Auratus’ BitexLive blocks US and Canadian investors

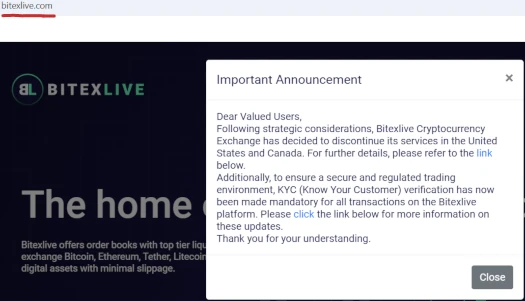

Auratus adjacent BitexLive has informed investors it has “decided to discontinue its services in the United States and Canada”.

Auratus adjacent BitexLive has informed investors it has “decided to discontinue its services in the United States and Canada”.

BitexLive is a cryptocurrency exchange that is believed to be used to launder funds invested into Auratus and Billionico.

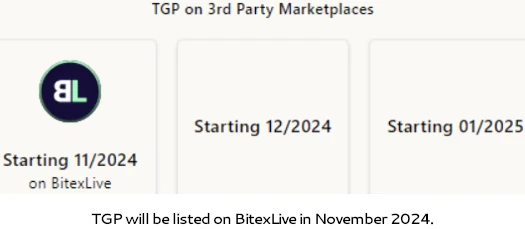

Coinciding with BitexLive being set up to allow Auratus and Billionico investors to cash out TGP points through on November 1st…

…on October 31st BitExLive announced “strategic considerations”:

Clicking either of the cited links takes you to another website page, on which BitExLive advises;

After a comprehensive review of the evolving regulatory landscape, Bitexlive has made the strategic decision to discontinue its services for users located in the United States and Canada.

This decision was not made lightly, and it reflects our dedication to complying with international regulations and providing the highest standards of service to our users.

Neither Auratus’ or Billionico’s claimed business models are inherently illegal. What makes them fraudulent is both companies are not registered with North American securities regulators.

In addition to verifiable securities fraud, as was the case with GSPartners, Billionico and Auratus failing to register with financial regulators lends itself to running of a Ponzi scheme.

As a vehicle through with Auratus and Billionico funds are transferred through, this increases the risk BitexLive will also be targeted by North American authorities.

Billionico and Auratus are already Respondents in a securities fraud cease and desist issued by the Texas State Securities Board (TSSB).

US and Canadian BitExLive account holders have until November 15th to withdraw what’s in their accounts.

After this date, access will be fully disabled, and funds not withdrawn will be processed according to our terms and conditions.

What “terms and conditions” BitExLive is referencing is unclear.

BitexLive is attached to IBBP Pay Services Kazakhstan Ltd., a Kazakhstan shell company registered by Leon Filipovic (right).

BitexLive is attached to IBBP Pay Services Kazakhstan Ltd., a Kazakhstan shell company registered by Leon Filipovic (right).

Filipovic is a long-time business partner of Josip Heit’s. He’s also the registered owner of Orbit Conceptum AG, a shell company attached to Billionico.

The TSSB named Filipovic as a “related non-respondent” in their April 2024 Billionico and Auratus order.

Auratus recently launched a “storage boxes” investment scheme. Although the terminology is different, it’s essentially a clone of GSPartners’ collapsed metaportfolio certificates scheme.

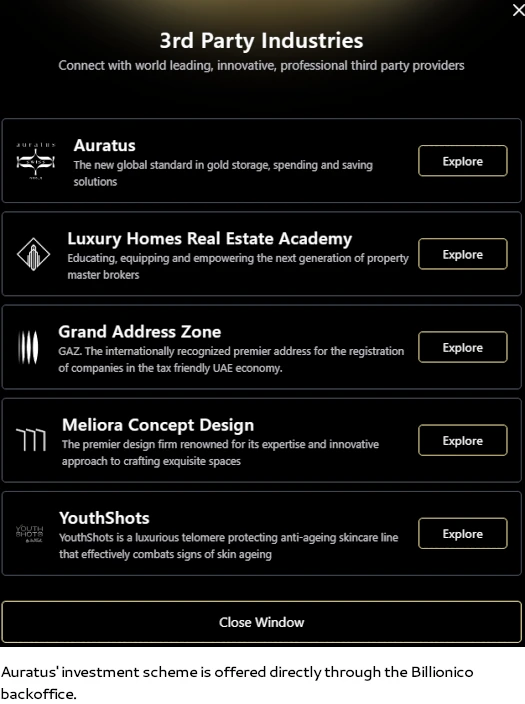

Auratus is linked to investors through Billionico’s backoffice, along with what appears to be several yet to be launched investment scheme ruses:

Pending further updates on any new Auratus and Billionico unregistered investment schemes, we’ll keep you posted.

Currently listed with a Trust Score of 3/10 on Coingecko, the poor liquidity would deter most users – there’s under 8K views a month.

The Auratus.gold website had a phishing warning on 30 Sept and coincidentally the BitexLive trade volume went to 0 on that day.

coingecko.com/en/exchanges/bitexlive