Mike Sims up for contempt over mortgage shenanigans

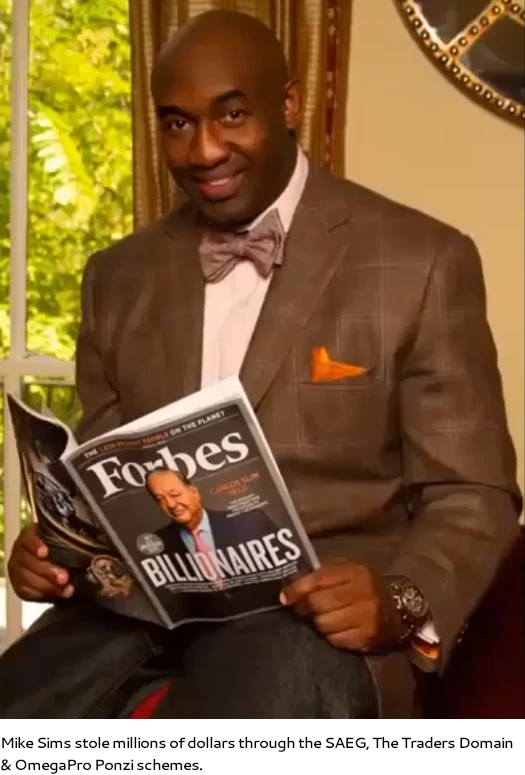

![]() Michael Shannon Sims, a defendant in the CFTC’s The Traders Domain Ponzi case, has been accused of mortgage shenanigans, hiding luxury watches and failing to disclose requested financial information.

Michael Shannon Sims, a defendant in the CFTC’s The Traders Domain Ponzi case, has been accused of mortgage shenanigans, hiding luxury watches and failing to disclose requested financial information.

On July 28th, the Traders Domain Receiver filed a motion requesting Sims be ordered to show cause over multiple injunction violations.

The Traders Domain preliminary injunction was granted against several defendants, including Sims, on October 22nd, 2024.

As per the injunction, a freeze order was placed on a Florida property Sims owned.

From the Receiver’s show cause filings;

On May 6, 2025, the Receiver notified Mr. Sims’s counsel of the Receiver’s intent to sell the Sunny Isles Property due to the significant amount of equity in the property that could be realized for the benefit of the Estate.

At that time, the Sunny Isles Property was encumbered by a mortgage with an outstanding balance of roughly $2,900,000, and the property’s market value was estimated in excess of $6,000,000.

The sale of Sims’ seized property would result in the return of around $3 million to The Traders Domain Ponzi victims.

Mr. Sims initially resisted and delayed the Receiver’s efforts to sell the Sunny Isles Property, and then later to obtain access to the property so that the Receiver’s real estate broker could photograph and list the property for sale.

Eventually, after repeated efforts from the Receiver and the Receiver’s Broker, on July 10, 2025, Mr. Sims provided the Receiver’s Broker access to the property.

Turns out between May 6th and July 10th, Sims acquired a $3 million second mortgage through Ultim8 Investments LLC. Ultim8 Investments was registered in Missouri on April 3rd, 2025.

Mr. Sims did not disclose the Second Mortgage to the Receiver; rather it was only recently discovered by the Receiver’s counsel while preparing a motion to approve the sale of the Sunny Isles Property.

On July 24, 2025, the Receiver demanded that Mr. Sims return all funds obtained in connection with the Second Mortgage, but Mr. Sims has ignored this demand.

The Traders Domain Receiver claim she learned about Sims’ secret luxury watch collection through a jeweler based out of Georgia (the US state).

The total purchase price of the watches exceeded $450,000. The watches were not disclosed by Mr. Sims during his asset deposition.

The Receiver demanded Sims turn over the watched on June 24th, June 28th and July 1st.

On July 1, 2025, Mr. Sims’s counsel informed the Receiver that Mr. Sims no longer had the watches, and the Receiver requested that Mr. Sims provide a sworn declaration including detailed information regarding the watches and how they were disposed of.

Later, Mr. Sims sent two of the watches to the Receiver, which are now in the Receiver’s possession, but Mr. Sims has not provided an explanation as to the remaining watches.

Finally, with respect to Sims’ financial disclosures;

On May 6, 2025, the Receiver requested the production of documents and information referenced or discussed by Mr. Sims during his deposition.

Mr. Sims failed to produce information responsive to numerous requests made by the Receiver, including:

a. Records related to the Roswell, Georgia home previously owned by Mr. Sims, including mortgage documents and documents related to the purchase and transfer of the home.

b. Mortgage documents related to the Sunny Isles Property.

c. Documents related to various other pre-construction properties purchased by Mr. Sims.

d. Documents related to numerous luxury vehicles that were purchased and sold by Mr. Sims.

e. Records related to deposits made by Mr. Sims into an FXWinning trading account.

f. Information and documents regarding Mr. Sims’ life insurance policy.

g. Records related to vehicle payments made by Mr. Sims on behalf of other individuals.

h. Documents reflecting the agreements between Mr. Sims and Defendant Robert Collazo and/or Mr. Collazo’s entities, including Block Consulting Services, LLC and Algo Capital Group, LLC.

The Receiver later learned of yet another Florida Sims had failed to disclose. Information on this property was requested on June 3rd.

On July 1, 2025, Mr. Sims’ counsel informed the Receiver that the real property purchase was a “quick-flip” that Mr. Sims sold, and that Mr. Sims would provide additional documents related to the sale of the property.

On July 2, 2025, the Receiver requested that Mr. Sims also provide a sworn declaration with detailed information as to the “quick-flip” property.

To date, Mr. Sims has failed to provide any information or documents related to that property.

The Receiver claims Sims’ three cited injunction violations

are part of a pattern and practice of dishonesty and failure to cooperate with the Receiver.

It is apparent from his actions that Mr. Sims believes he can simply violate the Orders and repeatedly fail to comply with the Receiver’s requests.

To maintain the integrity of its own orders, and to ensure that the Orders are not casually disregarded, the Court should order Mr. Sims to appear in person before the Court and show cause as to why he should not be held in civil contempt for violating the Orders by engaging in a pattern of dishonesty and repeatedly failing to comply with the Receiver’s requests.

At time of publication, the court has yet to issue an order on the Receiver’s show cause motion.

As per the CFTC’s October 2024 lawsuit, The Traders Domain was a Ponzi scheme that defrauded consumers out of over $180 million. Leaked The Traders Domain investor data pegged losses at over $3.3 billion.

Sims ties the SAEG, The Traders Domain and OmegaPro Ponzi schemes together.

The Traders Domain was a Ponzi scheme run by insiders of the earlier launched SAEG Ponzi scheme. OmegaPro was an MLM crypto Ponzi believed to have fed into The Traders Domain.

Sims settled SAEG Ponzi fraud charges brought by the CFTC for $250,000 in September 2024. Sims was arrested on OmegaPro criminal charges last month.

Pending an update on the Receiver’s show cause motion as it pertains to Sim, stay tuned.

Update 29th August 2025 – The court found Mike Sims to be in contempt on August 29th.

The Court finds Defendant Michael Shannon Sims in civil contempt for failure to comply with multiple Court orders, including the Statutory Restraining Order and the Consent Order of Preliminary Injunction.

Sims has been given seven days to “unwind or transfer” to the Receiver, the $3 million he received from the second mortgage.

Sims also has fourteen days to respond to all requests from the Receiver in relation to “information and records”.

Sims will pay $8195 to cover the Receiver’s legal fees but the court denied the Receiver’s request Sims be fined $500 per day of non-compliance.

Article updated noting Sims has been found in contempt.