BDSwiss denies GSPartners Ponzi partnership

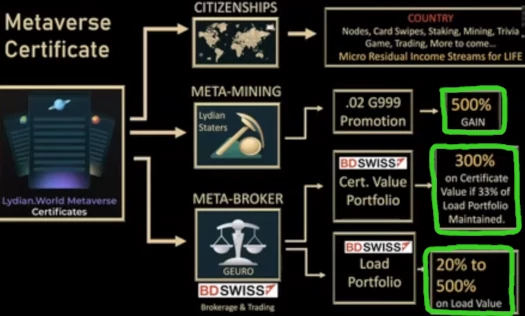

When GSPartners unveiled its “metaverse certificates” Ponzi scheme last May, BDSwiss was presented as a trading partner.

When GSPartners unveiled its “metaverse certificates” Ponzi scheme last May, BDSwiss was presented as a trading partner.

So the ruse went, BDSwiss was trading invested funds so that GSPartners could pay out up to 480% annually.

Now, roughly eight months into the purported arrangement, BDSwiss deny any partnership existed.

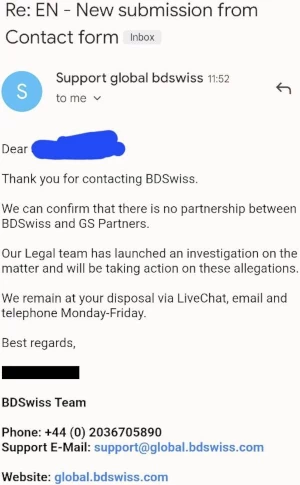

A BehindMLM reader reached out to BDSwiss to query why the broker, which claims to do $84 billion in average monthly trading volume, had partnered up with a Ponzi scheme.

Here’s the response from BDSwiss Global Support;

Here’s the response from BDSwiss Global Support;

We can confirm that there is no partnership between BDSwiss and GS Partners.

Our legal team has launched an investigation on the matter and will be taking action on these allegations.

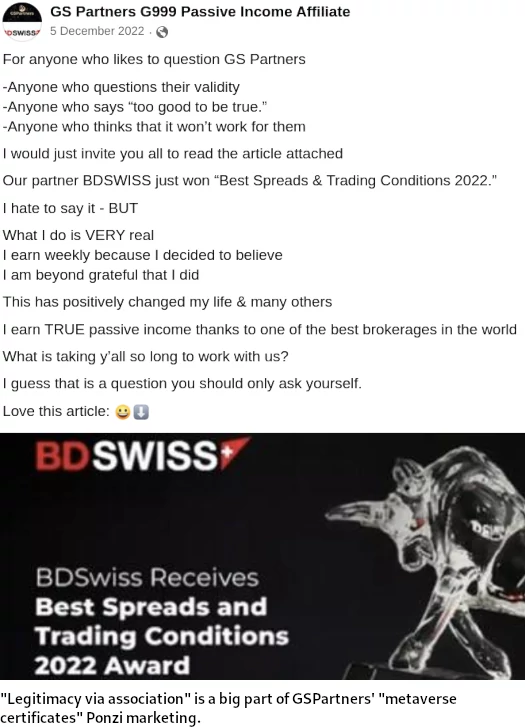

BDSwiss has featured heavily in GSPartners’ metaverse certificate Ponzi promotion.

In May 2022, a purported BDSwiss executive appeared on stage at a GSPartners event to confirm and market the partnership.

Putting aside it has no bearing on GSPartners committing securities fraud, BDSwiss being registered with financial regulators was a major selling point.

And that selling point has been parroted by GSPartners affiliates looking to recruit new victims:

It’ll be interesting to see if anything comes of BDSwiss’ legal investigation.

This isn’t the first time GSPartners has landed in hot water for fabricating corporate partnerships.

One of GSPartners’ prior Ponzi schemes, JONE tokens, was pitched on a supposed partnership between GSPartners and Accor Group.

Accor Group owned Movenpick Hotels and Apartments, which GSPartners represented it had bought a series of apartments from in Dubai. The ruse was that GSPartners would break up the floorspace into tokens, sell these to affiliate investors, and generate external revenue via rentals.

Upon learning of the supposed partnership, Accor Group confirmed GSPartners was not authorized to sell their property.

GSPartners’ Dubai-based property developer was also sent a cease and desist. After all this played out, GSPartners’ JONE token Ponzi fizzled out and was never mentioned again.

Getting back to BDSwiss, with the broker out of the picture GSPartners’ metaverse certificates external revenue ruse falls apart.

We know new investment is what funds metaverse certificate withdrawals (that’s always been the business model), but it’ll be interesting to see whether a new ruse surfaces now that BDSwiss are out.

Prior to metaverse certificates GSPartners was flogging LYS tokens and G999. LYS has collapsed to under $10 and G999 to $0.0019.

The metaverse certificates Ponzi is run through yet another token, GEUR. GSPartners represents GEUR is pegged to the euro.

The problem is GEUR doesn’t exist outside of GSPartners, so in reality it’s pegged to new investment.

Pending any further updates, we’ll keep you posted.

Update 30th January 2023 – BDSwiss has publicly confirmed it never had a partnership with GSPartners.

Update 3rd February 2023 – GSPartners is trying to cover up its BDSwiss lies through a new Skyground Group partnership.

Are you not invented? Is this scare mongering?

It’s an article covering an email from BDSwiss support confirming no partnership with GSPartners.

I suggest you don’t use words you don’t know the meaning of.

“WHEN” not “IF” empasisis on WHEN, the company collapses, then you won’t be feeling scared. Depression, anger and confusion.

Or thankful that you came across this review that was put up before you gave up your dollars to them.

It’s almost like their followers are too lazy or too dumb to verify the facts put out by the “leaders”.

@Crypto Shaman, that tends to be the case with the vast majority of ponzi participants. There are very often things that are so easy to verify that it genuinely blows my mind that they don’t put in that little bit of effort.

Intellectual laziness is quite a disability.

The FACTS are laid out for you. The fear that you feel is your common sense telling you that you’ve been scammed.

The BD Swiss thing is everywhere including a reference in John Johnsons latest update

youtu.be/mcP9cHrjo6E?t=1851

If you go back to the start of that he also claims G999 is low because GSPartners affiliates did not send millions to Josip and co.

If BDSwiss isn’t partnered with GSGlobal, then why was Jan Maluk, the owner of BDswiss, at the last 3 events GSGlobal put on?

And the former CEO who is with Sky Ground now? Seems a bit weird if there’s friction there.

I raised this question in the article. Pending further clarification from BDSwiss I don’t have an answer.

I am doing my own verification with BD Swiss. Will report back.

The COO and his brother left BD Swiss in 2021 to start their own company called SkyGround. This is the new claimed partner.

The BDSwiss partnership was claimed in May 2022 though.

If SkyGround is a new partner, that was only namedropped after BDSwiss claimed there was no partnership a few weeks ago.

Also SkyGround is being presented as a Lydian World partner. BDSwiss was a metaverse certificates partner.

Thank you for this information. I was approached just a few days ago about investing.

It now would seem that as the truth is getting out, and the walls are closing in, the “elite investors” ( “Global Ambassadors” and “Executive”) are pushing to get as much into the pot as possible before the whole thing collapses.

My guess is the “elite” will be able to pull out their investments long before the 18 month lock in for new investors. Same way all these type of scams basically work?

I have no experience with this sort of thing but have been learning a great deal in the past 5 days.

Pretty much. If you didn’t transfer over from Karatbars or recruit a ton of people you’ve already lost money.

Numbers on a screen will convince you otherwise until you face reality. Or jump through the next opportunity hoop Heit and co. come up with.

I had no involvement with Karatbars.

The certificate program is a powerful carrot, ( the only reason I was considering investing in GS ) but I have a feeling there will be a new, even more lucrative one coming out very soon.

So many red flags.

Getting huge SCAM vibes. A really good friend of mine just pitched me on GS Partners certificates and showed me that she had made 4% “guaranteed” each week and last quarter made an additional 46% which was higher than the 18% quarterly “guarantee” that it normally would be but the returns came back higher than expected.

She said she’s made all her money back which was roughly $150k in 4 months. Of course this sounds very scammy but I saw her dashboard with the GURO coins that she converted to USDT and withdrew to her Coinbase account.

She also has not signed up anyone under her. How is all that possible if these certs are such a scam?

This is a genuine question because I want to tell her to get out but how can I when she is making real returns?

Riiiiigh…..t.

Ponzi schemes aren’t scams in that you sign up and nobody steals any money. Ponzi schemes are scams in that early investors steal from those who invest after them, and over time this collapses because math.

Your friend might be comfortable with stealing money from people through Ponzi schemes, are you?

It’s a rhetorical question, I don’t really care if you are or aren’t – but that’s the answer to your “my friend is stealing money so how can GSPartners be a scam?” question.

GS Partners is an illegal and criminal Ponzi Scam and a continuation of the previous Karatbars crypto Ponzi scam. Josip Heit is a scammer with connections to East European Mafia.

Stay away from it.

BDSwiss has confirmed via press release there is no partnership or association with GSPartners:

global.bdswiss.com/company-news/updates-on-bdswiss-collaborators/

This is clearly a Ponzi scheme and GSPartners are straight up lying about everything.

Wasn’t aware BDSwiss had issued a public statement. Thanks for the heads up!

Just read the BD Swiss press release. Incredible.

As of only a week ago, those trying to recruit new investors are still saying BD Swiss are partners.

Scam. Scam. Scam.

so is this now what was Karatbars?

thought that had gone quiet — i was getting one or two emails a week from karatbars then nothing mmmm.

just do the math — if 1000 people sign and with say 50k each the compound returns over five years are enough to destabilize any enconomy.

I tried looking for the letter written by BD Swiss, it looks like it has been removed from wherever it came from.

Lol, they took it down. Maybe Heit threatened BDSwiss with his lapdogs at Irle Moser, or the mafia.

Ah well, the screenshot is there.

edit: The announcement is still there, they just changed the URL slug from “updates-on-bdswiss-collaborators” to “beware-of-fraudsters-posing-as-bdswiss-collaborators”.

I’ve updated the link in the confirmation article.