Scott Warren’s Crypto World Evolution securities memo is deeply flawed

![]() In my almost ten years of covering the industry, I’ve come to realize that if an MLM company tries to convince you they’re not selling securities – then they probably are.

In my almost ten years of covering the industry, I’ve come to realize that if an MLM company tries to convince you they’re not selling securities – then they probably are.

This of course isn’t a hard rule, but it’s generally applicable to the companies that pay lawyers to convince you otherwise.

As far as I’m aware no MLM company with a “we don’t offer securities” legal opinion that has attracted the attention of US authorities, has been cleared of offering unregistered securities.

That’s because the securities law with respect to MLM investment opportunities is pretty clear-cut: MLM + passive ROI = security.

Over the past few years cryptocurrency has emerged as a dominant niche within the MLM industry. What that has sadly lead to is a reboot of dodgy business models, resurrected under the misguided belief that “cryptocurrency = no regulation”.

On one hand it’s not difficult to see how this myth arose, seeing as regulators have taken years to catch up with the cryptocurrency MLM niche.

On the other we’ve seen an uptick of securities regulation in the niche, all but confirming be it cryptocurrency or fiat, a passive ROI in MLM is a security regardless.

Yet there are still companies out there who think they’ve got it worked out, that the law doesn’t apply to them.

Worryingly, despite a number of their colleagues having gone down for rubber-stamping scams, there are also lawyers out there still willing to enable them.

Today we take a look at one such combination, Crypto World Evolution and attorney Scott Warren.

The instigator of this article is marketing claims made by Crypto World Evolution investor Ari Maccabi, which we covered yesterday.

Maccabi, who has strong ties with Crypto World Evolution management, is promoting the company based on it being “fully endorsed by Scott Warren“.

Scott Warren is a named partner in Wellman & Warren, a law firm in California.

In support of his claims Maccabi touts a “legal document” authored by Warren. This document, Maccabi claims, is proof Crypto World Evolution is “100% legit”.

Maccabi is only willing to share the document with potential investors as a marketing tool, however at my request readers were kind enough to supply copies for review.

The cliff-notes? Scott Warren’s legal analysis of Crypto World Evolution is deeply flawed.

The Scott Warren document is dated January 10th, 2018 and titled “Memo issued to CryptoWorld Evolution regarding applicable laws and current

Cryptocurrency issues as applied to the CryptoWorld Evolution business model”.

Warren kicks off his memo by citing a July, 2017, SEC report, which he claims

did not clarify whether cryptocurrency must be registered as a security; simply put, it’s still a maybe.

Why Warren went back so far I can’t say. But literally a month before Warren published his memo SEC Chairman Jay Clayton issued this public statement;

market participants should treat payments and other transactions made in cryptocurrency as if cash were being handed from one party to the other.

With respect to securities law and well before Warren published his flawed memo, the SEC have made it abundantly clear that cryptocurrency is treated the same as cash.

Ignoring this, Warren goes on to position himself as someone working to “counter new regulations” pertaining to cryptocurrency securities offerings.

Oh dear.

In order to counter new regulations, the legal profession is turning to the famous Howey Test for guidance.

Bearing in mind the SEC Chairman’s cryptocurrency = cash sentiment, I already covered how Crypto World Evolution met all four prongs of the Howey Test yesterday.

Here’s Scott Warren’s “counter” analysis;

Under the Howey Test, the following four elements must be met in order for an “investment contract” to fall under the definition of a security:

1. Investment of Money

An investment of money may include not only the provision of capital, assets and cash, but also goods, services, or a promissory note.

In other words, the determining factor is whether an investor chose to give up specific consideration in return for a separable financial interest with the characteristics of a security.

This element is generally always fulfilled.

Buyers of cryptocurrency exchange fiat currency backed by a government, such as U.S. dollars, or another cryptocurrency that constitutes a specific consideration.

No argument on the first prong.

2. Common Enterprise

Under the common enterprise element, the courts will look at one of three approaches:

1) horizontal; 2) broad vertical; and 3) strict vertical.

The horizontal method states that a common enterprise exists where multiple investors pool funds into an investment and the profits of each investor correlate with those of the other

investors.

Nope, not that one.

The broad vertical commonality approach focuses on the expertise of the promoter.

Nope, not that one either.

The strict vertical commonality approach to evaluating the existence of a common enterprise requires that the investors’ fortunes be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties.”

There it is.

In his assessment of the second Howey Test prong, Warren references “horizontal commonality” and completely ignores the other two approaches.

This prong of the Howey test is not met, therefore, CryptoWorld would not be considered a security.

Affiliate returns in Crypto World Evolution, irrespective of how they are paid out, are generated entirely by the company itself.

Under strict vertical commonality, Crypto World Evolution is thus a common enterprise.

Its affiliate investor’s “fortunes” are “dependent upon the efforts and success of Crypto World Evolution, aka. the “third party” “seeking investment”.

Thus Crypto World Evolution constitutes a “third-party” for the purpose of satisfying the Howey Test’s second prong.

3. Expectation of Profits(traditionally prong 3) solely from the efforts of the promoter (traditionally prong 4)

Traditionally, this prong requires that a person “is led to expect profits solely from the efforts of the promoter or a third party.”

This one’s easy.

At the time Scott Warren published his memo, Crypto World Evolution was soliciting investment on the promise of “automated … consistent, significant 24/7 earnings”.

This was so up until a few weeks ago, whereby a shallow attempt as pseudo-compliance saw the company remove that verbiage from their website.

Even then Crypto World Evolution’s business model is still the same. And thus it’s easy to see why Crypto World Evolution has attracted some of the MLM underbelly’s most notorious.

Thankfully, Warren does not contest Crypto World Evolution meets the third prong.

He does however argue the fourth prong isn’t met.

Utilizing the hybrid software product, an individual makes all of their own investment choices and is therefore not dependent on the promoter.

The fourth prong would not be met.

I’m sorry, what?

The involvement of investors in generating a ROI through Crypto World Evolution does not extend beyond a few mouse clicks. This action alone fails to generate a ROI.

The ROI is solely generated via the efforts of Crypto World Evolution, purportedly via a bot they claim to manage and maintain.

Crypto World Evolution investors are given no information about the bot, and are told only that it is capable of generating “automated … consistent, significant 24/7 earnings” (as at the time of Warren’s memo).

Once again ignoring the SEC Chairman’s late 2017 “cryptocurrency = cash” sentiment, Warren claims the third prong’s ‘application to cryptocurrency has yet to be established‘.

However, profits could refer to any type of return or income earned as a result of holding cryptocurrency.

This could come from passive actions such as mining.

Or in the case of Crypto World Evolution, trading. But strangely enough Warren’s memo only mentions mining.

With respect to Crypto World Evolution and the Howey Test, Warren writes;

As stated by the SEC, the Howey Test should be applied to ICOS and any entity dealing with cryptocurrency on a fact-by-fact basis in order to determine whether it should be listed as a security.

He then goes on to assert

- cryptocurrency is not a stock

- cryptocurrency does not fall under the SEC’s technical meanings of a security and

- cryptocurrency does not fall within the definition of a certificate

The devil of course is in the details.

Cryptocurrency in and of itself is not a security, any more than dollar bills in your wallet are.

It’s what an MLM company might do with said dollar bills or a cryptocurrency that creates a securities offering.

In Crypto World Evolution’s case, it’s using cryptocurrency to generate a passive ROI for investors via trading.

The obvious fiat equivalent of this model would be forex. One could set it up the same way, centrally-controlled trading through investor accounts on exchanges.

Thing is though, if that’s what Crypto World Evolution was doing, we wouldn’t even be having this conversation.

Yet because “cryptocurrency”, he we are.

And it’s not as if Scott Warren is a complete moron.

In a stroke reminiscent of classic Gerry Nehra “don’t call an investment an investment” pseudo-compliance, Warren writes

The Automatic product gives me cause for concern in that it takes away the independent judgment of the individual.

As we have previously discussed, having opt out buttons and proper disclaimers should alleviate this problem.

So continue to offer a passive ROI unregistered security, just whack some extra buttons for affiliates to click on and she’ll be right.

The rest of Warren’s memo goes over existing regulatory cases involving cryptocurrency at the time, none of which have anything to do with Crypto World Evolution’s business model (ICOs, mining and token sales).

At first I was willing to write off Warren’s memo as a once-off fail, put together without the knowledge that the month prior the SEC clarified, with respect to securities regulation, that cryptocurrency == cash.

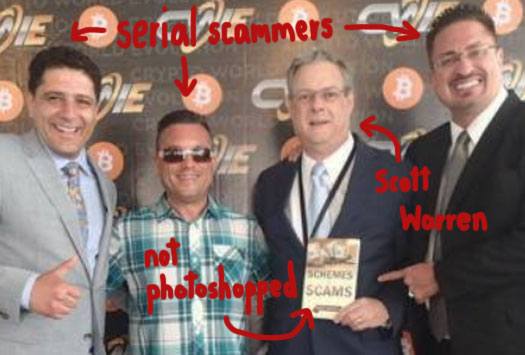

With absolutely no shame however, earlier this month Warren appeared at a Crypto World Event in Thailand – where he posed for happy snaps among some of the MLM industry’s most well-known scammers.

In what is the equivalent of bringing a Martin Luther King book to a KKK rally, that’s Warren’s own “Schemes and Scams” book he’s holding up for the camera.

And pro-tip:

If the MLM company you’re promoting is primarily made up of US investors but has to hold dinghy events in Thailand, that’s probably a strong signal you’re involved in something you shouldn’t be.

In conclusion, the current model seems to be compliant in the United States.

The SEC appears to be growing much more aggressive, which is understandable with all the fraud taking place via crypto in one

way or another.They are taking action against several “bad players” in the crypto space.

I think Crypto World Evolution’s unregistered securities offering more than qualifies them as a “bad player” in the MLM crypto space.

Here’s to a prompt regulatory investigation and securities fraud complaint.

I am surprised Mr. Warren would allow himself to be paraded at a convention / event like that. Didn’t he learn the lesson from Nehra and Grimes respectively?

Babener and Thompson would never be caught dead like that. And the fact that the company needed to find a lawyer to endorse such suggests something is fishy indeed.

On the other hand, I have to say I don’t completely agree with you on your analysis, Oz.

It *is* possible that CWE actually provides a bot, and the bot may actually work as advertised (however, so far, nobody has demonstrated such, other than personal testimonials and special pleading “trust me”).

If they ONLY provide trading signals, then they may be legal, not run afoul of Howey test. But is that what’s really going on? That’s yet to be determined.

They don’t “just provide trading signals”. Investors give Crypto World Evolution access to your trading account and the company generates an entirely passive ROI.

If CWE provided signals and investors had to manually trade, there’d be no issue.

Meanwhile whether there’s an actual bot or not is immaterial to a passive ROI being offered, which constitutes a securities offering.

Setting up the passive ROI around investor exchange accounts is no different to “you’re buying a mining rig you’ll never see and we’ll completely manage” (or Genesis Mining and their “computational power”).

The bot is the mining rig (whether it actually exists or not, doesn’t matter), and from there it’s the same old “lulz passive ROI” story.

actually, the US circuit courts are split in defining what constitutes ‘commonality’ under howey’s second prong.

most circuits are comfortable with ‘horizontal commonality’ only.

however, and here’s the pinch, the ninth circuit court accepts the vertical [broad and strict] commonality test for the second prong.

CWE is registered in california which is a ninth circuit court jurisdiction, so how scott warren has ignored the vertical commonality test is strange.

seeing that he plodded over to thailand to support CWE, it’s possible he’s an old doddering fool seeking attention and retirement money.

Whatever the outcome of the revealing of Mr Warrens’ email to Crypto World Evolution CEO Tomas Perez Quevedo, his (Warrens) name and reputation are forever linked to a blatantly fraudulent scheme and no amount of spin doctoring is going to undo the damage already done.

whoa, it seems that persons who create Algorithmic Trading Strategies [BOT’s would fall in this category] are required to pass a series 57 exam and register as a Securities Trader with FINRA.

this rule became effective on January 30, 2017:

finra.org/sites/default/files/Regulatory-Notice-16-21.pdf

does this^^ apply to BOT’s used in the cryptocurrency trade markets? i’m not sure, but it definitely seems like the SEC is looking to regulate cryptocurrency trading just like trading on stock/commodities/forex exchanges.

1] the SEC has said transactions in cryptocurrency are like transactions in cash :Jay Clayton SEC chairman issued this public statement – ‘market participants should treat payments and other transactions made in cryptocurrency as if cash were being handed from one party to the other’

2] the SEC has asked cryptocurrency exchanges to register with them: cointelegraph.com/news/us-cryptocurrency-trading-platforms-must-be-registered-with-sec

3] recent cryptocurrency trading scams using BOT’s like bitconnect have been pulled down by the SEC [texas] for : providing no information on how it will make money for investors – including the algorithms behind the Trading Bot

so, i’m going to complain to the SEC and FINRA that CWE is using a secret BOT developed by some unknown person who is not registered as a securities trader with FINRA and yet offers this BOT’s trading primarily in the US.

[lovely way^^ to spend a sunday afternoon, but what the hell. bollywood can wait 😉 ]

anjali that’s a great find! If the SEC says Crypto=Cash, then it would just seem logical that it should apply here.

I hope this scam gets shut down real soon. I am so sick of seeing the same scamming as*holes get away with this crap.

If crypto == cash I don’t see why not.

CFTC already ruled that cryptocurrencies are commodities, and a judge agreed earlier in March 2018.

NOLINKS://www.coindesk.com/us-judge-rules-cryptocurrencies-are-commodities-in-cftc-case/

Commodity markets are already trading on Bitcoin futures with real commondity brokers.

Potentially any trading of cryptocurrency may potentially be illegal without a commodity trading license, or conducted on an exchange without such a trading license.

According to 99bitcoins, trading cryptocurrency can make the trader “money transmitter”, and failure to register with FinCEN/Treasury as a “money service business” is a Federal crime.

NOLINKS://99bitcoins.com/how-to-trade-bitcoins-and-not-get-arrested/

Motherboard/Vice has an article explaining that two people in Arizona were charged with “operating unlicensed money transmitting business” for trading in bitcoins between 2013 and 2017, which is another charge thrown on top of the pile they got for money laundering and other stuff.

In fact, at least 4 plead guilty in 2017 alone to the same crime, though they are generall in association with other crimes like child porn and money laundering. It’s gotten serious that there are crypto-specialized lawyers now in the US.

motherboard.vice.com/en_us/article/j5qa7y/people-keep-getting-charged-with-a-crime-for-selling-bitcoin

The legal implications are even more widespread. IRS has declared it equivalent to cash, CFTC has declared it a commodity, and certain forms of cryptocurrency are basically securities as defined by SEC.

FINRA already stated that ICOs and cryptocurrencies will be on the top of their regulation agenda

NOLINKS://www.lexology.com/library/detail.aspx?g=20754848-8e3b-4169-b64e-7e6fa6191393

Instead of being something not controlled by any government, Bitcoin and cryptocurrency is something that will be controlled by EVERYTHING.

SEC complaint done:

well some regulation is required otherwise crypto will become a free for all playground for scammers.

with regulation coming in i’m thinking of buying bitcoin myself! 🙂

aw, i’m having problems submitting the FINRA complaint.

either the complaint portal is malfunctioning or i’m doing something wrong.

somebody else try?

finra.org/investors/file-complaint

1032(f) does not apply, at least as far as that particular text goes, because it refers explicitly to “equity, preferred or convertible debt securities”.

Whatever cryptocurrency is, it’s not an equity, preferred share or convertible debt security. It’s not a share in or loan to a business and no dividends or interest are payable, nor are there are any conversion rights.

Of course, this doesn’t matter, because you giving money to CWE and them paying you a passive ROI in return emphatically is a security, as covered extensively on this blog, and therefore numerous other securities laws apply.

If in an alternative universe there was another clause in Rule 1032 which stated that the controller of a bot trading currencies (crypto or otherwise) or commodities in general must register as a Securities Trader, CWE would simply ignore it. In exactly the same way as they are ignoring the Securities Act. But in any case, there isn’t.

I left a glowing review on thier FB page. I also made it known that review are possible. Maybe with 20 1 star ratings the lawyer will change his tune.

How many MLM groups does Scott Warren support?

He has been showing up at conference for iPro Network goons and giving them reasons to say they are a legal crypto MLM business.

Actually, I just saw there is an previous article about Scott Warren and TexMex answered my question:

Crypto World, iPro, Wealth Generators, Mining Max, Coinsino, all have Scott Warren in common.

Approximately $2900 sitting in an account with them, can’t withdraw it instead need to “get active” then sign someone up using that money and get cash from them.

No new money in = no money out. It’s a Ponzi scheme, not rocket science.