SEC opts to dismiss iX Global case after internal review

In light of date errors made in presenting its case, the SEC has opted to voluntarily dismiss securities fraud proceedings against iX Global and Debt Box.

In light of date errors made in presenting its case, the SEC has opted to voluntarily dismiss securities fraud proceedings against iX Global and Debt Box.

The revelation was made in a January 30th surreply filing, made in response to why the SEC shouldn’t be sanctioned.

BehindMLM has previously covered the SEC’s date errors so I won’t go into them again. Suffice to say mistakes were made by attorneys that should have known better.

As of January 30th, the SEC states in its surreply that it

is continuing to take steps to address the issues the Court identified and to identify any other issues that may warrant further consideration.

As part of those steps,

experienced trial attorneys from the Commission’s Denver Regional Office have been assigned to this matter.

It appears the intent is to refile the case at some point with these attorneys at the helm.

To that end;

The Commission has authorized the filing of a motion to dismiss this action without prejudice, which will be forthcoming.

Both Debt Box and iX Global have asked the court for monetary sanctions, which the SEC has opposed on legal grounds.

As alleged by the SEC, and holding true irrespective of whether SEC attorneys got some dates wrong, iX Global and Debt Box orchestrated a fraudulent investment scheme to the tune of ~$110 million.

Whereas authorities in the US haven’t filed criminal charges, Indian authorities have been busy dismantling iX Global’s money laundering operations.

This began with the arrest of Sailesh Pandey in October 2022.

Ringleader Viraj Patil was arrested last month, putting a stop to iX Global continue to defraud investors in India.

At time of publication Patil remains remanded to the custody of the Enforcement Directorate.

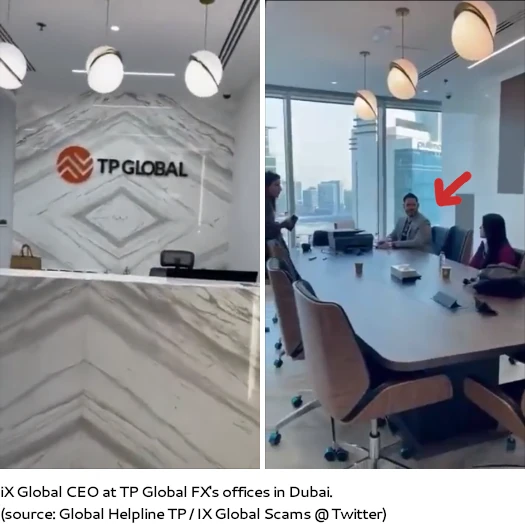

Criminal charges have also been filed against iX Global CEO Joe Martinez (right).

Criminal charges have also been filed against iX Global CEO Joe Martinez (right).

Martinez’s Indian charges pertain to laundering of iX Global investor funds through TP Global FX, a fraudulent investment scheme run by Patil.

Martinez is believed to have been in India last month but managed to get back to the US without arrest.

An open arrest warrant remains in place, making Martinez a wanted fugitive.

On the Debt Box side of things, a BehindMLM reader has tied money laundering operations to Vertex Global FZCO.

Vertex Global FZCO is another Dubai shell company owned by Patil.

Whether the DOJ files its own criminal case in the US pertaining to the same illegal activity remains to be seen.

In the meantime, stay tuned for a decision on sanctions against the SEC.

Update 6th February 2024 – The SEC filed its Motion to Dismiss on January 31st.

If granted, the SEC writes it will

thoroughly review the record, take investigative steps as appropriate, and engage with Defendants and Relief Defendants to determine whether to file a new complaint and the scope of any re-filed complaint.

The SEC advises the court it will file a Status Report within 90 days of a decision on its motion, advising what it will do after the above course of action is concluded.

A decision on the SEC’s motion remains pending.

Update 19th March 2024 – The SEC has been found to have acted in bad faith, with respect to obtaining ex-parte relief.

Sanctions limited to covering costs have been ordered. The SEC’s Motion to Dismiss, which would have effectively reset the case, has also been denied.

Update 30th May 2024 – On motion of the SEC, their securities fraud case against Debt Box and iX Global has been voluntarily dismissed.

Somebody gon’ get fired for that one.

Yeah not something I’d want on my resume tbh.

“I messed up some dates so the SEC had to refile a $110 mill securities fraud case.”

We already had the shills yelling VICTORYYY COURT DECLARES IT NOT A SCAM when this first came out ugh.

Well the original Ponzi is dead. Don’t worry though, iX Global is coming out with an NFT grift.

Like what, two years too late? NFTs are dead. At least make it an AI grift or something.

edit: And there’s a matching IN8 shitcoin… because of course there is.

I’m kinda rooting for Martinez to go full cryptobro crimelord (bonus points if he runs off to Dubai). The future lulz will be epic.

Oh nice, IN8 is a full-blown “staking” model crypto Ponzi. Having a meal break then I’ll get stuck into it.

Hilarious.

Ooh goodie.

the stupidity and sleeze associated with IX Global and DEBT Box is unprecedented. this one will be fun to watch.

Article updated to note SEC has filed its Motion to Dismiss.

Senator JD Vance issues a letter to the SEC and Gary Gensler, calling the mistakes made by the SEC in the Debt Box case “unconscionable.”

Getting a few dates wrong and wholly acknowledging the mistake when it’s picked up by the court is “unconscionable”?

Crypto bro in politics is trying to create a storm in a teacup.

subscriber.politicopro.com/article/2023/07/vance-bill-would-shield-crypto-energy-firms-from-bank-regulators-00106094

What a fucking idiot. Like regulation of securities fraud is political.

Securities fraud has been illegal in the US since 1933. This hasn’t changed in 91 years, irrespective of who’s running the government.

Is a rightwing Cryptobro drone angry that bitcoin miners have to report their electricity consumption to the government during times of Electricity shortages and complains about “the left” as if there is a Leftist party in the US – instead of the duopoly of Right-leaning and Far-right that is the Democrat/Republican corporate bootlickers.

He’s made Crypto his schtick since he started in 2022 and Republicans have little to offer except “Democrat bad”.

@oz

Please comment on this video by ix global – crypto land and the daily returns committed . I have downloaded it in case it gets deleted.

youtu.be/TldDd8OsYDQ

I saw NFT in the title and noped out. Assume CrYpToLaNd was a common NFT grift that was a thing at the time.

Haven’t read it yet, but I thought I’d share.

assets.ctfassets.net/c5bd0wqjc7v0/1u6cDaFa3REg8wHUc6onZ8/e1257f64a80ca440d887f67821f872fe/Debt_Box_Order.pdf

80 pages, phew. Today’s going to be a long day. Thanks.

@OZ – Do the sellers of NFTs commit to it generating US$20-50 per day ??? as in the video by Joseph Martinez

if yes, why did they delete that video along with various other podcasts from their channels and asked their main promoters to remove them from their channels ???

Sellers as in Debt Box and iX Global? They don’t have to specify a specific ROI for it to be securities fraud.

If there’s an expectation of a return and the rest fits the Howey Test then it’s a securities offering.

@oz – yes , in this video Joe mentions that the level x land will generate US$….. per day

youtu.be/TldDd8OsYDQ

watch it before it gets deleted and write an article on this too

That video is from two years ago. I think we’re a bit past that at this point…

I mean yeah, it’s a securities offering but the SEC has already put its case together.

I know someone who is still currently invested in this scam project. They said that Howey vs SEC is outdated and isn’t a measuring stick for securities by judges. They also said that the Judge ruled that Debt Box didn’t commit securities fraud. You can’t make this up.

He’s purporting that he’s still making substantial earnings on debt tokens and the IN8 nft grift. I’m not investing in the scam tokens, so I wouldn’t know.

This is false on both counts. Unfortunately scammers spreading misinformation to justify fraud is nothing new.

Also the IN8 NFT grift collapsed. In the face of what is probably relative high financial losses, this person has turned to copium.

It’s still in use,it’s fairly simple and accurate,it’s literally 3 sentences that covers every use case up to today. Only scammers try to muddy the waters

The judge did not,the entire thing is public so it’s easy to confirm. Your friend did make it up

They’re just delusional tbh. They are trying to convince people to invest in the ponzi by FOMO’ing them into this project. No amount of evidence can get someone who is a crypto maxi to see the truth.