DAO1 & Apertum fraud warning from Latvia

DAO1 has received a fraud warning from the Bank of Latvia.

DAO1 has received a fraud warning from the Bank of Latvia.

As per Bank of Latvia’s December 5th DAO1 warning;

The Bank of Latvia warns about offers of DAO1 and related products, the provision of which has not received appropriate permission in Latvia.

DAO1 promotes its services in the digital environment – through webinars and social media channels, including in Latvian.

DAO1 claims that its participants can earn passive income through automated trading and artificial intelligence robots that analyze the market and execute transactions automatically.

The Bank of Latvia points out that trading in any form of crypto-asset investments poses significant financial risks and urges caution and not to use such offers.

Offering unlicensed investments to Latvian residents is illegal under Latvian financial law.

Bank of Latvia specifically cites DAO1’s website and the website of Apertum Foundation.

DAO1 is a fraudulent investment scheme built around Apertum Foundation’s APTM token.

DAO1 and Apertum Foundation are run by convicted fraudster Josip Heit and several accomplices.

Originally from Croatia but believed to hold a German passport, Heit launched DAO1 and Apertum Foundation after GSPartners collapsed.

GSPartners was a fraudulent investment scheme built around its G999 token. For all intents and purposes, DAO1 and Apertum Foundation are a continuation of the fraud Heit started with GSPartners.

GSPartners collapsed in late 2023 following over a dozen regulatory fraud warnings from North American regulators.

Heit settled GSPartners fraud charges with North American regulators in September 2024. As part of the settlement, which remains ongoing as of December 2025, Heit agreed to refund GSPartners victims in settling jurisdictions.

In addition to Latvia, DAO1 and/or Apertum Foundation fraud warnings have been issued by Germany, New Zealand, Australia and Lithuania.

DAO1 website traffic has been in steady decline over the past few months, dropping 40% month on month to just ~22,700 monthly visits in November 2025.

As tracked by SimilarWeb, top DAO1 website traffic sources are Germany (62%), the Dominican Republic (24%) and the UK (8%).

DAO1’s website traffic decline corresponds with APTM’s public trading value tanking.

APTM reached a new all time low of 39.2 cents on November 26th, 2025. The decline is believed to be due to DAO1 executives and investors cashing out, outstripping internal trading and the declining rate of new investment.

In response to DAO1 and APTM collapsing, DAO1 recently informed investors it had a “zero tolerance policy” against investors “spread[ing] negativity”.

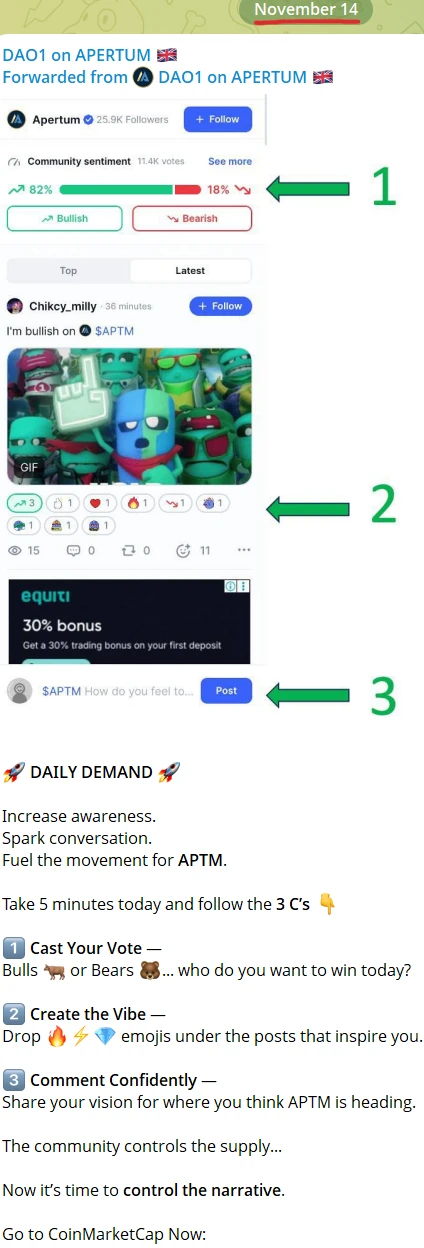

DAO1 is also begging investors to engage in astroturfing on CoinMarketCap and other social media platforms:

As per CoinMarketCap’s official Community Rules;

No user should manipulate or provide incorrect information to other users, spread rumors about a particular project or coin, or use community power to cheerlead or bash any project and try to drive the opinion of a certain coin or project.

Users shall not create multiple accounts to post similar messages or opinions either.

No users should post information about selling or buying any illegal goods or services, or reveal any unlawful actions.

As of December 2025, DAO1 now has five fraud warnings against it. Whether CoinMarketCap takes any action remains to be seen.

Looks like DAO1 is completely lacking in MiCA compliance for the whole of the EU.

Hearing that the company is re-opening operations and all accounts we opened and ready to earn again starting Jan. 1? Any rumors of this?

Is it a company? I thought it was a decentralised investment opportunity 😉

What happened to all of the US & Canada authorities suits and complaints? Anyone know what this CertiK audit is all about?

Nothing. There’s been no updates on settlement proceedings so they are all still in place.

Certik isn’t a regulator, nor do the audits they do have anything to do with securities and commodities laws. Within the context of regulatory compliance, a Certik audit is meaningless.

Okay, but WHAT is the CertiK audit outside of securities and regulatory laws? What does it mean outside of securities and regulatory laws?

“Hay guyz we have a smart contract. Certik confirmed we have a smart contract.”

As opposed to an actual financial audit done by a third-party which is then submitted to financial regulators (legal requirement for investment schemes), Certik’s audit is meaningless.

It’s the crypto investment scheme equivalent of a shell company certificate.

CertiK is a crypto investment scheme?

Not as far as I know.

Johnny5, yes I also heard that the company is reopening in the US and Canada in January. All accounts will be reopened.

There are LOTS of warnings and cease and desist orders against this company which seems to be worldwide. Has the company been fined by any of them?

Georgia issued a $500,000 fine. That’s suspended pending the outcome of the North American settlement process.

Was the fine against the company or an employee of the company?

Search bar is on the top right of every page.

Is there any word on the re-start on the 1st? Both up lines I have connections with claim everything is a go. Details are still few and far between, so trying to figure out what others have heard.

Was told all gsp accounts would be transferred to the a new site next week that will be able to operate in the US. No other drtails. If anyone knows more, please pass it along.

I don’t think it’s really productive to keep coming on here with “I was told this, I was told that.”

If you don’t provide proof of claims I’m going to start spam-binning for spreading misinformation.

In other news, Martene Wallace has just moved to Dubai from Australia. In a social media update she cited “business reasons” or er is that “extradition and Australian Tax Office” reasons?

Nothing says legitimacy like your Australian upline fleeing Australia for the MLM crime capital of the world.

Weren’t these guys all “we live in caravans lulz” lifestyle grifters? Or am I thinking of another company?

Being stuck indoors in the middle of a desert is a bit of a sea change.

Yes Martene is part of and runs the “we avoid tax in our outback caravans” crowd.

I’m not sure if this is a good thing or bad thing. Probably bad because she will need to commit more fraud than ever to keep up with the lifestyle. More kids yanked away from their childhoods and stuck in the nihilistic glass box desert city.

Here’s what was sent to the group via a memo from a call with heit and Hughes. Notes below.

Two year pause is over. Settlement is over. Gsp came out of the process clean therefore the company will move forward. Gsp will move to apertum. Cease and desist over. Refund request over and handled correctly. Members with referrals will be adjusted accordingly.

MAIN INFO MOVING FORWARD;

starting January (next week), you’ll be able to log into Gspro and there will be steps to move your account including any and all funds earned to apertum dao for smart contracts. (It failed to say what smart contracts are).

There will be steps once inside your account on Gspro to verify the account and be sure scammers don’t get info. Exact date of site going live or what will be needed were not specified yet, but we were all told to continue to monitor our Gsp accounts.

If this is spam please delete, but the most detailed info the group has sent out in sometime.

Well I can tell you right that the refund process is not over. I am in one of the settlement states and I have not received an offer or a refund from Alix Partners.

As I understand it, the settlement requires refunds to be processed first, followed by a new consent order, with the prior allegations and cease-and-desist orders withdrawn.

That’s a lot to finalize by 1 January.

It also raises questions about how funds can simply be moved from one entity to another—especially when the original entity involved an unregistered security. That kind of transfer seems like something regulators would take a close interest in.

There was never a “two year pause”. That’s made up. Settlement process also isn’t over. Fraudsters gonna fraud.

In case it wasn’t obvious, DAO1/Apertum has flatlined. Scamming US residents is where the money is so that’s what they’re trying to kickstart again.

Was just informed the start date will be sometime.

Mid January, not the beginning as initially indicated. There will be another call prior to the site going live where a bulk of info will be shared.

Next updated or contact from the Main group is scheduled for today.im guessing a zoom meeting. If anything of note is passed along I will share it with you.

Meeting turned out to be nothing. Just informing everyone they still had all their money in their account and the minute the site is back on, you’ll have access to your funds to access and move it how you choose

Big meeting next weekend with everyone now. Same one that was sheuduled for this weekend but didn’t happen. Looks like the open I. January promise is looking bleak

Corporate call occurring on the 16th. This is fully advertised with same language as the gsp messages came from. Advertising as the first ever global call for DAO1.

Heit himself will be on the call to detail vision, events, strategy and many other things according to the message. I have two uplines and both produced the same message. Both also encouraged not spreading any information to large groups.

I’ll post any other concrete details if they come up.

Corporate call was made today. Timeline gets pushed back again. Things were suppose to go live in January now pushed to early February. They did confirm that GSP and DAO will combine.

That processed will be explained and streamlined in early February. It’s continued to be believed that gsp money will be able to be accessed and recouped thru DAO.

Nothing official sent that can be read There were no documents sent or atttached in this meeting, This information was just noted by people who tuned in to the meeting.

So today was suppose to be the day all the news would spill and again GSP kicked the can down the road. From today’s big zoom call that was suppose to kick off the restart of the pyramid scheme. Here is what was told

Dao still needs 2 states to sign off before it can begin. Not sure what they are referring too here. They are expecting the states to have that done within the week. They also need Alix partners to finish the entire refund process before the can kick off.

They claimed alix partners will have that done this week or next.They’ve informed everyone this is why the website that was promised to go live today cannot go live, however they expect the above hurdles to be cleared this month so everything will be live at the end of the month if not sooner.

Again nothing official on any document. They also had very limited space on the zoom call. Many could not get into the zoom. Their excuse was there was simply too many people trying to see this amazing zoom call, if you actually believe that.

Same promises no results so far. Upline are frantically trying to keep everyone positive.

Typically a claims process is:

1. victims file a claim.

2. claims are verified against provided data (usually woefully incomplete and unorganized for fraud schemes).

3. victim claims approved, denied or adjusted based on provided data.

4. victim has option to dispute any adjustments (provide more evidence etc.).

5. GSB/Heit should have option to also provide more evidence to challenge any disputes (normally this would be the role of a Receiver/Trustee).

6. Any unresolved disputes are settled by a Judge (AlixPartners?).

Someone posted a communication from TSSB a few days ago. We don’t even appear to be at step 3 yet.

Yes when I heard that I noticed where this is going. My guess is gsp and company will blame the entire delay on Alix partners in hopes of keeping people engaged and hopeful.

I don’t see the alix partners complete in the coming weeks and it was made clear today that this was needed before anything could go live

Prior to a scheduled update to the Texas administrative courts for Feb 6, the TSSB and GSP filed a motion to ask for an extension.

Meanwhile – on a global call (Feb 4) Bruce tells GSP members to check their GSPro+ account back office’s every 2 days.

I’m reading this as the holdup is problems between AlixPartners and GSB. Obviously this is not confirmed.