Angel Business Club: Viral Angels Ponzi rebooted

Angel Business Club surfaced around the time Viral Angels collapsed in mid 2015.

Angel Business Club surfaced around the time Viral Angels collapsed in mid 2015.

When it first launched, a “risk warning” page on the Angel Business Club website directly referenced Viral Angels.

Angel Business Club cite their parent company as Angel Equity International, a company registered in the UK.

Angel Equity International was incorporated in May of 2015, again around the time Viral Angels collapsed.

Dominic Berger and Philip Reid are listed as Company Directors of Angel Equity International, both through an address in London.

Dominic Berger and Philip Reid are listed as Company Directors of Angel Equity International, both through an address in London.

The Angel Business Club website cites Reid as Chairman and Berger as CEO of the company.

Both Reid and Berger were members of Trig’s Board of Directors.

Viral Angel’s CEO Anthony Norman was also the CEO of Trig (for a more detailed history refer to BehindMLM’s Viral Angels review).

Trig was tied to Viral Angels via the offering of virtual shares in Trig to Viral Angels affiliates.

Although Norman is not publicly fronting Angel Business Club, for all intents and purposes it appears to be a reboot of Viral Angels.

Viral Angels was primarily operated out of Sweden, with this likely also the actual base of operations for Angel Business Club.

Read on for a full review of the Viral Angels MLM opportunity.

The Angel Business Club Product Line

Angel Business Club has no retailable products or services, with affiliates only able to market Angel Business Club affiliate membership itself.

The Angel Business Club Compensation Plan

Angel Business Club investors invest funds each month on the promise of a weekly ROI:

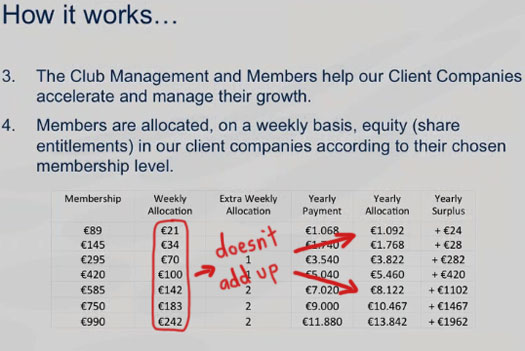

- invest €89 EUR a month and receive €21 EUR a week for 52 weeks (€24 EUR ROI)

- invest €145 EUR a month and receive €34 EUR a week for 52 weeks (€28 EUR ROI)

- invest €295 EUR a month and receive €70 EUR a week for 53 weeks (net €170 EUR annual ROI)

- invest €420 EUR a month and receive €100 EUR a week for 53 weeks (net €260 EUR annual ROI)

- invest €585 EUR a month and receive €142 EUR a week for 54 weeks (net €648 EUR annual ROI)

- invest €750 EUR a month and receive €183 EUR a week for 54 weeks (net €882 EUR annual ROI)

- invest €990 EUR a month and receive €242 EUR a week for 54 weeks (net €1188 EUR annual ROI)

Referral Commissions

Referral commissions are paid out on funds invested via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Angel Business Club cap payable unilevel levels at five.

Referral commissions are paid out as a percentage of funds invested across five unilevel levels.

Angel Business Club do not publicly disclose percentage payouts across each unilevel level.

Virtual Shares

Angel Business Club runs a virtual trading platform, through which affiliates can trade virtual shares with eachother.

Leadership Pool

Angel Business Club affiliates receive a share in 1% of company-wide investment.

Qualification criteria for the Leadership Pool are not disclosed.

Joining Angel Business Club

Angel Business Club is tied to a monthly subscription investment of between €89 and €990 EUR.

The more an affiliate invests the higher their income potential through the Angel Business Club compensation plan.

Conclusion

Angel Business Club is the latest incarnation from a group of scammers dating back to at least early 2012 ( SpinGlo, Synkronice and Enwire).

The business models of Angel Business Club and Viral Angels is pretty similar. Pay a monthly fee, get a ROI and earn additional commissions if you recruit new investors into the scheme.

Viral Angels had affiliates trade virtual shares in Trig, with Angel Business Club expanding this concept to virtual investment in third-party companies.

These are companies Angel Business Club has set up, complete with corresponding websites. Traffic analysis estimates to any of the company websites is pretty much zero, suggesting no legitimate business activity is taking place.

This is where the “investing in companies” ruse is exposed.

Whether they’re legitimate enterprises or not, investing in third-party companies doesn’t pay a weekly guaranteed ROI. Yet that’s exactly what Angel Business Club offer.

The only way Angel Business Club can guarantee a ROI is by recycling newly invested funds to pay off existing investors. This makes it a Ponzi scheme.

For clarification on this matter, prospective affiliates can ask their potential Angel Business Club affiliates for a dollar for dollar accounting tying weekly ROIs to angel investing.

If this is not or cannot be provided, you have your answer.

Angel Business Club’s virtual share market is an additional layer of fraud, with Angel Business Club not registered to offer securities (virtual or otherwise) in any jurisdiction.

The market is basically affiliates shuffling money between eachother via virtual share values set by Angel Business Club management.

Perhaps the most revealing aspect of the company is the following disclaimer in the official Angel Business Club presentation material:

Neither this presentation nor any copy of it may be

(a) taken or transmitted into Australia, Canada, Japan or the United States of America (or)

(b) distributed to any U.S. person

Legitimate angel investing very much exists in Australia, Canada, Japan and the US. The only reason Angel Business Club is avoiding those jurisdictions is because they’re far more likely to detect Ponzi fraud.

Perhaps not so much Australia, Canada and Japan, but the exclusion of the US in particular stands out.

On top of this Angel Business Club appear to have intentionally excluded English in their marketing material up until recently. I spent considerable time researching for this review and even then some parts of the compensation plan were unavailable.

Furthermore Angel Business Club’s English marketing presentation doesn’t appear to be accurate (weekly payouts don’t match their annual counterparts):

It’s far easier to scam people in fraudulent investment schemes in Europe, which the Trig folks have been doing for some years now.

Primary affiliate recruiting grounds for Angel Business Club are currently France (51%) and Germany (19%). Affiliate recruitment dropping off in these countries might explain Angel Business Club’s recent addition of official English marketing.

Either way, once newly invested funds dries up, like Viral Angels before it Angel Business Club will also collapse.

It’s been fully in English since it launched as Viral Angels and only changed name to ABC because all the members wanted a name change plus it coincided with new professional marketing.

On your nice little graphic showing subscriptions and returns stating that it does not add up, there is a reason it doesn’t add up which is because it gives a ROI.

You pay money and receive shares in companies that are looking to float on the stock markets. These companies need a certain amount of share holders to be able to float on the exchange and that is part of the whole idea.

It’s not a reboot and VA never collapsed. A few companies so far have floated and all members now have shares in these companies.

Newly invested funds are not required to pay people out. The subscription gets you shares and you only earn money if you sell at a higher price than you bought them for in your subscription.

Best way to do that is when the company goes on the stock market and its price rises.

What does that have to do with basic math not adding up?

Virtual shares, which have nothing to do with the real world.

Viral Angels most definitely collapsed, making Angel Business Club a reboot.

So why illegally solicit them at all then?

Hi, thanks for this. I was going to join as It was recommended from an affiliate I normally trust, but I will treat with caution now.

Must admit, firescape global which is one of their companies does sound legit. What do you think?

I think it has nothing to do with MLM and is thus entirely irrelevant.

This team of gangster fraudsters!

Just follow Anthony Norman=Tony Norman/Tilly etc.

Everything he, and all his friends is fraud.

All money goes to pay for a very expensive lifestyle and luxurious houses.

The money that dissolved from trig/angels went to a yacht in Ibiza “mooring A9” “Atlantiz” a Mangusta 80.

His friends Berger you can find there from time to time.

They still run with mr cook from his hideout I UAE.

Now they are making their own fake crypto currency, private jet club, Vip travel, but it’s all bull shit.

Do not involve with these guys, you will lose big in the end.

Many thanks for the warning, I was very tempted but no longer.

join abc wating for refund that they promise over 4 weeks. paul the affilate braggs how good it is and has been no help.

please dont join my bank has been trying to get a refund no joy yet.

hi all ive now had a fullrefund i belive to be good person a lady at the office send he was helping with refund and i wish munch sucess and belive the company seams good i stilldont no why it took them so long but its all been delt with i wish them all the best

Open Letter regarding THE ANGEL BUSINESS CLUB

Date: 08 January 2020

Dear Behind MLM,

The freedom for all to use the internet should be protected and respected, however too often today we see that freedom being threatened by online posts that are both badly researched at best and slanderous at worst.

The print media has a code of ethics that include, truth and accuracy (get the facts right), independence, fairness and impartiality (always two sides to a story), humanity and accountability. This code should in our view be used by all who wish to print opinions to the public online.

At the very least the person or business publishing their opinion should seek answers and contact the people that the article is about to ensure accuracy and fairness. You have neither attempted to contact us or sought any clarification of the facts.

Following a proliferation of articles published on the internet about the Angel Business Club we have been compelled to write this open letter to correct factual inaccuracies and address opinions with our side of the story.

We would further welcome full and open dialogue with any commentators in a public or private forum.

Furthermore, all of the Companies that the Club has invested in are open to scrutiny and the directors of the same would welcome any and all enquiries.

For the record we are not shy of constructive criticism – we welcome it. We strive at all times to improve and perfect our offering. We aim to be fully transparent and available to our Members.

We are however fiercely protective of our community, employees and associated businesses. An opinion on our Club affects a much wider community and, if required, we will resort to legal action to protect all involved.

The essence of all of the online articles is that the Angel Business Club is a scam or a Ponzi scheme – following is a definition of a Ponzi scheme

In the case of the Angel Business Club the suggestion is that we are using Members’ membership fees to pay returns and we are not investing their money. Before I provide you with factual evidence that this is not the case, I would like to explain our structure and business model so you can see how the Club actually works.

Our Structure and People

The Club itself is effectively controlled by its Members – it is an unincorporated association domiciled in Gibraltar which is managed by Angel Business Services Limited also in Gibraltar.

The Club is not regulated, and it does not have to be as it does not carry out any regulated activity.

The Club is independently advised by Capital Plus Partners Limited (CPP) which is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, and whose directors are myself Dominic Berger and my business partner Philip Reid, among others.

All investments made by the Club, as principal, are reviewed and arranged by Capital Plus Partners. Please note that the Club itself does not have an investment policy in place.

The CEO for the Club and the Club’s administrator is Joao de Saldanha.

The Club offers to its Members the opportunity to participate in the development of businesses with exciting potential, not to mention that the Club has built a strong sense of community allowing its Members to truly engage with such Companies to drive business growth.

From time to time, Members of the Club are invited to invest in approved Companies over and above their membership fees – this activity is arranged by Capital Plus Partners in its fully regulated platform 360equity.com.

Please note that 360equity.com is not available to US, Canadian, Japanese and Australian citizens or residents as Capital Plus does not have the relevant permissions to do so in those territories.

The Club uses an independent nominee company to hold all the shares it acquires in Companies as a bare trustee. This company is now called Premium Nominees Limited (previously Angel Business Club Nominees).

As a bare trust it does not register the shares on its balance sheet as it does not own any shares – it will always be a dormant company as it does not generate any revenue from the services of a nominee.

Its directors were changed recently to maintain further independence from the Club. The costs of running the nominee are covered by the Club. The Nominee also holds some of its shares that are held publicly or electronically with regulated nominees and custodians.

At present, the Club has shares held through its account with Novum Securities Limited and Global Prime Partners Limited and Pershings. Therefore, some shares are held in the names of the above or in the name of any other Nominee or Custodian as may be appointed from time to time.

How it works

Firstly the Club does not offer any cash guaranteed returns – weekly or other – this is simply not true.

Members pay a non-refundable membership fee for access to the Club, its services (including an educational program) and diversified events, as well as free share entitlements in the Companies that the Club invests in.

The Club does not offer its Members any guaranteed financial returns or a preordained entitlement to share in a net asset value (unlike in a collective investment scheme), although we recognize that this is perfectly achievable.

The Club openly discloses that 50% of all membership fees covers the costs of running the Club – circa 30% on Club overhead and circa 20% for its affiliate marketing program. That leaves 50% of the membership fees that could be used as investment in outstanding business, from early stages to pre-IPO Companies.

The Club, through its regulated corporate finance advisers (CPP), curate’s investment opportunities where the Club always looks for a minimum 50% discount to value in the investee Company with the right to acquire further shares at the same price over a period of time – otherwise known as an option.

This allows the Club to invest further as the Company in theory increases in value. Please note that we also recognize that not all Companies succeed and that very much forms a part of our membership narrative.

The Companies that the Club invests in are always independently valued and the main reason the Company is willing to accept the discount is that they see the positive impact a network of business angels can have on the growth of their business.

Again, all the Club’s investments are open to scrutiny and we would be more than happy to provide anybody a list of our investments and contact details of the management for independent scrutiny of our ownership.

Therefore, the alchemy here is to secure on behalf of Members investments in Companies where the Members get the shares allocated at the fair independent Company valuation while the Club is able to acquire the shares at a discount.

The Club describes itself as a private equity community, and it takes a very active role in all of its investee Companies, if required. The Club’s investment agreements allow for intervention, including the appointment of directors in said Companies.

Lastly, the Club uses a variety of private equity strategies and legal agreements to protect its investments, including loans with security charges / debentures and warrants / options.

You will therefore often see team Members such as myself and Philip Reid as directors of investee Companies.

In fact, some of the biggest successes of the Club have come from its failures and active intervention, including the recent turnaround of Firescape amongst others where I personally became Chairman and have steered the business through difficult times.

Members of the Club who participated in the Firescape loan have now either converted their loans to shares or been repaid with an 8% annual coupon. We have every belief that Firescape is now well positioned to disrupt a global fire extinguishing market and save many lives with its unique solution recipe.

Firescape is a great example of our active engagement and how we can help Companies to navigate changes, improve their operations, grow their business and deliver value to their customers and stakeholders.

Proof that Angel Business Club, through its designated nominees, holds shares in its investee Companies is a matter of public record and its UK investments can be verified online at Companies House or indeed on some websites.

If anyone wishes to check the nature of our share ownership, we would be more than happy to get the Companies in question to confirm our holdings.

Please find below two public record examples and many more can be found on Companies House – although please note Companies House is not necessarily always up to date.

companieshouse.gov.uk/company/11465800/filing-history

See confirmation statement

Shares held at Premium Nominees

companieshouse.gov.uk/company/10843995/filing-history

You can clearly see Angel Business Club owns the shares as disclosed and in turn our Members have the right to these shares. Any opinion that the Club is a Ponzi scheme or that is does not own shares in Companies is completely false.

In fact, if following this open letter, opinions are not corrected we will seek legal advice and take any action available to us to protect our good standing as a business and as individuals, including seeking damages.

Please also accept this letter as an invitation to come to our offices or schedule a call with me in order that any further questions can be addressed, if required.

We felt compelled to also address some other comments that are on the internet:

Why are there references to Viral Angels and the Angel Business Club on the internet?

Before forming the Angel Business Club, the two founders – Dominic Berger and Philip Reid – both acted as consultants to a Swedish Credit Union called Viral Angels (VA).

The services provided by the consultants were exclusively related to reviewing the regulatory framework that Viral Angels required to operate. In June 2015, both Philip Reid and Dominic Berger resigned from Viral Angels and formed the Angel Business Club.

The owners of Viral Angels subsequently agreed to sell the software of Viral Angels to the Club. To avoid disruption to existing VA Members, both VA and ABC agreed the possibility of transferring membership and assets from Viral Angels to the Angel Business Club. Approximately 20% of the VA Members transferred to the Club.

Consequently, some (but not all) of the investments made by Viral Angels were also transferred into the custody of the Angel Business Club.

Since the transfer, the management of the Club has worked on behalf of their Members to manage and develop the VA investments with some success.

While the Club takes no responsibility for the investments made by Viral Angels, ABC has and will continue to act in the best interests of its Members in managing these legacy Companies.

Indeed we have managed successful cash exits from some of the VA investments namely Trig – now called Stratevic Finance Group.

About Capital Plus Partners Limited

As previously mentioned, Capital Plus Partners is based in London and is regulated by the Financial Conduct Authority (FCA). For your easy of reference, please find a link to the firm’s authorization below:

register.fca.org.uk/ShPo_FirmDetailsPage?id=001b000000MfIRDAA3

Why are the directors of the Club also Directors of some of the Companies the Club invests in?

The Club is an “active” investor and, as part of its investment agreements, in some scenarios, it will have the right to appoint a Director to the board, to best support developing those Companies.

This is normal prudent practice in private equity investing. The Club sometimes receives shares as payment for services which can be allocated to Members, free of charge and as part of the membership services.

In certain circumstances the Club has taken board seats and been successful in building value for Members. The Club will in the future take up those rights to manage investments on behalf of Members, if required.

What products are being sold?

The Club is a membership club, and, for membership fees, people get access to the Club’s services, its platform and investment opportunities that the average person would not normally be able to access.

As part of the membership, Members also get free shares in Companies the Club invests in, as covered above.

Please refer to an interview I gave on “How the Club works” in the link below:

youtube.com/watch?v=a-zulUyve4c

In summary we hope this letter serves to provide all reviewers with the necessary information to adjust or inform your stories and provide your followers with a more balanced review of the Club.

Indeed, if this letter does not satisfy any line of enquiry then again, we are open for a dialogue and to answer any questions one may have.

We welcome open and constructive factual criticism and readily admit that the Club is not for everyone and that we are always looking to improve our offering.

We are completely unique in the sector, but we do believe we have a compelling, transparent and ethical business that is focused on curating quality investment opportunities our Members would not be able to access on their own.

In just over 4 years we have delivered three IPOs and we have two more IPOs planned in the current year, which when compared to the sector as a whole is a solid performance.

The Club’s portfolio is in our opinion in incredibly good shape with great potential for the future.

Do not be mistaken, our Club is not some fanciful ‘get rich quick scheme’ (these do not exist), our focus is to curate Companies with outstanding potential over a 5 to 10 year period.

If you would like to ask me any more questions or wish to clarify anything, please feel free to contact me rather than continue to respond online.

In fact, we would welcome the opportunity to discuss the Club to ensure that a balanced review can be achieved.

Yours sincerely

Dominic Berger

APPENDIX 1

BEHIND MLM

There are a number of specific statements on the Behind MLM website which we have addressed below.

There are statements specifically about Mr Berger and Mr Reid that are defamatory and we would kindly ask you to remove them please.

1. Angel Business Club / Angel Equity

The relationship between the Club and Berger and Reid has been answered on the letter above

2. Trig – Berger and Reid became directors of the company to save it from bankruptcy – the business was successfully restructured and has been trading on the Frankfurt stock exchange for the last two years where members of ABC have managed to exit with a profit. It is now called Stratevic Finance Group

4. ABC is operated out of Gibraltar not Sweden

5. There is NO weekly guaranteed cash ROI – out of interest where do you get this from?

6. The Club owns the shares in the companies on trust for its members in a separate bare trust arrangements

7. Members do not invest they pay a membership fee in return for which they get the services of the Club and FREE shares in Companies the Club invests in.

8. All of the information I have given you is on our website – perhaps we should go over the website together?

9.

I do not understand this statement ….. the Club does not offer a weekly guarantee – the free shares allocated do not offer any financial guarantee. All the investments the Club makes have a high degree of risk which is clearly stated in all our marketing material

10.

ABC operates an internal private member to member bulletin board for the sale or purchase of the shares held by the Nominee in which members are the ultimate beneficial owners.

This is an activity that does not require regulation. There is no offering of securities to the public.

Why do I need to do that when I have everything I need to publish a review? If I have corporate details and a copy of your compensation plan, I’m more than able to publish an accurate and fair review.

Face it, you’re only upset because we published a fair and accurate review – without the corporate spin. Which I’ll gladly now tear apart below.

This review was published almost two years ago. But uh yeah, OK.

No it isn’t. It’s run by individuals such as yourself.

not Angel Business Club and is therefore irrelevant.

Affiliate membership is not a retail product. Thus Angel Business Club has no retailable products or services and operates as a pyramid scheme.

No, not really. It’s mostly just a bunch of meaningless pseudo-compliance corporate waffle.

If you want to contribute in a constructive manner, feel free to provide evidence Angel Business Club has registered its passive investment opportunity with financial regulators.

That brings with it the legal requirement to file periodic audited accounting proving newly invested funds are not being recycled to pay existing investors.

I wrote this review in 2017, so if Angel Business Club is operating legally you should have plenty of these reports to send my way.

Angel Business Club’s website traffic fell of a cliff in May 2019 (Alexa). This is a disaster for an investment scheme and ultimately why you’re here.

Passive investment opportunities + MLM = securities. Securities are regulated in every civilized country.

No idea what Stratevic Finance Group is, but Trig was a virtual shares Ponzi scheme that collapsed. You might have changed its name and rebooted it (shell companies is a common theme here) but Trig as it was is no more.

It seems you can’t keep up with your own shell company structure.

Angel Equity Group states this on its website:

Angel Business Club is operated from wherever yourself and Philip Reid are based. Sweden I believe at the time of publication (2017).

Whatever shell company nonsense you’ve set up in Luxembourg, Gibraltar or any other scam friendly jurisdiction is neither here nor there.

From Angel Business Club’s compensation plan. I included a screenshot in the conclusion of our review.

Y’huh. Those shares pay a return. So we have money invested on the promise of returns. Membership fees don’t pay returns, investments do.

“Free shares”, lulz. *winkwink*

I don’t see a copy of Angel Business Club’s compensation plan on your website. I believe we had to obtain it via another source.

Not much going over a website that intentionally hides critical information about an MLM opportunity. Even less so when we’ve already published the details here two years ago.

The shares pay a return. Where is the audited third-party accounting (legally required) to prove to the public that new investment is not being recycled?

Nice corporate waffle but that’s not an exemption from securities regulation. Either Angel Business Club’s passive virtual shares investment opportunity is registered to offer securities in every jurisdiction it solicits investment in, or it’s not.

At the time of review publication it wasn’t. The only reason for this is if Angel Business Club isn’t doing what it represents it is on the backend, which lends itself to Ponzi fraud.

This of course ties into Viral Angels and Anthony Norman’s numerous Ponzi reboots since. You’re all cut from the same cloth.

This is somewhat confusing, given what I find on

abc.angelequitygroup.com/article/terms-of-service:

And what I find on

abc.angelequitygroup.com/article/legal-information:

Perhaps you could clarify things for us.

One thing we can establish without clarification needed is that neither of your Luxembourg companies are registered with that country’s financial sector regulator, the Commission de Surveillance du Secteur Financier, so they cannot legally conduct the activities you describe above.

As to your actual location: one of your affiliates (who uses this affiliate link: abc.angelequitygroup.com/user/mqrdz4l) states that your “bureaux opérationnels” are in London and Stockholm (source: lacledelareussite.com), not in Luxembourg (and doesn’t mention Gibraltar at all).

As my sainted mother used to say –“never do anything you wouldn’t want to see on the front page of the newspaper”

Behind MLM is a big bull sheat when . speaking about they don’t know….

I am a member since 5 years. I already get back 40% of my investment money from. first widcell London maket introduction 4 years before and some 8% interest from firescap company too.

My portfolio grow up on many company too.

Four years ago puts us in the first year of Angel Business Club.

You joining early and stealing money from people who joined after you doesn’t negate the facts laid out in this review.

If the company was legit they’d register their securities offering as legally required. They never did for obvious reasons.

This MLM chap should do the ‘right thing’. Join for free for 2 weeks and check ABC out. Simply check it out.

It’s pie-in-the-sky stuff he’s producing if he’s not prepared to do this. Correct? Correct.

Only on this basis – ie by being thorough in his scrutiny – can he be said to be doing a good job. Because he’s met many many companies which behave badly, he’s just presuming things.

Letting his imagination run riot. This is simply not fair play. Be it known: the vast majority of ABC members simply don’t bother to promote the Club. They’re just too busy and are happy to be members. Period.

Dear Reader, I ask you…Why is the FCA (Financial Conduct Authority in the UK) happy with ABC? For the simple reason the Club does ‘good things’ and insists on the transparency demanded by the Authority.

My logic is simple and ‘for the good’. Once again, if MLM does not give the Club the 2 weeks free, proper scrutiny the truth deserves, then it’s showing its own flimsy and superficial take on matters.

MLM makes its money by the advertising it shows on its website…is my assumption. In order to serve the public better than it’s doing, it surely has to take the chance it’s wrong in this ABC case. (We all make mistakes. All of us. Including MLM here, possibly.

May it find the courage and presence of mind to dig much deeper than it’s done so far and – once again – ‘do the right thing’….Or why doesn’t MLM phone some of the companies that ABC has in its portfolio of companies it looks after?

Now, this would be another indication of the good ABC is doing in the world. Firescape, SmartApp (New name, I believe, is PayMe!), Skinny Tonic, RiderCam, TECS, TES ++. MLM should speak to the CEOs and experience the praise that Dominic Berger and the ABC team receive from these people.

Be brave MLM. Be prepared to ‘eat your hat’ if you realise – like Saul on his road to Damascus – that he was wrong after all. Create your own epiphany. (If there’s one to be had. Gloat away if not. Seriously).

This is called ‘being a man’. MLM, we can all get it wrong. You know this. I’ve been a member of ABC for a bit more than 18 months now. I love the Club. Love it for all the right reasons…including the professional dedication it imbues amongst its directors and staff. Trying out the Club for free is the only way to go, correct?

Guess what? I can see you not ie not publishing this on your website. If you do, then I’m beginning to see you as ‘proper people’, open to views other than your own.

If not, then there’s little extra to consider. To reiterate: You know; I know; Commonsense knows that the only real way forward is to become a 2-week, free member, scrutinise thoroughly, then make your comments.

The Financial Conduct Authority (FCA) and many people across the world will thank you for doing so…Hear endeth the reading!

Oh dear.

On what authority are you speaking for the FCA?

Angel Business Club is a Ponzi scheme by virtue of its business model.

One need not join a Ponzi scheme to identify one, any more than one need jump of a cliff to know it’s not good for your health.

*cringe*. Best of luck with the scamming.