iX Global collapses amid ongoing SEC investigation

iX Global has collapsed.

iX Global has collapsed.

On a “final global call” held on June 24th, founder Joe Martinez confirmed an ongoing SEC investigation into the company.

[1:38] Over the last year or so … we ran into some regulatory issues here in the US, where we’re headquartered.

Unfortunately those challenges, doesn’t matter that we got the case dismissed against us, those challenges have uh, given us … challenges that are inconceivable.

[2:19] We just got word this last week that the SEC is, as they said they would, reinvestigating the case against Debt Box.

The SEC filed suit against Debt Box and iX Global in August 2023. At the center of the suit was an alleged $49 million dollars in securities fraud.

Following fallout from admin errors by SEC attorneys, the case was voluntarily dismissed in May 2024. Attorneys tied to the errors left the SEC and a new group of attorneys are handling the case.

This brings us to Martinez’s response to renewed investigation into iX Global’s alleged securities fraud.

This brings us to Martinez’s response to renewed investigation into iX Global’s alleged securities fraud.

[2:40] Because of how much regulation and regulatory issues throughout the world have been challenging us, we’ve decided … that iX Global as of this week will cease operations.

ix Global affiliate investors have been advised they will be able to withdraw any wallet balances in their backoffice.

All systems will remain online for the next 30 days, with brand ambassadors able to login to their accounts, request payouts, and continue to operate in accordance to the company agreements and procedures through July 24th.

iX Global’s initial business model hid purported automated forex trading returns behind an education platform. To defraud consumers out of millions, Martinez teamed up with Debt Box in the US and TP Global FX in India.

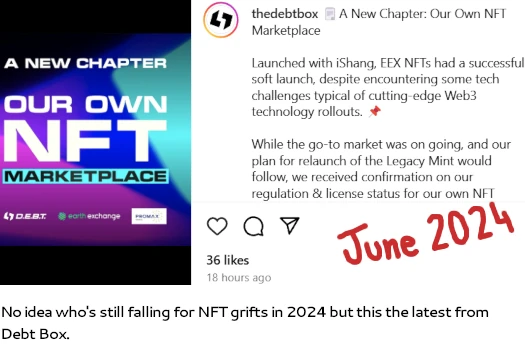

The Debt Box side of the scam came to an end after the SEC filed suit. iX Global and Debt Box doubled down on securities fraud with an IN8 NFT grift. That lasted a few months before collapsing.

IN8 Tech, an iX Global associated shell company owned by Martinez, would resurface as a service provider in CloudX.

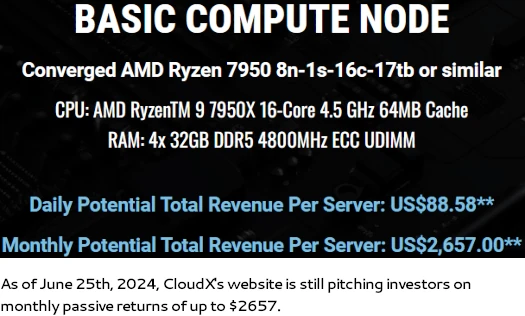

Through CloudX, iX Global pitched investors on annual passive returns of up to $72,000 per $15,000 investment.

Evidently believing the SEC’s investigation won’t expand to IN8 NFTs and CloudX, Martinez advised;

[8:11] Anybody that is continuing to purchase any of our technology products, like CloudX or Nova, those products will stay online with the products provider of the technology companies.

So all of those things are staying in place but they were completely separate from iX Global.

This is of course baloney seeing as Martinez owns both iX Global and IN8. That CloudX investors had to be addressed on an iX Global say it all really.

The TP Global FX side of the scam collapsed following the arrest of Viraj Patil in India.

As part of an ongoing criminal investigation into TP Global FX and iX Global, Martinez himself is a fugitive wanted by Indian authorities.

Addressing iX Global’s Indian investors on the final global call, Martinez confirmed they were screwed. Martinez advised funds stolen from Indian iX Global investors would be put towards his legal fees.

Upon becoming aware of regulatory investigations into Debt Box, its founders began transferring assets to Dubai. With the SEC’s case still active, they too then also fled to Dubai.

From Dubai, Debt Box’s founders continue to defraud consumers through various crypto schemes.

There haven’t been any public updates from Debt Box corporate following voluntary dismissal of the SEC’s case.

SimilarWeb tracked just ~11,400 monthly visits to Debt Box’s website for May 2024. Most of that is assumed to be investors wondering where their money went.

There is no timeline for when the SEC’s renewed investigation will complete and when the regulator will file new charges.

Update 20th August 2024 – Joe Martinez has marked the cited June 24th “final global” video private. The video was previously accessible on iX Global’s official YouTube channel.

As a result of Martinez removing access to the video, the previously accessible link to the video in this article has been disabled.

How do these entities get banking for back-office to transact, and why hasn’t the DOJ dropped an indictment, seems to be a obvious ponzi scheme that’s had a lot of attention – the perfect low hanging fruit to set an example off.

also why did FTC not flag this MLM operation like it does in many cases ??? strange – charging USD 115 for 28 days of automation – gold/forex promising returns as high as 5-25 % per month and calling itself a direct selling company . should have ……

The FTC doesn’t file many MLM related fraud cases. We haven’t seen one since the Neora defeat almost a year ago.

That and securities fraud is the jurisdiction of the SEC. While we see the SEC team up with the DOJ I’ve never seen the SEC (or CFTC) team up with the FTC. At least not publicly.