AuLives Review: SGC Ponzi points OneCoin clone

![]() AuLives provides no information about who owns or runs the company on its website.

AuLives provides no information about who owns or runs the company on its website.

The AuLives website domain (“aulives.com”) was privately registered on May 29th, 2018.

An address in Dubai is provided on the AuLives website. Multiple businesses operate out of the same address however, suggesting the address actually belongs to a virtual office provider.

AuLives has an official corporate YouTube channel, on which there are several marketing videos.

These videos reveal the co-founders of AuLives to be Parwiz Daud and Mansour Tawafi.

Up until very recently, Daud and Tawafi were prominent promoters of the OneCoin Ponzi scheme.

On December 4th, 2017, Ted Nuyten’s Business For Home celebrated Daud and Tawafi stealing approximately $400,000 a month from OneCoin victims.

OneCoin’s ROI payments collapsed in early 2017 but the company continued to pay pyramid commissions on recruitment.

With the company no longer honoring ROI withdrawal requests however, OneCoin affiliate recruitment also collapsed.

With their OneCoin earnings likely plummeting, now it seems Daud and Tawafi want to run their own MLM cryptocurrency company.

Update 28th August 2018 – Testament to their lack of MLM executive experience, in a YouTube video dated August 25th, Daud and Tawafi revealed Frank Ricketts as CEO of AuLives.

Rickett’s MLM claim to fame is Unaico and SiteTalk, a combination of investment and pyramid fraud. When those scams collapsed, Ricketts rebooted the business as as The Opportunity Network.

In early 2016 Ricketts sold off The Opportunity Network’s list of investors to OneCoin.

In early 2016 Ricketts sold off The Opportunity Network’s list of investors to OneCoin.

In addition to an undisclosed sum of money, Ricketts was also gifted a OneCoin Black Diamond investment position.

Behind the scenes Ricketts is believed to have been instrumental in setting up OneCoin’s shell company money laundering network.

Publicly Ricketts tended only to make appearances when OneCoin teetered on collapse.

Without any pomp or ceremony, sometime over the last eight months Ricketts quietly left OneCoin. /end update

Daud and Tawafi reside in the UK, where they primarily promoted OneCoin to the local Muslim community.

It stands to reason that as opposed to Dubai, the UK is where AuLives is actually being operated from.

Why none of this is disclosed on the AuLives website is unclear.

Read on for a full review of the AuLives MLM opportunity.

AuLives Products

AuLives has no retailable products or services, with affiliates only able to market AuLives affiliate membership itself.

The AuLives Compensation Plan

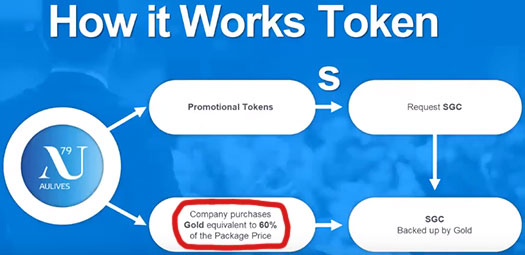

AuLives affiliates invest euro and receive “promotional tokens”.

- Beginner – invest €100 EUR and receive 50 tokens

- Access – invest €500 EUR and receive 250 tokens

- Intermediate – invest €1000 EUR and receive 510 tokens

- Advanced – invest €5000 EUR and receive 2625 tokens

- Professional – invest €15,000 EUR and receive 8025 tokens

- Exclusive – invest €50,000 EUR and receive 27,500 tokens

Once acquired, AuLives affiliates convert invested tokens into Secured Gold Coin (SGC).

SGC is marketed as a viable cryptocurrency altcoin, but in reality are just pre-generated points that don’t exist outside of AuLives.

Recruitment Commissions

AuLives affiliates are paid 10% of funds invested by personally recruited affiliates.

Residual Commissions

AuLives pay residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each week AuLives tallies up new investment volume on both sides of the binary team.

Affiliates receive a flat 10% of new investment volume generated on the weaker side of their binary team.

Paid volume is flushed from both sides of the binary team, with leftover volume on the stronger side carried over the following week.

Matching Bonus

AuLives pay a Matching Bonus via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

The Matching Bonus is paid out on residual commissions earned by unilevel team members.

AuLives cap the Matching Bonus at four unilevel team levels as follows:

- level 1 (personally recruited affiliates) – 10% match

- level 2 – 10% match

- level 3 – 20% match

- level 4 – 25% match

Leadership Rewards

- Trainer (generate 7000 GV (minimum 1650 GV on your weaker binary team side) and recruit two investing affiliates) – a pin

- Executive (generate 40,000 GV (minimum 10,000 GV on your weaker binary team side) and recruit and maintain at least two Trainers (one on either side of the binary team)) – €600 EUR

- Team Leader (generate 80,000 GV (minimum 40,000 GV on your weaker binary team side) and recruit and maintain at least three Executives (at least one on the weaker side of the binary team)) – €800 EUR

- Regional Director (generate 200,000 GV (minimum 80,000 GV on your weaker binary team side) and recruit and maintain at least three Team Leaders (at least one on the weaker side of the binary team)) – €2500 EUR

- Chairman (generate 500,000 GV (minimum 200,000 GV on your weaker binary team side) and recruit and maintain at least four Regional Directors (two on either side of the binary team)) – Rolex watch

- Vice President (generate 1,500,000 GV (minimum 500,000 GV on your weaker binary team side) and recruit and maintain at least five Chairmen (at least two on the weaker side of the binary team)) – €15,000 EUR

- President (generate 8,000,000 GV (minimum 1,500,000 GV on your weaker binary team side) and recruit and maintain at least six Vice Presidents (three on either side of the binary team)) – €60,000 EUR

Joining AuLives

AuLives affiliate membership is €35 EUR plus a €100 to €50,000 EUR investment.

Conclusion

Why settle for $400,000 a month in recruitment commissions when, like OneCoin’s Ruja Ignatova, you can dupe tens of millions out of gullible investors?

Following in the footsteps of Nils Grossberg’s DagCoin, Parwiz Daud and Mansour Tawafi have launched their own OneCoin spinoff.

Both companies bundle “education packages” with affiliate investment, however it is the promise of riches that lures investors in.

Whereas DagCoin’s marketing hook is their worthless points not having to be mined, AuLives claim their worthless points are backed by gold.

According to AuLives marketing material, AuLives take 60% of invested funds and purchases gold with it.

This gold supposedly backs up the value of SGC points

Naturally the company provides no evidence of gold being purchased or stored.

Furthermore, AuLives marketing material goes on to state the invested “gold value” can be used as a line of credit with MasterCard.

First things first, MasterCard aren’t running gold-backed credit cards.

Second of all if invested gold is able to spent by AuLives affiliates, what’s propping up the internal value of SGC?

I mean presumably AuLives affiliates are going to be able to cash out their SGC points through an internal exchange, right?

Gold can’t be simultaneously able to be spent by affiliates and backing up SGC at the same time.

And if AuLives drop the “we’ve invested in gold charade” and just peg an internal value per SGC point invested in and offer it on a debit card, what is the point of SGC then?

Affiliates won’t be able to do anything with it, other than look at made-up SGC balances in their back office.

And so we come to the crux of AuLives’ business model.

Like OneCoin and DagCoin, AuLives combines pyramid recruitment with recycled invested funds.

Be it gold, imagined or otherwise, whatever AuLives affiliates manage to withdraw is sourced from subsequent investment.

The whole thing falls apart once recruitment dies down, because no matter what the internal SGC value is, if there’s no new money to withdraw AuLives can’t pay anything out.

This is precisely what happened with OneCoin, has yet to happen with DagCoin and will eventually happen with AuLives.

As Nils Grossberg is finding out with DagCoin, reload scams are rarely as successful as their predecessors.

DagCoin’s website Alexa ranking is tanking and with EU tapped out, showing no signs of a reversal anytime soon.

This late into the game, AuLives is going to have an even steeper hill to climb.

And even giving them a chance is generous.

The only cryptocurrency experience Parwiz Daud and Mansour Tawafi have, is recruiting people into a Ponzi scheme and profiting handsomely from it.

There’s a big jump between Ponzi promotion and actually running one.

After AuLives has milked what’s left of OneCoin’s English Muslim community again, what then?

Great timing Oz!

I just tried to send you the presentation via the “Contact” page, but this seems to have failed (> 10MB).

I saw this new article only after that.

Some extra info not mentioned in the article yet:

1. Next to ex OneCoin/OneLife scammers “Dr” Parwiz Daud and Mansour Tawafi, Frank Ricketts has been appointed as CEO: NOLINK://youtu.be/5MX_tMLDMcI?t=423

2. Global Consultant Nawid Habib and CTO Aleksandar Martinovic work for ICO HeadStart (NOLINK://icoheadstart.com/), so contrary to OneCoin they MIGHT implement some real crypto tech.

3. This text on NOLINK://aulives.com is currently commented out (between “Strong Finance” and “AuLives Foundation”). Ready for future use, I hate them for this already:

4. For Manual transfers they use this Australian bank account, visible in the back-office after Checkout in the SHOP:

5. First global pre-launch event planned in Amsterdam on September 15th: NOLINK://youtu.be/5MX_tMLDMcI?t=653

PRO scammer from Sitetalk/Onecoin former CEO and Captain – Frank Ricketts is the CEO of this scam… they’ve announced it yesterday on their global summit in Istanbul, Turkey.

Pics to prove it are available on their FB support group.

Don’t those who steal under Sharia law lose their hands as punishment? Can’t really see a Ponzi passing the test.

They can’t even spell the law they are supposed to be compliant under!

Dr Parwiz Daud and Mansour Tawafi are criminals that scam poor and ignorant people out of their hard earned savings.

So whats stopping the uk police from arresting them with several severe charges? I do not understand how these immoral criminals can just continue out in the open like this?

Also you said dubai does not prosecute nor have laws against mlm plnzis?

LOL@Frank Ricketts. You really couldn’t find any other job than this, Frank?

Thanks for the additional info OneCoin Squad, I’ve added Ricketts as AuLives CEO to the review.

Sorry to say but MANSOUR TAWAFI DR PARWIZ DAUD. ARE BIG PONZI DIRT! SCUMBAGS!

AULIVES IS SCAM AND STUPID DOWnLINE FrOM ONECOIN BELIEVE THEM AGAIN!

POOR SUCKERS!

Speaking of Sharia law, This is hidden in the source code of their website:

I guess the Sharia certificate is still missing, so they had hide it.

These are the same guys ( Parwiz Daud and others ) from other mlm scams.

He stole £50 000 from an elderly Muslim woman from Birmingham. The money was for her grandchildren’s education. This was when they were in onecoin. Watch out!!

Big scammers. I hope police will catch them and put them in jail.

These people will get what’s coming to them. They spoke so much about one coins value as if it’s facf. They lauded their accounts to people to show all the money they made. They knew what they were doing. Absolute joke.

It is from the Sunnah to pay using cash and to pay with your right hand. Muslims, don’t get sucked into crypto currency.

I was in this Dr Daud’s house. And looking back his Dr title gave him credibility. Which is why so many get sucked in. That and greed. But this man has been a part of ACN and then one coin and now this.

Stay away! AULIVES is big scam. Dr Parwiz Daud is a crook. Everything he says is lie. Do not invest!!

I read most of the comments written and it seems most of them are written by the same person.

Do you people really think if Daud are Tawafi had stolen money from people, would they be walking so freely and then coming with their own cryptocurrency.

Leaving such stupid comments will not make any difference.

Evidently yes. Although that’s more of an indictment on UK authorities than the legitimacy of stealing money through Ponzi schemes.

Not to those who religiously follow Daud and Tawafi from scam to scam, such as yourself. You already know OneCoin is a Ponzi scheme and that AuLives is no different.

Hmmm, The Australian bank account detail has changed:

BVI and Mauritius? Totally nothing suss going on there…

When you denounce god and take money and desires as one you don’t look around how many people you hurt and how much money you stollen from them.

These people used religion as thier tool to lore me and many more like me into scams one after another.

Dr parwaiz and his little lap dog mansoor will always remain as one of the top scammers of the 2017 and 2018. They live in their own little bubble and think they are amazing but whoever they have touched they destroyed those lives.

Congratulations for the tittle and I and sure this money will help you in your grave. Scambags

Thieves. These guys will be in prison soon! Dr Parwiz Daud has been scamming people for years now.

Well, Daud did lie for years as he claimed to work as a doctor at Leicester General Hospital. In reality there was no one named Daud in the whole staff of the hospital. In fact, he doesn’t even have a license to practise medicine in the U.K.

But I guess the hospital in Leicester is a paid hater and the register of medical practitioners is just a scheme of the government to make Daud look bad, so never mind these stupid comments.

This AULIVES is a scam, beware. Dr Parwiz Daud and Mansour Tawafi are bad people who will take from the poor.

Good efforts to save mlm and end user’s.

This is 100% a scam.

Peopl also forgetting to mention the other two scammers very much known in holland. Mr Nawid Habib and mr ALEXANDER who both started icoheadstart in 2017 and run away with over $11.7M of peopled money by end of 2018 staring this company aulives.

They have been named and shamed in many magazines and news outlets triggering here in Holland resulting in Interpol investigations. These low life scammers will be brought to justice oneday.

I am not sure who the other two partners of aulives are but these two have been involved in many more scales previously so stay away.

@Steven a – always good to leave links to scammers being exposed here in the comments. Just begin the link with: NOLINK + actual link (no spaces)

Good to preserve these for future shaming purposes.

@Oz

This part in the original article:

I’m sure you meant to say DagCoin?

Otherwise, great text. It’s amazing part of scammer psychology that once the scam you participated dries out, you start your own copy of it.

(DagCoin Dascoin, AuLives, Swissmine, Orientum,…)

Ah yes I did, thanks for catching that.

Same scam crew from Onecoin. Crypto + MLM = SCAM.

Dr Parwiz Daud & Mansour Tawafi will feel the rath of Allah.

Is Frank Ricketts still CEO of AuLives? Or are Frank Ricketts and Staffan Liback planning a new scam together? Or two? Both crooks have never earned money with honest work. Should that change now with CLOUD HORIZON?

A very short video from December 12, 2018:

share-your-photo.com/bf312aa4aa

In this video on January 28, 2019 about CLOUD HORIZON, Frank Ricketts is cited as CEO:

share-your-photo.com/e6372a25ae

youtube.com/watch?v=aMUz4_IUFlc

There are two CEO’s on this Facebook photo, but a Frank Ricketts is not there:

share-your-photo.com/55a2be6353

We’ve known the scammer on the right side for a long time. But who is the guy on the left?

Jens Lausten from Denmark is the NEW COO for Cloud Horizon – he is well known for beeing in TV as Pyramid Star –

tv.tv2.dk/articlenew.php/id-20555838%253Apyramidevirksomhed.html

Hello

Is it true that Dr Parwiz Daud and Mansour Tawafi we’re arrested for Onecoin Ponzi scam?

We know there have been arrests in UK. The police haven’t named those arrested though.

Does anyone know what happened to the scamsters Dr Parwiz Daud and Mansour Tawafi? I think Aulives has closed down…

AuLives website Alexa ranking is almost 4 mill. Not closed down, collapsed.

What about Dacxi ed ludbrook latest offering.

Dacxi is another pointless shitcoin scheme, but it seems to be a single-level commission shitcoin scheme:

Alexa ranking tanked Jan 2019, #RIP.

Nope I take that back, there’s a second level “coach bonus”. I’ve added Dacxi to the review list.

Ok thanks for advice.

I have a muslim friend in sweden that was ripped off badly by OneCoin. He invested A LOT, as a top seller, and was “friends” with Mansour, Parwiz and Navid.

He was planning of moving to London and working with them full time when it all went down. Boy, did they fool him.

No arrests in the UK regarding OC sadly

Don’t worry Aulives Kari and Udo are available to come and save the day , the mighty chicken and is sidekick.

BIG SCAMMERS, KEEP AWAY FROM THEM, THEY CALL THEMSELF MUSLIM BUT THE ONLY THING THE BELIEVE IN IS MONEY.

I KNOW THESE GUYS PLEASE STAY AWAY FROM THEM, BIGGEST LIERS I HAVE EVER MET!!!

The number of daily visitors on aulives.com is gigantic! Most of them live in Nigeria:

share-your-photo.com/50ebb838cb

Serial fraudster “Dr.” Parwiz Daud wanted to change that and registered the domain aurder.com on September 12, 2018.

aurder.com was to become his eCommerce platform, comparable to the DealShaker of the OneCoin scammers in Sofia. It has been 21 months since registration and what can be seen on the website?

share-your-photo.com/86a2b45ab8

In March 2019 he uploaded this video:

share-your-photo.com/f39181e94b

youtube.com/watch?v=AHOhGyvCM64

Soon is a flexible term, but in Germany that means less than a month. Two years and three months are clearly too long and no one will call this “soon”.

Why is this taking so long? Does Parwiz Daud too much time in his new portal teclabs.co.uk, registered on May 19, 2019? This website is not finished either, because the links marked in red are all without function:

share-your-photo.com/42c9d18412

To sum up: Parwiz Daud was “successful” as a scammer for OneCoin. His last rank was “Black Diamond”. As a self-employed fraudster, he totally failed.

During a OneCoin scam event in Malaysia in November 2017, “Dr.” Parwiz Daud made a 22-minute solo performance.

share-your-photo.com/e6e498999f

youtube.com/watch?v=EjgztqDyhwE&list=PL2KZZn0mHVptGqQVCGe9vWmAcRWbqQDqr&index=109

How stupid must those people be who still believe notorious liars and deceivers like Parwiz Daud?

there is seemingly no shortage of “doctors” at OneCoin. If i ever have a heart attack at an MLM event, it will be in my best interests for it to be there.

Serial fraudster Parwiz Daud was asked on Instagram on October 28, 2020:

share-your-photo.com/e606f0b089

Unfortunately I can’t read the answer.

instagram.com/drpd_official/

If anyone wants to know what happened to Parwiz Doud and Mansour Tawafi. Here is the latest information.

the two founded a new company about a year ago in 2021, it is called VALIDUS. I was at a VALIDUS event in Croatia and believe me, the both are lying that the beams are bending. You can even call it brainwashing.

It’s always the same principle, nothing new. Please folks don’t fall for these scams.

Don’t get fooled and don’t invest any money. People never change, once a cheater always a cheater.

I hope these two get their just punishment for all their scams and for the people who robbed them of their money.