iMarketsLive Review: Stock advice as a product?

International Markets Live (more commonly referred to as iMarketsLive), is headed up by President and CEO Christopher Terry and based out of New York in the US.

Describing how iMarketsLive came about, the company claims that

after years in the financial markets, a group of traders have come together with a group of marketers to create what is a perfect marriage for people who are looking for a way to create real wealth in their lives.

In a rather spammy interview conducted by Denise A. Martino (who was in the same MLM company as Terry at the time), Terry (right) reveals

I was dating a girl and she was bragging about how her boss was making $5,000 a month in some business and that I should talk to him, so I did.

He signed me up, and then my girlfriend, the very one who told me to speak to him, wanted me to quit because it was Amway! I told my sponsor that I had some problems and I had to quit. He told me, “Get rid of the problems.”

So, I broke up with my girlfriend and built Amway.

I was actually in Amway for several years in the 1990s. I was fortunate to hit levels of success here in the United States in that company. I then went overseas as Amway opened up new markets, which gave me the opportunity to have an international business.

The interview is dated August 2012 and in it Terry states that other

than the company he and Martino were in at the time (Martino was recruited into Terry’s downline), he has not joined any other MLM opportunities.

Unfortunately the company he and Martino were in is not mentioned by name, however Terry does mention that

I have no products to carry around, no juices or vitamins to purchase or sell, I did not have to sneak up on my family and friends, and I do not have to sell expensive products that I can buy in the store cheaper. We get paid to advertise. Period.

I have been approached by other network marketing companies that involve selling legal insurance, utility companies, juice companies, vitamin companies, weight loss companies, you name it! I have found that ours is so simple; our work is to advertise and it takes no more than two minutes per day.

In my experience of reviewing hundreds of MLM opportunities, nothing legitimate has ever come out of the marriage of “we get paid to advertise” and an MLM business opportunity.

One possibility is Zeek Rewards, who were the grand daddy of “get paid to advertise” at the time. If it is Zeek Rewards Martino and Terry are talking about, that would be somewhat ironic seeing as the spammy interview was uploaded on August 13th, just five days before the SEC filed charges against the company.

Note that the above is just a possibility and is not confirmed, I was unable to link either Terry or Martino to Zeek Rewards.

I did however find this tweet from the 5th of October 2012 in which Martino is promoting Wealth Creation Alliance:

At the time, Wealth Creation Alliance was a popular reload scam (micro-Ponzi) for ex-Zeek Rewards affiliates.

Other than Amway and the mystery “passive earning” “we get paid to advertise” business mentioned in the Martino interview, I don’t believe Terry has been involved in MLM. On the executive side of things, iMarketsLive would appear to be his first venture.

Read on for a full review of the iMarketsLive MLM business opportunity.

The iMarketsLive Product Line

iMarketsLive has no retailable products or services, with affiliates only being able to market affiliate membership to the company itself.

Bundled with affiliate membership is access to what iMarketsLive call the “Live Trading Room”.

The ‘Live Trading Room’ is where you can follow our expert traders to see exactly what they are doing each day to win in the markets; watch as they identify Support and Resistance levels and areas that provide the best trading opportunities in the Forex markets.

This is where the real money is made in the markets. Open from 8:30 am to 4:15 pm EST, Mon – Fri, the Live Trading Room gives you access to everything you need to set yourself up to place winning trades consistently.

iMarketsLive claim access to their Live Trading Room is worth $5500 USD.

Also bundled with iMarketsLive affiliate membership is access to a “Trade Signal Service”.

IML’s Trade Signal Service gives you access to the SAME BUY & SELL signals sent by our traders in the Live Trading Room.

We do all the hard work for you by watching the markets for hours, until a golden opportunity is spotted then with our expertise the right signals are immediately sent to you.

This gives you the freedom to go about your daily activities without worrying about finding the knowledge and/or time to analyze and time the markets.

iMarketsLive claim access to their Trade Signal Service is worth $6500 USD.

The iMarketsLive Compensation Plan

Update 7th September 2017 – The analysis below of the iMarketsLive’s compensation plan is out of date.

BehindMLM published an updated review of iMarketsLive on September 7th, 2017 /end update

With nothing but affiliate membership to sell within the opportunity, the iMarketsLive compensation plan revolves around the sale of iMarketsLive affiliate membership.

Recruitment Commissions

iMarketsLive offer a Fast Start Bonus commission whenever a new affiliate is recruited into the company. The iMarketsLive Fast Start Bonus is paid out as a percentage of a newly recruited affiliate’s membership fee, and is paid down 4 levels of recruitment:

- Level 1 (personally recruited affiliates) – 30%

- Level 2 – 10%

- Levels 3 and 4 – 5%

Residual Commissions

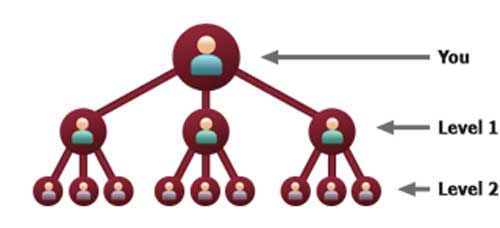

Residual Commissions in iMarketsLive are paid out using a 3×8 matrix. A 3×8 matrix places an affiliate at the top of the matrix with three positions directly under them (level 1).

In turn, these level 1 positions branch out into another three positions each (level 2) and so on and so forth down 8 levels for a total of 9840 positions.

Within this 3×8 matrix, each position represents a recruited affiliate. Affiliates are recruited into a matrix either via direct recruitment or the recruiting efforts of an affiliates up and downlines.

For each position filled in an iMarketsLive matrix, the company pays out 8% of that affiliates monthly membership fees out as a commission.

An iMarketsLive affiliate membership is $247 a month, so this equates to $19.76 commission per position filled in an affiliate’s matrix.

Note that an affiliate is not able to earn on all eight levels of their matrix unless they recruit new iMarketsLive affiliates:

- recruit 2 affiliates – earn on levels 1 to 4 of the matrix

- recruit 6 affiliates – earn on levels 5 and 6 of the matrix

- recruit 9 affiliates – earn on level 7 of the matrix

- recruit 12 affiliates – earn on all 8 levels of the matrix

Joining iMarketsLive

Affiliate membership to iMarketsLive is $247 a month.

Conclusion

I don’t really know where to begin with iMarketsLive. With no retailable products or services, affiliates being charged monthly membership fees and a compensation plan that pays out on the recruitment new affiliates, iMarketsLive from an MLM perspective functions as a pyramid scheme.

Affiliates join the company, pay their $247 a month and are then paid 8% of affiliate fees paid by affiliates recruited by themselves, their upline or their downline.

What this is attached to is irrelevant, as it is the payment of monthly membership fees that generates revenue for the company to pay commissions with.

The fact that iMarketsLive have attached this to a stock market advice service and “buy and sell signals”?

Here’s how iMarketsLive envisage their Live Trading Room will work:

That’s the affiliates at the bottom of the picture, being told what to buy by iMarketsLive’s “expert traders” up the top.

Within the Live Trading Room, you will obtain the following benefits:

-Watch Chris and his team of moderators time the markets using time-tested techniques that will be well-explained to you and other traders in the room.

-Get detailed explanations of the thought-process behind each and every single trade that is placed. We provide guidance through each trade as well as an explanation after the completion of a trade. There is always a technical reason why we trade!

-Watch how each trade is setup in real-time with exact entries/exits, stops, and targets.

-Daily reviews of each trading day, with recaps of the days trading events and our game plan for the next day. We never exaggerate results.

-Look over the shoulders of our Expert Traders and see exactly what they are doing each day to win in the markets.

The idea being you sit back, get told what to trade in, follow iMarketsLive’s “expert trader” advice and make bajillions of dollars.

Hell, the SEC are probably on their way to arrest you just for reading about iMarketsLive in this review…

Update 7th September 2017 – The compensation plan component and conclusion of this review is out of date.

BehindMLM published an updated review of iMarketsLive on September 7th, 2017.

Update 23rd December 2019 – iMarketsLive rebooted as IM Mastery Academy in September 2019.

Update 2nd May 2025 – The FTC has sued Iyovia (formerly iMarketsLive and IM Mastery Academy), for over $1.2 billion in fraud.

*sigh* These wannabes borrowed the terms from the “momentum traders”, but you can’t beat the “high frequency automated trading” already done by the biggest firms.

This is a good way to pay for something you get for free on CNNfn Bloomberg, and such, while making the “moderators” feel important and wanted.

Received the following via email, indicating that Christopher Terry was indeed involved in Zeek Rewards:

Hearsay, Oz. Hearsay.

Maybe when that “public shaming” you’re thinking of happens…

Hearsay to a point. “You get paid to advertise” was Zeek Rewards’ marketing mantra was it not.

No wonder why he has ponzi queen scammer Linda Helin as his master distributor, signs people, signs! Top it off with losing trades and well, I don’t think it will go long.

Hi…..Jan can you tell me more…Are you in the trading part?

The name of the game at the moment appears to get enough people in your downline to offset the initial payment and monthly fees.

This weekly hangout video has one of the traders, ‘Nick Stoddart’ explaining his strategy.

@John

That’s what you do in a pyramid scheme…

Sorry, I can’t James, I won’t do any program Linda Helin is in, she is bad news. Think of her name as a barometer, if she is in, its a scam, run!

I know a few people who joined, they regret it and will not pay another monthly after their included 2 months expires, too many losing trades, $247/mo is just too much to hope it gets better.

Well knock me down with a feather!

If you can’t make money by doing whatever the business is supposed to be about, and you had to resort to recruiting, then it *is* a pyramid scheme, isn’t it?

YTBI got kicked out of California because they charge a huge enrollment fee AND $50 a month for members to sell travel, but there’s almost NO MONEY in selling travel. Almost all members had to recruit to keep paying that monthly fee.

Then Attorney General Jerry Brown sued them out of the state, made them pay a million in fines, AND institute changes, AND two more states sued them later.

The only person known to financial regulatory bodies on either side of the Atlantic, from both the Executive and Trading teams, is Isis De La Torre.

Source: http://www.finra.org/Investors/ToolsCalculators/BrokerCheck/

A one page screenshot of trading results;

http://i42.tinypic.com/2drc7sj.jpg

Note the trade sizes; 0.01, 0.02, 0.04, 0.08, 0.16

To me, it looks like IML are using a Martingale staking system, where after a loss stakes are doubled, however, during a losing streak the stakes become obscenely high and the user using the Martingale system will not have enough money in their bank to cover previous losses – bankrupt.

@FiscalCliff

If you check the source of your quoted information about Isis de la Torre at brokercheck.finra.org, you’ll find that the $9,115 was NOT what she owed in a bankruptcy case; you’re unwittingly spreading misinformation.

Rather, it was a disputed charge from a creditor company called ‘DISCOVER’, which is likely the credit card company of that name.

The record shows that terms were reached: “After speaking with creditor we agreed to settle the account for $3,075.”

Big difference between a disputed credit card charge and bankruptcy.

The amount was apparently settled in 2006. I personally don’t consider that much of an item.

Oh definitely. I was just being ironic but thanks for your informed reply.

@ Julie Diligent

This is copied verbatim;

The original amount owed was $9,115.00. The creditors accepted $3,075 as something is better than nothing in a bankruptcy case.

Nowhere does it state the bankruptcy, Finra’s word not mine, was a credit card dispute.

@ K. Chang

At the time Isis Del La Torre filed for bankruptcy, her Linkedin profile shows the following;

VICE PRESIDENT

CIP CORPORATION

July 2001 – July 2006 (5 years 1 month)

Responsible for the Company’s Efficient Financial Condition, including Risk, Liquidity, Capital Structure, and Long-Term Analyses and Projections.

http://www.linkedin.com/in/isisdelatorre

Bit of a contradiction, don’t you think? On one hand Isis was made bankrupt, on the other hand she purports working in a role that is responsible for the company’s efficient financial condition.

You mean sarcastic.

Oh, I agree that it doesn’t speak well of her ability as investment advisor if she had to settle her credit card debt, but it’s her personal money and debt.

NO…Honestly. Just hoping for some humor. But I understand why you say what you are saying.

Hmmm… It seems I have somehow missed the difference between sarcasm and irony. Back to my English refresher! 😀

LO-freaking-L!

So those two scumbags are still at it?

FWIW…

http://www.moneyshow.com/marketdata/Corporate_Landing_Page/300/OTE27335/Terry-Christopher/

The subtlety might only be noticed if you were British. But that’s another subject.

Incidentally, there is a IML convention in September in Vegas.

Looks like we have different interpretations of the FINRA data, Cliff. I reckoned that if it was a bankruptcy they would’ve categorized the event as “Action Type: Bankruptcy” rather than “Action Type: Compromise”.

Anyway, if you’d care to search the Public Access to Court Electronic Records (PACER) website, as I have, which gives access to case information from federal, appellate, district and bankruptcy courts, you’ll find there’s no record in any court in the land for Isis De La Torre – bankruptcy or otherwise.

pacer.gov

That settles it for me. Case closed. Or rather no case at all.

Julie, in the UK, bankruptcy stays on record for six years and is then wiped. I imagine on the other side of the pond, bankruptcy gets deleted from financial records in a similar fashion after a certain amount of time?

The PACER site shows a record of Chapter 7 and 13 cases, even after they’ve been discharged, Cliff.

Among the 4,361 records containing the surname De La Torre, there are plenty of discharged cases going right back to the nineties. The case might be withdrawn from a credit report after a specified time but evidently it remains in the PACER database.

Julie, in principal, I will concede that point.

Source – worldprofitwp.blogspot.co.uk

Hmm everyone recruiting for IML is promising 2mins of work a day and you make huge amounts. Sickening when all the IML recruiters were Banners Broker big players and profiteers and dragging those people into another sham.

Launch report by Chris Terry:

Happens all the time at trading events, said no one ever.

Any one see similarities to “firewalking” and other rituals usually performed at cult events?

Definately sounds like one of the stranger MLM launch events out there…

Currently UK members that are showing earnings in order to entice new people in, are making that money from recruitment bonuses and not actual trading (well copy cat trading as they don’t do the trading ..)

These guys are trash. 50% have left and by years end it will be 90%.

What’s your source for the ‘50%’ claim, Dennis?

Hi, I cancelled my IML membership and lost my money in January 2014 and my downline did similar.

Chris Terry is a FRAUD. He was 100% involved w ZEEK. He also had a Credit Repair Biz that he used to commit Fraud He would create Corp Credit – Pull the $$$ out & leave some schmuck w the bill.

He also was chased out of Construction Biz – he wore a wire & testified against the MOB. Ask Chris why he doesnt have his series 7 ? Because he has a $500k Tax Lien. This guy is PATHETIC. Never Made a Dime Trading in his life.

Chris Terry is a CROOK! He is a big LIAR and a very bad trader.

Me and my team (20+) lost over $ 1500 p.p. and I know at least 30 people more who have lost the same amount.

iMarketsLive is a big SCAM! We worked very hard for that money and he stole it all…

Jan and all , I have been going through all the comments. Can you please tell me the name of the trading Scam that Linda was in? And a bit more about what she did.

I am currently looking at a company that she is in and am concerned about her involvement.

thanks

Stay far away from anything she is in. She will make money off you and it will die…..not one program she has been it survives..

What is this new company she is in??

Hey Oz have you been following this lately, and global visionariez.

I have been inundated with proposals of late and one from a lender who just happens to be an affiliate. go figure!

I was just looking around to see if I can finally find something negative, and what do you know a review from 3 years ago lol.

IML has improved so much, the value it provides is just amazing. I don’t recruit, I’ve been a happy customer for 5 months now with great trades based on the live webinars and harmonic scanner.

This company is definitely not a scam 🙂 but everyone else will think other wise.

Cool, but that doesn’t change the fact that IML affiliates get paid to recruit new affiliates.

That makes it a chain-recruitment scheme. There’s no “think” about it, it is what it is.

Look into Global Visionariez. They are starting to hit the midwest market very hard with the same shit IML did.

There is a young team under Christopher Terry acting as his minions:

Arsalan Jan

Quillan Black

Austin Godsey

Lots of kids in Dallas, Houston, etc are getting hit with this scam. We’ve been seeing lots of kids that were scammed by other MLMs now saying they are “forex” traders.

They are offering a very similar recruitment structure and a trading tool that is supposed to measure trading frequencies. If it’s that easy to trade, wall street would be dead kids.

Someone needs to let the SEC and other enforcers know because this is just sad seeing people proclaim they are forex entrepreneurs while knowing absolutely nothing about the real market.

Their compensation plan is based on everyone paying $145 per month for their software platform and expertise, and $5 per month to cover the cost of their marketing site and training.

Some people pay the $145 or $150 per month and choose to not build a referral income. They simply use the software.

Some pay the $145 or $150 per month and never do anything. That’s their choice. (Consider how many thousands of people bought Encyclopedia Brittanica sets and never opened a single book. Was that a scam?)

It needs to be pointed out that IML doesn’t handle anyone’s money or do any trades on anyone’s behalf. They provide educational services.

Is Terry perfect? Probably not. But then again, none of the commenters in this group is.

“To a carpenter, everything looks like a nail”, Oz.

which qualifies them to earn commissions when they recruit others who do the same.

This constitutes a chain-recruitment pyramid scheme. Everything else is irrelevant.

YES, IML IS A COMBINATIONS OF OVESSIZE FAKE SCAM WITH A FLORIDA UNHONEST GREEDY GUY WHO COVER UK LIERS WHO STEAL MONEY FROM ALL OF US.

Someone from uk contacted me many time and convince me to make money and on 1-13-2016 i payd $200 and $150/mo.

After one week, the uk iml scammers warning me if i don’t pay other 1249Euro, ill don’t make any money with iml.

I realised that it is a real scam and i ask to cancel and refund before 15 days and they refused to refund. I dispute my credit card, and they rejected the refund of my $200. So wht can i do to get my money back?

Thank you to that person who can help me in this bad case. Livia

IML it is good or not A1 vision just began in montreal , canada , alot of my friend are going to joined this and they what to involved me

Livia Vlad,

I call your bluff! IML has a 14-day moneyback guarantee.

Probably the posts from 2013 got one right. The concept was being born and like all visions needed to be perfected.

Since late 2015 the company actually has thrown some value to the market place and there’s some more couple of thousands of young traders getting rich fast.

I been in there and it was really beneficial has I paid the lousy 150$ a month to be educated and hanging with people with the same mind set.

I would of stayed but now I trade for myself and mostly thanks to iml. So haters just go back to your regular 925 fast bcuz the clock is running.

Livia, you didn’t ask for a refund until AFTER the 14 day money back guarantee otherwise they would have gladly refunded as they do with many people who cancel.

Also you were never asked for 1249 Euros extra. No one is ever asked to give money to iML. The only money you give to iML is to pay for the subscription fee for the service, which of course you can cancel anytime you wish so there’s no long term commitment.

Hope that helps clarify things a bit for those reading Livia’s comments.

Does any one have statistical performance records about the advice given by this whatchamacallit? i.e. how good are the shots called? Or is it really more of a random dart thing?

The pyramid scheme definitely is the way to make money and a lot however you can make it trading as well or so I’m told.

I’m in contact with a friend who I met in Cali trying to get me on board with him so he can add to his team internationally. I know the guy a few months and I’m usually a good judge of character however one thing I learnt from living in California is everyone’s intention leads back to money.

Although I know he spent a lot of time learning forex from reviewing him the last few months he seems to have gone about this specific IML marketing scheme which he tells me I’ll learn too when I join.

The scheme seems to be basically post about your trade wins to draw attention, show people that trading is your passion and then wait for them to latch on and pull them in.

I did my investigation and can’t find a single bit of information on success rates of the all mighty cash printing harmonic scanner. He insists it is high and while you learn how it works you can invest in there 5 different autotraders.

You can tell from researching that there is clearly some sort of hold on the information around IML every review links to an affiliate and this is 100% part of the marketing campaign. It looks like they’ve used the affiliates to swamp the market.

My decision before joining and investing is down to trusting this friend, if he really wants me on board then even if the trading Isnt legit something can come from it.

Oz, This directly links Chris Terry to Zeek Rewards….

bizapedia.com/ny/PENNY-COMPOUNDING-WIZ-INC.html

IML Assassin. Sorry, but what has “Penny Compounding Wiz Inc” got to do with Zeek?

So did you guys find any bugs in this? I mean if it’s just to learn trading etc what could go wrong? Is this thing even legal ?

i heard it was legal since you had full control of your money. Am i right?

There’s no retail, everyone is an affiliate which is a problem in MLM (see FTC vs Vemma).

There’s also investment advice being given, and iMarketsLive aren’t registered with the SEC (or any regulator for that matter).

Can’t find direct link from Christopher Terry to Zeek. There are rumors that CT was involved in Zeek AND BannersBroker, but I think Lynndel would know more about BB than us.

This is a legitimate business. I’ve personally made a lot of money because the trainers that give the calls actually know what they’re doing. I’m impressed.

I was very hesitant because in the past ive been fooled by a couple of these payment scheme businesses. I’ll keep you posted as to how my interactions go with the company

I just stumbled across their videos. They make it look like that one MLM that blew up… literally. Wake Up Now.

Im thinking IML is the same concept, but they justify it with Forex Market trading. I am still really new to the trading scene, but im learning alot and practice different strategies with indicators.

The Hilton, you’re actually right, almost all of their “leaders” are from WUN originally. You can still find old youtube videos of them hyping up wakeupnow the same way they do iML haha.

And global visionariez is a team under iML, they are the same thing. Austin Godsey and Arsalan Jan share an account in iML and are the founders of GV.

Am considering joining primarily for educational purposes as I have been studying fx trading myself. However I need a boost in my techniques.

Trying to decide on which indicators & strategies to use. Been researching & kind of locked in on a combo of ichimoku & bollinger band depending on trends supported with rsi, stochastic rsi, & candlestick analysis.

I’m wondering what techniques & strategies the automated system & signals use?

I’m ordering the encyclopedia of candlesticks for myself. Just wondering if I should pay the fee for the add techniques & support if these ‘advisors’ are really any good, or continue on my own volition? Any thoughts?

well from the looks of this being pimped by KR you can try it out for a buck. this was over on the realscam board I am not even sure what a more favorable customer/business rating is? if they are making money for their clients and are legit.

Ken Russo says in the title of his latest email and I quote…”Urgent Program Update – IML Needs More Customers – Awesome Opportunity For You”…. SMH… LMAO….

Quote Originally Posted by Ken Russo

I’ve been reading through these comments, and it seems that people don’t understand that there are several retail products (all come for the $145/month subscription fee):

(1) the Autotrader (allows you to mirror in your forex account what other expert traders are doing in their accounts) – I am using this and it is working.

(2) Live Trade Room where you are with Christopher Terry as he examines the markets and calls trades. These you place in your own account.

If you want to place your own trades, you should have a separate forex account than you do for the autotrader, otherwise you could affect the results (USA has first in first out, no hedging rules – so if you place a trade and the autotrader wants to place an opposite trade, it will not be able to because of the USA regulations).

(3) Harmonic Scanner – this signals harmonic patters which are often very high probability trades. But they are not all winners, you need to review the accompanying educational info to increase your odds of winning when you see a pattern develop.

(4) Educational videos to help you learn to trade forex.

The fact that people earn commission if they refer others does not take away from the fact that people are paying for a subscription to these products. If you were a life insurance salesman, you would be earning a commission on what you sell – even though the person you sold the policy may never use it.

You would even earn commission on a policy that a sub-agent sells. Just because a product is not a hard, tangible object doesn’t mean it is not a genuine product.

FYI – the compensation plan has just changed to require that you have 55% retail customers in your group – in other words, if all you have are other affiliates, you won’t earn from the plan.

The company wants it to be clear that they have a product that stands on its own, one that people can benefit from. If you subscribe as a customer, you don’t have to recruit anyone and you can still make a great return on your money, just through the autotrader.

There are several expert traders to choose from, most making over 100% in a year. You won’t find that kind of return with many other money managers, especially for $145/month.

If you want to see their past history, go to (affiliate link removed) and click on the “FXSignals Live” under the Products menu. From there, click on “Traders” and then you can click on the 5 traders to see their performance. You will see winners, losers, and their stats.

One last thought – your money is not held with IML. You setup a separate account with a Forex broker, whether it be to use the autotrader or to trade yourself.

You can do both if you have two or more accounts with a forex broker. If you aren’t satisfied, you can always withdraw your money from your Forex broker.

Yes, I am an affiliate, but I am also a customer. I have made money without sponsoring anyone.

Money goes into iMarketsLive and “autotrader” provides a passive ROI based on the efforts of others. That’s a securities offering.

Have iMarketsLive registered with the SEC yet?

iMarketsLive is not in control of anyone’s money. They are not trading securities for anyone, they are providing education, signals, software… but it is up to the individual to decide whether they want to follow it, how much they want to risk, etc.

Since they are not money managers or introducing brokers, they do not need to be registered.

The ROI is not entirely based on the efforts of others, it is up to the individual customer to make their own choices based on the info they receive whether they want to take a trade, how much they want to risk, etc.

You can choose to discontinue with the autotrader, lower or increase your risk with it – the autotrader is simply a signal/software that you can setup to work on your account, much like an Expert Advisor or other software.

You are paying for the signal, the education, not someone to make all the decisions, though if that is your choice, you can do that too.

Right but… I pay money to iMarketsLive, something something auto-trader and I get a ROI. That’s a securities offering.

So uh, are iMarketsLive registered with the SEC yet?

They might simply have forgotten to register with the SEC, in which case someone can call to let them know.

Otherwise they know that they would not be approved by the SEC. But we all know that anyway.

OZ, that is incorrect. You do not have your forex account with iMarketsLive. You have your money with an independent forex broker who is registered with the SEC.

You pay a subscription for software/other products to iMarketsLive – it is you who decides what to risk, when to stop if you want, etc. If you want, you can close trades that were opened by the autotrader – you are in control.

Suppose you wanted to benefit from the autotrader, you would open an account with a registered forex broker like FXCM and you would put your funds there. So say you put $1,000 with FXCM. iMarketsLive has no access to that money, they are not trading that money. YOU are the one who has control of that account.

If they were in control of that money, then yes, they would need to be registered with the SEC, but they are not in control of your funds.

There’s a cliche in the real money pro industry… “Those who can, do. Those who cannot, teach.”.

However, strictly offering advice is not illegal or needs to be registered and licensed.

It’s also not illegal to do “copy trading”, (i.e. I just ape someone else’s trades, subject to my confirmation which I place THROUGH my own broker) or to offer copy trading services as long as the person doing the actual trade is registered and licensed (which need not be the person giving the signals / trades to be aped).

The main problem is referral marketing… getting paid to refer others while you yourself is a customer, essentially getting a discount.

Yes – a cliche, not necessarily true.

Referral marketing is a perfectly legal way of building a business. Instead of a company paying to advertise on TV, magazines, etc. they pay people to market their products. This is no different than hiring a salesforce and allocating a certain percentage of your profits to pay that salesforce to bring in more customers.

The difference is that the salesforce are not employees, but independent affiliates (like independent contractors).

You said “The main problem is referral marketing… getting paid to refer others while you yourself is a customer, essentially getting a discount.”

I would not look at it as getting a discount. I would look at it as getting a commission for selling a product. Why would it matter if you’re buying/using that product as well?

Banks, ISPs, and other businesses may use referral marketing, giving their customers bonuses (Visa Cards, bonus points good toward something, etc.) for referring new customers.

It is completely legitimate. The main issue is whether people are actually paying for a product and/or if the company/affiliates make unrealistic promises.

Referral marketing is legal. It usually goes by a different name: affiliate marketing.

Referral SELLING, however, is VERY illegal.

— mlmlaw.com NOLINK://mlmlaw.com/law-library/guides-reference/multilevel-marketing-primer/#referral

Sounds like they can do all the above.

Yeah I think they need to register with the SEC don’t you think.

Else you are just blowing smoke!

@Terrence B

Suppose you subscribe monthly to Verizon Fios. You are paying for their signal, their content, the box/software that allows you to see the programming. You can easily change the channel if you want to, or you can just keep it on the same default channel it was on when you first subscribed.

Would you say that Verizon is in control of what you watch. Not at all – you are the one who can switch, turn it off, etc. You’re paying for access to their content and you decide what you want to do with it.

The same is true with IML.

They do not need to register with the SEC. If they were handling the money in your account, earning a commission from trades they place, then absolutely, they would have to. But they don’t manage your money, they don’t earn commissions from your trades. They simply sell a product and you choose how you want to use it.

@K. Chang,

Things are not as black and white as you suggest. If that were the case, network marketing would be illegal and all companies like Amway, etc. would be out of business.

iMarketsLive pays commission to independend business owners (IBOs) as if they were independent contractors. Businesses are able to hire a saleforce, are they not? Is it illegal for a salesperson to purchase product from the company whose products they are selling? No.

@Don

So what exactly is “auto” about the auto-trader then? Shouldn’t they have called it “manualtrader”?

Not in MLM. If a company primarily generates revenue from affiliates (close to 100% internal consumption) it’s a product-based pyramid scheme (see Vemma litigation for a recent example).

Oz, the autotrader is an application that is used to mirror trades. You set a risk parameter – you can increase it or decrease it. Trades will be placed automatically based on your risk criteria. But you can still control when they are closed.

This is because your forex account is with a forex broker, not IML, so if you want, you can use the broker’s platform to view and manage trades that were placed by the autotrader. If you want to, you can place your own trades, though this might interfere with the autotrader’s ability to place trades (no hedging in the USA).

If you see trades that have been opened by the autotrader and you’re thinking that the market will reverse and you’re happy to take the profit, you can close the trade. You are in control, the autotrader allows you to automatically mirror the trades of an expert, but you are not tied to it.

Of course, if you place or close trades yourself, your return will differ from that of the expert you’re following.

You said: “If a company primarily generates revenue from affiliates (close to 100% internal consumption) it’s a product-based pyramid scheme”

This is why IML requires 55% retail customers to pay out commissions.

Who owns the software?

That’s fair enough, I was countering your assertion revenue generated primarily from internal consumption only was a viable MLM business model.

Wouldn’t your sponsor be better off having you be one of his retail customers?

I am not suggesting. I am quoting an expert in MLM law. We are quite sure Amway had dotted the i’s and cross the t’s. Their legal department would probably outnumber iMarketLive’s entire operation.

What’s your counterpoint other than the special pleading fallacy, i.e. “I can’t explain it but surely there’s an exception to what you said”?

@K. Chang,

With network marketing, an independent business owner is not simply “referring people”, he is the point of sale, he is the one telling a potential customer about the products of the company – so technically, he is an independent sales person.

He has a written agreement with the company that allows him to function as a 3rd party (independent) sales person and he is compensated for sales with a commission. This is similar to a company like Best Buy that can sell phones for Verizon – they show people the product and they get compensated when a sale is made.

The part you obviously don’t like is the idea of building a sales force and being compensated for that.

If you start a company with the intention to sell Verizon phones and you bring other people into you company, training them, helping them to know the features of the product, how it can benefit people, what accessories people may want to buy with the phone, etc. – you are not going to do all of that without compensation.

You would expect to earn part of the proceeds of the sales they make, after all – you’re the one who put in the time and effort to help them succeed, and so you have shared in the effort of the sale.

This is how real estate brokers, insurance brokers, etc. work. The broker has the resources, the experience and know how and the realtor or agent they’ve brought into work with them benefits from that in exchange for giving a portion of the sale commission to the broker.

What is not legal is if the compensation plan is not based on the sale of a product or service. If it is simply a recruiting mechanism without value, then it becomes a pyramid scheme.

As I’ve said several times, iMarketsLive requires an Independent Business Owner to have made retail sales (to non-IBO customers) to qualify for commission.

If a customer becomes an IBO, he will need to generate another retail sale to make up for that – this puts the focus of an IBO on retail sales of the product.

IML has no retail price for its products, so affiliates and retail customers pay the same price. how do you then differentiate between affiliates and retail customers. do you simply label non recruiting affiliates as retail customers?

such a definition of ‘customers’ doesn’t fly. ask vemma.

IML is USA based, and needs to be registered with the SEC as an Investment Adviser.

this is how the SEC defines an investment adviser:

IML satisfies all three requirements for an investment adviser.

whether or not you have ‘final’ control over your trades is not the issue. any person/firm providing investment advice for compensation needs to be registered with the SEC.

so, is IML registered with the SEC or not?

sec.gov/about/offices/oia/oia_investman/rplaze-042012.pdf

It’s not whether I like or not, but whether the law will accept that as legal. Right now, there is NO difference between an affiliate, and a customer, other then customer has no downline.

If you have to become a customer first, THEN an affiliate, then you have referral selling, because you are basically getting discount by referring other customers and your pay is contingent on them buying in.

If majority of affiliates joined WITHOUT being a customer, then it’s for sure a sales force.

But if most of the affiliates started as customers, then there is HEAVY suspicion of referral selling, which is ILLEGAL, as per MLM lawyer.

It has nothing to do with LIKE or DISLIKE. Don’t bring emotion into a factual and logical discussion. It muddies the waters.

This has gone unanswered, but the reason I brought it up was because we all know iMarketsLive own it.

Based on what Don says here:

Autotrader has access to customer money. Autotrader manages the money automatically based on iMarketsLive’s trades.

Effectively iMarketsLive are managing customer money through autotrader, on the promise of a passive ROI.

How is this not a securities offering again?

listen in to the radio interview with kevin thompson, MLM attorney, which i have linked below.

he clearly says that compulsory autoship or having most affiliates on autoship is unacceptable to the FTC and courts.

bundling product with such autoship, does not necessarily mean that the compensation plan is based on the sale of a product or service. the court looks for the ‘intent’ behind the affiliates purchase of products on autoship.

in IML affiliates do not enjoy any product discounts, so that cannot be the intent behind their autoship.

moreover IML affiliates have to be on autoship to qualify for commissions, and earning such commissions are construed by regulators and courts, to be the Primary reason for being on autoship, instead of real product value.

you really must check out FTC vs vemma and stay abreast of the times.

commissionable autoship has had a free run for a long time in the MLM industry. but now, as thompson says, the ‘police are on the streets’, and IML needs to rethink its comp plan to survive.

mlmnation.net/169-kevin-thompson/

Oz, if you have a forex account, your funds are with a broker like FXCM, NOT with iMarketsLive. How you trade with those funds is entirely up to you.

You can choose to go on Twitter and see what other traders might be doing, you can choose to buy a robot that places trades based on signals – whether following it’s own indicators or trades of a 3rd party.

You are the one in control, even if you’ve set the software to trade automatically. Why – because you decide on risk, you decide on whether to turn it on or off, you are the money manager.

Anjali, IML has revised it’s compensation plan as I mentioned in earlier posts. They require retail sales to customers who are not Independent Business Owners (IBO) before qualifying for commission.

They also do not require you to purchase the product to be an IBO. You can be an IBO for just $15/month which covers tools you are given (website, training, company support).

K. Chang, I brought like/dislike into it because you didn’t seem to want to look at the changes IML has made. They have split the IBO/Customers apart.

Yes, you can obviously buy the product as an IBO, but you’re not required to. You also need to make retail sales before qualifying for commission.

Through use of autotrader, iMarketsLive access affiliate funds and trade with them – with the aim of generating a passive ROI for the customer paying them fees.

How is this not a securities offering?

an IML compensation plan video published by a ron crane on march 20, 2016, mentions that a ‘retail customer’ can upgrade to an IBO, by paying a 5 $ fee.

the rest of the video is all about ‘recruit recruit recruit’ and unlock great wealth! nothing about the product, nothing about product retail.

i think IML affiliates will run around signing up people as ‘retail customers’ who will then pay a 5$ fee and voila! they will become IBO’s, as they intended to be.

sounds like ‘compliance’ BS to me [lets consult an MLM lawyer and ‘appear’ compliant!].

Yep Anjali. You’ll notice he didn’t address my very simple question reposted below.

Since Don said he wasn’t sponsoring anyone.

If their retail customers become IBOs, they need to sell to additional retail customers or they will not be paid commissions.

If you want to build a business, you really want both customers and IBOs. Looking at a short term view, yes, it may be better for my sponsor to have me be a customer only, not an IBO. But, just like any sales force, more sales are made by many giving some effort than one person giving 100%.

So in a longer term view, it helps to have other IBOs you’re training/working with to be more successful. It’s the same with any business, if you want to expand it and be more profitable, you need more sales people.

I have not sponsored anyone yet. I hope to build a business with IML, but I’ve chosen to try the products first to make sure they are effective before I really start working hard to sell it to others.

If you weren’t sure, why did you sign up right away? Gosh how did you even know you could turn this into a business?

Well that’s a silly question. Obviously I see the potential with iMarketsLive. I signed up with a twofold purpose: (1) to benefit from the products, (2) to build a business.

Is it strange for me to want my own personal testimony of a product before heavily promoting it?

don, cut the bull crap about IML’s ‘pretend’ retail. you have no retail price and a 5$ differential between ‘so called’ retail customers and affiliates.

christopher terry goes and changes the comp plan to ‘appear compliant’ but forgets to introduce a retail price? why?

if IML has such banging products, it must prove that people are willing to buy it at retail and continue services with the company month after month.

right now, IML has 100% internal consumption and cosmetic changes like a 5$ differential between customers and affiliates will not withstand the scrutiny of a regulator or court.

BTW do these comp plan changes have anything to do with the FTC asking questions?

a ripoffreport published by a James Chaston on april 22, 2016, has made some pretty strong allegations against terry and IML.

the report can be read in its entirety on the ripoffreport site but here are some interesting allegations made:

ripoffreport.com/r/iMarketsLive/New-York-New-York-10111/iMarketsLive-IML-Chris-Terry-Pyramid-Scheme-IML-Sinking-Ship-terminated-me-and-took-al-1301332

IML has a virtual office address at:

45 Rockefeller Plaza Suite 2000 New York, NY 10111

apparently, christopher terry operates his IML business from his hotel room where he lives.

with no office and no home address, how will IML affiliates contact terry if IML goes south?

i’m just surprised that terry, who can apparently sell great trade signal advice to his affiliates, has not made enough moolah himself, to afford a home or office.

there are complaints on the net that the contact phone provided on the IML website is never answered and there is no response from the ‘support’ email too.

call me suspicious, but IML does show signs of being a shady fly-by-night operation.

So, (1) buy from yourself and, (2) teach others to do the same.

Btw, thanks for the lesson on how to expand your sales force. And, good luck finding those retail customers. You know, the ones just like you.

How much experience do you have with MLM anyway?

Hey everyone, what is true is that’s a scheme for sure.

Why would you reffer someone to get a comission while you can “apparently” trade a position for sure, then put $1000 on a signal they provide or following their scanner or auto trade, and you will get more money than any of these guys trying to sell u the product…. SO….? What the hell ?

I noticed a lot hide their balance or the “profit and loss” part on their screenshot of their MetaTrader results… Plus as one of yall said before, they are only showing us low earnings.

Maybe just to get us to their product, cause if you do that money and you’re introduced to forex, you’re supposed to show us 5 zeros on your earnings.

Is there someone here that can prove that he made money following their soft or recommends ?

Ridiculous – no thought at all in your comment. I am buying from the company, not myself, not another IBO.

Yes, an IBO introduced me to the company, buy I pay IML for products/services: the signals, the live trade room, the harmonic scanner, the education.

The retail price is $145/month for the products. If you want to be an IBO, you pay $15/month.

You can choose to just be a customer, you can choose to be just an IBO (not pay for the $145 product), or you can be both.

If you found a system that makes you money. Why wouldn’t you share that with others? Why not profit in both ways?

Because selling people on the system is WAY more profitable than taking a chance on some sort of signal.

Plus for the dumb guy that just paid to join and has no money to do a trade guess what he will be doing?

So you are fooling no one here saying you can do both. Its quite obvious why its being sold and told to others

Guess when you done losing on trades you can always dupe someone to join under you as well.

Have fun.

I post this:

Don’s answer:

Judging by the way he’s been talking, I believe we have ourselves a newbie who has just discovered mlm. Oh joy!

DON ARE IML IBO GETTING PAID COMMISSIONS OR NOT?

Here is another Chris Terry program: circleofwealthgroup.com

I do have a question and possibly some food for thought. Is is possible that Terry and his top people are trying to manipulate the market be giving false signals through their scanner and advice.

If a mere $5 separates them, you may want to look up Burnlounge decision, which was sued into oblivion by FTC.

They “divided” the “moguls” vs. regulars apart too. Though their threshold is $6.

Hi, Can someone confirm if IML members are being paid commissions or not for referrals?

Some say yes some say no, whats going on ? Are they paying now or payment processor problems etc??

Not getting paid is a HUGE Red Flag. Do not accept excuses like payment processor problems.

If they were on the up and up they would find an alternative way to pay you like PayPal, a bank wire transfer or a money order.

IML offers you products that you can find at lessor cost somewhere else and in some cases free. Sometimes it pays to research all of the yourself.

intheknow, people like you are the problem with sites like this. nobody is saying there not paying, I was just asking if they are paying or not as the rumor mill is going.

IML offers great products, live trading rooms, harmonic scanner and auto trading, where can you get these products for less?? for $200 per month its a bargain… look your other comment

… dude its impossible for them to manipulate a 5 trillion daily market. Keep your silly statements to yourself please.

We are all entitled to our opinions and statements. Rest assured that the SEC is watching sites like this one and ALL the sites the Terry is involved in.

Be careful my friend of your involvement in this or any other MLM. No one needs the FBI or the SEC at their front door asking questions that they can not or do not know how to answer.

Perhaps you should read the this entire site to get the whole story. Get out while you can or be prepared to find yourself a good attorney.

You have seen the BIG RED FLAGS and you are ignoring them. Step back and reevaluate.

Oh and I am sure that you can get these tools a lot of them FREE for less the $200 per month. Just do the research.

So all the fools that were pimping IML have moved on to a new venture called Kaizen Global, run by the real Teflon Don of Forex, Reza Mokhtarian (formerly of Capital Trust Markets/CTM Group) and Mentor Tips.

This keeps getting worse and worse..

& LOL You don’t have to worry about the FBI or the SEC knocking down your door for being a customer of these MLM’s. If anything these customers are * VICTIMS * of good marketing and getting sucked into the hype, like I did.

I do NOT recommend joining IML, Wealth Generators, especially Kaizen Global.

Honestly, do you really want to pay $169 a month to hear Reza Mokhtarian complain about where to spend his money while you are struggling with a $500 forex account?

I purchased IML platinum package for the harmonic scanner indicator, mirror trader service and occasionally I visit the live trading room. It cost me 195 first month and now it’s 145 per month.

I can’t comment on the referal side but the product is definitely good value for money and I’ll continue using it.

I don’t know why person above refers to cusromers as victims you know what your buying in advance and have 7 day refund period.

Some of my trading friends want to join so I guess I could become an IBO and refer them.

Anyway lots of people commenting here that have no idea about trading or products which iml offers.

You don’t have to be licensed by sec to provide signals as it’s just someone else’s analysis.

I was in IML for about two months, it actually wasn’t bad, but I found alternative products that were better.

Christopher Terry is a legit trader. However, the products and how to use them were not explained properly or at all and some of the YouTube videos from their marketers are just outright misleading.

The “victim” thing, yeah, I am referring to the group known as “Global Visionariez” a excellent marketing/social media group that pumps up these groups for their own profits (which is fine).

Young kids are getting sucked up into this hype, but it is really their association with Reza Mokhtarian, of Capital Trust Markets which I find disturbing.

oz, i think i remember seeing an article here a few days ago about alex morton joining imarketslive?

am i mistaken or have you removed that article?

on august 12th, 2016, ted nuyten of business for home reported:

Not an article I noted it as a comment on one of the Morton Jeunesse articles.

so, alex morton did not last even an year with jeunesse? did he have a fallout with the management or did his recruitment dry up?

whatever the reason, morton seems to be traveling downwards in his career graph.

at least vemma and jeunesse had some semblance of a structured corporate entity.

imarketslive has a virtual office address, and a CEO who sits in front of the kitchenette of his rented hotel room, to give corporate updates.

imarketslive has no product and sells memberships. the recent comp plan changes which include retail requirements, look good on paper, but unless christopher terry releases real data about retail sales, i wont be inclined to believe him.

the comp plan states that IBO’s can join for a fee of $15 a month without purchasing the membership, but encourages IBO’s to purchase the platinum membership:

it will be interesting to see how many IBO’s have NOT purchased the platinum pack – the numbers will be very low.

i suspect everyone joins as a retail customer, and once they find someone to recruit they pay $15 and become an IBO. this is not true retail as the intent behind the purchase is to become an IBO.

morton has begun his journey downwards from grey but somewhat respectable MLM companies, to the shadier underbelly type of MLM. he’s young and he’s hit the self destruct button pretty fast.

alex morton is over.

IML affiliates are incredulous all over facebook because the great revered MLM magician alex morton has joined their ranks.

it’s like alex morton will personally ferry them to success and wealth and will change the ‘game’ for them.

but alex morton did not change the game for jeunesse at all. juenesse is in a downward spiral even today and may crash soon.

IML affiliates have great expectations of morton and he may just fail them.

in a recent photo on FB, alex morton is seen addressing a rather young audience. i hope he’s not back to trapping students into autoship again. the FTC needs to whack this guy.

Does anyone know what a pyramid scheme is?

Getting paid to recruit new affiliates.

In MLM this extends to having little to no retail activity taking place.

Anjali, Have you heard about Kaizen Global ran by Reza Mokhtarian (formerly of Capital Trust Markets/CTM Group Ltd.?

Most of the promoters, aka “Global Visionariez” are pumping this thing hard.

besides roping in alex morton [possibly with a backroom secret deal?] IML has engaged the law firm of spencer reese to tweak its comp plan and be ‘compliant’.

troy dooly has been hired as an advisor to christopher terry, and accordingly dooly has started ‘promoting’ IML.

dooly parrots the IML website’s claim that terry is a 8 figure earner in trading, maybe he should personally check this out before possibly misguiding people!

dooly also ‘prepares’ his audience for the negative info about terry and IML they might run into on the net:

dooly has had long conversations with terry and is going to meet him in his office, so i hope he will ask terry about his new ‘compliant’ comp plan in which affiliates and customers both buy the product at the same price, and are differentiated by a $15 affiliate fee.

as IML affiliates are not ‘forced’ but ‘encouraged’ to buy the product, maybe dooly can check out how many affiliates have indeed bought the product.

all i can see is some psuedocompliance BS, where non recruiting affiliates are going to be passed off as retail customers.

alex morton seems to be a bad luck charm, so dooly surely does not want to be pitching the wrong MLM after his run in with the regulators in zeek.

a dooly endorsement is as good as a nehra endorsement at this point.

Anyone having real results from the signal system IML is offering? I’ve heard that Wealth Generators signal services, which is similar to what IML is offering, are going to any direction and a lot of ppl are quitting. Why IML is different?

Also, there is another called Kaizen Global and seems like a scammer.

I really wonder if IML signals are different from WG or Kaizen G. otherwise I wouldn’t pay for crap. Also heard signals are free online.

Any thoughts?

I have traded for many years and very good at this as well, I am 39 years old and retired this year foerm my Job.

I also Looked at IML did alot of research Like anything in life its a opportunity only if you take it and move forward with

The tools are world class n the train for young people well online is great for the

Thank you Christopher Terry thank Rob King of IWC and all that are amazing Total Gratitude to yo all.

No comments for 7 months. Is this system still going?

for the Moment some People are active in the austrian Region and via a closed Facebook-Group…. cannot tell how active they are … and they offer also “auto-trading” just pay in and get passive income out…..sounds like an securities offer 🙂 ……

from my Point of view this is not allowed in Austria (or Germany, where it came from to Austria), but somehow they made it without beeing charged by any authorities….

Hi Oz and everyone, any updates on IML? Thanks.

None on my end.