SEC investigation into iGenius ongoing as of May 2024

Investview has confirmed the SEC’s investigation into iGenius is ongoing as of May 2024.

Investview has confirmed the SEC’s investigation into iGenius is ongoing as of May 2024.

The status update was confirmed by Investview in a 10-Q quarterly report, filed with the SEC on August 13th.

Through the end of our second quarter in 2024, with the exception of a follow-up request to provide supplemental documentation during May 2024, we have received no follow-up communications from the SEC following our original production of documents in 2022.

Investview first disclosed the SEC’s investigation into iGenius back in November 2021. Beyond acknowledging the subpoenas pertaining to iGenius, specific information the SEC requested hasn’t been disclosed.

Recent confirmation of the SEC’s investigation into iGenius is significant following the launch of a new passive returns investment scheme through CoinRule.

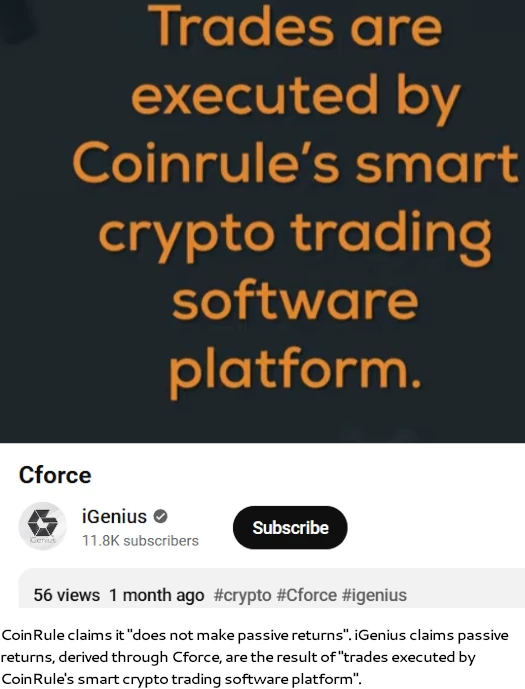

In July 2024 BehindMLM reported on “Cforce”, the name iGenius had come up with for their new opportunity.

To quote iGenius President Chad Garner (right);

To quote iGenius President Chad Garner (right);

CoinRule, these guys they essentially create software that connects to your crypto exchange account.

And the software can also execute trades. You give it basically authorization to execute trades on your behalf, and so you can have automated trading take place in your exchange account.

Upon application of the Howey Test, as per US law Cforce is clearly a securities offering. Yet there is no mention of either Cforce or CoinRule in any of Investview’s SEC filings (including the August 13th 10-Q).

Shortly after BehindMLM’s video went live, iGenius’ Cforce and CoinRule marketing videos, including the two cited by us, disappeared.

Perhaps wary of their own SEC investigation, CoinRule has since attempted to suppress consumer awareness through requested search engine delisting.

In a meritless defamation complaint sent to Google Search on or around August 15th, Collyer Bristow LLP, representing CoinRule to be a client of theirs, raised seven points.

Point 1

Quoted BehindMLM text;

Under the “lulz can’t touch our money!” model, an MLM company’s customers place their funds under control of a central entity. In this case its “Cforce”, a purported “exclusive” trading bot CoinRule provides to iGenius.

CoinRule’s response:

This is incorrect:

(i) Coinrule does not hold user funds, funds are held on the exchanges; and

(ii) the strategy is not provided by Coinrule, Coinrule is a software platform that analyses market data and allows its users to undertake various trading strategies of their choosing and converts signals into trading instructions that are sent to exchanges.

The strategy is operated by iGenius and not by Coinrule. This statement gives the misleading impression that our client sets strategy which is definitely not the case.

BehindMLM’s response:

On point (i), BehindMLM never claimed CoinRule holds user funds. We did state investors place funds under the control of CoinRule, which is enough to satisfy the Howey Test.

The applicable Howey Test prong is “investment of money in a common enterprise”. In this case the “common enterprise” is Cforce, which is operated by CoinRule.

Where exactly funds are held while invested into and under control of Cforce and Coin Rule is irrelevant.

On point (ii), this is from CoinRule’s website;

Create a bot strategy from scratch, or use a prebuilt rule that has historically been traded on the exchanges exchange.

So through “prebuilt rules”, CoinRule offers investors automated trading strategies. Again, whether CoinRule themselves came up with these strategies or not is neither here nor there.

With respect to securities fraud, all that matters is CoinRule and iGenius are the ones selling access to passive returns, purportedly derived via automated trading.

Point 2

Quoted BehindMLM text:

Lulz can’t touch our money!” trading schemes typically implode through bad or rigged trades. I can’t speak specifically to CoinRule but bot owners typically steal client funds through rigged trades and blame it on hackers, or disappear etc.

CoinRule’s response:

This statement is grossly defamatory and implies that our client will steal client funds through rigging trades. It is also wholly inaccurate as well as being baseless comment.

Coinrule is a reputable company with a public profile and presence which has been operating for 6 years and as mentioned above, Coinrule is simply a tool used by users to execute a strategy. Coinrule does not set the strategy.

BehindMLM’s response:

First of all we never implied anything – in fact, as quoted by CoinRule, BehindMLM categorically stated, “I can’t speak specifically to CoinRule …”

As for how “lulz can’t touch our money!” scams end, from our end this is a statement of fact. It is backed by sixteen years of published research.

With respect to securities fraud, CoinRule’s second paragraph is irrelevant marketing waffle.

Point 3

Quoted BehindMLM text:

CoinRule launched its passive returns automated trading scheme in 2021. CoinRule appears to be UK based and is headed up by CEO Gabriele Musella.

CoinRule’s response:

Coinrule is not a passive returns automated trading scheme. Coinrule is a ‘DIY’ strategy builder.

Coinrule is a platform that enables users to build their own trading strategies. Coinrule facilitates the strategy building process by others and does not make ‘passive returns’ as alleged.

BehindMLM’s response:

Securities law violators come up all sorts of mental gymnastics to justify fraud.

Here’s a handy-dandy YouTube video from the SEC directly addressing the practice.

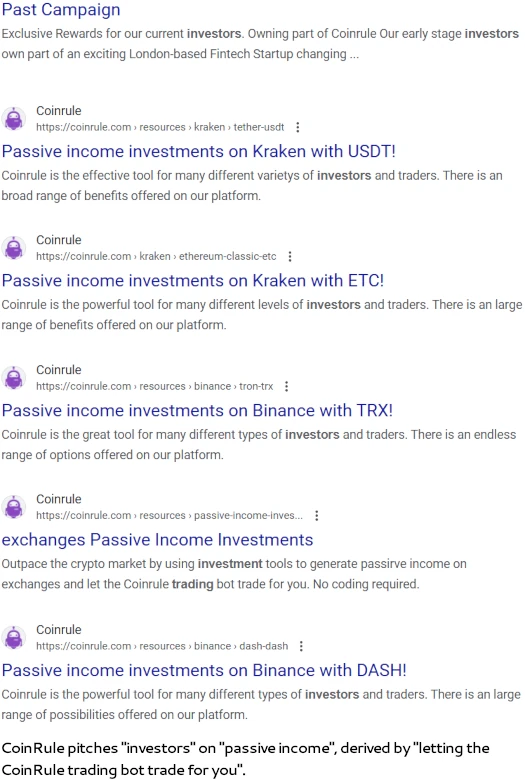

Beyond that, this is from CoinRule’s website (accessed August 17th, 2024):

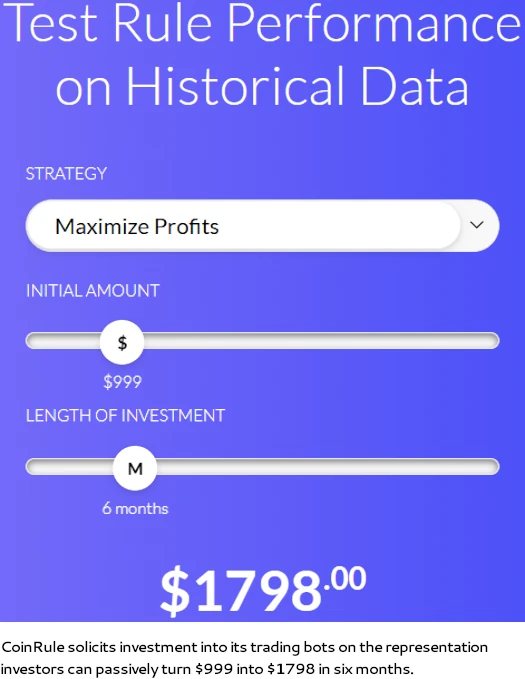

Directly below that CoinRule provides a handy-dandy passive returns calculator:

Terminology is important here, because passive returns is a prong of the Howey Test (“a reasonable expectation of profits to be derived from the efforts of others”).

Here’s CoinRule marketing exactly that to investors:

Note that while the above is search results of CoinRule’s website, each page was active “as is” on August 17th, 2024.

Circling back to the SEC’s goldfish video, calling a passive return “passive income” doesn’t change what is. Even less so when CoinRule is clearly aiming its “passive income” at investors.

Point 4

Quoted BehindMLM text:

On its website, CoinRule also advertises a $200 referral program. Presumably this means iGenius gets an undisclosed kickback per Elite member they sign up.

CoinRule’s response:

Coinrule has a referral program, which is not available in the UK due to the financial promotions regime. Coinrule splits proceeds for CForce subscriptions with iGenius.

However, Coinrule do not refer any members to iGenius nor are they in any way involved in any membership program of iGenius. It is untrue that there is an ‘undisclosed kickback scheme’ and to make this allegation is defamatory.

BehindMLM’s response:

Here CoinRule confirms BehindMLM’s suspicion that “iGenius gets an undisclosed kickback per Elite member they sign up.”

This wasn’t disclosed on iGenius’ website, CoinRule’s website or in any Cforce marketing material that BehindMLM cited. Thus, by definition, CoinRule’s suspected kickback scheme with iGenius is undisclosed.

Point 5

Quoted BehindMLM text:

That said CoinRule’s passive returns investment opportunity through automated trading should be registered with the FCA …. By failing to register its passive returns investment opportunity with the FCA, CoinRule is committing verifiable securities fraud in its home jurisdiction.

CoinRule’s Response:

This is incorrect. Coinrule does not provide passive return investment opportunities.

As a software platform, Coinrule does not require the Financial Conduct Authority (“FCA”) authorisation to conduct its activities.

This has been confirmed by the FCA. The article is wholly incorrect in its assertion that Coinrule is in breach of FCA requirements by not registering.

Further the allegation that our client is committing ‘securities fraud’ is grossly defamatory. The comment is untrue and is a serious allegation made without any foundation.

BehindMLM’s response:

As to “CoinRule does not provide passive return investment opportunities”, refer to Point 3 above.

The FCA is to securities regulation in the UK as the SEC is to securities regulation in the US.

While I can’t say for sure, I’d bet the topic of CoinRule’s advertised “passive income” investment schemes didn’t come up with any purported conversation with the FCA.

Furthermore while we stand by our factual statement that CoinRule is committing securities fraud in the UK, more to the point is iGenius’ and CoinRule’s US securities fraud.

As of July 2024, SimilarWeb tracked the top source of traffic to CoinRule’s website as the US (39%). Despite offering a “passive income” opportunity to US residents, CoinRule is not registered with the SEC.

For what should be obvious reasons, iGenius’ securities fraud is currently directed outside of the US – namely in Poland and Germany.

Polish authorities launched an iGenius pyramid fraud investigation in late 2023.

Point 6

Quoted BehindMLM text:

Under US law (the Howey Test), the passive returns iGenius markets through CoinRule’s automated trading bot constitute a securities offering.

iGenius client investors place their money under control of Cforce, which is owned and operated by a common enterprise (CoinRule).

This is done on the “reasonable expectation of profits to be derived from the efforts of others” (returns generated via automated trading through CoinRule’s bot).

CoinRule’s response:

Coinrule is a software platform. iGenius is using our client’s software to offer Cforce but they have no insight or control over the ‘contents’ of Cforce or whether iGenius has the right to offer this strategy to its members.

BehindMLM’s response:

Again, refer to SEC’s goldfish video on CoinRule referring to its unregistered passive returns investment scheme as a “software platform”.

Whether another third-party client is involved or not is irrelevant with respect to CoinRule’s alleged defamation claims.

Where it might be relevant is disclosure failures with respect to violation of US federal securities law. A third party client acting in concert with iGenius and CoinRule to commit securities fraud was not disclosed in any of iGenius’ cited Cforce marketing material.

Point 7

Quoted BehindMLM text:

iGenius affiliates connect and participate with CoinRule’s unregistered investment scheme through their iGenius backoffice.

CoinRule’s response:

Coinrule does not operate an investment scheme. It is a software platform. It is untrue and dangerously defamatory to state that our client is an unregistered investment scheme.

These false allegations again wrongly suggest our client is operating without the appropriate regulatory authorisation.

BehindMLM’s response:

With respect to CoinRule operating a passive returns investment scheme, refer to documented evidence in Point 3.

By nature of CoinRule marketing and operating a passive returns investment scheme being verifiable fact, BehindMLM’s quoted statement cannot be defamatory – dangerously or otherwise.

As it is in the US, securities fraud is illegal in the UK. Despite pitching consumers on “passive income” purportedly derived from “automated trading”, CoinRule is not registered it’s passive returns investment scheme with the the FCA.

This constitutes bonafide securities fraud, in violation of UK financial law.

Regulated activities relate to investments specified by the Treasury or to property, and include …

- dealing with investments (buying, selling etc) or offering or agreeing to do so

- investment management and advising on investments

- computer or web-based investment transactions

- dealing in securities – eg stocks and shares (or certificates representing them), or options and futures

Closing thoughts

In their complaint, ConRule goes on to waffle on some more about alleged defamation and copyright infringement;

The statements are in breach of the Defamation Act 2013. The meaning of these statements read together is clear, the author of the blogs is alleging that our client is operating in breach of FCA requirements, is involved in fraudulent activity, it is operating without the appropriate authority and is therefore committing criminal acts.

They call into question the legitimacy and integrity of our client’s business. We are instructed that the allegations are false and fabricated.

These allegations are untrue, grossly defamatory and cause serious damage to our client’s reputation and will cause serious financial harm. We request that Google delists these URLs from its search result.

Article 1 is also in breach of copyright using a photograph and extract from the LinkedIn page of Gabriel Musella CEO of our client. Mr Musella has not consented to this use.

In view of the above we require Google delist any links to the above identified pages from Google search results.

In the meantime, our client reserves their rights in this matter.

Yours faithfully

Collyer Bristow LLP

Truth is the ultimate defense to defamation claims and I’m confident I’ve more than addressed the factual nature of BehindMLM’s reporting with respect to iGenius and CoinRule’s joint Cforce securities offering.

As for copyright infringement, BehindMLM’s use of any copyrighted work is protected under Fair Use.

Tellingly, it should be noted that at no point did CoinRule reach out to BehindMLM directly.

I’ll close up by advising CoinRule and Collyer Bristow LLP, instead of going the slimy route and trying to suppress consumer awareness through attempted search result delistings, to get in touch with iGenius regarding their ongoing SEC investigation.

It’s also probably worth asking iGenius why, within days of BehindMLM reporting on Cforce, iGenius marketing videos mentioning Cforce was pulled. Also why there’s never been any mention of Cforce or CoinRule in any of Investview’s SEC filings.

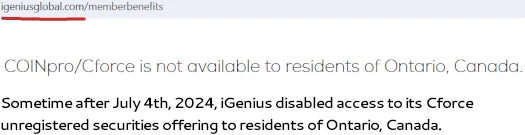

And be sure to ask why Cforce is no longer available to residents of Ontario, Canada:

We’re confident it’s not because BehindMLM’s reporting is “inaccurate and defamatory”.

Oh and of course feel free to reach out to the SEC yourselves, either directly or through Collyer Bristow LLP. For our part BehindMLM will be forwarding CoinRule’s frivolous defamation complaint to the SEC.

Suppression of BehindMLM’s research and reporting has been a focal point in at least two SEC securities fraud related lawsuits (ref: OnPassive, NovaTech FX).

People will NEVER learn to stay away from these illegal securities MLM companies. These things are just glorified Ponzi schemes waiting to implode on itself.

Where does the money go when it does? If you said “into the pockets of the owners”, then you’d probably be right. The owners will be enjoying fruity island drinks in the Caribbean.

Great stuff, Oz. Please keep us updated on the Collyer Bristow situation.

As you know, Investview is publicly traded (on the OTCMKTS, but whatever); however, the market seems to believe that all they do is mine bitcoin (which is actually less than 10% of their gross revenue; the other 90% is iGenius subscriptions.)

That’s why it’s critical to broadcast that what this company is doing is primarily engaging in fraud.

Incidentally, this pushing forward the bitcoin mining stuff is coming back to bite them. Since the halving event in April, Investview’s mining revenue has declined more than 50%. The stock price dipped below one penny US (for the first time ever, I think..)

Keep up the good work.

Happy because I can’t wait to watch this company get what it deserves, hoping this will lead to something serious not just a slap on the wrist.

And at the same time I can’t deny it’s a bit frustrating to read that an SEC investigation is ongoing 3 years after we heard about the first one concerning a similar security fraud with endotech (thanks to OZ’s work).

As during that period they had the opportunity to sell their “We’RE ReGulaTEd BY the SEC” narrative to gullible consumers all around the world who where tricked into believing that Igenius benefits from some sort of magical SEC approval for their crappy investment services they market as educational content…

Thanks Oz for the update and for always pushing back with talent!

As I read the last article published by OZ, about traders domain warning coming from Canada, it reminds me that since April 7, 2022, there’s also a warning against Igenius issued by the Quebec financial authority (AMF):

lautorite.qc.ca/en/general-public/media-centre/investor-warnings/investor-warnings-sheet/igenius-llc

That one slipped through the cracks. Thanks for catching it!

Looks like SEC settled with the company for a mere 375K. Looks like all issues behind them now?

Apex != iGenius.