NFT Rewards: Zeek Rewards’ Robert Craddock returns

Zeek Rewards’ Robert Craddock has reemerged as the owner, CEO and President of NFT Rewards.

Zeek Rewards’ Robert Craddock has reemerged as the owner, CEO and President of NFT Rewards.

NFT Rewards Team is an MLM crypto Ponzi combined with selling of virtual shares. Before we dive deeper into that though, it’s important to recap on who Robert Craddock is.

Robert Craddock made a name for himself as part of Zeek Rewards’ “Zeek Squad”.

Robert Craddock made a name for himself as part of Zeek Rewards’ “Zeek Squad”.

Zeek Squad was part of Zeek Rewards’ compliance efforts, headed up by Gregory Caldwell.

With Zeek Rewards of course being a $900 million Ponzi scheme, what “compliance” boiled down to was threatening to sue anyone who didn’t take down incriminating evidence.

Eventually the Zeek Squad’s shenanigans would expand to anyone who criticized Zeek Rewards.

Craddock also ran ZTeamBiz and used it to sell bogus leads to Zeek Rewards investors.

Leads were required to dump penny auction bids onto as part of Zeek Rewards’ Ponzi model.

After the SEC shut down Zeek Rewards in 2012, Craddock repurposed ZTeamBiz to spearhead the usual “but it can’t be a scam!” denials.

Craddock made a decent grift of it to, convincing investors to hand over thousands of dollars. This money was supposed to go towards legal defense fund but wound up only protecting a group of 12 top net-winners.

While all of this was going on, Craddock was planning to funnel Zeek Rewards victims into a new Ponzi scheme. Turns out the ZTeamBiz legal fund ruse allowed Craddock to collect the email addresses of a large number of investors.

Unfortunately for Craddock, the plans came to an end in November 2013 after the Zeek Rewards Receivership got in touch.

A year later details of Craddock attempting to sell the email addresses he’d collected to other Ponzi schemes emerged.

In March 2015 Craddock was indicted for wire fraud. Unfortunately the charges had nothing to do with his Zeek Rewards Ponzi scamming.

The charges related to Craddock filing bogus invoices, to support claims submitted to the Deepwater Horizon rig explosion compensation fund.

In June 2015 Craddock pled guilty. He was sentenced to six months in prison in October 2015.

As a net-winner of the Zeek Rewards Ponzi scheme, Craddock is believed to have quietly settled with the Zeek Rewards Receivership. Other than that, Craddock was never held accountable for his Zeek Rewards related conduct.

So what is NFT Rewards?

NFT Rewards’ primary website domain (“nftrewards.biz”), was privately registered on August 6th, 2022.

In early May, possibly late April, Robert Craddock began sending out communications pertaining to NFT Rewards and NFT Pay Pro. Note that insiders were likely onboarded well in advance.

On the marketing side of things, NFT Rewards and NFT Pay Pro are being pitched as a combination of penny auctions, NFTs and the Metaverse.

Yeah, that’s the same penny auction model Zeek Rewards used a decade ago.

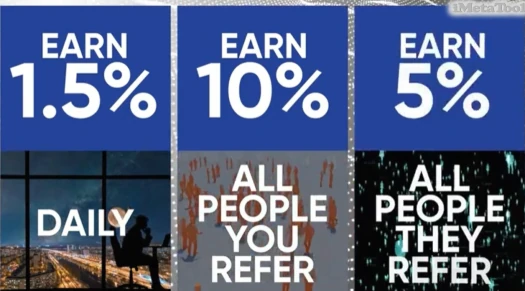

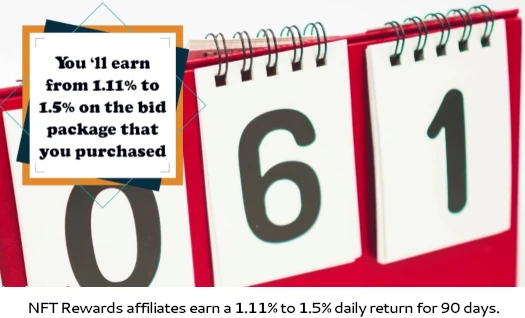

Like it was in Zeek Rewards, penny auctions are just a front for an “up to” 1.5% a day investment scheme:

NFT Rewards affiliates invest in $50 to $10,000 bid packages:

To qualify for the daily 1.1% to 1.5% ROI, NFT Rewards affiliates must place a certain number of bids in the company’s penny auctions each day.

NFT Rewards’ penny auctions are for NFTs. Initially sold by the company, they can be relisted by affiliate investors if won at auction.

NFT Rewards marketplace demonstrates a unique platform that promotes users to effectively buy, sell, bid, and create NFTs.

It is a place where buyers and sellers meet and involve in the trading of crypto assets.

NFT Rewards’ bid packages expire after 90 days, after which reinvestment is required to continue earning.

NFT Rewards pays out referral commissions on invested funds across two levels:

- level 1 (personally recruited affiliates) – 10%

- level 2 – 5%

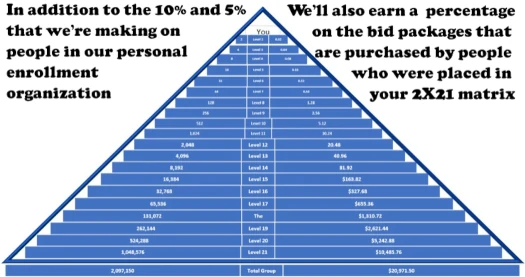

There’s also a company-wide matrix, which pays out additional percentages on NFT Rewards bid package investment:

Specific payouts across each matrix level are not provided.

NFT Rewards solicits investment and runs its MLM opportunity in the cryptocurrency tether (USDT).

The money side of NFT Rewards is handled through NFT Pay Pro (“nftpaypro.com”), set up on January 25th, 2023.

NFT Rewards has a daily earnings cap of 20,000 USDT, although it’s unclear whether this is just the MLM commissions or if it includes the daily ROI.

Obviously as far as a securities offering goes, NFT Rewards is a spin on Zeek Rewards’ penny auction Ponzi model.

Whereas in Zeek Rewards bids had to be dumped on bogus accounts to qualify for returns, in NFT Rewards Craddock has investors use the bids to drive up auction prices.

NFT Rewards’ bids are likely to be available to purchase by retail customers, but as we saw with Zeek Rewards, that volume is dwarfed by affiliate investment volume.

This corresponds with NFT Rewards’ daily return withdrawals being funded by affiliate invested, creating the same closed-loop investment scheme Zeek Rewards was shut down for.

In an attempt to deceive consumers about the Zeek Rewards Ponzi scheme, thus inferring it and NFT Rewards’ Ponzi model is legitimate, Zeek Rewards is referenced in NFT Rewards’ marketing material.

In one such video, believed to be narrated by Jeff Evers, Evers states;

(Craddock) knew all about that penny auction program of 2011.

In fact he told me he fixed the problems they had. He said one of the issues that they had was, they had so much money going through their bank account, that it attracted the attention of certain regulators who labeled it a Ponzi scheme, in order to seize their money.

Robert said, “Thanks to advanced technology that didn’t exist back then, NFT Rewards is programmed as a smart contract on the blockchain.” Which means that there are no bank accounts to seize.

This ominous warning shouldn’t be taken lightly by prospective NFT Rewards’ investors. It’s also baloney.

US regulators are certainly able to claw back funds stolen through MLM cryptocurrency scams.

NFT Rewards marketing also directly references the SEC:

NFT Rewards is doing everything by the book. The first thing Robert did was, he registered the company with the SEC.

A search of the SEC’s Edgar database reveals Robert Craddock has incorporated NFT Rewards Biz in Florida.

Then, on January 20th, 2023, Craddock filed a Form D Notice of Exempt Offering of Securities for NFT Rewards Biz with the SEC.

In the filing, Craddock cites Rules 506(c) as the reason behind NFT Rewards Biz being exempt from US securities law.

Rule 506(c) states;

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that:

-all purchasers in the offering are accredited investors

-the issuer takes reasonable steps to verify purchasers’ accredited investor status and

-certain other conditions in Regulation D are satisfied

The problem here is NFT Rewards is pitching a passive 1.5% a day ROI to the general public. The exemptions in Rule 506(c) clearly don’t apply.

In summary, NFT Rewards’ marketing claim that it is “registered with the SEC” is misleading in that its securities offering is in fact not registered with the SEC.

Craddock is trying to pull a fast one on the SEC, by claiming NFT Rewards’ securities offering is exempt from US securities law. This claim is through a rule NFT Rewards’ securities offering doesn’t qualify for an exemption under.

Furthermore, Craddock’s SEC filing pertains to equity – which I believe corresponds to the virtual shares scheme. It has nothing to do with the core of NFT Rewards’ business – the 1.5% a day passive investment scheme.

NFT Rewards’ 1.5% a day passive investment scheme hasn’t been registered with or disclosed to the SEC.

As per a communication sent out to NFT Rewards investors on May 8th, 2023, Craddock claims he’s pitching his Ponzi scheme at “an older age bracket”.

With NFT Rewards about ready to launch, we are closing in on about 20,000 people, most of whom are in an older age bracket. Once we go live, we expect that number to increase to well over 200,000 people within a 60-day time period.

In the communication, Craddock also attempts to address unregistered securities;

We are creating an opportunity for you and we want it to be long term.

If we did not register with the Securities and Exchange Commission, we would be subject to selling unregistered securities, and we do not want to do anything wrong or be accused of doing so.

As previously discussed, Craddock’s SEC filing doesn’t disclose NFT Rewards’ daily returns passive investment scheme to the SEC.

This is NFT Rewards’ said investment scheme, as disclosed in Craddock’s May 8th investor communication;

When you buy a bid package and the auction is live, we require you to make bids on a daily basis.

For example, if you have a $1,000 bid package, you are required to use the bids over a 90-day period.

When using the bids on the daily auctions you earn up to 1.5% daily based on the Bid package value, for a 90-day period.

And such to the extent Craddock has requested an exemption for NFT Rewards’ share scheme, the applied for exemption doesn’t apply.

If you are one of the individuals that will receive shares as a participant in one of our contests, or you have purchased shares as part of our private placement offering, or you intend to purchase shares before this offer expires, you can feel confident the shares should exceed $375.00 per share sometime this year.

For someone having 2,000 shares, that can be an estimated $750,000 US Dollars.

Someone paying $1,000 for shares now could potentially see as much as $150,000 before the end of this year.

In an attempt to get around US securities law, Craddock trots out baloney about the metaverse.

What may not be clear to some is how this platform will solve a lot of issues as it is acquired and merged into the Metaverse.

The Metaverse is an unregulated platform, which protects against unwarranted attacks by regulators.

To be clear, securities fraud remains securities fraud regardless of the platform its committed on.

I don’t have an NFT Rewards launch date but as per Craddock’s cited May 8th investor communication;

Shortly after launch, we will be announcing a Post Launch Gathering in Las Vegas, Nevada this year.

Paul Burks, founder and CEO of Zeek Rewards, was sentenced to 14 years in prison in 2017.

Through NFT Rewards, it seems Craddock is keen to follow in Burks’ footsteps.

I hope this is a miserable failure!

Oz thanks for getting this out to the public early enough – hopefully most people learned their lesson with Zeek and avoid this one like the plague.

Perhaps this will be like Daryl Douglas from Zeek who truer to reboot as Auction Addicts and restart the ponzi.

Why has this program not been stopped ?

Sounds like it’s all legit!

Not getting shut down by authorities != legitimacy.

NFT Rewards’ business model defines whether it’s legitimate or not. And securities fraud by definition can’t be legitimate.