MinerX Review: BitGood mining securities fraud in Texas

MinerX fails to provide ownership or executive information on its website.

MinerX fails to provide ownership or executive information on its website.

MinerX’s website domain (“minerx.tech”), was privately registered on May 16th, 2024.

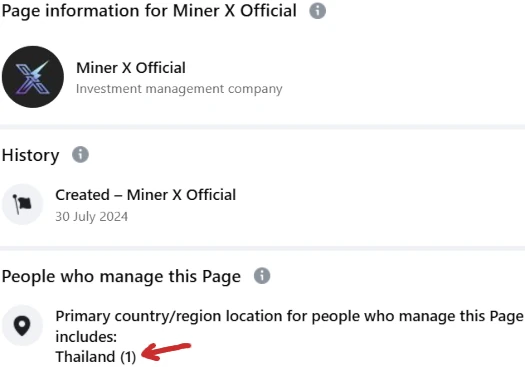

MinerX’s official FaceBook page is managed from Thailand:

MinerX marketing places its purported headquarters in Phuket:

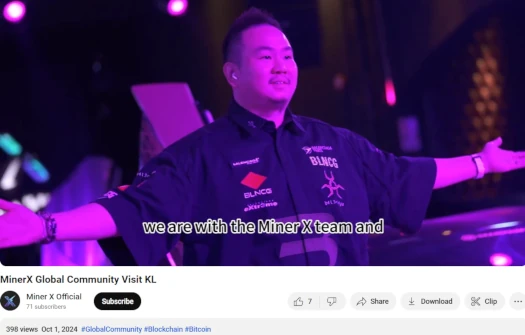

On October 1st, MinerX uploaded a video titled “MinerX Global Community Visit KL” to its YouTube channel.

The video features what appears to be a bunch of randoms (actors?), and an individual cited as “Dr. Jeffrey”:

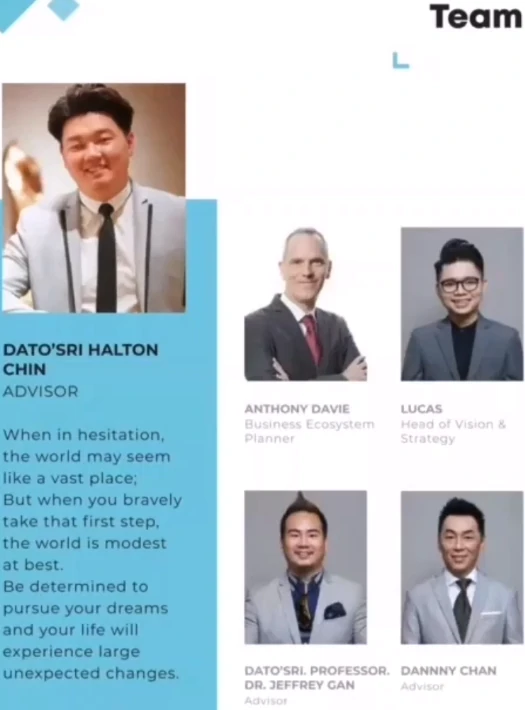

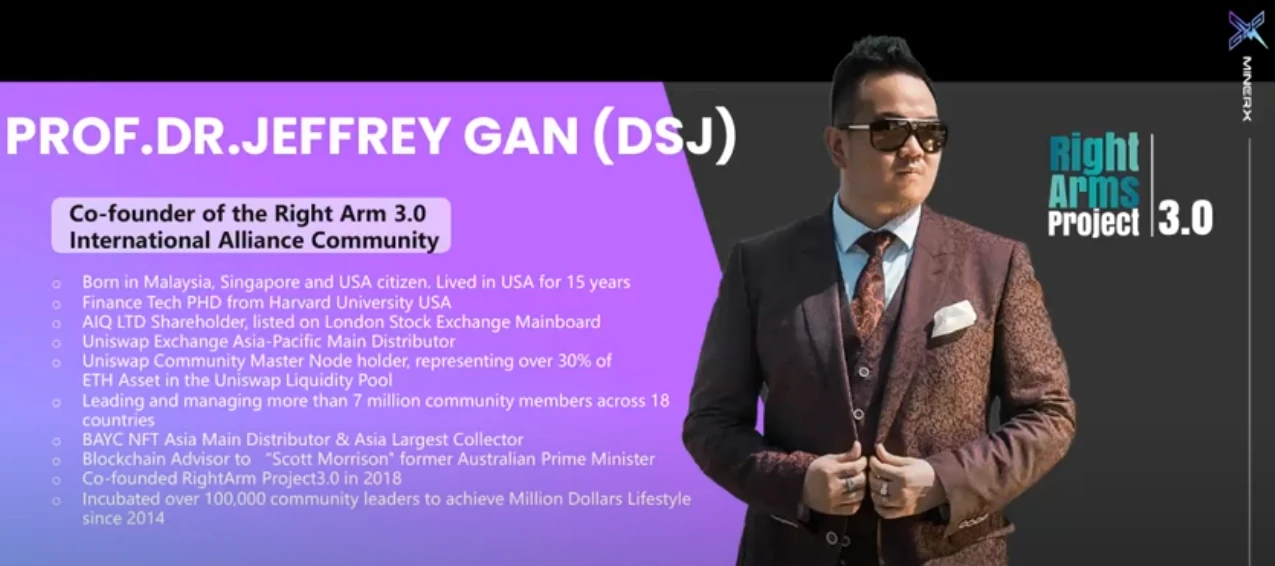

“Dr. Jeffrey” is Jeffrey Gan. Gan’s specific role within MinerX is opaque but he’s presented as the corporate face of MinerX.

My research into Gan led me down a rabbit hole leading to a Chinese crypto mining cartel operating out of Texas. Things get a bit complicated so bear with me as I lay it all out.

In MinerX marketing material, Gan is represented to be a US citizen with ties to Malaysia and Singapore (click to enlarge)

Four years ago Gan was the Chief Marketing Officer and face of “G-Power“:

G-Power was run by these individuals…

…and was attached to a bunch of companies:

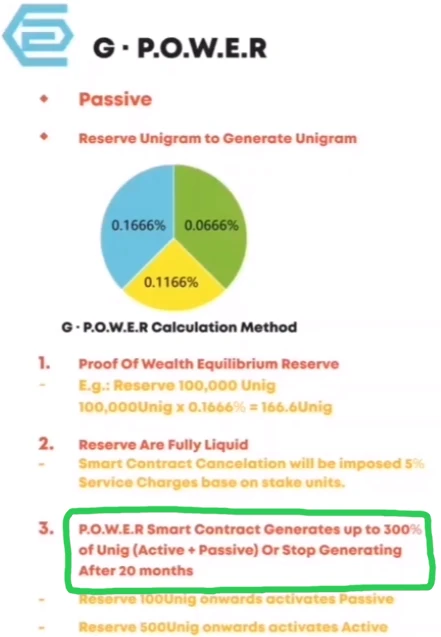

G-Power itself was a 300% smart-contract staking Ponzi built around “unig” tokens.

Today, neither G-Power or its “unig” tokens exist.

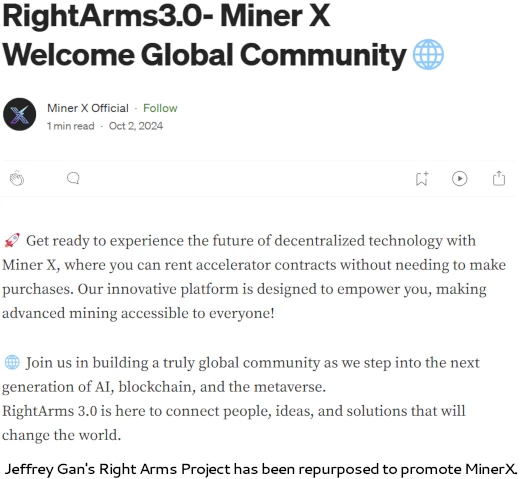

Gan also runs “Right Arms Project”, which he claims launched in 2018.

Right Arms Project, which is evidently up to version 3.0, operates from the domain “rightarms.io”. As opposed to 2018, Right Arms Project’s website domain was registered in January 2023.

Presently Right Arms Project’s website is nothing more than a signup/login form:

As far as I can tell, Right Arms Project is the culmination of Gan’s crypto Ponzi scamming over the years… now rolled into MinerX.

Attached to Right Arms Project we have something called “Assembly of Gods”. Sounding very cultish, Assembly of Gods appears to be a group of Gan’s Chinese investors.

Assembly of Gods’ logo featured prominently in an August 2024 MinerX “kick off” event held for Chinese investors.

Research into the connection between Assembly of God and MinerX led me to Kewusuma, an MLM ecommerce retailer that also dabbles in MLM crypto fraud.

As above, Kewusuma presents Assembly of Gods as

the primary investor in Miner X which had invested $10 Million and has entrusted the Right Arm Community to manage the promotion, subscription, and marketing of the project.

Kewusuma is one of the key member in Right Arm Community.

Miner X collaborates with global mining farms, like BitGood, to boost their Bitcoin output without increasing costs, and sharing the extra profits generated.

BitGood is the name of a Chinese owned purported crypto mining facility built in Texas.

The first thing visitors to BitGood’s website see is this:

We’ll get into why BitGood has a North American disclaimer on its website in the conclusion of this review.

What’s pertinent to the introduction of this review is BitGood is owned by a Chinese outfit going by Dbank.

BitGood is a platform that relies on its own North American mining sites to provide global investors with a one-stop intelligent Bitcoin mining pool service.

In early 2023, the Dbank Group, a leader in blockchain finance, embarked on constructing a mega Bitcoin mining facility (120 megawatts) in Texas, USA – a state renowned for its abundant energy resources and compliance-friendly mining environment.

Embracing Dbank’s vision of establishing a globally compliant mainstream cryptocurrency industry ecosystem, BitGood launched its mining service products based out of its self-operated Texas mining sites.

Founded in 2017, Dbank Group began its journey with the development of the Dbank wallet in the same year.

Since 2018, the group has strategically invested in a blockchain technology R&D center, a traditional financial management institution, and two mainstream compliant trading platforms globally.

Other than it being Chinese owned and operated, I don’t have any specifics on who owns and/or runs Dbank and BitGood.

Dbank and BitGood don’t appear to directly interface with the MLM crypto investment companies tied to them.

That’s handled by yet another company, PrymeBit:

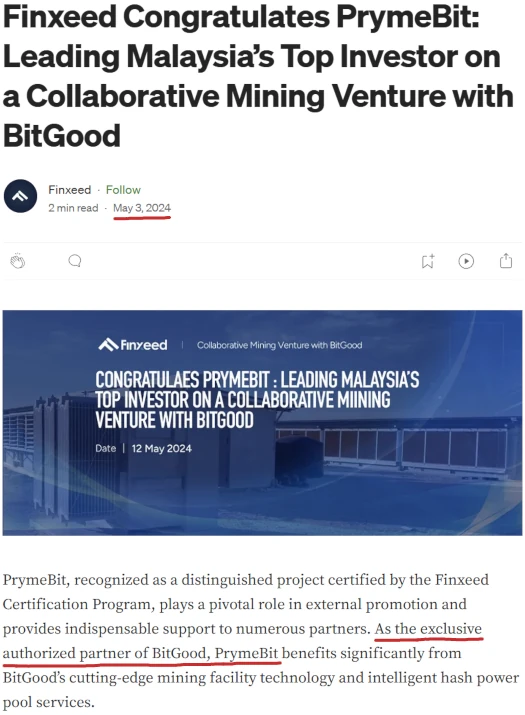

On May 3rd, 2024, Finxfeed published a press-release citing PrymeBit as an “authorized partner” of BitGood;

PrymeBit, recognized as a distinguished project certified by the Finxeed Certification Program, plays a pivotal role in external promotion and provides indispensable support to numerous partners.

As the exclusive authorized partner of BitGood, PrymeBit benefits significantly from BitGood’s cutting-edge mining facility technology and intelligent hash power pool services.

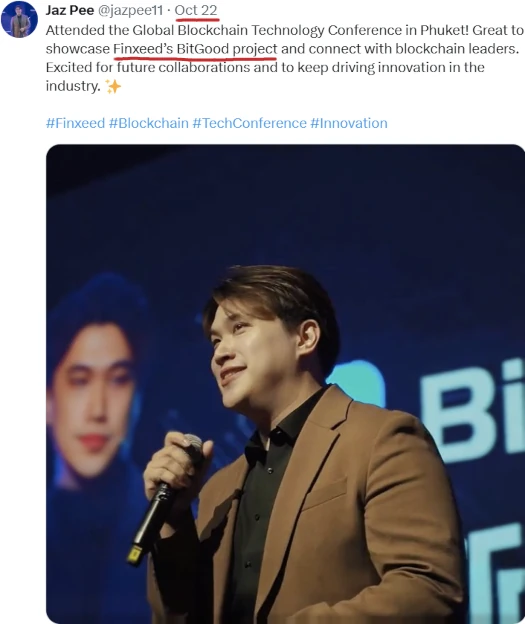

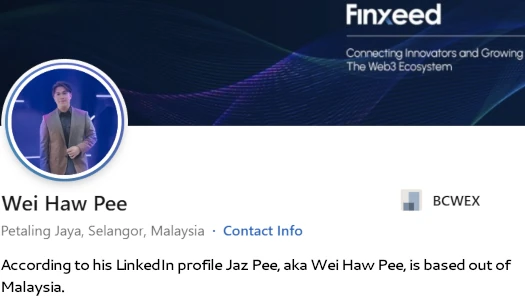

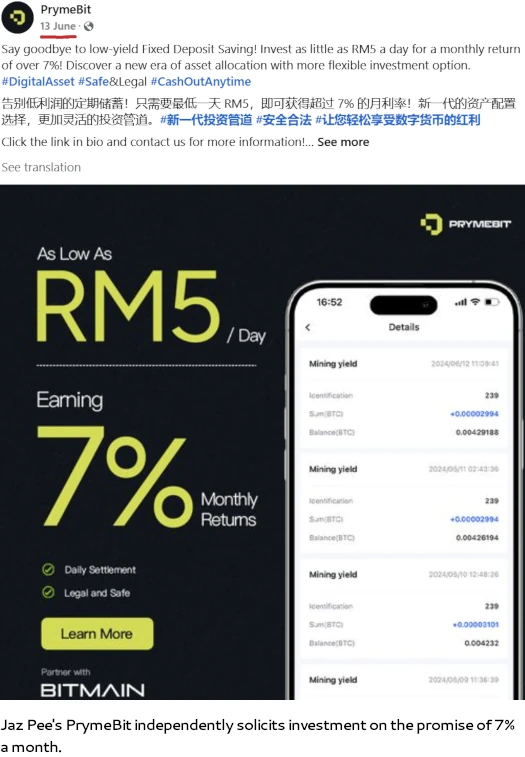

Finxeed pitches itself as a “certifier” and is run by CEO Jaz Pee, aka Wei Haw Pee and “Mr. JP”.

Pee appears to be a Malaysian national and is at the center of everything.

We’ll cover Pee’s direct involvement in MinerX and the MLM crypto Ponzi it’s a clone of in the conclusion of this review.

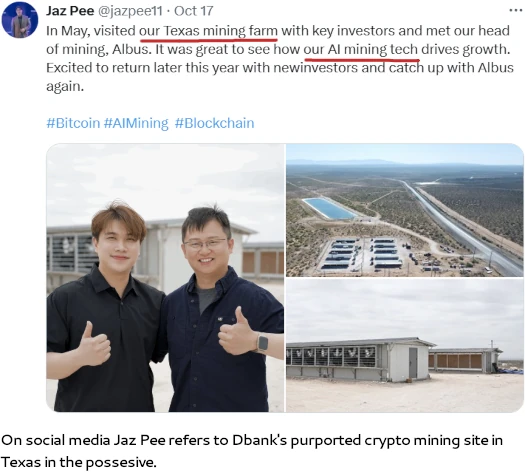

On Twitter, Pee cites BitGood as a project of Finxeed’s. This ties Pee to ownership of BitGood, Dbank and MinerX.

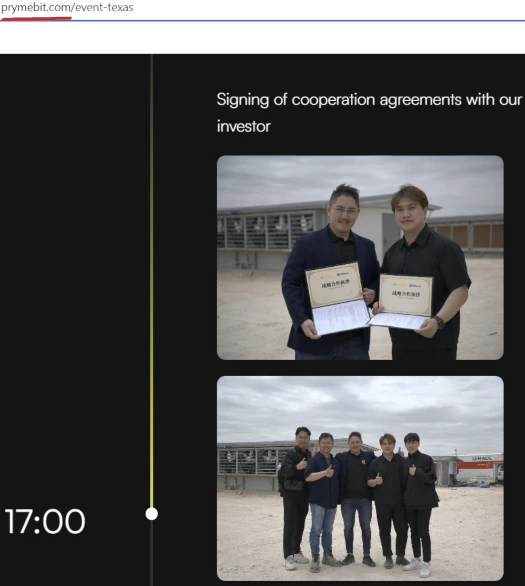

Pee obviously isn’t working alone. These individuals are represented to be owners of Dbank’s/BitGood’s mining facility in Texas:

At time of publication I don’t know who any of them are.

Marketing videos on BitGood’s website has Dbank’s/BitGood’s owners speaking Chinese, which brings us full-circle to Chinese scammers working across Texas and Asia (Malaysia and Thailand).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

MinerX’s Products

MinerX has no retailable products or services.

At time of publication affiliates are only able to market MinerX affiliate membership itself.

MinerX’s Compensation Plan

MinerX affiliates invest tether (USDT). This is done on the promise of daily passive returns paid in bitcoin (BTC):

- Shared Contract – invest 100 to 900 USDT and receive a 290% ROI

- Single Contract – invest 1000 USDT and receive a 290% ROI

MinerX’s 300% ROIs are paid out daily at a rate of 0.00007 to 0.00015 BTC.

The MLM side of MinerX pays on recruitment of affiliate investors.

MinerX Affiliate Ranks

There are seven affiliate ranks within MinerX’s compensation plan:

- Member R0 – sign up as a MinerX affiliate

- Royal R1 – recruit three affiliate investors, generate 10,000 USDT in personally recruited affiliate investment volume and 40,000 USDT in total downline investment volume

- Royal R2 – recruit three Royal R1 affiliates

- Royal R3 – recruit three Royal R2 affiliates

- Royal R4 – recruit three Royal R3 affiliates

- Royal R5 – recruit three Royal R4 affiliates

- Royal R6 – recruit three Royal R5 affiliates

Referral Commissions

MinerX pays referral commissions on USDT invested by personally recruited affiliates:

- Member R0 and Royal R1 ranked affiliates earn a 5% referral commission rate

- Royal R2 ranked affiliates earn a 6% referral commission rate

- Royal R3 ranked affiliates earn a 7% referral commission rate

- Royal R4 ranked affiliates earn a 8% referral commission rate

- Royal R5 ranked affiliates earn a 9% referral commission rate

- Royal R6 ranked affiliates earn a 10% referral commission rate

Note that MinerX referral commissions are coded, meaning higher ranked affiliates earn the difference between their rank referral commission rate and lower ranked downline affiliates.

This caps out at 10% for Royal R6 affiliates.

ROI Match

MinerX pays a matching bonus on daily ROI payments to personally recruited affiliates:

- Member R0 ranked affiliates earn a 5% match

- Royal R1 ranked affiliates earn a 10% match

- Royal R2 ranked affiliates earn a 15% match

- Royal R3 ranked affiliates earn a 20% match

- Royal R4 ranked affiliates earn a 25% match

- Royal R5 ranked affiliates earn a 28% match

- Royal R6 ranked affiliates earn a 30% match

As with referral commissions, the ROI Match is coded. This means higher ranked MinerX affiliates earn the difference between their rank match percentage and that of lower ranked affiliates.

This again caps out at 30% for Royal R6 ranked affiliates.

Note that if a personally recruited affiliate is at the same rank as you (for Royal R1 and higher), the ROI match is fixed at 10% regardless of rank.

Joining MinerX

MinerX affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 100 USDT investment.

MinerX Conclusion

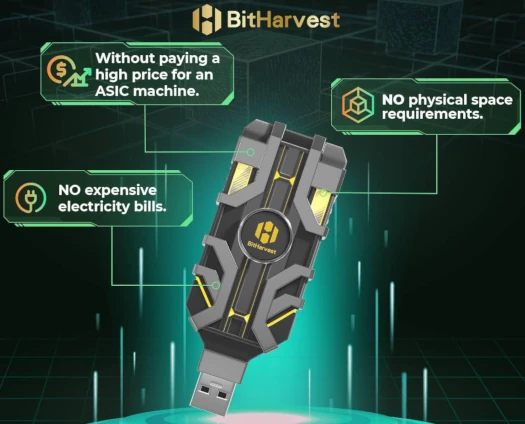

MinerX is a clone of the previously launched BitHarvest MLM crypto Ponzi.

Both schemes utilize a “bitcoin mining booster” ruse, crafted around USB devices that purportedly “boost” bitcoin mining by up to 150%.

Here’s MinerX’s device:

And here’s BitHarvest’s equivalent:

If plugging in a USB device to pump crypto mining output by up to 150% makes no sense, it’s not supposed to.

BitHarvest’s and MinerX’s purported devices don’t exist beyond marketing props used to impress potential investors.

MinerX and BitHarvest are part of a wider series of fraudulent investment schemes.

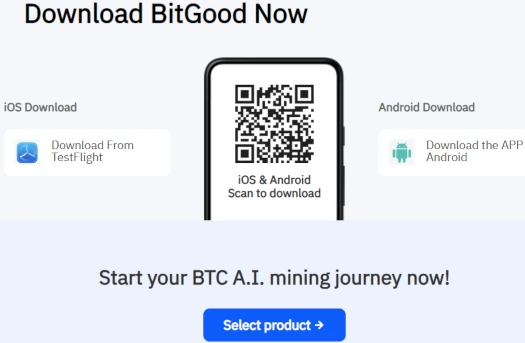

BitGood runs a passive returns investment scheme through offers passive returns through an app.

To get around Google’s Play Store restrictions on fraud, BitGood has Android users sideload the app.

Apple users are provided access to MinerX’s app via abuse of Apple Store’s TestFlight platform.

TestFlight is supposed to be used by developers to provide beta access for testing. The apps aren’t certified by Apple like regular apps are.

A developer can abuse TestPilot by uploading a new beta version every 90 days.

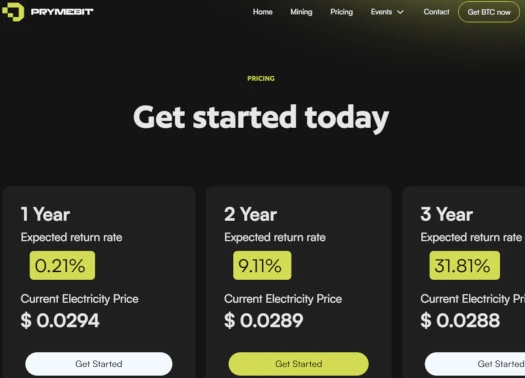

PrymeBit pitches investors on annual passive returns straight from its website:

As previously stated, central to all of these investment schemes is Jaz Pee.

We’ve already established Pee’s ownership of Finxeed, the company that owns PrymeBit, which feeds up to Dbank.

Pee was also a speaker at MinerX’s “kick off” event:

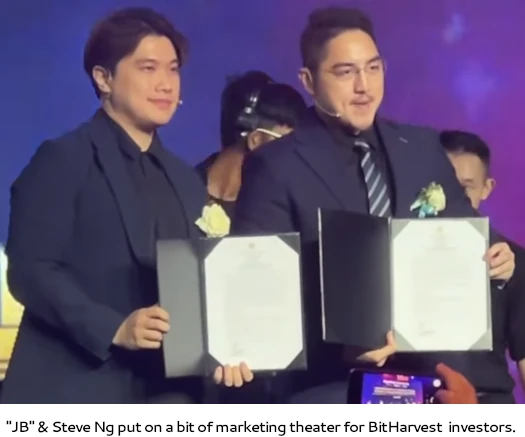

And here’s Pee signing some marketing agreement with BitHarvest’s CEO Logan Lee, played by Singaporean national Stephen Ng.

I’ll additionally point Pee featuring Ng as BitHarvest’s CEO on PrymeBit’s website, citing them as “our investor”.

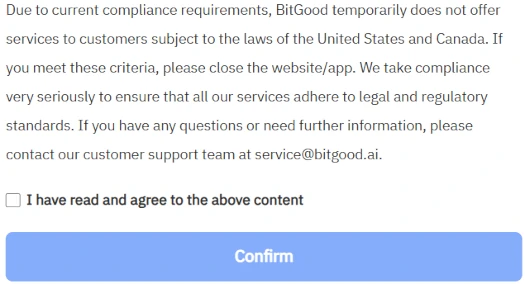

This all brings us back to the previously cited North American disclaimer on BitGood’s website.

Due to current compliance requirements, BitGood temporarily does not offer services to customers subject to the laws of the United States and Canada.

If you meet these criteria, please close the website/app. We take compliance very seriously to ensure that all our services adhere to legal and regulatory standards.

Putting aside the disclaimer being meaningless with respect to regulation, no such disclaimer is provided by PrymeBit, BitHarvest or MinerX.

By representing itself to be based out of Texas and running multiple passive returns investment schemes, purportedly generating ROI revenue via cryptocurrency mining, Dbank, BitGood, PrymeBit, BitHarvest and MinerX are required to be registered with the SEC.

None of the Dbank associated companies or anyone running them, including Jaz Pee, are registered with the SEC.

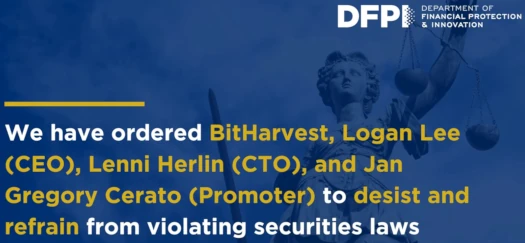

The good news is BitHarvest, launched before MinerX, has already caught the attention of US regulators.

California’s Department of FInancial Protection & Innovation issued a BitHarvest securities fraud desist and refrain in August 2024.

The enforcement order explicitly names BitHarvest, Logan Lee, Lenni Herlin and Jan Gregory Cerato.

Lee is to BitHarvest as Jeffrey Gan is to MinerX. While still culpable for committing securities fraud, both are essentially executive puppets for Jaz Pee and his Dbank associates.

Jan Gregory, a Canadian national previously busted for securities fraud, is a serial promoter of MLM crypto Ponzi schemes. Gregory is essentially the face of BitHarvest marketing.

Pending further action by US authorities, it’s unclear whether Jaz Pee’s and his Dbank associates are operating from Texas, or whether they’re spread out across Malaysia, Thailand and other Asian countries.

Who exactly mans Dbank’s Texas purported crypto mining facility remains unclear. Jaz Pee refers to Dbank’s “head of mining” as “Albus”.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve MinerX of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 17th November 2024 – Finxeed has deleted the May 3rd, 2024 Medium article cited in this review.

This appears to be an attempt to cover up links between Finxeed, PrymeBit and BitGood.

As a result of Finxeed deleting the Medium article, I’ve disabled the previously accessible link.

The idea of large-scale crypto mining in the US is pretty ridiculous. US electricity is twice the cost of China.

statista.com/statistics/263492/electricity-prices-in-selected-countries/

Not excusing mining in the US but China already banned crypto mining in 2021.

Wherever it takes place crypto mining a colossal waste of resources.

Review updated to note Finxeed is deleting incriminating evidence.

I think this article speak half truths. I’m a member of Miner X and I’m making money daily. So, why would you say it’s a Ponzi?

lies begets lies, and all you do is hurting people. Please STOP you’re Bullshido!

Whether you’re stealing money through a Ponzi scheme is irrelevant to said Ponzi scheme being a Ponzi scheme.

And you’re not making money daily, anything you actually withdraw is stolen from other investors.

As for “hurting people”, nothing worse than a thief who thinks stealing money from people is helping them. I forget sometimes the absolute garbage end of the gene pool MLM crypto Ponzis attract.

I mean really, you’re literally commenting on an article on a financial regulator spelling out MinerX’s fraud.

The only bullshit here is your Ponzi shilling. Best of luck with the scamming.