OSC seeks disgorgement & civil penalty from NovaTech FX

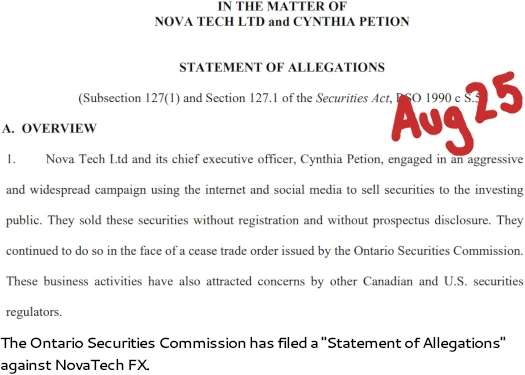

The Ontario Securities Commission has filed a Statement of Allegations with Canada’s Capital Markets Tribunal.

The Ontario Securities Commission has filed a Statement of Allegations with Canada’s Capital Markets Tribunal.

As per the August 25th filed statement, OSC has requested the CMT

- certify that NovaTech FX and owner CEO Cynthia Petion committed securities fraud in Ontario;

- issue a permanent injunction against NovaTech FX prohibiting further acts of securities fraud;

- reprimand NovaTech FX publicly;

- order NovaTech FX pay an “administrative penalty of not more than $1 million for each failure to comply with Ontario securities law”;

- order NovaTech FX to disgorge ill-gotten funds “obtained as a result of non-compliance with Ontario securities law”;

- order Cynthia Petion to step down as an officer or director of any company offering securities in Ontario, including NovaTech FX; and

- issue an injunction permanently prohibiting Cynthia Petion from “acting as a director or officer” of any company offering securities in Ontario.

OSC’s Statement of Allegations opens by alleging NovaTech FX and Cynthia Petion

engaged in an aggressive and widespread campaign using the internet and social media to sell securities to the investing public.

They sold these securities without registration and without prospectus disclosure. They continued to do so in the face of a cease trade order issued by the Ontario Securities Commission.

These business activities have also attracted concerns by other Canadian and U.S. securities regulators.

NovaTech FX’s business model is presented as evidence. OSC alleges NovaTech engaged in securities fraud via its’ “Percentage Allocation Management Module (PAMM), through which investors were pitched “returns of approximately 3% per week without ever sustaining a

loss.”

The OSC’s NovaTech December 2022 securities fraud warning and subsequent February 2023 Cease Trade Order are also cited.

The Respondents breached this order by allowing reinvestments of purported returns into PAMM units, and by selling new PAMM units to Ontario investors.

While the Respondents made changes to their website to make it appear they were restricting access to Canadian investors, individuals involved in perpetuating NovaTech’s multilevel marketing scheme were publicly disseminating instructions on how to circumvent geographic restrictions.

NovaTech failed to comply with the terms of the a temporary cease trade order (TCTO).

While the TCTO was in force, NovaTech continued to trade in securities, including by allowing reinvestments of purported returns into PAMM units, and by selling new PAMM units to Ontario investors.

I’m not sure how long the CMT will take to issue an order on OSC’s Statement of Allegations. I’m also unclear on how any such order might be enforced.

NovaTech FX collapsed in February 2023. Cynthia Petion and husband Eddy, US nationals, have not been seen in public since late 2022.

California issued a NovaTech FX securities fraud cease and desist in November 2022. Wisconsin followed up by fining NovaTech FX and the Petions $50,000 for securities fraud violations in April 2023.

Beyond that though, US authorities are as of yet to take further action.

Pending an update on the OSC’s Statement of Allegations, we’ll keep you posted.

Update 4th September 2023 – The Capital Markets Tribunal has scheduled a hearing for September 28th, 2023.

OMG thought I recognized these individuals. I lost lots to their AWS MINING scheme.

Article updated with news of hearing.

J’m a victim of novatecthfx for 85000.00 j need help j believes it’s a scam.

If you believe NovaTech is a scam why did you invest?

Also your money is gone. Your only chance of getting a percentage back is ongoing regulatory action leading somewhere.

I too have lost an upward of 6 figures and quite devastated that there is so little information out there on what is happening.

I do not understand how so many people that were affected are not posting or commenting. Just doesnt make sense but I am trying to remain hopeful that we will get back what we out into it, if it has been ceased where else could it go?

AFAIK NovaTech FX funds haven’t been seized. Also you’re not ever going to see a 100% recovery under normal circumstances.

Funds invested into an MLM Ponzi scheme are withdrawn by earlier investors, paid out as recruitment commissions, kept by the admin etc.

Is there any legal reason why NOVATECHFX Ponzi scammers, Cynthia and Eddy Petion are not on the U S FBI most wanted list, and cannot be extradited from Dubai?