1501 GSPartners victim claims filed as of March 13th

One thousand five hundred and one GSPartners victim claims have been filed as of March 13th.

One thousand five hundred and one GSPartners victim claims have been filed as of March 13th.

Of the claims filed, Secretary of State Brad Raffensperger asserts one hundred twenty one are from Georgia investors.

Speaking on the GSPartners victim claims process, an AlixPartners administrator stated “Georgia’s winning right now.”

Georgia was the recruiting ground of top GSPartners promoter Michael Lynn “El” Dalcoe.

In January 2024, Georgia’s Commissioner of Securities issued a joint $500,000 fine to Dalcoe, fellow promoter Eric Ture Muhammad, GSPartners and owner Josip Heit (right).

In January 2024, Georgia’s Commissioner of Securities issued a joint $500,000 fine to Dalcoe, fellow promoter Eric Ture Muhammad, GSPartners and owner Josip Heit (right).

The dollar amount of filed GSPartners victim claims hasn’t been disclosed. Citing its marketing material, North American regulators claim GSPartners took in over a billion dollars worldwide.

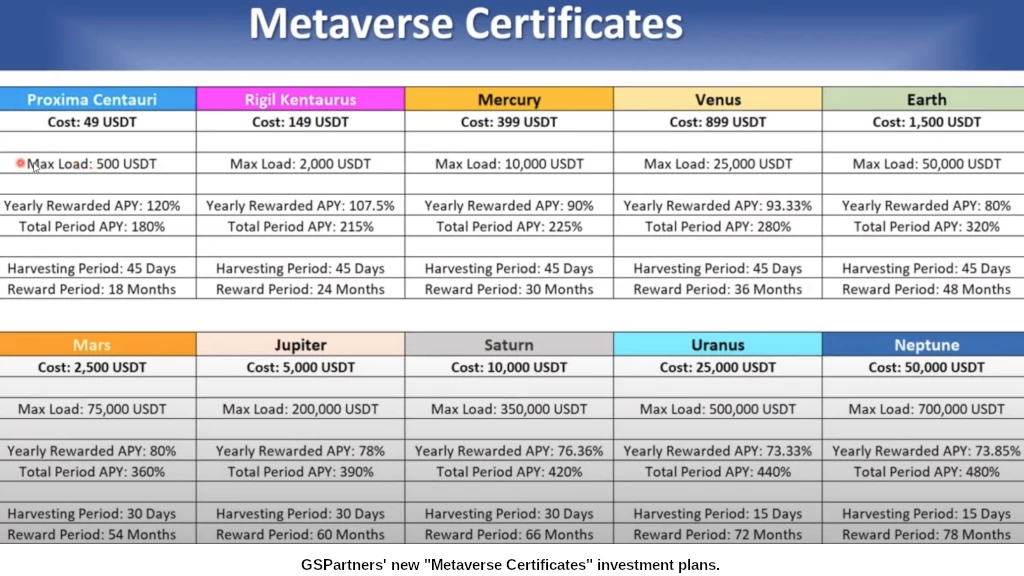

Through various “fraudulent investment schemes”, GSPartners solicited investments in cryptocurrency of up to $700,000 (click to enlarge):

GSPartners victims have until May 22nd to file claims with North American jurisdictions participating in the settlement. Up until recently, Texas was one of those jurisdictions.

Citing settlement contract violations and general allegations of fraud, earlier this week Securities Commissioner Travis Iles announced “the settlement is terminated“.

A hearing on Texas’ previously issued GSPartners fraud enforcement action, which names owner Josip Heit and several associates, has been scheduled for April 14th.

One concern raised by the Texas State Security Board was GSB, GSPartners’ parent company, fudging investor transaction data.

Citing an undercover GSPartners account that made no withdrawals, TSSB Enforcement Director Joe Rotunda claims data received from GSB showed the account had “withdrew assets valued at $690.69”.

GSB had determined the undercover account was thus not eligible to participate in the victim claims process.

If fudged investor data has been provided to Texas, it has more than likely been provided to other participating jurisdictions.

As of yet though, no other participating jurisdiction has publicly commented on GSB’s alleged settlement terms violations.

Pending the outcome of the Texas April 14th hearing, the future of the GSB settlement remains unclear.

How the fuck do you launder a billion $

@Tom you rent out luxury vehicles and boats then travel to China and convert that money to gold and the trail ends.

@pravda, you can’t leave china with Gold….

They buy bitcoin or other cryptocurrency and then use a prepaid debit card to spend it directly. This is why their scams always need some card provider on board.

There are rumors on a polish blog that the money had been used to fund a vat syndicate in Europe. Apparently it has to do with buying and selling luxury cars between Germany and Poland – and some accounting that allows for the reclaiming of unpaid vat.

Some of the people in hot water have connections to Heit one way or another. Assuming the Texans have subpoena power, we may learn more about the true financial status for GSB after the hearing in April.

There’s photographs of Australian promoters in Asia taken with vac packed gold as part of the Auratus scheme, to “prove the gold is real”.

I am informed that this gold belongs to one of the GS Partners leaders (Heit most likely).

Maybe the same “gold’ they (including Josip Heit and Alex Bodi) showed and handled in that classic Karatbars “vault” video… Rented props to make believe there was/is gold in Karatbars, Auratus, whatever the scheme is called.

why don’t they just refund the filled certificates?

Refund with what? That money is long gone.

Dubai is literally built on slavery and fraud.

Is there any confirmation that a refund has actually been received by anyone?

Too early.

Only 1500 claimants, I would suggest not too many people had faith this was for real. They basically scammed the authorities now or at least it seems that way.

I’m down about a grand but I would rather see this guy rot in jail then get it back at this point.

@Old Yeller – It may be wise to file a claim in any case. Should the offer not be correct, then it will serve as evidence for the state or the feds should they take this further (as is the case in Texas).

From an armchair perspective, this may add another count on any potential future indictment. If it’s correct, you get your money back. To me it seems like a win win for someone like you?

Question, how does Behind MLM know that One thousand five hundred and one GSPartners victim claims have been filed as of March 13th? I am just curious. I am interested in keeping track the numbers.

Literally in the first few paragraphs. Get out of the habit of just skimming headlines.

Oz, thanks for responding! Geez I didn’t catch that!!

All good. I do it too but try not to.

So as the deadline approaches to file for refunds, the GSB Alix Partners site has been MYSTERIOUSLY down for the last few days.

Those who have waited for the last minute to file looks like they might be out of luck. It figures… leave it to Heit and his cronies ( who are probably behind the outage) who will say we missed the deadline so no refund.

Fingers crossed that this gets resolved. Anyone with a contact email address for Alix Partners GSB settlement?

??? Both the GSB Settlement and claims portal are loading here (at least up until the “sign in” page, no idea beyond that).

is there a current count on how many have applied?

Not a public count, no.

I tried to login to the site today and it says account not found. That means it is currently down or they lost my claim.

You can contact Alix Partners at this address:

(Ozedit: contact details for AlixPartners are available on the GSB settlement website)

Thanks !!

A friend in Aus who is involved had a webinar the other night updating on the refund process.

Her indication was she can “see” the money now but it is being moved into DAO1. Anyone not on the call won’t know what is going on.

I don’t know if they are planning on paying them out in Apertum tokens and then getting them to transfer over to USDT to withdraw or something similar. Interesting to see what will happen to the APTM price if so.