369X Review: Second Mavie Global Ponzi spinoff

369X operates in the cryptocurrency MLM niche.

369X operates in the cryptocurrency MLM niche.

369X’s website domain (“369x.io”), was privately registered on October 30th, 2023.

On January 20th Mavie Global held a marketing event in Budapest, Romania. At the event, 369X was launched.

In a January 19th Instagram post, 369X claimed to be in a “partnership” with Mavie Global and Ultron.

Mavie Global and Ultron are the same Ponzi scheme run by CEO Michal Prazenica.

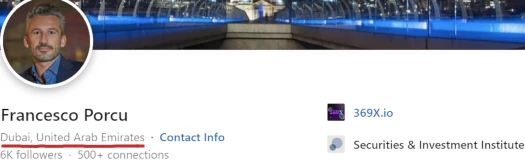

369X seems to be an attempt to break into Central and South America, spearheaded by CEO Francesco Porcu.

Porcu appears to be an Italian national. Possibly due to language barriers, I wasn’t able to ascertain whether Porcu has an MLM history.

As per his 369X corporate bio, Porcu appears to have a history in non-MLM forex.

With nearly two decades of experience in the financial markets, Francesco played a pivotal role in funding efforts at Hantec Markets Ltd before founding Black Peral [sic] Securities Ltd in 2013, a highly respected and FCA-regulated online trading brokerage.

369X’s other named executives, Francesco Fiacchi (CTO) and Marco Baggioli (CCO), also appear to be Italian nationals.

That said, 369X, Francesco Porcu and Michal Prazenica are all based out of Dubai.

Instead of being honest about Dubai 369X operates through 369 Clearing Group Limited, a Seychelles shell company.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to 369X, read on for a full review.

369X’s Products

369X has no retailable products or services.

Affiliates are only able to market 369X affiliate membership itself.

369X’s Compensation Plan

369X affiliates purchase VIBRA for 30 cents each. Later investors will likely be charged more.

Once acquired, VIBRA is invested with 369X on the promise of an “annual % yield”.

The specified annual return on invested VIBRA is 12%.

It should be noted 369X’s website also references 369T tokens. I believe these have the same 12% annual ROI attached to them (purchase details are not disclosed).

369X hide their compensation plan from consumers but do confirm it’s MLM.

Earn a percentage on all tokens staked by your referrals up to the 6th level of referral.

Six levels of referral commissions would mean 369X is using a unilevel based compensation plan.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

In addition to a ROI match, 369X also pays MLM commissions on the initial VIBRA purchase and any trading downline affiliates engage in (369X offers affiliates access to a manual trading platform).

Joining 369X

369X affiliate membership is free.

Full participation in the attached income opportunity requires an undisclosed minimum investment in VIBRA.

369X Conclusion

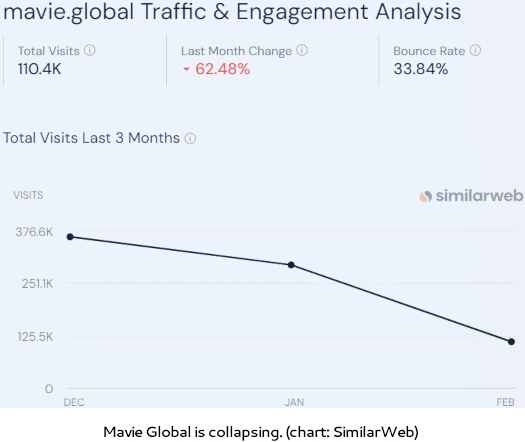

369X is a continuation of the Ponzi scheme started with Mavie Global and Ultron. It is the second recent spinoff following Lottoday, suggesting Ultron and Mavie Global are running low on investor funds.

With respect to 369X’s VIBRA and 369T investment scheme, no external source of revenue is identified.

This leaves new investment into VIBRA as 369X’s only source of verifiable revenue. Using new investment to pay affiliate withdrawals on cashed out VIBRA and 369T tokens would make 369X a Ponzi scheme.

On the regulatory front, 369X immediately raises red flags:

The information on this site is not directed at residents of the United States [and] Canada.

The US and Canada are the most active countries with respect to regulation of securities fraud.

Like Mavie Global and Ultron, 369X’s passive returns investment scheme constitutes a securities offering. 369X fails to provide evidence it has registered with financial regulators in any jurisdiction.

This means that at a minimum, 369X is committing securities fraud the world over. US and Canadian pseudo-compliance on 369X’s website is an attempt at regulatory evasion.

Given Francesco Porcu’s claimed “two decades of experience in the financial markets”, it’s logical to assume he’s familiar with securities law and knows full-well 369X is operating illegally.

As with all MLM Ponzi schemes, once 369X affiliate recruitment dries up so too will new investment.

This will starve 369X of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

As with Mavie Global’s and Ultron’s ULX token, VIBRA and 369T are worthless outside of 369X’s Ponzi scheme.

When 369X inevitably collapses, investors will be left bagholding two more Ponzi tokens they can’t do anything with.

Oh, come one, Budapest in Romania, really? Budapest is the capital of Hungary, Bucharest is the capital of Romania.

When I heard the pitch for Lottoday and FlipMe, there was no mention of 369X, and still isn’t.

I just checked their website so whatever 369X was, it’s gone now.