BuilderDefi Review: Alan Friedland’s third NRGY Ponzi scheme

![]() Despite settling his CFTC CompCoin fraud settlement last week, Alan Friedland is still pushing crypto Ponzis.

Despite settling his CFTC CompCoin fraud settlement last week, Alan Friedland is still pushing crypto Ponzis.

Not billed as such but quite obviously an NRGY sequel, today we’re looking at BuilderDefi.

A visit to BuilderDefi’s website reveals the promise to build “a better financial system for everyone”.

Builder is the future of decentralized finance, a one-of-a-kind distributed business building platform that enables the creation of decentralized apps.

No details about who is behind BuilderDefi are provided.

BuilderDefi’s website domain was privately registered on November 8th, 2021.

On Sunday February 6th a guy going by “Sal Alicio” hosted a BuilderDefi webinar.

I can’t find this name so I’m assuming I’ve got it wrong. That’s what it sounds like though so we’ll run with it (if anyone recognizes him leave details in the comments).

Alicio presents as the person behind BuilderDefi. He doesn’t take full credit though, stating he hired Alan Friedland as BuilderDefi’s “developer and architect”.

The guy that I brought on board and that I hired, to be the developer and the architect of this Builder project.

Alan is sort of the architect, the brain behind this entire platform that we built for Builder.

That Friedland is in fact running BuilderDefi becomes evident later in the call.

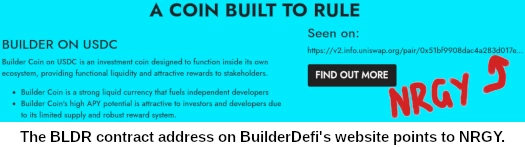

It’s also worth pointing out that the contract link on BuilderDefi’s website points to NRGY.

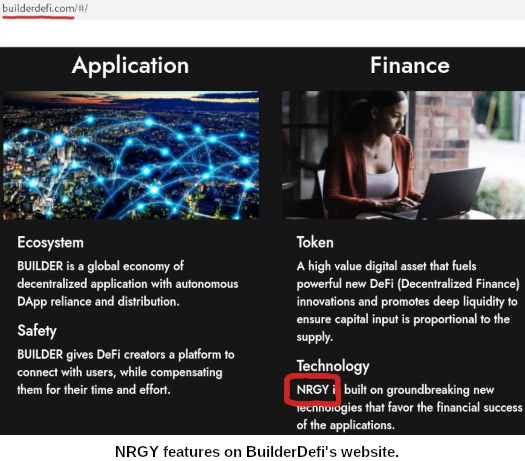

NRGY is also directly referenced on BuilderDefi’s website:

NRGY was Friedland’s second attempt at crypto fraud, after the CFTC went after him for CompCoin.

Friedland did take the case to trial but, rather than lose, settled mid-trial last week.

NRGY flopped. So did its reboot NRGYGO. That brings us to BuilderDefi, a third attempt to resuscitate the scheme.

BuilderDefi is supposed built around BLDR. But with the website linking to NRGY’s contract, whether BLDR exists or not (yet) is unclear.

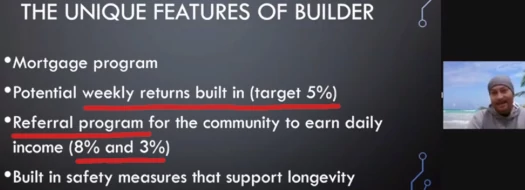

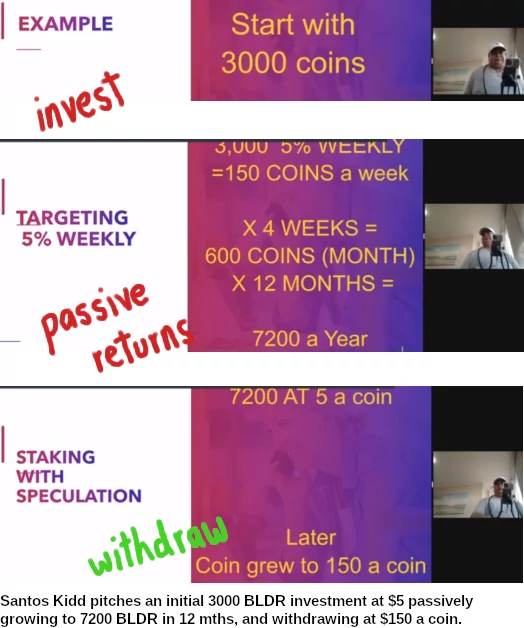

What is clear is BuilderDefi’s pitch includes a 5% a week ROI.

Alicio pitches BuilderDefi’s passive returns as an alternative to traditional banking:

I want you to think about this for a moment. Is there another cryptocurrency out there, that can pay that kind of return?

Does your bank pay you 1% a week?

That’s what we’re targeting here and I think that’s really important for the community.

That they know they’re putting their hard-earned money to work for them. That’s what it is.

To encourage investment, two-level deep referral commissions are also available.

Convince others to invest in NRGY (or BLDR) and you’ll get 8%. If your recruits solicit investment, you’ll get 3% of those funds.

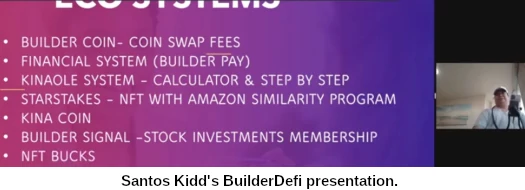

The aforementioned webinar hosted by Alicio features him giving a presentation on the opportunity. He’s joined by Santos Kidd and Chris Hawk.

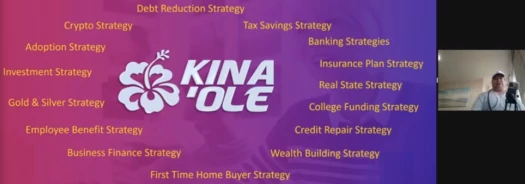

Kidd claims he was washing dishes before getting into finance. He now runs Kinaole Financial, a debt elimination service with a dead website.

Between cracking jokes about buying children from the Philippines on credit, Kidd explains Kinaole Financial is part of BuilderDefi’s offering.

Chris Hawk is an NRGY alumni. Alicio, who claims he got involved with Friedland and Hawk “about a year ago” (likely also making him an NRGY alumni), states Hawk “pretty much handles the NFT side of this whole thing.”

This is a repackaging of Starstake, some music NFT bullshit Hawk was touting last year.

Starstake was supposed to be part of NRGY.

While he is referenced in Alicio’s webinar, it’s unclear whether Friedland was supposed to appear on it.

He only jumps on after someone going by Henry asks about how long invested funds will be tied up for.

Locked liquidity when BuilderToken is released. Is it gonna be locked for 3 months, 6 months, 1 year, 5 years?

Alicio appears to have a mini panic attack (“Um, hold on a second…”), before Friedland comes to the rescue (“Alan, is Alan here?”).

It seems like Alicio didn’t understand the question, which on its own is a bit concerning.

Alicio: Hey Alan, did you understand that question? Sorry…

Friedland: Yeah he wanted to know what the locked liquidity of Builder’s gonna be.

I should point out that Alicio being clueless isn’t surprising.

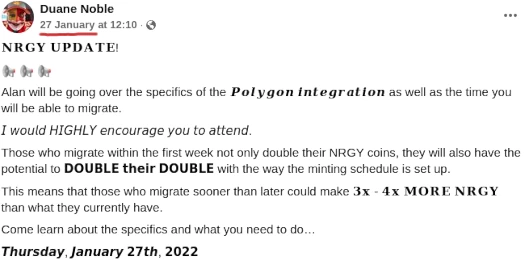

Friedland had Duane Noble and Chris Hawk front NRGY. Alicio is playing the same role in BuilderDefi.

I looked up Noble and, as of late January, he was pushing some Polygon NRGY integration waffle:

Getting back to the webinar, in answering Henry’s question, Friedland reveals;

The way that it’s set up … we didn’t want to have where early investors, who also got the benefit of the lower price of the coin, would be able to pull large amounts of coin right away, out of the staking contract, (to) the detriment to people that staked (invested) later.

And so the idea in the design of Builder was that there would be a calendar percentage of staking that you could withdraw your earned rewards, which are quite substantial, each and every week if you choose – or you can reinvest those into the staking contract.

But the original purchase amount, you wouldn’t be able to withdraw that for the first forty weeks.

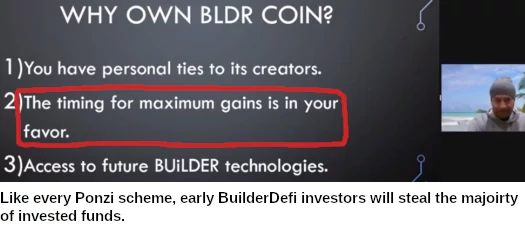

Friedland goes on to acknowledge “people on this call are going to have all the advantages”, versus those who invest later.

This is typical of any Ponzi scheme.

Later in his answer Friedland spells out the Ponzi flow of money within Builder.

With Builder, the beautiful part about it (is) new rewards are only minted when new money is staked.

Someone has to come in with capital, purchase the coin, the funds go into the liquidity pool on the decentralized exchange and only then does the protocol mint new rewards over the following three weeks, that are shared with all the stakers.

The take-away there is those funds invested into the pool, are what’s withdrawn on the backend (converting worthless Builder tokens to USDC, which is then cashed out elsewhere).

To summarize, NRGY bagholders are being transitioned to BLDR – except the BLDR link on BuilderDefi still points to NRGY.

5% a week is the going passive return rate, with referral commissions also on offer.

Instead of the NRGY instant dump followed by a slow-bleed collapse…

…BLDR investment will be locked up for 40 weeks – after which early investors will clean out what’s left.

During those first 40 weeks, those with the largest amount invested (Alan Friedland and friends), will clean out invested sums through ROI withdrawals.

Rank and file BuilderDefi investors meanwhile are encourged to reinvest:

The idea is that by the time they’re ready to withdraw, there isn’t anything left.

BuilderDefi is still a closed-loop flow of money. Returns are monopoly money until withdrawals are realized, with said withdrawals paid out of invested funds.

In other words, BuilderDefi is as Ponzi as Ponzi gets.

Unfortunately BuilderDefi isn’t likely to attract the attention of the CFTC. I only saw signals mentioned.

There were plans for automated trading with NRGY through TradeGenie, but that seems to have been dropped.

What BuilderDefi does violate is US securities law, which is regulated by the SEC. They haven’t moved on NRGY or NRGYGO.

Whether anything happens with BuilderDefi now in light of the CFTC settlement remains to be seen.

Wait a minute. You mean that Duane Noble is not promoting this?

Since this is the 3rd iteration of NRGY, I am stunned, I say, stunned that he is not promoting this.

After all he told us that NRGY and NRGYGO were not Ponzi’s and they were the future of DeFi!

Since this is just the “new” NRGY/NRGYGO does this mean that this is not the future of DeFi?

They must have cut him out of this new deal since he couldn’t deliver on NRGY/NRGYGO the suckers, err members to join NRGY/NRGYGO and the Polygon Integration of NRGY.

And another one of his can’t miss, sure-fire, future of DeFi has bit the dust.

Getting harder and harder to pimp these programs after all his past failures.

Seems his past is finally catching up to him.

There has to be a lot of really ticked off NRGY members who got sucered into NRGY at over $900 that is now selling at just over $62, and liquidity is under $390,000.

I think this video will bring even more clarity. I reference this site and actually this article multiple times in both Text and Voice. Please feel free to Embed it in the Original Article!

Should I Buy #Builder #$BLDR Coin? Is This A Great #Buy #Or A #Ponzi Scheme? #BuilderDefi #CFTC #SEC

youtube.com/watch?v=s1njSQSdSAE

We don’t talk about Alan, no no no…

That’s basically BuilderDefi’s marketing tag.

Yep! Need to record that song for EVERY new Ponzi he is involved in!

Hi, I’m a friend of one of the people involved in BuilderDefi, not going to state specifically who.

The “Sal” person’s name in your article is actually Cel Alesezio, I know it’s a very strange way of spelling a name, and even stranger pronunciation, but in Hawaii, you get used to it.

Hah! Yeah there was no way I was ever going to accurately transcribe that :D. Thanks.

We sure Cel Alesezio is what he’s going by?

Punch that into Google and you get:

Just visited their website and none of the Feature links work. So much for “Transparency,” and that link doesn’t work either.

They said this was going to go live on 2/10 and here it is 2/13 and the Feature links don’t work? I guess the only thing live is your ability to invest.

Their big preview launch appears not to have gone over well with the masses. Just too many “pesky” questions they didn’t want to answer.

Half the time you got the impression they didn’t even know what they were talking about. All their attempts to sweep Alan’s plea deal under the rug isn’t working. They are finding out that Google is not their best friend.

Going to be fun to see just how long this will last before it crashes and burns. Early signs are it won’t be a long time before it happens.

Since Alan and the management team are into “full transparency” I am sure Alan will be posting the terms of his settlement with the SEC on BuilderDeFi’s website.

Since he has nothing to hide, I am sure that he will gladly post it for all to read.

OK back to reality. There is no way in Hades that Alan is going to post the terms of his settlement agreement with the SEC on the BuilderDeFi website or any other website.

So much for their “transparency” claim.

*CFTC

Have they deserted BuilderDeFi already? It sure seems that way.

I see the pump is on for NRGY. Pumped the liquidity from $360,000+ to over $527K, and coin price to $115.30 in 2 weeks.

However, NRGYGO is not having that success. It looks like the downhill ski slope at the Olympics without the twists and turns.

Come on Chipmunk cheeks, you need to pimp this harder. It’s the future of DeFi. Oh wait, BuuilderDeFi is the future of DeFi.

So confusing to have so many programs from the same perps claiming to be the future of DeFi.

Now let’s see how long before the dump begins and NRGY falls back to the $300K range in liquidity and coin price back to the low $60 range; or lower.

DO NOT TRUST THESE GUYS! Stay far away. Please. They have scammed SO many people in Hawaii, they should be totally ashamed of themselves.

They are trying to save face coming from two different scams of Outstanding Real Estate Solutions and PGI Global. These people are not smart and will get your money gone!

Hello everyone,

This is a warning. Do not go with anything Santos Kidd tries to get you into. He has hurt me and my family financially because he promotes complete scams.

He doesn’t stop at a desperate attempt to make money for himself. He doesn’t care because he knows there will still be vulnerable people out there that will buy into it.

This company makes no sense. He has filed for bankruptcy and will probably soon need to do it again after all the damage he has caused.

Himself and Chimene Van Gundy should be in jail.

Oh Great, I have some family that is in this now. I warned them that many cryptocurrencies lead to scams or can be highly volitle. Hopefully the damage isn’t too bad when the dust settles but who knows.

Thank you for the article and keep us updated on this guy’s tactics.

Cel Alesezio is wrong you morons. You folks are clearly not from Hawaii lol.

I would recommend to never go with these people. Santos has a bad reputation here in Hawaii.

Plenty people mad at him because he scammed them of thousands! Seriously it’s just crazy how he can do that to families here.

He only cares about his pockets and owes lot of people money. It’s crazy sad.

Well, it has now been 3 months since BuilderDeFi launched and checked out the coin price. Currently it is at around $0.73. I thought this was the future of DeFi?

Hmm, they said the same thing about NRGY and NRGYGO. They all 3 can’t be the future of DeFi, well in a real world that is.

Notice Alan hasn’t posted the results of his CFTC case on the website. So much for transparency.

NRGYGO is falling in price, but NRGY is still being pumped and they are supporting it keeping the liquidity above $500,000.

Current coin price is $221.40 and Total Liquidity is $557,323. A far cry from the high coin price of over $900 after this launched.

But seriously, only $0.73 for the future of DeFi?

Careful folks. I just talked to Alan Friedlan via Zoom and he’s promoting nrgydefi, NRGY coins tied to NFTs and Starstake.

He and his crew have multiple scams going concurrently. Supposedly, the actual launch is January 2023, but if you invest now and stake NRGY coins on polygon blockchain (valued at $561.00+ on their UI app) you can a huge return, and of you bring in friends and companies, you can get up to 25% in royalties.

Alan said he lives in Florida and visit California often. When investing in anything, remember to only put in what you can afford to lose.

NRGY has been covered pretty extensively on BehindMLM.

Search bar is on the top right of every page.

Yeah…. but they trying to launch Starstake again…. distancing from NRGY….. I’ll have more for you via email soon… juicy new junk!

So do you get a kick out of just pointing all the bad that has been done by these people? You have been blogging on this page since 2021.

If you have all this information you can look up that court cast and get the prosecutor that was on the case to go after him now.

You can also call the FBI, SEC or even an ADA from the US Attorneys office. Calling the police wont do much because this type of case actually requires more effort than they can offer.

If you really want to help the people that are about to be ripped off you need to do something now before they pull that liquidity out.

J bought $4,200 worth of NRGY just after the initial pump and dump. My tokens have a value of $86,000.00 now but they are locked in the staking contract.

You need to call the FBI, SEC, an ADA from the US Attorneys office, your home state’s attorney’s office tomorrow morning and contact the prosecutor from his last case.

You have enough info to get them to pay attention and take action now. Don’t just play the whistle blower role. Be the person that stops them instead of just talking. Others will back you up on this!!!

BehindMLM doesn’t get involved in the victim side of MLM. It’s too messy and time consuming.

If you come crying to me after the fact, I have no patience or interest. The only exception to this is if you have intel on how a scam went down that might be beneficial towards consumer awareness.

What people do with the information and research published on BehindMLM is up to them. Bold of you to assume nobody has contacted the authorities.

Also I’m not aware of any criminal charges being raised against Friedman. Understanding the basics of regulatory framework is a pretty important component of being an MLM victim advocate.

Bold of you to assume nobody reports any of this stuff.

But also naïve to assume authorities act with anything but malaise.

Here’s a little hint: Victims gonna victim,education is the only thing that will help prevent more in any meaningful fashion.

It’s always the same thing:

Report on the con, defenders come to say “it’s a lie”. Eventually it collapses and the cycle repeats.

Government don’t care…. unfortunately!

It Week 41, 20% should be unlocked for withdrawal. It’s not and the beginning of the end.

Oops

I have some interesting news.can only share privatly.

Contact button is on the top right of every page.

I do believe this man with a beanie cap is named sly aloisio from hawaii. Now moving into new territory in cold weather Utah.

cftc.gov/PressRoom/PressReleases/8510-22

Alan is banned from selling digital currencies so he needs to use other people to do it for him. This man settlement was a slap in the wrist. But he is doing it again through others. It seems all very bad.

The founder of Builder Defi is Silivetelo “Sil” Aloisio. He should be reported to the SEC along with Alan Friedland.

Now scheming on some window cleaning invention to build the Builder coin value. He is now living in Utah.

Someone needs to turn them in.

Got more info on the window cleaning invention…. I’d love to take that down too!

Sil Aloisio on his telegram posts says he the invention is in the prototype stage and has not been released on the market yet. He claims the profits will be going in to the builder coin.

Community members say He is using the money from the coin as a “kickstarter scam” to fund his invention. The product name is Windo Guru.

Alan Friedland is currently setting up a new platform to carry out the next scam.

So watch out for the websites he is working on.

Alan Friedland is currently setting up a new platform to carry out the next scam.

So watch out for the websites he is working on.

realworldfunding.com

https://app.starmax.ai/pops-connect-marketplace

Website new project From Alan