Warren Finance Review: WARREN token Ponzi scheme

Warren Finance fails to provide ownership or executive information on its website.

Warren Finance fails to provide ownership or executive information on its website.

In a corresponding GitBook, Warren Finance claims the “masterminds” behind the scheme are individuals who go by “Moonshot Max”, “Math” and “Nomad”.

Only Telegram user accounts are provided as points of contacts for these individuals. This is an immediate red flag.

Moonshot Max has a YouTube channel and, at least based on his accent, appears to be a US national.

MoonShot Max uses his YouTube channel to promote various fraudulent crypto investment schemes. Notable is Drip Network, which has collapsed and been rebooted numerous times.

Warren Finance’s website domain (“warren.finance”), was privately registered on November 10th, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Warren Finance’s Products

Warren Finance has no retailable products or services.

Affiliates are only able to market Warren Finance affiliate membership itself.

Warren Finance’s Compensation Plan

Warren Finance affiliates invest DAI on the promise of an advertised 2% daily ROI, capped at 175%.

A 0.05% conditional bonus applies to the following incentives:

- don’t withdraw

- invest 153,129 DAI

An additional 0.1% bonus is applies for every 4,287,612 DAI invested into Warren Finance.

Warren Finance differs from a typical MLM compensation plan in that, while commissions are only paid down one level of recruitment, qualification utilizes a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Warren Finance utilizes five levels of the unilevel team to calculate referral commissions.

Referral commissions are tiered between 2.5% and 10% of DAI invested by personally recruited affiliates.

Note that Warren Finance do not disclose required downline investment volume to progress from 2.5% to 10%.

Joining Warren Finance

Warren Finance affiliate membership is free.

Full participation in the attached income opportunity requires investment in DAI.

Warren Finance

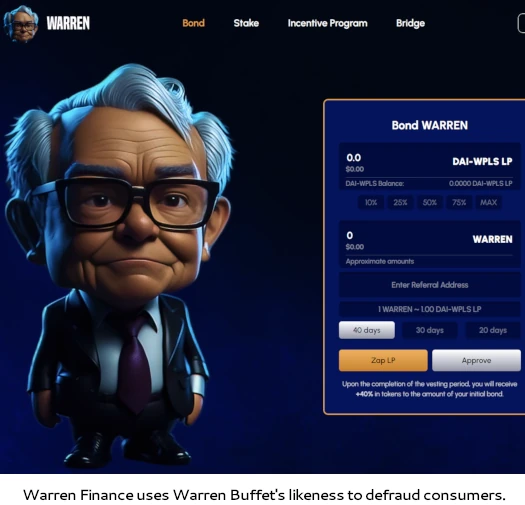

Warren Finance markets itself via the unauthorized use of Warren Buffet’s likeness.

This is no different to crypto scams that misappropriate well-known individuals to promote themselves (Elon Musk being an obvious example).

On the regulatory front Warren Finance is a combination of securities fraud, wire fraud and money laundering.

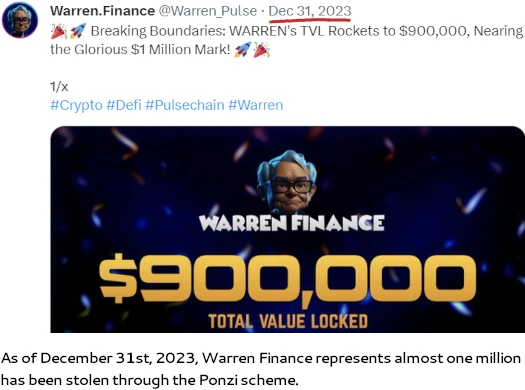

(money stolen)

With “Moonshot Max” appearing to be a US national Warren Finance falls under the jurisdiction of the SEC. A search of the SEC’s Edgar database reveals Warren Finance isn’t registered.

The reason Warren Finance isn’t registered and operates illegally is because it’s a Ponzi scheme.

Investment from new Warren Finance victims is stolen by Moonshot Max, his co-conspirators and early investors.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Warren Finance of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

As with Drip Network and its DRIP token, Warren Finance runs its Ponzi scheme through WARREN token.

WARREN a PRC-20 shit token. Like other blockchain equivalents (ERC-20, TRC-20 etc.), these can be set up in a few minutes at little to no cost.

When Warren Finance inevitably collapses, investors will be left bagholding worthless WARREN tokens they can’t cash out.

It should further be noted that PRC-20 tokens are created on PulseChain. PulseChain is owned by Richard James Schueler (aka Richard Heart).

In July 2023 Schueler was sued by the SEC for misappropriating “at least $12 million” from consumers.

PulseChain is part of a broader crypto asset scheme that has already defrauded consumers out of over $1 billion.

Update 12th March 2024 – Warren Finance has collapsed.

As at the time of this update, Warren Finance’s website has been disabled.

There’s presently a placeholder note on the site claiming “L2 In Development..” If “L2” ever launches, this is presumed to be a reboot.

Meanwhile over on Telegram, Moonshot Max has wiped Warren Finance’s channel. The channel was renamed to Warren Portal prior to being wiped.

Thank you for this article as the Warren puppet was showing up in advertisements when checking on another scam…

Thought it interesting that they must have spend money on the puppet rendering to associate their scheme with Warren Buffet who obviously doesn’t think crypto is good for anything (as it is a non-producing asset).

Now people may disagree on his viewpoint on crypto in general, this “Warren Finance” scam is clearly trying to trip people into believing that it is a ticket into the success of Warren Buffet.

But there are many videos online where Warren Buffet explains that if you don’t know much about stocks and investing, then there is nothing wrong with picking some well known index funds (like those based on the S&P500) with very low costs and just buy these over time and do nothing else… Time in market being more important than timing the market.

With this Ponzi scheme, it probably allows some scam-fluencers to ride the scam wave until it collapses…

AI prompt spam is dirt cheap. You just feed the bots keywords and keep manipulating till you get what you want. You can even run the bot on your own GPU if it’s compatible.

Additionally turning a well-known figure into a cartoon is one of the easiest tasks you can get an AI image bot to do.

Thanks, now I can start my own rip-off…

Make sure you send the link in for review!

Review updated to note Warren Finance has collapsed.

Moonshot Max put out a YouTube video last month with a lot of “truth is…” excuses. Didn’t admit “truth is” he cashed out and stole investor funds.