Metafi Yielders bumps daily ROI to 4.2% less than 40 days in

![]() Typically MLM Ponzi schemes don’t start locking funds into higher ROI rates until after a few months at least.

Typically MLM Ponzi schemes don’t start locking funds into higher ROI rates until after a few months at least.

By then recruitment has tapered off and it’s the inevitable run to the end. Why not sap as much as you can out of particularly greedy investors?

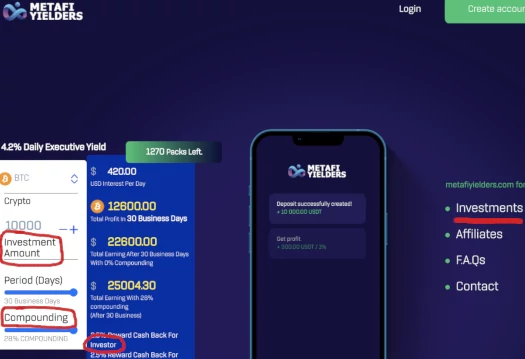

To that end Metafi Yielders have introduced a 4.2% daily ROI, to anyone gullible to lock in $10,000 for another 30 days.

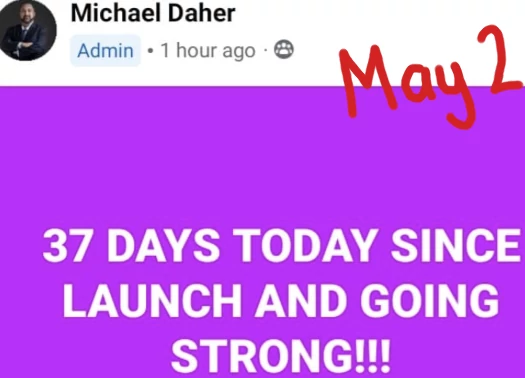

On May 2nd Metafi Yilders’ Boris CEO Michael Daher, aka Michel Daher and Micho Nicolas, celebrated 37 days since launch.

Metafi Yielders’ new plan comes nine days after 1.6% launch investments mature, and three days before 3.3% a day investments mature.

To recap, Metafi Yielders offers:

- Yield Farming Basic – invest $100 or more and receive 1% a day for 30 days (130% total ROI)

- Yield Farming Pro – invest $2500 or more and receive 3.3% a day for 42 days (238.6% total ROI)

By the end of the week Metafi Yielders will have a bunch of 238.6% ROI liabilities to pay out.

Cue the new 4.2% a day plan. It requires a $10,000 investment in bitcoin, on the promise of $25,004.30 after another 30 days.

Alternatively Metafi Yielders investors could pull their initial seed and reinvest their 3.3% a day balances, which I’m sure many will do.

Either way math is math and, even at 1% a day, withdrawal liabilities continue to spiral out of control.

Holding a stream to announce the new 4.2% a day plan, Daher wanted to first address Metafi Yielders’ elephant in the room:

[2:50] There’s been a few things coming up in the groups about us uh, doing the wrong thing and I’d like to address that.

[3:12] I’m abiding by every rule, by every law. Um, doing licensing. Going through AUSTRAC, going through the AFSL and I just don’t get it, why people are not coming for it.

[7:37] I have started the AUSTRAC to get compliant. We have started the KYC stuff to fit into the United States, the UK and the Australian jurisdiction.

The other side of that is we will have a full banking style license in two weeks time. I’m just waiting for paperwork.

If I may, with respect to securities regulation, the elephant in the room for any MLM investment scheme, AUSTRAC, AFSL etc. are utterly meaningless.

Daher states that when questioned about Metafi Yielders’ regulatory obligations, he was left feeling “a little bit down about it”.

[3:40] This is new for me so I didn’t take that so well.

The only thing that matters is registering with financial regulators and filing periodic audited financial reports.

In Australia this would be ASIC, a financial regulator known for allowing anyone to register anything and not doing anything about it.

Even if you took ASIC registration at face value though, it still only covers investment solicited from Australian residents.

Whatever cryptocurrency is being invested from within Australia into Metafi Yielders is negligible. When BehindMLM reviewed Metafi Yielders a few days ago, behind Vietnam, the US was the second largest source of traffic to its website.

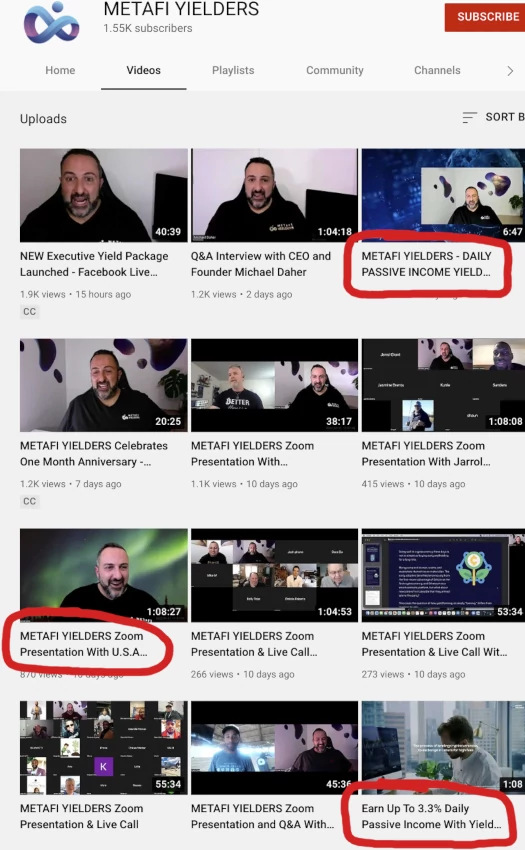

Furthermore there is an abundance of affiliate investor interviews published on Metafi Yielders’ official YouTube channel, featuring top promoters with North American accents.

In the US securities are regulated by the SEC. Neither Metafi Yielders or Michael Daher are registered with the SEC. You can verify this yourself by searching the SEC’s Edgar database.

Irrespective of anything else, Metafi Yielders, Michael Daher and whoever is actually running Metafi Yielders are committing securities fraud.

Securities fraud can’t be undone. And certainly Metafi Yielders has made no attempt to cease committing securities fraud. In fact by offering new investment plans, if anything they’ve doubled down on fraud.

Other than operating legally, why does this matter?

Because it’s the only way for investors to verify Metafi Yielders is doing what it claims to be doing.

Claims like this:

[8:55] Before we’d go out to exchanges. We’d go out to do the whole um, y’know, the yield farming on exchanges. And now we’re gonna bring it in house.

So that all of the things that you guys are receiving, and all of the rewards are gonna stay with the people who are involved in Metafi Yielders.

Without fail, MLM companies running investment schemes that fail to register with financial regulators and file audited financial reports do so for one reason and one reason only: they are running Ponzi schemes.

Rather than register with the SEC and provide it and affiliate investors with audited financial reports, Daher instead offers up this nonsense;

[5:40] We are launching a new package. I did spill some beans yesterday during an interview and I wasn’t supposed to … (Ozedit: gee, I wonder who wouldn’t let him?)

[5:59] The catch is really simple, we want you guys to stay with us.

So we’re going to offer you 4.2% on anything above $10,000.

So you can use your re-inve… we’re not allowed to use the word investment, so your redeposit into your own account.

Why Daher is bothering with pseudo-compliance isn’t clear. The scammers he’s answerable to aren’t bothering:

Daher’s own pseudo-compliance falls apart just minutes later;

[8:25] We’ve got one more thing that’s coming, the borrowing platform. It’s so, so, so different to what’s been offered to people in the past.

Now we’re able to give you higher intere… sorry, not allowed to use that word either.

We’re allowed to give you a higher return on your investment …

On top of the existing 1% and 3.3% a day investment plans, as well as the attached MLM opportunity, Daher states he believes Metafi Yielders’ new 4.2% a day plan is “sustainable”.

[12:14] You have nothing to worry about with the yield farms and all of that. Sustainability is the most important. Right?

It’s simple as that. There is no external trading, there’s no buying and selling.

[12:53] If we give away those percentages that we’re able to yield at the moment, past 1% and 3.3% and now 4.2%, this would kill us.

Daher claims Metafi Yielders currently has just shy of 9000 investors.

Stay tuned for Metafi Yielders shenanigans over the next 30 to 60 days.

Update 17th May 2022 – Metafi Yielders is collapsing. The Ponzi scheme has announced withdrawal restrictions.

Update 24th May 2022 – Metafi Yielders has collapsed.

And by doubling down on fraud, Daher crosses over from unsuspecting actor to accomplice.

The bag the Vietnamese/Russian scammers are gearing up to leave Daher holding is shaping up to be epic.

Game over!!…shitcoin prolly coming next…lol.

“The other side of that is we will have a full banking style license in two weeks time. I’m just waiting for paperwork.”

WTF is a “full banking style license”? – Oh wait, no such thing actually exists… *LOLs*

I get a feeling Mikey got a little “Please explain” letter from the ACCC… and he’s trying to keep the ‘investors’ snowed until he and his mates pull an exit strat.