as a fraud).

I say “little businesses”, because I’ve also taken a brief glance at some of the published accounts of those Belgian companies of his. We’re talking about companies where his paid-up contribution to the starting capital is in the order of a few thousands of euros, with profits that at best reach into the tens of thousands of euros, and which never had a single full-time employee.

Hardly the kind of thing a semi-retired multimillionaire, still dabbling in high finance to manage his fortune, would keep himself busy with.

Perhaps us mere mortals can’t understand how hard he worked?

According to his Facebook, he graduated Amsterdam University with an EMBA in 1996 (which he started in ’93 – LinkedIn says ’94). Law school in Leiden is absent from Facebook, no dates are given on LinkedIn.

Police academy from ’88 onwards, maybe he combined that with evening classes or distance learning to achieve his law degree. While also being a police officer and starting his MBA in ’93 or ’94.

While being CEO-CFO at Vemma Europe from 2006 to 2010, he also attended the PLD (Program for Leadership Development) at Harvard Business School in 2008. Which these days is a 7 month course with a USD 52,000 fee. (May have been different back in ’08).

Or as the man himself said in 2013 “through the years, I’ve done quite some formal education, I got my MBA when I was 39”. youtube.com/watch?v=u0C1Wz9SJFE

I watch another webinar yesterday, it is no more funny: you think maybe Fred reading this pages?

For first time, Fred say he studyed law ‘on the side’ and ‘did that pretty fast’. He always say he go to university and meeted a lot of interesting people. He still say he moved to USA 9 years and retire at 31. But now you and Jonas say he studying in Amsterdam and working in Belgium then. For first time in webinars, he say he go bust a few times.

Sorry if I been mean before, but please, I don’t know to believe whom.

Likely, I’d say.

Apart from pretty much immediately responding to the Estonian warning once this site mentioned it; your question made me think of his story about how his private mutual fund had to be turned into a hedge fund once the 50th accredited investor joined was all of a sudden accompanied by a remark along the lines of “in most jurisdictions, mutual funds can only have up to 50 accredited investors”.

I’d pretty much forgotten that passing remark, but now that you mention it; I remember finding it weird at the time, like 3 days after this site mentioned it.

Well, we can’t say for sure whether he was in the USA or not (which should have been between 1991 and 2000; if his claims of retirement at 31 are true.

I guess he then sold his businesses before the dotcom bubble of March 2000 if he could retire on them.) When though would he then have had the time to be a police officer, and also graduate law and finance?

After that, would someone be able to work as the CEO-CFO of Vemma Europe from ’06 to ’10; while simultaneously founding and heading Vemma Netherlands in 2007 (businessforhome.org/2010/09/the-netherlands-mlm-country-report/), being involved in a couple of Belgian companies, founding and heading an unnamed payment processing company and apparently abandoning all these company commitments by going to Harvard Business School for half a year in 2008?

Friday he say his story is correct; he work very hard all his life, 20 hours every day. He’s not working for billion dollar company, he is 50% coowner of billion dollar company. He do still say he retire at 31, his payment firm was with a partner.

This is all confusing me, what all this got to do with new company Elysium anyway?

When you’re hearing conflicting stories from two sides, you must ask yourself which side is more likely to be telling the truth, and which side is more likely to be making up stories. Well, none of us at behindmlm are asking for your money, so what would our motivation be to lie?

On the other hand, you have Pascal wanting your money. Money is a strong motivator for greedy people, and Pascal has made it known that his greed level is sky-high. Is he willing to tell stories (lies) to get your money? What do you think?

Herr D, Jonas, and PassingBy have clearly documented how Pascal’s stories do not add up. Having had it pointed out his resumé has 5 decades’ worth of career squeezed into fewer than 3, he now claims he’s worked 20 hours a day all his life to do more than any normal human could ever accomplish.

That’s funny; didn’t he earlier claim he retired at 31 (in 2000 or 2001)? For how long, 4 hours?

And what does it have to do with Elysium? Plenty, because Pascal == Elysium. Even if Pascal’s stories about his staff of traders is true, he is still in charge, calling the shots and making the speeches.

Do you want to entrust your money with someone who clearly padded his resumé to the point of implausibility? Who keeps changing his story to cover his own inconsistencies.

He retired young, but has worked 20-hour days all his adult life? He can’t have it both ways, so he’s clearly lying about at least one of those (likely both).

For me, it’s mainly because a friend keeps trying to rope me (and all his other friends and family) in and too many things are just off about Stege and Elysium.

He buys Elysium’s explanation about the Estonian warning, I’m hoping to do some due diligence and hopefully convince him to start asking his upline some questions.

I leafed through his 2002 book this weekend:

[Fast-forward… it’s almost 2003]

“Gary” (the guy he allegedly cold-called) is “still in my organization” […] “I can call from three offices on two continents now” […] “I still do it today as it’s so duplicatable”

All fine and dandy, but in 1997 he supposedly lived in the US – why call “Gary from St Louis” from his Europe office then?) After which he retired at the age of 31 (which must be between May 8, 2000 and May 7, 2001 then). Which organization does he then still have and why is he still calling in late 2002?

The alleged payment processing company can’t have been that big, Deutsche Bank doesn’t mention it in annualreport.deutsche-bank.com/2010/ar/notes/05businesssegmentsandrelatedinformation/businesssegments.html (who’d already acquired a payment processor in October 2008 they’d developed in a joint venture).

app.duedil.com/company/ie/423877/vemma-europe-limited/directors shows us that he was a director at Vemma Europe from December 28, 2007 until November 12, 2010.

@bypasser, the story that he didn’t work for Vemma but rather co-owned Vemma, where he then got a management buyout in late 2010, is very probably true.

Was that company worth 1.6 billion USD though? In 2008, they had a post-tax profit of EUR 774,300. (Through search.cro.ie/company/ListSubDocs.aspx?id=423877&type=C, you could check the accounts from 2009 and 2010).

But let’s say the company was worth enough that he could convince someone to buy him out in late 2010 and that he cashed a couple of millions, enough to start up Origin without needing external funding.

Fair play to him. Though I’m not sure you could convince anyone to pay up USD 1.6 billion for Vemma Europe Ltd – liabilities of EUR 1.1 million, assets of 2.5 EUR million, fixed assets of EUR 2.1K

Or maybe he was talking about yet another of his billion dollar endeavours.

I just check his facebook, he finish at the University in Amsterdam in 1996. He just say in webinar today he start direct sell business affilliate marketing after that and that gets him to America 9 years.

But then he say he come back after retire at 31 and living in Mallorca. But 1996 + 9 is 2005?

I listen to all his calls for 2 months, he never say anything about dotcom bubble; tonight for first time he say he start long before dotcom bubble. Is this me paranoid?

It’s you using good sense. His stories don’t add up; that’s why he keeps changing them. Do yourself a favor and stay well clear of this guy and his schemes.

And here’s another reason to stay clear:

He meant duplicable, but that word is favored by people running schemes. By pretending they have a winning business model that can spawn innumerable clones, they seek to discourage their marks from thinking for themselves.

“Don’t ask questions, just follow the system. Erase doubt and negativity. Only quitters fail, and only failures quit.” That sort of thing. It’s very manipulative, and they’re just trying to sucker you in.

It is indeed extremely interesting that he brings up the dot-com bubble for the first time, just a few days after Jonas first mentioned it in passing in a comment here. And typically, it leads to yet more inconsistency.

A major part of his timeline problem is those 7 years he claims to have worked as a policeman, a claim he’s apparently been consistent about over the years, and which I see no reason to doubt (exactly because it doesn’t fit in with the rest of his constructed story, that of someone who’s been a successful businessman throughout his life).

Even if we disregard his claims about having gone to university, and assume he didn’t do anything other than go to school, then his required 14 months of military service, and immediately join the police, that means he cannot have embarked on any kind of business venture or private sector employment until he was 26 at the earliest, in 1995.

Policemen cannot have side jobs. It also means he cannot have left the Netherlands for any significant length of time until then. There’s simply no room for a 9-year business career, or a 9-year stay in the US, before he turned 31 in 2000.

His apparently latest version, that he started in business in 1996, is actually consistent with what we can establish with certainty. But then he doubles down on the inconsistencies by bringing up the dot-com bubble.

That bubble is considered to have begun in 1995, and it burst in 2000. So how can he claim to have gotten started long before?

He’s probably kicking himself now that he didn’t eliminate those 7 years with the police from his bio when he started out. They would have provided ample space in his timeline for all kinds of unverifiable, and more importantly not easily falsifiable, achievements.

But he’s put it in so much stuff about himself over the years, and even told stories about how an experience as a policeman led him into MLM, stuff that can still easily be found on the net, he can’t run away from it anymore.

You guys, Monday and today he sayed nothing about the army in Lebanon or about policing. He say he was at the prosecutors and did investigation following the money. Today he just say he keeps it short and sayed he did as a job financial forensics before business and family office.

Monday he still sayed everything about his 9 years of business and retire at 31. Later consulting and deűtschbank and 50% stock in 1,6 billion company. But he say nothing about police the day you say he has problem. This is becoming much.

@ bypasser, your justified paranoia – they are out to get you(r money) – convinced me to attend another call on Friday.

He just stopped mentioning concrete dates until late 2010 or his time in the army in Lebanon or at the police.

He was at the prosecutor’s office and did financial forensics (“follow the money”) in the “early 90s” (with some goodwill, this may constitute policing).

Which of course gave him great insight in how the world ticks, then he went to study finance, got his MBA and started affiliate marketing when the internet came up in the “mid-90s”.

He built up huge sales funnels and a massive downline with his sales organization.

He spent his days “mostly in the US” (didn’t mention for how long), came back to Europe for his 1st retirement (didn’t mention at what age).

Then started a consulting firm, added payment processing to his portfolio as well, did acquiring for these inc 500 companies he consulted, got that management buyout in late 2010…

Didn’t mention Mallorca this time (may just have forgotten about that estate he claims as home in his facebook background picture on February 15, 2012); seeing how his domicile from say 2002 until 2010 is documented as being in the Netherlands or Belgium, that estate could just be a holiday home of course.

May have confused his retirements at ages 31 and 41 of course. May have just bought the estate at 41 after his Vemma and Deutsche Bank windfalls.

Hope he enjoyed his time there, seeing how he’s been hanging out in Malmö from around 2013.

you guys, maybe thank you for confusing me, today I watch and take notes.

Today he only say prosecutor and then studying finance and then with MBA leaving public sector. Then nobody wants to invest in him, so he teach himself and then he go to US for direct selling affiliate marketing. Now he say he retire in 2010!?!4 Then he settle in Mallorca and start consulting!?, He always sayed he did that after retire at 31!?

I think I get angry, I must have to apologize to PassingBy – I steal your name thinking you being hater.

My friend show me results, he make profit, how you explain this? They lying I think now, but maybe they understand trading?

Oh dear. He just keeps making it worse.

Let’s start with a very easy one, which was new to me:

The only Dutch military presence in Lebanon ever was its contribution to the UN peacekeeping force UNIFIL (nl.wikipedia.org/wiki/Dutchbatt), between 1979 and 1985. Stege was 9 when it started and 16 when it ended. Whatever he’s telling about it, it’s another bald-faced lie.

Now let’s look at some other problems with his claims, which I hadn’t looked into before.

He has two lists of his academic achievements, on Facebook and LinkedIn. These don’t match, and in a way that shows that at least one of them must contain lies.

On Facebook, he has attended what he absurdly refers to as the “Royal Netherlands Police Academy”, which as I explained in an earlier comment, in Dutch is simply called the “Politieacademie”. I consider it highly likely that this claim is truthful, since all those (and only those) who join the police attend that.

He now seems to try and twist his many past claims of having been a policeman for 7 years into having worked for the prosecutor’s office (in Dutch, “Openbaar Ministerie”) in some capacity, but that is obviously something entirely different, and would never lead to someone attending the police academy. It would also require him to have had some legal qualification, which neatly brings us to the subject of his claimed degrees.

On Facebook, he claims an LL.M., without saying when or where he got it. I am guessing he is trying to pass this off as its origin:

Which is obvious nonsense, since such a program has got nothing to do with a law degree.

On LinkedIn on the other hand, he hasn’t gone to the police academy, and doesn’t have an LL.M. either, but only an LL.B., which he got, at some unspecified time, from Leiden University.

Major problem (besides the discrepancy between the lists): the division of higher education degrees into Bachelor and Master wasn’t introduced in the Netherlands until 2001. Before that, there was no such thing as a Bachelor’s in Law (or any other universitary field). Nor was there some other degree that was retroactively declared equivalent to it. There was only the Master’s degree, which requires at least four full-time university years, and entitles one to put the title “mr.” in front of one’s name (that’s not the Dutch equivalent of “Mr.”).

So an LL.B. from Leiden he could only have gotten at some time after 2001, while already working full-time for a succession of MLM companies, some of them his own. And long after any employment by either the police, or the prosecutor’s office.

The one common claim between Facebook and LinkedIn is an MBA, which he got from the University of Amsterdam in 1996, after starting in 1994 (this would therefore be the two-year part-time study program).

Problem #1: you need a Bachelor’s degree to start that program, and unless he’s keeping a secret from us in both lists, he clearly doesn’t have one in 1994.

Even if the LinkedIn LL.B. claim were true, that could only have come years later.

Problem #2: such an MBA didn’t exist.

I actually should have checked this earlier. 1994 isn’t long after I went to university, and I cannot recall legitimate European universities at that time already issuing MBA degrees. They’re a pretty recent American import.

In my time, they were primarily known as favourite bogus degrees sold by fraudulent diploma mills, which usually claimed to be affiliated with some American university, supposedly entitling them to issue MBAs by proxy.

A bit of searching confirmed my suspicions:

mbaopleiding.org/amsterdam-business-school/

The University of Amsterdam (UvA) didn’t set up the Amsterdam Business School, which issues its MBAs, until 2007. Stege claims to have gotten that degree over a decade before it existed. It’s another big, fat, whopping, incontrovertible lie.

Lies about degrees in themselves are pretty hard to prove using just online searches. But not bothering to check first whether the degrees you lie about actually exist, makes someone not just a liar, but a pathetically stupid one.

The only things in his lists of educational achievements which are likely to be truthful are where he went to secondary school, the Fraters Maristen Azelo (that’s a real, completely unremarkable, school which existed when he was the right age, and why would he lie about that?), and his attendance at the police academy (since that actually causes problems for the rest of his current array of fairytales).

Just in case he notices this and start removing the embarrassing stuff, I’ve saved screenshots of the two pages:

imgur.com/a/ldBhiOF

imgur.com/a/Tl72aDU

Hey, I think Phil Ming Xu had one of those too! 😀

Doublechecking… Yep, PLD is offered through executive education, which is where Phil Ming Xu got his “VC And Private Equity Program” certificate. But Harvard won’t verify his attendance without his permission.

Which PMX used to portray himself as “graduated from Harvard Business School” and that’s a bald-faced lie as that’s a certificate course, not a degree course.

Review updated with additional information from latest Elysium Capital compensation plan.

Or something like youtube.com/watch?v=hygi0wsxrxQ

“Keep it very short, clean, simple, easy, fun, magical, duplicatable” […] how I built my business within a decade to over 200,000 people […] only simple things are duplicatable, write that down”.

One does wonder which decade and which business he could mean?

If you are going to use facebook.com/fredstege/posts/10221307315659854 to convince potential customers of “Fred is also a frequent guest lecturer at several European top-tier universities”, perhaps you shouldn’t use the exact same picture someone else uploaded on April 12, 2012 to foursquare.com/v/nyenrode-pfizer-zaal/4e1b200c18a8ce9e385db85a?openPhotoId=4f8709b0e4b0cec3a90aaeb5

Oh well, even experienced C-level executives can make schoolboy errors.

Even without stealing a picture, what’s particularly pathetic about that is that absolutely anyone willing and able to plonk down a few thousand euros can speak in that auditorium.

Nyenrode was originally just a training institute for the staff of large Dutch corporations. Even though it’s grown into a proper private university, it remains true to its commercial roots by trying to maximize the income it can derive from its, extremely nice, campus (it gets no state subsidies).

Not only can anyone rent out their lecture and conference facilities, some of the more picturesque older buildings are even licensed as wedding venues, and they have a hotel on the premises.

As a result, I am sure if one went looking for it, one could find an awful lot of pictures of extremely dubious characters standing being a Nyenrode lectern, characters without any connection to Nyenrode University beyond having rented a room for the day. It’s sort of the rented Lambo of universities.

For some reason he’s been toning it down considerably over the past couple of weeks;

Wednesday gave us no information on or mantion of Lebanon, the police, law school, 9 years in America, achieving an MBA, 1st retirement at 31, settlement in Mallorca, consultancy for inc 500 companies, stakes in and ownerships of various billion dollar companies, payment and acquiring processors, management buyouts or 2nd retirement.

His career up till 2010 was condensed to “my background very briefly is prosecution, later on finance as well and fast forward, 2010 I started my family office”.

Friday “my background is prosecuting, after that business I built sales funnels, set up large affiliate organisations up till 2010, then started family office”.

They have a master account (or 3, one for each portfolio) at Equiti, which their customers can copy. As long as the bots are working, customers will probably be in profit.

Elysium may have acquired the bot somewhere or may even be writing the bots in house; as far as anyone can see, they have no license anywhere to offer this service to customers.

It doesn’t even matter whether they offer this bot through an mlm scheme which may have enough retail revenue not to be a pyramid scheme (cautious guess – it doesn’t).

Offering auto-copy is a form of investment/portfolio management. It is perhaps not a securities offering in the classical sense (stocks, bonds, futures,…); but still something which requires regulation.

Elysium now puts the name of a certain Mattias A. Larsson forward as their CIO & Senior Analyst (dk.linkedin.com/in/maxelia and merinfo.se/person/Malmö/Mattias-Axel-Larsson-1975/brbqx-367rq).

“Holds ACI Dealer Certificate and SWEDSEC, Licensed Life Insurance Broker in Sweden, and an Authorized Nasdaq OMX Equity Derivatives Trader (Click Genium Inet)”

The 1st seems to be aciforexdanmark.dk/ACI-Dealing-Certificate; looking at “A help line is available until each participant has passed the exam.”, one can presume anyone who spends EUR 1,800 can get that certificate.

swedsec.se/licensiering/sok-licenshavare/ gives us 2 Mattias Larssons, unfortunately none of them work at a company Elysium’s Larsson has on his cv.

fi.se/en/our-registers/company-register/?query=larsson#results gives us no Mattias A. Larsson (a couple of Mats, Mats Einar and one Mattias Larsson; but none which would fit his cv).

Maxelia was allegedly established in 2009 (though maxelia.ml wasn’t registered until January 17, 2020 and Larsson only started working for them in January 2019).

Maxelia is the secondary business name of Isonine International Investments AB, which doesn’t have the most informative website (www.isonine.com). Owned by a Tord Larsson and registered in Pionjärgatan 12, S-70381 Örebro.

Most recent activity I could find for this company is book publishing (boktugg.se/forlag/6089/isonine-ab) and shows up at eniro as a book publisher. If kartor.eniro.se/streetview?query=Isonine+International+Investments+AB&id=14510799&index=yp&hide_info=true&refback is somewhat recent, I guess there’s is not a lot of activity at that address.

More importantly, neither Isonine nor maXelia are registered at the Swedish Finansinspektionen in whatever capacity.

Which is a shame really, should they show audited evidence their licensed asset managers made a profit of 10,831.14% on the commodities market in less than 2 years, most of us would join in a heartbeat.

I’m also noting this “disclaimer” from the compensation plan:

Elsyium Capital Limited does not accept clients from the U.S.

This in and of itself is a red flag but also ties into Elysium Capital’s securities fraud and pyramid recruitment red flags.

That could partially be caused be caused by the fact that Equiti don’t accept customers from the USA.

How the New York prop desk trading the Aurum Digital fund manages to get its trades to an Equiti Master Account to then be copied by Elysium affiliates is anyone’s guess.

The Swedish bolagsverket (Companies Registration Office) gives us three results for maXelia at foretagsfakta.bolagsverket.se/fpl-dft-ext-web/home.xhtml?cid=2.

One as “enskild näringsidkare” (sole proprietorship) in Oxie, a suburb of Malmö. allabolag.se/750713NIMB/verksamhet gives us that date of registration in 2009.

Also tells us it is a passive company which was never registered in the VAT-register. Financial consulting is one of the activities.

One as the secondary name of Isonine International Investments AB (Aktiebolag or limited company). Through most of its existence, maXelia shared the registered addresss with Isonine.

One as a kommanditbolag (KB or limited partnership). Deregistration due to discontinued operations.

vetarn.se/9696191460/Maxelia-KB tells us the company was mainly involved with direct marketing.

bolagssajten.se/bolag/MaXelia_KB/ tells us the company was registered in 1995 and that there was no turnover in 2012.

maxelia.ml tells us “trades it owns capital and engage in consulting for banks, brokers, asset managers and financial institutions globally.”

Why would Elysium need to work with this (one-)man (company) when they are merely a “fintech acces provider”; not a bank, broker, asset manager or financial institution?

My friend say Fred say sites like this just make up storys (Ozedit: snip, see below)

Feel free to point out a story we’ve made up.

Failing which, we’re done here. Best of luck with the scamming.

In the immortal (but always slightly misquoted) words of Mandy Rice-Davies: well, he would say that, wouldn’t he?

( not sure if trolling or genuinely in doubt)

Ask your friend whether Elysium’s offer at Equiti looks a bit like the one in

youtube.com/watch?v=DPBvrc12ZZs

If it does, that shows Elysium is doing account management.

My guess would be that it is (seeing as their website says ” Participants can, at their own discretion and liability, appoint a proprietary trading desk to trade on their behalf by providing a signed limited power of attorney subject to compliance approval.”).

If this is the case, participants must appoint this prop desk, which as far as anyone can find, is not licensed to do account management.

If it doesn’t, that would show that Elysium is probably just one amateur bloke with some bots doing some trading on his own, whose trades you could then copy.

If that is the case, their stories about not needing a securities regulation could be true (they compare themselves to eToro, if you just copy some retail trader on there, the person you copy doesn’t need a regulation.)

If that’s how Elysium work though, they’ve been lying about the desks (“most at the desk have an investment banking background with Merrill Lynch and Goldman Sachs”) and the company.

As you helpfully told us on another thread, Elysium didn’t acquire an LEI until August 5, 2020 (search.gleif.org/#/record/984500CB3M451FAZ0914).

Who then has been trading the Alpha Linea portfolio since March 2020?

All the portfolios get their “quant signals” from Elysium Capital, whose Prop Desk is the “Auto-copy MAM”.

Did the companies trading Aurum Digital and the Pinnacle Portfolio only join forces with Elysium in August 2020?

How then has the Pinnacle Portfolio been getting Elysium’s EA signals since 2010, when the first idea of Elysium only came to Stege some five years ago?

Or there’s a third option I’m not getting, please enlighten me.

Some deceptive advertising may have been going on I feel.

But hey, it’s almost October and the update to the portfolios is upon us.

Ask your friend to prove that Aurum Digital has reached a performance of 11,000% and I’ll remortgage the house in an instant to start investing.

You guys, please believe I do not try scamming or trolling; I want warning you. My friend say Fred will use lawyer on people telling storys.

Really, Stege is going to sue people for telling stories? What will that do to his CIO and Senior Analyst?

Up until last week, the capital website told us “Mattias is a licensed Investment Adviser and holds several licenses, including: ACI Dealing, SWEDSEC, Swedish Insurance Broker, Nasdaq OMX Genium Inet.”

Today, the very same source tells us “Mattias holds the ACI Dealer Certificate and are an Authorized Nasdaq OMX Equity Derivatives Trader.” One of life’s coincidences that the 3 positions questioned on here disappeared.

Checking dk.linkedin.com/in/maxelia, at some point Mattias Axel Larsson must have realised his name is Mattias L. He also realised on there he is neither a licensed Investment Adviser, nor an insurance broker. We all make mistakes, small details like that are easy to forget.

Behindmlm even jogged his memory about his Swedsec license, which expired in Dec 2019.

Mattias A. Larsson’s LinkedIn on Sep 04: imgur.com/a/2cLErIE

Mattias L.’s LinkedIn on Sep 28: imgur.com/a/BGlBR01

It is a rather entertaining thought that a man who tells tales about having served in the Dutch military in Lebanon, even though their participation in the UN peacekeeping force there ended two years before he was old enough to join the military, who claims to have gotten a master’s degree in law from a non-degree program at Harvard Business School, and to have gotten an MBA from the University of Amsterdam a decade before that university started its MBA program, would sue people for “telling stories”.

He only wanted showing september trading result, he just keep saying they got proven track record on their site and I must have to stop listening to you guys.

He say he protecting me, I can be already in trouble by talking about webinars, you think they can use lawyer?

Wouldn’t worry too much if I were you; everything published on here is in the public domain.

Why would a financial and legal mastermind with 2 law degrees need a lawyer anyway? He could just form an ad hoc legal team with compliance officer Shalini Persson. Who, like Mattias A. Larsson (sorry, Mattias L.), still doesn’t mention Elysium on LinkedIn.

Just noticed that Aurum Digital is at 11,170.10%. Also noticed “We do not have direct clients, nor do we provide any investment services or ancillary services to others. Participants can utilize our trading signals and have them auto-copied via a managed account at a 3rd party independent prime brokerage.”

Who manages the account again?

If they do not provide ancillary services, why does creditreports.ee/elysium-capital-ou say that “The company’s activity is other activities auxiliary to financial services, except insurance and pension funding”?

On the latest webinar, Fred informed us that the trading desk is adding trading on silver to this portfolio.

Strange, we were led to believe Aurum Digital (“trades currencies and precious metal commodities like gold silver etc.”) has been traded by an external desk since October 2018. So why wait until early October 2020 to actually add silver trades to the portfolio?

Stege helpfully informs us on calls that Aurum Digital mainly trades gold, but also silver, platinum and rhodium.

Unfortunately, Equiti’s FAQ (www.equiti.com/support/faqs/#precious-metals-68967) informs us that Equiti doesn’t offer trading in rhodium.

Are you aware this is a cult manipulation technique? They are basically telling you to trust no one but them. They will only love you if you trust them. You just depend on them for “information” and “obey” them. And they claim they are doing all this “because” they love you.

Does that sound like a healthy relationship to you?

Please read this section about “information control”, which is how a cult gains control over a person.

freedomofmind.com/bite-model/

Then see if they also want to control OTHER aspects of your life, such as behavior, thought, and emotion.

We want YOU in control of your life, not someone else. We are NOT telling you what to think. We want you to think for yourself.

Do they want you to think for yourself? Think about that.

Could you perhaps ask your friend why it took Stege until November 26, 2018 to ask for a trading bot on mql5.com/en/job/89220?

I thought he met all these investment officers, analysts, quants, math experts and allround financial wizards after starting that mutual fund in his family office turned hedge fund in late 2010?

So the alleged portfolios have been traded since Jan 2010 and Oct 2018 with EA strategies provided by Stege and/or Elysium.

Why would Stege then still need an EA trading bot in late November 2018?

Not only a bot, but also “integration with broker, ongoing maintenance, admin and enhancements as well.”

Wow, just wow.

I wasn’t going to whine about details like the subject-verb accordance in “Mattias holds the ACI Dealer Certificate and are an Authorized Nasdaq OMX Equity Derivatives Trader” on both LinkedIn and the Elysium website (which is a bit sloppy for someone with a full professional ability) and how the exact same mistake in two places is a bit weird.

I guess the ongoing task Stege asked for under freelancer.com/projects/editing/editing-website-text-english-europe/?ngsw-bypass=&w=f must have ended.

It’s a good thing he spent 9 years in the US and released several publications on linguistic marketing to practise his English a bit.

Looking at the crummy grammar in the alleged portfolios’ KIIDs, Elysium could do with rehiring a proofreader.

Thanks for that link; it gets better.

The Elysium business plan (“I need to full Business Plan written to Start a Forex Brokerage (Forex, ETF’s, CFD’s) with a base in The EU (MiFID compliant)” – that sloppy grammar again) was outsourced on that same platform. – freelancer.com/projects/business-analysis/business-plan-written-start-forex/?ngsw-bypass=&w=f

Once he acquired a bot with “integration with broker, ongoing maintenance, admin and enhancements as well” on mql5.com in 2018 (even though Elysium themselves have been developing the software since 2015 as per Stege’s webinars), Elysium went looking for a website/logo designer on the same platform (freelancer.com/projects/php/would-like-hire-website-designer-13161936/?ngsw-bypass=&w=f).

Didn’t find one there, luckily designcrowd.com/design/21053980 could design a “logo for Fintech / hedgefund”.

Maybe stuff like this is why people just won’t understand Elysium is not a hedgefund?

The software in Elysium Network, which is indispensible to conduct your business of course and which are definitely not a pretext to give a semblance of compliance and which unfortunately you cannot sell to anyone who is not in the network are

– EOS (Elysium Operating System), which is a rebranding of what Equiti offers to any Asset Manager or Introducing Broker (equiti.com/support/faqs/#partnerships-68968)

– Xoom (Video conferencing software which is definitely not piggybacking on the name “Zoom”) is rebranded whitelabel software from livewebinar.com/enterprise (FAQ under cdn.livewebinar.com/site/support/manuals/en/faq_v2.pdf)

– SoHo (“An automated algorithmic social media dashboard with an ongoing monthly supply of ad hoc marketing collateral”) is still nowhere to be found unfortunately.

Recapping what the visionary founder said on Monday, hope I caught it all.

Hope I don’t get sued for telling stories, maybe the founder of the Pinnacle Portfolio is Marc with a c.

I don’t know guys, is my friend my friend and just really believing all the things or is he being liar to me?

He show me article on seekingalpha.com/instablog/50717150-vprakash568/5499804-forex-market-sets-to-regain-loses-traders-are-witnessing-high-volatility-in-market and then claiming this is good press; but is this good site or just blog? The writer only writed this article so I don’t know.

He still just saying historical 10 year proofs of the portfolios is on their site and I must have to stop talking about unimportant details. If I show him this site, he just laughing and say me you guys don’t have the real wisdoms.

Who cares? You can’t read minds and you’ll lose exactly the same amount of money whether he sniffs his own farts and believes his own bullshit or not.

Doesn’t matter. Not a substitute for legally required regulatory authorisation and independently audited accounts that verify Elysium has produced the historical performance it claims.

That’s not proof. That’s a claim, which requires proof.

ANYBODY can write for SeekingAlpha.

NOLINKs://seekingalpha.com/page/become-a-seeking-alpha-contributor

Heck, I think I wrote for SeekingAlpha once or twice.

NOLINKs://seekingalpha.com/instablog/6986191-kschang/1480471-why-should-you-care-about-what-happens-to-herbalife-hlf

Do you trust everything I wrote?

Unfortunately, we no longer get to hear entertaining stories about his career; but he more than makes up for that with exciting new information.

The figures we see on the website are already adapted and show the net asset value a retail client would have gotten (i.e. minus the 50% performance fee Elysium obtains). So Aurum Digital actually made a profit of 22,342.20% over the last 2 years.

You know, with the bots and strategies they’ve been delivering to institutionals since 2010; before they decided to open up their strategies to retail clients.

Although the Elysium companies weren’t established until August 22, 2019 (Hong Kong) or January 23, 2020 (Estonia); from whom have these external funds been getting their information then?

They are working on a 4th portfolio, where cryptos will be traded. With the same settings by the trading desk, but by the time they open that up ro retail clients, it will be traded on a different platform with a new liquidity provider, so Elysium unfortunately won’t be able to share the history of the desk.

There will be no use in sharing because “we can’t prove anything”. Odd, hasn’t bothered them so far (I’d be more concerned about my inability to prove a bot’s trading results from 2010 if I only acquired that bot in 2018, but I’m no experienced C-level executive).

Elysium Network should be up more, “really important to triple or quadruple by Christmas”. There’s a bull market in gold and bitcoin coming up, stop being cagey or else you’ll miss it.

Affiliates and introducing brokers should be recruiting all day long apparently, opportunity of a lifetime and all that.

Elysium’s documentation: “We do not have direct clients”.

Equiti’s FAQ “any Asset Manager can create his/her own MAM program. Clients can join this program after signing a limited power of attorney and allow the AM to trade on their behalf.”

Elysium still hasn’t got an asset management license anywhere, what rotten luck that CIO Mattias Axel Larsson lost some of his abilities around September 20.

Today Stege informed us “we only take a commission when the client wins”; whereas Equiti’s answer to the question “When will I get my rebate/commission?” is “Half the payment is received when a position is opened, and the other half will be paid when the position is closed.”

Getting contradictory information here, if you look at t.me/s/networkmoneyme?before=602; we get a dropbox link:

dropbox.com/s/7n94q8w7yk1x535/ClientRegistrationActivation.pdf?dl=0

Though Elysium do not have direct clients, they’ve produced a tutorial explicitly named “Registration and Activation process for Clients”.

A non-direct client is supposed to “tell the Support Assistant:

As the telegram link tells us that “this document will be refined if needed”, imgur.com/a/Fv8xoMl should anyone at Elysium feel the need to refine that sentence.

The document seems to have been refined and condensed to 30 pages (down from the original 36).

Interestingly, we get a glimpse of the LPOA a client (non-direct I guess?) has to sign on page 27. “Asset Manager: ELYSIUM CAPITAL LIMITED”

Looking at their portfolios “Elysium Capital Limited itself does not carry out any regulated activities”.

In a twisted way, that’s not a lie – Elysium Capital Limited itself does illegally carry out activities for which it isn’t regulated.

If you’re not regulated, you can by definition not be carrying out regulated activities. I doubt a regulator would see it that way though.

We can also find this document on elysiumallstars.com/let-the-professionals-trade-for-you/. We know this man form the false information regarding the founder of the Pinnacle fund.

Maybe this document is once again a misunderstanding and it’s once again just an affiliate partner providing false information?

You guys, this is almost litteral what my friend say to me earlier this week; he say my mindset is typically one of the masses and now he no longer talking to me.

You guys think this elysiumallstar guy is this guy? (Ozedit: spam removed)

He is also on facebook and twitter and promoting coins and mlms and hyips. I don’t know if it is good if a guy like this is promoting Elysium?

Good riddance then. As the old saying goes “If you loan a friend twenty dollars and you never see them again, it was probably worth the twenty dollars”.

And you are only worth $20 to him too. Remember that.

He decided you weren’t going to give him any money and covered by saying you were no longer worthy of his “help.” (It’s like when a woman breaks up with her loser boyfriend and he growls at her, “Your loss, babe! You’re not even worth my time.” Yeah, keep telling yourself that, buddy.)