Jifu founder alleges “legally risky business practices” (FTC?)

In a lawsuit filed against fellow Jifu co-founder Kyle Copeland, Bradley Boyle has made allegations of “legally risky business practices”.

In a lawsuit filed against fellow Jifu co-founder Kyle Copeland, Bradley Boyle has made allegations of “legally risky business practices”.

Boyle’s lawsuit also seems to suggest the FTC and State of Nevada are actively investigating Jifu.

Boyle and his company TTAN LLC filed an Idaho lawsuit against Copeland on September 11th, 2025.

Boyle and his company TTAN LLC filed an Idaho lawsuit against Copeland on September 11th, 2025.

If I’m being honest, the lawsuit as a whole isn’t particularly interesting. Basically you’ve got a bunch of middle-aged dudes squabbling over money.

For reference though, here’s a list of the eleven defendants Boyle has sued;

- Kyle J. Copeland – Jifu co-founder and current CEO

- Paul Southam – Chairman of the Board of Directors at Jifu

- Danien Feier – Jifu’s current Master Distributor

- Scott Symington – Director and Secretary of the Board of Directors at Jifu

- Jifu LLC – an Idaho company (Jifu as an MLM company)

- Mango – Jifu LLC – a Utah company that appears to be under the control of Paul Southam

- Pincast LLC – a Utah company

- KJC Global Solutions LLC – a Delaware company owned by Kyle Copeland

- DBGK Holdings LLC – a Tennessee company

- Seven Holding Limited – a Dubai company owned by Danien Feier (as alleged by Boyle)

- Unity Global DMCC – a Dubai company owned by Danien Feier and wife Stefania Lo Gatto (as alleged by Boyle)

Long story short, Boyle claims the above defendants, led by Copeland and in violation of the Securities Exchange Act and Idaho law, squeezed him out of Jifu and his CEO position.

Boyle further alleges the above defendants illegally screwed him over financially.

Boyle further alleges the above defendants illegally screwed him over financially.

Other than the alleged recipient of Boyle’s stake in Jifu being Dubai-based OmegaPro Ponzi promoters Danien Feier and Stefania Lo Gatto (major red flags)…

Defendants’ campaign is not an isolated act but represents one step in a broader, malicious scheme to consolidate control, neutralize Plaintiffs’ influence, misappropriate Plaintiffs’ economic interests, and ultimately force the sale of the entire Company to one of the conspirators, Defendant Danien Feier, through his entity Defendant Unity Global DMCC, under coercive and self-dealing terms.

Defendants’ conduct is a textbook example of member oppression, executed under the guise of corporate formality but intended to achieve an unlawful end.

…things don’t get interesting until Boyle cites “legally risky business practices”.

The Defendants’ breaches of their duty of care extend to their failure to properly oversee the Company’s business practices, thereby exposing the Company to significant legal and financial risk.

Upon information and belief, this conduct occurred and continues to occur within a “Jifu Directors+” online chat group, which includes Company leadership and the Defendants.

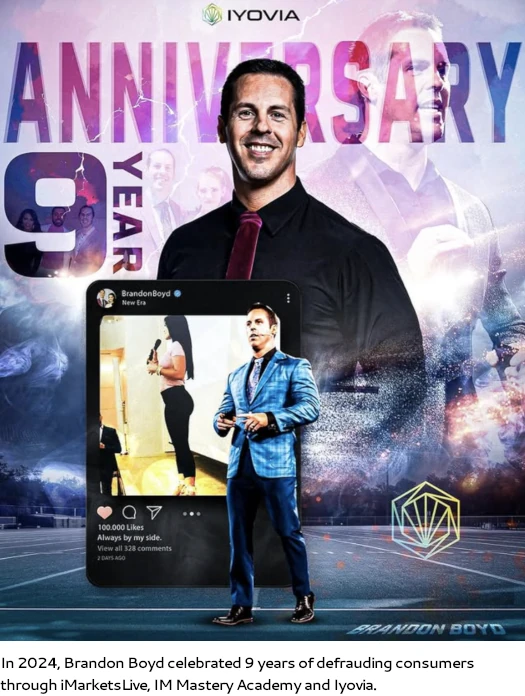

For example, in a message within this group, an individual named Brandon Boyd posted a photograph of a vehicle loaded with 37 cases of a Company product, stating, “I hope the FTC doesn’t have a problem with me doing ‘product loading’ in order to ensure my points are met.”

A true and correct copy of a screen shot from this chat is attached hereto as Exhibit 17.

Unfortunately, all exhibits attached to Boyle’s Complaint were filed under seal. Nevertheless, Brandon Boyle participating in inventory loading in a presumably private Jifu leadership group is concerning.

Brandon Boyd is fresh off his Iyovia fraud settlement with the FTC.

Out of the $6.3 million he settled for back in August, based on financial representations made during settlement negotiations, Boyd was only on the hook for $500,000.

Boyd also consented to a permanent injunction, explicitly prohibiting him from

- making any misleading earnings claims unless they have a basis for such claims;

- making misrepresentations, or assisting others in making misrepresentations, of any material fact in connection with the marketing or sale of any good or service; and

- misrepresenting the ability to make certain earnings or profits or other misleading statements as part of any telemarketing activities.

If Brandon Boyd is inventory loading to qualify for Jifu commissions (in lieu of making sales to retail customers), any income or earnings claims or representations Boyd makes or has made, wherein Boyd does not disclose his purchase of Jifu products to qualify for commissions and bonuses earnt, violates Boyd’s Iyovia FTC settlement.

With respect to Jifu, corporate permitting top leaders to self-qualify for commissions by purchasing thirty-seven cases of product is major compliance negligence.

Boyle’s Complaint continues;

“Product loading” is the practice of requiring or encouraging distributors in a multilevel marketing or direct sales company to purchase large, unreasonable quantities of inventory to qualify for commissions or bonuses, rather than basing compensation on actual retail sales to consumers.

This practice is a major red flag for the Federal Trade Commission (FTC) and is often associated with illegal pyramid schemes.

He’s not wrong. And perhaps one can see why Boyd transitioned from Iyovia, a then collapsing pyramid scheme about to be walloped by the FTC, to Jifu.

This is the next paragraph in Boyle’s Complaint;

The casual discussion of “product loading” in a “Directors+” group, at the same time the Defendants knew they were under investigation by the FTC and state of Nevada for precisely these types of legal violations, demonstrates grossly negligent oversight by the Defendants.

Their failure to prohibit and instead tacitly condone practices that could attract severe regulato1y scrutiny and penalties from the FTC constitutes a breach of their duty of care to act in the best interests of the Company and to protect it from foreseeable harm.

The FTC sent Jifu and a bunch of other MLM companies a deceptive/unfair conduct notice back in 2021. This however is the first I’m hearing of a current FTC investigation into Jifu. And, evidently, Nevada has come along for the ride.

To the best of my knowledge, up until this point, whatever proceedings the FTC and Nevada have initiated against Jifu isn’t public. Jifu has not disclosed any pre-lawsuit probes or investigatory demands by the FTC and/or Nevada.

If it hasn’t found its way over there already, I can see the FTC and/or Nevada being extremely interested in Boyle’s Brandon Boyd “inventory loading” exhibit.

Getting back to Boyle, he claims he was “immediately removed” from Jifu after expressing “legitimate and prudent concerns about the tax and legal structure of a proposed equity transfer”.

Boyle cites Jifu’s actions as an example of “tolerance for legally perilous activities [rising] to the level of official company policy”.

This reprisal further evidences that the actions taken against Plaintiffs were pretextual and pait of a badfaith squeeze-out, rather than a good-faith effort to protect the Company.

One last takeaway from Boyle’s Complaint circles back to Danien Feier, Stefania Lo Gatto and their company Unity Global.

The Defendants’ conspiracy culminated in a plan to sell the entire Company to Defendant Unity Global, an entity owned and controlled by Defendant Feier and his wife, Stefania Lo Gatto, under terms that are coercive, self-dealing, and designed to finalize the squeeze-out of [Boyle].

Boyle goes on to claim the $21 million sale price is “significantly below a prior agreed valuation of $33,134,526”.

The Secured Promissory Note explicitly states that the entire $21,000,000 purchase price is non-recourse and shall be paid “solely and exclusively from the profits of the Acquired Assets” and need not be repaid if the purchaser does not show sufficient “profits,” as determined by the individual Defendants who are also on the Management Board of Unity Global.

It further states that “Under no circumstances shall Unity Global DMCC, Danien Feier, or Stefania Lo Gatto… be personally liable for any obligations, debts, or liabilities under this Note.”

Not only did JIFU, LLC agree to sell the Company without any concrete payment terms, the only money to change hands in the “transaction” was from the seller to the buyer, with JIFU, LLC (seller) paying $5 million to Unity Global (buyer) to cover alleged “wallet liabilities” and future operating expenses.

This structure allows Defendant Feier to acquire the entire Company using its own future revenue, shifting all risk to the selling members while he bears none.

It is a classic self-dealing transaction designed to misappropriate a company opportunity for an insider’s benefit.

Furthermore, the agreement illegally attempts to unilaterally change the governing law and venue for disputes from Idaho to the United Arab Emirates, a clear attempt to evade the jurisdiction of this Court and the protections of Idaho law.

Sounds to me like, staring down the barrel of a potential regulatory shutdown by the FTC and Nevada, Jifu is trying to shift assets to Dubai.

As of April 30, 2025, after Plaintiffs had been systematically removed from oversight, the Company was in a strong financial position, with over $20 million in year-to-date sales revenue and at least $3.7 million in cash.

Following this period, and after Plaintiffs were cut off from Company information, financial statements show massive and unexplained movements of Company funds.

For example, a Stripe statement for July 2025 shows over $1,000,000 in payouts. A Revolut bank statement for the first two weeks of August 2025 shows numerous large transfers, including multiple transfers of $100,000 each to “JIFU Travel LLC,” totaling millions of dollars.

This pattern of mismanagement also includes entering high-risk, bespoke deals with certain inside affiliates costing the Company millions of dollars.

Looking at Boyle’s case docket, a motion for default judgment against Jifu was filed on October 9th. Entry of default motions were filed against several other defendants on October 10th.

Those motions were opposed on October 30th. In the meantime, Jifu filed a motion seeking to compel arbitration on October 17th.

I’m kind of expecting this one to resolve through a confidential settlement. But looming regulatory action from the FTC and Nevada might be a wildcard. Stay tuned for updates.

The most important phrase in the documents is “insider benefit”. The fix is in. All reps should resign fast. No trust in that circus.

History repeats itself over and over, people figure out how to swindle each other playing in the space MLM “House of Cards”. Instead of building a business with integrity and grit.

Greed is not good when 90-98% off the downlines technically fail and never cover their monthly autoship. Dubai is where they feel protected from the long arm of the law.

Tip. Follow the top money earners on fake sites that don’t verify income like business for home.org

run!

Danien strikes again. Top money earners. Builder and destroyer! Eric Worre events always about how much money he makes with his side deals and multiple positions. There is absolutely no governing law in Dubai.

Of course you want to evade your home countries taxes, and swing for the fences no matter how many people get hurt. jifu will end up getting investigated by the FTC because they desperately took on Alex Morton’s crew.

Omega Pro, The Gold Deal all birthed in Dubai. Me and my friends lost 6 figures plus in Omega Pro and even more in his Gold deal Mike Sims and Eric Worre guaranteed.

Danien enjoy your new houses and new cars with are money.

What happened to integrity and honor. Why do these companies keep going. You know something bad is going on when the founder owner sues everyone!

(Ozedit: derails removed)