TranzactCard clarifies Bangor Bank is a “sponsor bank”

![]() On Wednesday December 13th, TranzactCard announced Maine headquartered Bangor Bank as its “new banking partner”.

On Wednesday December 13th, TranzactCard announced Maine headquartered Bangor Bank as its “new banking partner”.

On Friday December 15th, Bangor Bank confirmed they had no partnership with TranzactCard.

On Saturday December 16th, TranzactCard held an unscheduled “all hands-on-deck TranzactCard field update.”

During the call, new COO Ken Doherty confirmed Bangor Bank was not TranzactCard’s “banking partner”.

Doherty instead claimed Bangor Bank is TranzactCard’s “sponsor bank”.

What’s the difference between a “partner bank” and a “sponsor bank”?

No idea.

Instead of calling Bangor Bank to get to the bottom of misinformation coming out of TranzactCard corporate, Doherty pleaded with affiliates to “not call our Sponsor Bank to provide you with details”.

Seek clarification through upper leadership or your corporate support email. Support staff is standing by to assist.

Seeing as TranzactCard themselves revealed Bangor Bank as a “partner bank”, I’m not sure how solid that advice is.

TranzactCard co-owner Peter Rancie (right), went on to clarify that

TranzactCard co-owner Peter Rancie (right), went on to clarify that

Any passed terminology will be corrected on the corporate end. The correct terminology is Program Sponsor.

I guess we’ll find out this coming week whether Bangor Bank is in fact TranzactCard’s “sponsor bank”, whatever that means.

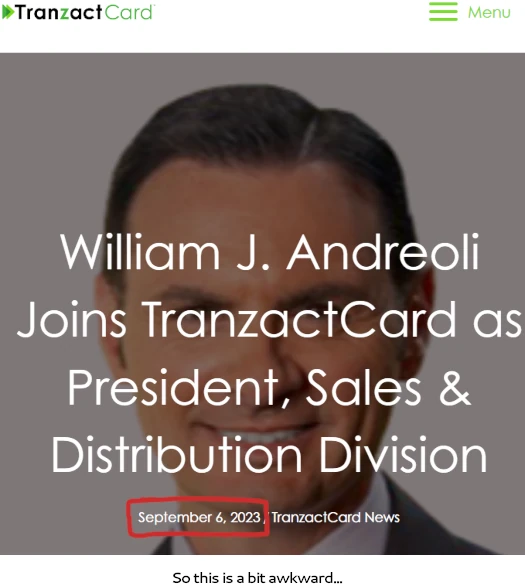

Something else unexpected on the call was the departure of newly appointed executive Bill Andreoli and his “executive team”.

A heartfelt tribute and best wishes to our New Hampshire crew, we thank you and wish you the best on your newest endeavours.

@Bill Andreoli @Mike Randolph @Petti Gardner and team

Having just left Kannaway after a year as President, Andreoli and his team are believed to have been behind an announced partnership between Kannaway and TranzactCard.

That partnership was then walked back under murky circumstances in October.

While at least publicly acknowledging he’d left, Tranzact Corporate didn’t provide any reasoning for Andreoli’s abrupt and unexpected departure.

While executives do come and go, Andreoli leaving after being appointed in August (whilst still working as a Kannaway executive), combined with the TranzactCard’s ongoing banking partner debacle is… strange.

The other announcement on the call pertains to Z-Club.

In next couple weeks Zclub will relaunch with a more robust version.

Our own product line, everyday items, bundling and brand items that provide NEEDED and NECESSARY value.

Z-Club isn’t relaunching till after Christmas, the busiest shopping season of the year. Bit of a missed opportunity there.

Update 4th May 2024 – Bill Andreoli has turned up at MWR Financial.

Their Walmart wholesale site will flop when people find out the truth.

So how many is that for ol’ Andreoli? We have all lost count.

We know he started FDI (and nearly bankrupted it), Youngevity bailed him out (though his story was always he bailed Youngevity out – laughable) and then he turned around and stole from them per the court records and had to pay them back.

Then there was Wakaya (total embarrassment to all who followed him – you could buy their products at the .99 cent stores).

There was some water thing “Bula Bula” he tried for a minute, then he was pushing women’s hygiene products for another second (still can’t shake Andre Vaughn’s laughable videos), then he turned back to Youngevity (not to work at – just to pilfer from) where he once again stole a supplier of theirs for a grape juice product that Youngevity was already selling and tried to what? Compete with the identical product?

He called that one MFinity. And people like the Pitcocks said the “M” stood for Money.

There was the questionable clay somewhere in all of that that he had people drinking even though it was for external purposes only – also pushed by the Pitcocks.

Then he was off to sell MaryJane – not sure why he couldn’t make that a smash success? Then he brought in the Z-Card (Tranzact) to merge with Kannaway BUT???

We’ll never know because Kannaway kicked the Z-Card and Andreoli to the curb. And now Z-Card has kicked Andreoli to the curb as well after just a mere 90 days??

I’m exhausted – aren’t you? Why would ANYONE follow Bill Andreoli, Mike Randolph, Patti Gardner, Andre Vaughn, Todd Smith, or Barb & Dave Pitcock anywhere at this point??

Complete insanity. These are the faces that belong on a poster for who not to trust in Network Marketing.

And on that note – does anyone have the list on how many MLM’s the Pitcocks have scammed people with?

If you ever tune into Barb’s sales pitches – she lists so many jobs and companies she has been in it’s hard to count them all.

But the story is always the same – she was a victim every time much like Andreoli I’m afraid. Can’t imagine where he will land next.

I have the Pitcock’s new MLM company on my review list. Wouldn’t be surprised if that’s where Andreoli jumped ship to.

Andreoli was fired, let go, by TranzactCard. I’d suspect that the reasoning has everything to do with any shadiness as TranzactCard keeps pushing forward and doesn’t want shady folks involved.

Nice of TranzactCard to wish him well. That shows integrity on their part.

How’s that work when the owner has a securities fraud conviction?

Now someone that helped to bankrupt WorldVentures is in charge of TCard. All failed “leadership” coming and going it appears.

Washed up distributors, who once had influence, should not become leaders of companies.

Eric Allen held a call yesterday. A rousing “buck up the troops” sort of affair.

He mentions 10,000 as the number of new DBOs and TCMs added in the month of December.

He doesn’t express it as such but that number is down from the rate they were growing in the weeks prior to launch.

Perhaps it’s the holidays or perhaps its the fact that they didn’t really launch anything at launch but the month of December was not one of explosive growth.

Eric confirms that “on boarding” to the banking platform has not yet commenced for the muckety mucks so there are no virtual banking accounts as of yet.

Physical cards were promised after the virtual ones so Peter Rancie’s September promise of cards “within a month” which was replaced with “cards at launch” which changed to “before Christmas” has now de facto altered into sometime next year.

The notion of the Z-Club being disappointing was raised, Mr.Allen pleads to be judged not by perfection but rather on progress.

Given that the publicly viewable website is still offline I can only imagine how much progress there is for the Z-Club to be judged on.

The original plan was obviously to launch Z-Club for Christmas 2023. That ship has sailed so I guess TranzactCard will limp on with whatever they can muster up in 2024.

The urgency is gone now that the shopping season is over so whatevs I guess.

How is this Walmart affiliate Z-club company going?

Any new lies, backtracks, or other new cultish hopium being displayed?

It is an interesting coincidence where TransactCard announces their partnership with Bangor Savings Bank while near simultaneously firing executive William Andreoli who lives a few miles from a New Hampshire Bangor Savings Bank branch as the partnership is denied by Bangor Savings.

William Andreoli was probably the only TranzactCard executive anywhere near a Maine/New Hampshire Bangor Savings Bank branch since TranzactCard is in Utah.

A full week into 2024 and there is no new word about the banking platform.

That is about all that needs to be said at the moment.

Is this like an Alcoholics Anonymous “Sponsor”??? Brought in for advice and counseling how not to ruin your life?

There was a much ballyhooed update call tonight.

Kudos to TranZactCard, they put Peter Rancie on a fast five minutes into the call. Too many MLM calls make you sit through nearly interminable yammering before getting to any relevant info but not here and not tonight and I do thank them for it.

Long not overly optimistic sounding buildup by Peter. “Challenging environments” (I guess “Banking is Hard” grew old). Much pussy footing but they are not announcing on boarding to the banking platform.

No Cards Yet.

New KYC procedure instead.

Peter says they are adding more banks.

No firm estimate was offered on when the cards will be available.

Lots of other fluff, a new executive was introduced. Stirring “lock arms with the pioneers” speech.

But no cards yet. This means no swipe income yet. This means that any rewards or commissions paid to the field are sourced from affiliate signup fees and are being paid for the act of recruiting.

Yet some checks are going out.

Commissions starting to go out means that TranzactCard will have a card in place before commissions will be paid – say what you will but these guys do it by the book.

Great call – New CEO – new person in charge of Z-Club tasked with creating value. (Ozedit: recruitment spam removed)

Nope, that’s a false equivalence.

The scammers handbook? They’ve lied and done every illegal thing possible. You must have run out of crayons to eat as a child and switched to lead paintchips clearly to get “by the book” that wrong.

Just another bobblehead to distract you drones.

There was no weekly corporate update call last night.

Which of course means no news on the “banking platform” nor any word on when the cards will ship.

Shades of rNetwork all over again.

How many months has this scam been going on now? So many empty promises that string people along, while they get rich, until they shut everything down, and walk away again.

This one should attract the authorities as it affected many more people than rnetwork.

It baffles me that people are so gullible to fall for these types of scams without doing their due diligence on the crooks behind the curtain.

Thank you Oz for staying on top of things for the public.

A “Very Special” Monday Night Corporate Update Call.

Peter Rancie confirms that they have relationships with banks but instead of acting on those relationships at this time they are cultivating deeper and more meaningful relationships with more and better banks for a slightly into the future timeline.

That was not strictly verbatim but you get the gist.

“Add the Swipes as we Go” said Peter. As in, earning from swipes is something to be added at some later date. As in, still no announced date for the shipping of physical debit cards.

Instead we have “EverMore”. This is a new subscription option, TCMs or DBOs pay $5 a month to “use any card” as a TranzactCard. What this means I have no clue but it claims to earn you Z-Bucks. Oh, and commissions on that $5/month run 10 levels deep.

They started off the call with a fast laundry list of bullet points. On of them was:

Commissions are being paid. Not from the sale of a product or service to an end consumer but commissions are being paid none the less.

And 1099s are going out.

So still no bank cards but people are getting paid for recruiting.

So I take it at this point it’s safe to assume Bangor Bank has fallen through? There’s been no movement on that since the December denial.

TL;DR: TranzactCard has no US banking partner at this time.

If you’re not selling anything to retail customers, you’re running an MLM pyramid scheme.

And sounds like Z-Bucks inflation must be through the roof. Have they bottomed out in value yet?

@GlimDropper More troubling than the $5/mo Evermore fee is that the registered personal debit/credit cards provide accounts for TranzactCard to collect the $50/mo DBO fee which is a $500K/mo grift from 10,000 DBOs.

A scant few additional details about the ever more offering.

It is slated to go live February 20th.

If you sign up before the end of January you only pay $2.49/month after that it will be $5/month.

Subscribers can designate one of their existing cards (credit or debit) to receive Z-Bucks on swipes. It will be interesting to see how these nuts and bolts come together.

There is no commission paid on those swipes but you can earn a commission by enrolling other ever more members.

It was stated that ever more will soon take the place of the 500 Z-Bucks a week TranzactCard pays members during their ongoing banking failures.

How many times have they said it will go live on _____ date?

Let’s see:

Late August of last year TranzactCard lost the banking relationships that allowed them to issue debit cards and pay (oh so very meager) commissions on swipes of those cards.

Company Co-Founder Peter Rancie promised in no uncertain terms that the banking issues would be handled in the month of September.

October arrived without banking relationships but as a shiny trinket to distract the faithful it also brought the eZ-Power Card. For a not quite nominal fee you could buy gift cards to any of many companies but the truly important thing is that you would also earn Z-Bucks for having done so.

At this point the promised delivery date for the physical TranzactCard debit card was shifted to the much awaited company launch in mid November.

November came, the launch happened but the darnedest thing, nothing launched at launch. No debit cards, no banking relationships, no Z-Club and no one talks about the hoard of social influencers that were supposed to endorse TranzactCard en masse anymore. It’s like they’ve been forgotten.

The post launch banking relationship promise became “before Christmas” and needless to say that fell through as well.

After that point I don’t think they’re making solid guesstimates anymore, they’re throwing everything at the wall and hoping something sticks.

TranzactCard insider Randy Schroeder claims in a 1/25/24 YouTube, a relationship if true with Bangor Savings Bank through an unnamed intermediary.

Schroeder also claims if true a signed contract with a second unnamed bank.

Schroeder acknowledges NO interchange fee income is being generated, the Z-buck account is empty, TranzactCard will no longer pay manager grants based on recruitment.

The $50/mo DBO marketing/technology fee will be replaced by a $50/mo market basket of goods fee for nonexistent services which keeps DBOs active to earn nonexistent income.

Schroeder encouraged enrollment of personal cards in the TranzactCard ‘Ever.More’ program which generates no interchange fees and no income.

Why TranzactCard wants all the personal credit/debit cards with cvv info is nefariously unclear. TranzactCard insanity evolves at a rapid pace.

So Tranzact offers no good or service now, and they charge a fee to stay in? That is the exact definition of an illegal pyramid scheme.

Actually here is the definition: A pyramid scheme is a fraudulent and unsustainable investment pitch that relies on promising unrealistic returns from imaginary investments.

The early investors actually get paid those big returns, which leads them to recommend the scheme to others. Investors’ returns are paid out of the new money flowing in.

Ignorance is BLISS but to make harsh and untrue statements that could persuade some to doubt a legitimate business based on said ignorance is just…………… SAD.

^^ Yeah, so that’s a Ponzi scheme.

Please sit down. Boomer meltdowns = spam-bin. First and last warning.

@Raz

So TranzactCard doesn’t have a relationship with any bank. They’ve gone the third-party or shell company route (we don’t know which because this information is hidden from consumers).

A legitimate company would just openly disclose this because they have nothing to hide. Not withstanding ongoing potential FTC Act violations.

Non-bank companies legitimately offer bank-like services without a direct banking relationship through an intermediary, a ‘Program Manager’.

TranzactCard previously had a direct relationship with ‘Program Manager’ Solid Financial Technologies and Solid had the direct bank relationship with Evolve Bank & Trust.

The TranzactCard-Solid direct relationship dissolved September 2023, coincidentally, shortly after Solid and Evolve faced a May 2023 lawsuit* for Fraud, Negligence, Breach of Fiduciary Duty with accusations of improperly sharing ‘gross interchange’ numbers and failure to conduct appropriate ‘due diligence’ among other claims.

TranzactCard has failed to relaunch with new partners as ‘due diligence’ is likely an insurmountable hurdle for an MLM but time will tell. As Peter Rancie once said, ‘Banking Is Hard’.

*’BSI Group LLC et al v. Ezbanc Corp et al’, Pacer case 3:23-cv-00127 and related cases where Ezbanc‘s et al is Evolve Bank & Trust and Solid Financial Technologies.

Today was a very very special corporate update call.

Yesterday’s invitation to today’s call were billed as “Tomorrow we Become a Butterfly.”

What a load of crap.

Peter Rancie was on the call. He spent five+ minutes talking about how all roads have hills and curves.

That’s when I realized THERE WILL BE NO BANKING UPDATE THIS WEEK!!!

Peter then went on to castigate the critics, the naysayers etc.

Here’s the deal Mr. Rancie, until you put swipe cards in affiliates hands and open the Z-Club to the buying public, things that are foundational promises of TranzactCard, you will always have critics and naysayers.

Instead they launched a new company.

FinMore Financial Flourishing

Melyn Campbell, TranzactCard’s Chairperson was on the call to make they very very exciting announcement that a new company is launching. FinMore.

Stop me if any of this sounds familiar.

For $50/year and $4.95/month you can be a FinMore Member (FM) and earn “FinCredits” for swiping any major credit card on a one to one FinCredit to Dollar ratio.

There will be a FinMore Marketplace selling essential items and day to day needs and you can use your FinCredits in the store.

For $199 and $50/year you can be a FinMore Business Owner (FBO) and profit off all the FMs and FBOs you can recruit.

The full presentation was drawn out, overly long and in places, confusing. So I don’t have all the details on the comp plan for example but I’m sure that “training material” will be circulating shortly. One significant point beling that upline/downline genealogys are transferred from TranzactCard to FinMore.

I don’t take this as the death of TranzactCard but more like an admission. There will be no swipeable debit cards for the foreseeable future and they needed to do something dramatic to keep the marks distracted and paying in.

I’m starting to wonder if this is in fact going to be a complete rebranding from TranzactCard to FinMore.

Is the dream of TranzactCard really dead?

Neither Utah nor Wyoming returns a business registration for FinMore.

Maybe Randolph and Andreoli will rebrand —— Dare To Be Great.