Conectiv Review: Investview reboots fraud for 3rd time

![]() Conectiv is the latest reboot of Investview’s long-running fraudulent investment scheme:

Conectiv is the latest reboot of Investview’s long-running fraudulent investment scheme:

- Wealth Engineering was launched in 2005 by Arthur Romano and Annette Raynor;

- Romano, Raynor and several other individuals co-founded Investview in 2013;

- Investview launched Wealth Generators sometime after its own launch, offering passive returns connected to Wealth Engineering trading signals;

- Wealth Generators was rebooted as Kuvera Global in 2018, just before a $150,000 commodities fraud fine from the CFTC was made public;

- Kuvera Global rebooted as iGenius in 2021 after Investview learned of a pending SEC investigation;

- Investview’s then CEO Joseph Cammarata was arrested on recovery scam fraud charges in December 2021;

- Cammarata was sentenced to ten years in prison for recovery scamming in June 2023;

- Investview’s former accountant was fined $400,000 for filing dodgy audits with the SEC in January 2024;

- Cammarata was sentenced to six years in prison for tax fraud in May 2024;

- the SEC filed suit against two Apex promoters in September 2024 (Apex was a fraudulent scheme launched by Investview in 2019);

- Investview settled Apex fraud charges with the SEC for $375,000 in January 2025;

- Investview settled securities fraud allegations from Ontario and Quebec in July 2025;

- Poland’s Office of Competition and Consumer Protection filed civil fraud charges against six iGenius promoters in July 2025;

- Conectiv’s website domain (“conectivglobal.com”) was registered on October 9th, 2025;

- a former iGenius promoter was fined $15,000 in Quebec in December 2025;

- Conectiv was disclosed to top iGenius promoters around early December 2025;

- Poland fined iGenius $4 million for pyramid fraud in January 2026;

- iGenius wiped/deleted its social media profiles in late January 2026;

- Conectiv distributor agreements are created on February 1st, 2026; and

- Conectiv marketing/branding from Investview surfaced on or around February 3rd, 2026

No executive information is provided on Conectiv’s website. Based on publicly available Conectiv marketing material though, Chad Garner (right) is still President of Conectiv.

No executive information is provided on Conectiv’s website. Based on publicly available Conectiv marketing material though, Chad Garner (right) is still President of Conectiv.

Garner has retained this executive role dating back to Wealth Generators. Garner joined Investview in 2016.

Investview is headquartered in Pennsylvania. Conectiv and its predecessors operate from Utah.

With Investview’s history out of the way, read on for a full review of its latest Conectiv MLM opportunity reboot.

Conectiv’s Products

Conectiv markets three subscriptions:

- Basic ($199 and then $99 a month) – access to personal finance and investing videos, one periodic “market insights and analysis” live session, debt elimination service and “trade ideas and analysis” for one market

- Core ($299 and then $179 a month) – adds additional “market insights and analysis” session, trading technical analysis and additional “trade ideas and analysis” market

- Plus ($599 and then $179 a month) – adds additional “market insights and analysis” session, additional “trade ideas and analysis” market and “identify market opportunities” scanner

- Pro ($1499 and then $179 a month) – adds undisclosed travel trip for two, travel discount platform, Cforce unregistered trading investment scheme and “exclusive alert channels and live streams”

Other products and services not disclosed on Conectiv’s website but featured in its marketing material include:

- Digital Learning Platform – “offers practical courses in AI, finance, Airbnb and Turo”, price not disclosed

- Smart Finance – “combines industry expertise with intelligent tech to optimize your economic well-being”, price not disclosed

- Alive Premium Coffee – “enriched with hydrolyzed fish collagen, superfoods and over 30 wellness ingredients”, price not disclosed

Conectiv’s Compensation Plan

Conectiv’s compensation plan focuses on the sale of subscriptions to retail customers and recruited promoters.

Presumably the sale of other Conectiv services and products is part of Conectiv’s compensation plan. At time of publication however details are sketchy.

Conectiv Promoter Ranks

There are fourteen promoter ranks within Conectiv’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Influencer – sign up as a Conectiv promoter and recruit two promoters (placed one on each side of the binary team)

- Executive – maintain two personally recruited promoters and generate 1000 GV over a rolling 4-week period

- Platinum Executive – maintain two personally recruited promoters and generate 2000 GV over a rolling 4-week period

- Global Executive – recruit four promoters (placed two on each side of the binary team) and generate 5000 GV over a rolling 4-week period

- Diamond Executive – maintain four personally recruited promoters an generate 10,000 GV over a rolling 4-week period

- Ambassador – maintain four personally recruited promoters and generate 25,000 GV over a rolling 4-week period

- Platinum Ambassador – maintain four personally recruited promoters and generate 50,000 GV over a rolling 4-week period

- Diamond Ambassador – maintain four personally recruited promoters and generate 100,000 GV over a rolling 4-week period

- Presidential Ambassador maintain four personally recruited promoters and generate 250,000 GV over a rolling 4-week period

- Crown – maintain four personally recruited promoters and generate 500,000 GV over a rolling 4-week period

- Legend – maintain four personally recruited promoters and generate 1,000,000 GV over a rolling 4-week period

- Star Legend – maintain four personally recruited promoters and generate 2,500,000 GV over a rolling 4-week period

- Royal Legend – maintain four personally recruited promoters and generate 4,000,000 GV over a rolling 4-week period

- Crown Legend – maintain four personally recruited promoters and generate 8,000,000 GV over a rolling 4-week period

GV stands for “Group Volume”. GV is sales volume generated by the sale of subscriptions and Conectiv products to retail customers and recruited promoters.

Note for Influencer through Presidential Ambassador, no more than 50% of required GV can come from any one recruitment leg.

- for Crown GV per recruitment leg is reduced to 40%

- for Star Legend and higher GV per recruitment leg is reduced to 35%

For binary team information, refer to “Residual Commissions” below.

Subscription Commissions

Conectiv pays commissions on subscription sales and renewals by retail customers and personally recruited promoters:

- Basic subscription sale pays $35 and then $25 a month on renewal

- Core subscription sale pays $50 and then $25 a month on renewal

- Plus subscription sale pays $100 and then $25 a month on renewal

- Pro subscription sale pays $200 and then $25 a month on renewal

Fast Track Bonus

If a new Conectiv promoter sells four subscriptions within their first 30 days and earned subscription commissions is less than $750, the Fast Track Bonus bumps the commission amount to $750.

Membership Credit

If a Conectiv promoter has four active subscription sales under them, they receive a credit towards their own monthly subscription renewal (sold subscriptions must be same tier or higher to count).

Pro and Elite Bonuses

Conectiv promoters qualify for Pro status by:

- recruiting six promoters who each have an active subscription; and

- generating 3000 GV over a rolling 4-week period

If the above criteria is met, Conectiv tops up earnings over a rolling four-week period to equal $1000 (max $250 any one week).

Conectiv promoters qualify for Elite status by:

- recruiting eight promoters who each have an active subscription; and

- generating 40,000 GV over a rolling 4-week period

If the above criteria is met, Conectiv tops up earnings over a rolling four-week period to equal $4000 (max $1000 any one week).

Residual Commissions

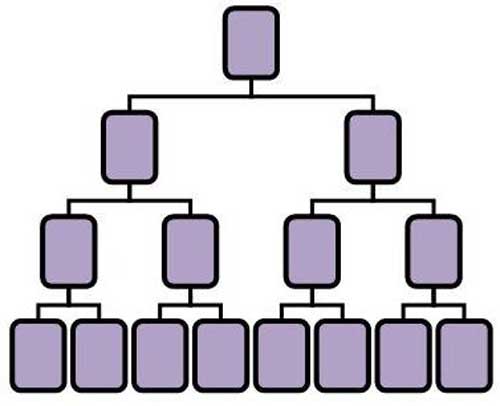

Conectiv pays residual commissions via a binary compensation structure.

A binary compensation structure places a promoter at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of promoters. Note there is no limit to how deep a binary team can grow.

At the end of each week Conectiv tallies up new sales volume on both sides of the binary team.

Residual commissions are paid as a percentage of new volume generated on the weaker binary team side, based on rank:

- Influencers do not earn residual commissions

- Executives earn a 10% residual commission rate, capped at $75 a week

- Platinum Executives earn a 10% residual commission rate, capped at $150 a week

- Global Executives earn a 12.5% residual commission rate, capped at $250 a week

- Diamond Executives earn a 12.5% residual commission rate, capped at $625 a week

- Ambassadors earn a 15% residual commission rate, capped at $1250 a week

- Platinum Ambassadors earn a 15% residual commission rate, capped at $2500 a week

- Diamond Ambassadors earn a 17.5% residual commission rate, capped at $6250 a week

- Presidential Ambassadors earn a 17.5% residual commission rate, capped at $12,500 a week

- Crowns earn a 17.5% residual commission rate, capped at $25,000 a week

- Legends earn a 20% residual commission rate, capped at $50,000 a week

- Star Legends earn a 20% residual commission rate, capped at $125,000 a week

- Royal Legends earn a 20% residual commission rate, capped at $225,000 a week

- Crown Legends earn a 20% residual commission rate, capped at $450,000 a week

Once paid out on, volume is matched against the stronger binary team side and flushed. Leftover volume carries over the following week.

X6 and X12 Bonuses

Conectiv takes 4% of company-wide sales revenue and places it into an X6 and X12 bonus pool.

Conectiv promoters qualify for shares in the pool as follows:

- X6 Pool (1%) – must have a Pro or higher subscription and generate 6000 GV in new or upgrade subscription volume during a month, receive one share

- X12 Pool (3%) – must have a Pro or higher subscription and generate 12,000 GV in new or upgrade subscription volume during a month, receive one share

Joining Conectiv

Conectiv promoter membership appears to be free. Note at time of publication there doesn’t appear to be any way to purchase Conectiv products without signing up as a promoter.

Also note that full participation in Conectiv’s MLM opportunity requires maintenance of a Pro subscription ($1499 and then $179 a month).

Conectiv Conclusion

Conectiv presents itself as a name-only reboot of Igenius’ pyramid, commodities and securities fraud.

We know the added products don’t matter, as none of them feature on Conectiv’s website. This isn’t surprising, as Poland’s $4 million pyramid scheme fine confirms retail was non-existent within iGenius.

Sidenote: No idea what happened to the diamonds Investview shared with top promoters during its Conectiv reveal in late 2025.

At time of publication there’s no mention of diamonds on Conectiv’s website or in its marketing materials.

The core of Conectiv is the unregistered investment trading scheme offered through Cforce. And funnily enough, there’s no mention of Cforce on Conectiv’s website.

What we do have on Conectiv’s website in relation to Cforce is extreme mental gymnastics denying fraud.

To start, Conectiv’s “products & services regulatory compliance” page opens with;

Investview Inc. and its wholly owned subsidiary Conectiv LLC (the “Company”), is classified as a publisher of financial news and information and therefore exempt from registration with the SEC.

The Company Is NOT An Investment Advisor, Broker, Dealer OR Fiduciary

We provide research, commentary and trade signals for world financial markets which may include but are not limited to: US equities, options, ETF (exchange traded funds), currencies including cryptocurrency and crowd funding.

To further clarify our position as a Publisher, please note the following:

- The Company does not take possession of any person’s investment capital

- The Company does not get paid by a financial institution for the research information provided

- None of the commentary, newsletters, alerts are an offer to purchase or recommend the purchase of securities

- The user of our products and services does so at their own discretion, they are free to act or not act on the information provided

- Users of our product may select any brokerage firm if they choose to act on the information provided. The only exception to this would be convenience “swipe” tools that may not be enabled by all brokerage firms.

- The Company does not know the individual financial situation, objectives or needs of the persons who use their services

- The Company does not modify the research information delivered to persons using their services, all information is delivered uniformly to subscribed members

Yeah except Cforce is offered exclusively through Conectiv. To access Cforce, consumers pay Conectiv and Conectiv is the sole gateway and point of contact.

To quote Chad Garner on a February 6th, 2026 Conectiv presentation;

[13:35] Chad Garner: Cforce is an exclusive crypto trading strategy. The strategy is managed by SEC registered investment advisor Blue Square Wealth, with the trade execution being powered by 3Commas.

It doesn’t matter who else is involved, from a consumer standpoint they are paying Conectiv for access to an “exclusive” passive returns trading investment scheme.

Conectiv and Investview can’t shirk regulatory compliance when they are the ones collecting money from consumers.

Continuing on Conectiv’s “products & services regulatory compliance” page;

The Company does not offer automated trade technology. In the past, we offered automated trading as a convenience for FOREX users.

The Commodities and Futures Trade Commission reviewed our automated technology and determined that it required a Commodity Trading Advisor. Since we are committed to providing education and not advice, we entered a settlement on the finding from the CFTC and discontinued the use of automated trade services.

We know automated tools are still available in the marketplace as described below, but we ALSO know promotion or use of this automation requires registration and licensing. We do not provide these services and we caution our customers about these types of automated tools.

Example of Automated Trading: A company or an individual trader issues a trade signal. A person pays the company/trader for their signals. The individual then attaches their MT4 enabled forex account to the provider of the trade signal.

Even though the customer attaches their account themselves, and the provider of the signal does not review, monitor or manage the client account, the signal itself is deemed as advice

Therefore, if the signal is deemed investment advice, then the tool requires a Registered Investment or Commodity Trading Advisory.

The Company does not provide automated trading or tools.

We’ve already established that Cforce is very much provided exclusively through Conectiv. But what is Cforce?

[13:48] Chad Garner: [After paying Conectiv $1499 for exclusive access] you basically open up a crypto exchange account, you fund that account and then you decide how much of that account you want to allocate to the strategy.

Let’s just say for the sake of this you allocate $100 to the Cforce strategy.

Great. You authorize the 3Commas software to execute trades on that $100 that you’ve allocated, according to the Blue Square Wealth strategy. So really simple, fully automated.

In other words, Conectiv very much provides access to automated trading through Cforce.

Having confirmed that, we can circle back to Conectiv acknowledging that Cforce thus requires it to register as a Commodity Trading Advisor. We can also confirm that, through Cforce, Investview is violating its settlement with the CFTC.

I want to close by addressing the focus on Blue Square Wealth being SEC registered as an investment advisor (3Commas isn’t and illegally offers access to unregistered securities and automated trading to US residents).

[14:38] Chad Garner: You can benefit from an SEC-registered investment advisory firm strategy. These guys are literally, you can go and check them out, Blue Square Wealth.

These guys are some of the pioneers and leaders in cryptocurrency solutions. And you get access to this exclusive strategy through this partnership with with both Blue Square Wealth and 3Commas and Conectiv.

BehindMLM has previously addressed Blue Square Wealth’s parent company, Blue Square Asset Management, not being registered to offer US residents passive returns through an unregistered trading scheme.

While Blue Square Asset Manage is registered with the SEC to “provide advice”, providing advice is not the same as coming up with crypto trading strategies (signals), that are fed into 3Commas’ automated trading platform.

Furthermore, neither Blue Square Asset Management or Blue Square Wealth are registered with the CFTC.

The icing on the cake is Cforce not being “available to residents of Canada”. This is a direct result of Canadian SEC and CFTC equivalents going after Investview for securities and commodities fraud.

The difference between securities and commodities law between Canada and the US is immaterial. Either you’re correctly registered or you’re not.

Dating back to its 2018 settlement with the CFTC, Investview has had eight years to register itself correctly. But it hasn’t, and that has led to arrests and civil fraud charges outside of the US.

As far as I can tell Investview’s “strategy” for the US is to wait for the SEC and/or CFTC to act, hope they get another $150,000 fine (cost of doing business), and presumably reboot again under a different name.

Notwithstanding mounting regulatory scrutiny towards the end of iGenius increasing, the FTC might also go after Investview for the pyramid side of the business.

Either way, be it through an unregistered trading opportunity or pyramid scheme, victim losses are and continue to grow.

We’ve seen this confirmed in Poland, where “significant financial losses” were cited. iGenius losses in other jurisdictions remain unknown pending regulatory action.

Participation in an unregistered trading investment scheme should be enough reason to stay way. If it isn’t, math guarantees the majority of participants in a pyramid scheme lose money.

I noticed a distinct pivot away from teaching day-trading to teaching “money management.” It all screams compliance theater. In the meantime, the exodus of the largest distributor team (GameChangers) in December 2025 heralds a messy crash-and-burn.

The latter should show up in Investview’s 10-Q filing in June 2026. I suspect the upcoming 10-K is going to look like crap already.