MTI’s top net-winners summoned to pay back ~$242 million

Liquidators in South Africa have issued a summons against eighteen of Mirror Trading International’s top net-winners.

Liquidators in South Africa have issued a summons against eighteen of Mirror Trading International’s top net-winners.

Together, the scammers are being held liable for R4.66 billion (~$244 million USD).

As reported by My Broadband’s Jan Vermeulen on May 10th, liquidators arrived at the $244 million amount “to cover the scheme’s debts – with 7% interest”.

According to the liquidators, these individuals are “masterminds” of the scheme, and it has asked the Pretoria High Court to hold them liable in terms of the Companies Act.

They argue that Mirror Trading International (MTI) was an unlawful Ponzi scheme and factually insolvent since inception.

The liquidators also contend that the defendants knew this.

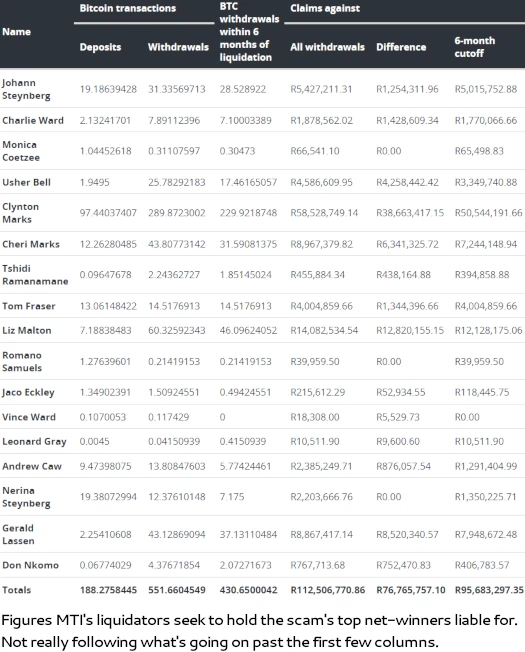

A chart provided by My Broadband details how much each MTI net-winner is up for:

Names of particularly significance are:

- Clynton Marks (suspected MTI co-owner with wife Cheri) – withdrew 289.8 BTC

- Cheri Marks (suspected MTI co-owner) – withdrew 43.8 BTC

- Johann Steynberg (MTI CEO and suspected frontman) – 31.3 BTC

- Andrew Caw (frontman of the Marks’ previous Ponzi BTC Global) – 13.8 BTC

Vermeulen got in touch with suspected Mirror Trading International co-owner Cheri Marks (right with Clynton) for comment.

Vermeulen got in touch with suspected Mirror Trading International co-owner Cheri Marks (right with Clynton) for comment.

Marks unsurprisingly trotted out the usual denials.

“There are some very concerning aspects of the application,” Marks stated.

“We have always denied the contention that MTI was trading fraudulently or recklessly with our knowledge.”

She also maintains that MTI was never insolvent.

While it’s not nothing, the CFTC has pegged MTI as a $1.7 billion Ponzi scheme. The ~$242 million liquidators in South Africa have come up with falls well short of that amount.

Around ~$57 million in recovered bitcoin has already been liquidated, but that doesn’t really add much (~$300 million all up).

As to the remaining ~$1.4 billion unaccounted for, the bulk of what wasn’t paid out is believed to have been stashed by Clynton and Cheri Marks.

To date nobody seem to have been able to hold them accountable. The CFTC only sued Mirror Trading International and Johann Steynberg. South African authorities have failed to take any meaningful action.

The Marks continue to live openly on what they stole through Mirror Trading International (and BTC Global) in South Africa.

I believe,the 6month thing is a South African liquidation law claim,anything paid out in the 6months you are fully liable for.

Before that depends on the deposits vs withdrawals to calculate the rest of what you owe (not my area of expertise).

So there are columns detailing the totals and the 6months, with their differences. Basically looks like Clynton drained it as much as possible in the 6months before collapse – typical behaviour for scammers in the know.

So does that mean the liquidator’s claims are gimped to the last 6 months of MTI’s operation?

If I understand correctly:

If the liquidators prove that the business was illiquid from the start – then all payments are “without value”

If not then only a certain period before liquidation is “without value” automatically

I believe in this instance the Court approved the “6months” but not the “from the start” since there “was trading at least initially”

So any claims before that period will need to be proven instead of automatically accepted. Fortunately a glance shows the majority of the money flowed out in the 6months

Everything is also being calculated as at the value of the transactions so the BTC price did affect the numbers obviously

TLDR: 6months column they can easily claim from the Top pops as that was court approved as a “Ponzi”,rest will need to be wrestled out of them

Ugh, non-regulatory civil action against Ponzi scammers is hopeless.

Yeah it does mean more fighting but at least the majority of the outflows there were in the sweetspot. Fighting for the rest will depend on how much they withdrew prior to the 6months – would it be worth litigating for that money or not

Issue is the gaping $1.7 billion –> $242 million deficit.

I think the FTC might have taken some liberties there based on BTC peak price. SA court wanted calculations as at transaction dates.

All crypto is bullshit. You hold scammers accountable for the dollar amount they stole at the time of theft.

I’ve yet to see a crypto scammer hit with disgorgement and civil penalties in USD come out on top.

Babysteps

But daddy I want my popcorn NOW.

Get the money back and then lock up theses scam artists.

The world is full of theses low life bottom feeders.

The High Court ruled it a scam.

Anyone can claim anything.

It’s South Africa. Few people waste their time going the strictly legal route.

Sucks to be Clynton or Cheri.

What I also want to see is what happens (if anything) to that lawyer, Ulrich Roux, who claimed on a Zoom conference that MTI’s operations are all above board.

Unfortunately i do not see Irish Scammers Mick Mulcahy & Ger Geary his business partner on the list.

They are into the WeWe Scam with Kalpesh Patel now.

AFAIK the top MTI scammers are all from South Africa.

Also there’s obvious jurisdictional issues with South African courts issuing international summons in civil proceedings.