Fintoch collapses, “William Thompson” outed as Joel Fry

![]() The Fintoch Ponzi scheme has collapsed.

The Fintoch Ponzi scheme has collapsed.

Withdrawals were disabled shortly after ~$31.6 million was reportedly withdrawn from an associated smart-contract.

Fintoch disabled withdrawals without warning on or around May 23rd. Later the same day Fintoch blamed disabled withdrawals on “network congestions”.

The company’s technical team is working overtime to test and deploy the FTC public chain … the FTC public chain will be launched on June 2023, and FINTOCH will usher in a new round of explosive growth.

As such, members will experience delay in transactions due to network congestions.

Three days later and Fintoch’s withdrawals remain disabled.

The Ponzi scheme’s collapse follows Singapore issuing a Fintoch securities fraud warning on May 4th.

Fintoch is believed to be run by Chinese scammers hiding out in either Singapore or Hong Kong.

Russians might also be part of the Ponzi scheme.

Fintoch is a simple MLM crypto Ponzi scheme. Investment is made in tether (USDT), on the promise of a 1% to 2.5% a day ROI.

The scammers running Fintoch hide between western actors.

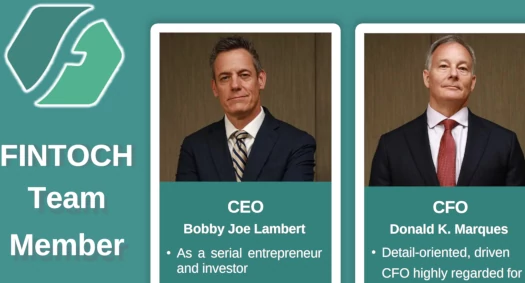

Mike Provenzano originally fronted Fintoch as CEO “Bobby Joe Lambert”.

Provenzano disappeared around March 2023. He was immediately replaced by Chairman of the Board “William Thompson”.

Since March, “William Thompson” has appeared in multiple Fintoch marketing videos:

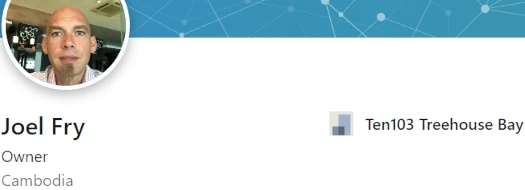

BehindMLM can reveal Thompson is in fact played by Joel Fry.

Prior to signing up to play Thompson, Fry was a US expat living in Sihanoukville, Cambodia.

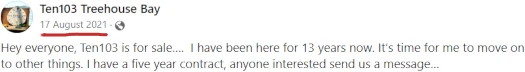

Fry ran the Ten103 Treehouse Bay resort, which he put up for sale in August 2021:

I don’t know if Fry wound up selling the resort. I was able to still place him in Sihanoukville as late as October 2022.

Sometime after October 2022, Fry was hired by whoever is running Fintoch to play “William Thompson”.

Fry has a history with Russian organized crime in Cambodia. While not definitive, it might explain how he wound up fronting a Boris CEO Ponzi scheme.

Joel Fry’s last appearance as William Thompson was at a Fintoch marketing event in Dubai.

The event was held a few days prior to the collapse.

Fintoch holding a marketing event in Dubai, the MLM crime capital of the world, suggests the scammers behind it might have fled Asia.

One last thing to note, Twitter user ZachXBT tracked $31.6 million being transferred out of Fintoch’s smart-contract. This was discovered within 24 hours of Fintoch disabling withdrawals.

I’m hesitant to give too much weight to this just yet, as we don’t know the total amount invested into Fintoch.

Following on from its “network congestion” exit-scam, Fintoch is now stringing investors along with talk of its own blockchain.

The company hereby announces that the FTC public chain will be launching on June 1, 2023, and Fintoch will user in a new round of explosive growth.

This appears to be a planned reboot, although it’s unclear whether Fintoch will actually reboot or disappear.

Similar exit-scams from Chinese scammers have played out this month from QZ Asset Management and SolaRoad.

Update 23rd June 2023 – Fintoch has completed its exit-scam. Earlier today the Ponzi scheme’s website was pulled offline.

Update 18th August 2023 – Fintoch is trying to reboot as Standard Cross Finance.

The Fintoch (“Fintosh”) marketing videos are so cringe.

Script:

Joel Fry sits at a restaurant pretending to eat breakfast.

Female Asian holding cell-phone camera: “Good morning William!”

Joel Fry pretends to be startled, despite having a cell phone camera in his face.

Fry struggles to swallow his bite, before eventually dropping his cutlery as he stumbles through the script.

The best Boris CEO videos are the ones where they goof around. The ones where they get into the role and try to act serious are amusing – but only because you know they’re desperately trying not to fuck up.

@Oz

Million Zoecoin (?) idea: a Worst fake CryptoGuru/Leader award.

I felt tempted to call it “The Boris” but since we have discovered Venezuelans, Mexicans, Nigerians, Germans and Austrians playing the part that might not be the best name for the award.

They’re all pretty terrible. Better to make it a “best of” award :D.

Did you see the recent Fintoch update? It’s hilarious. Instead of giving users cash they’re instead giving equivalent cash of the invested amount to buy a subscription to a fin chain node.

Typical of a ponzi to do lol. If people put more money into it they have to have a potato for a brain.

Lemme guess, chain node pays in some bagholder shitcoin?

I can confirm they’re instead giving equivalent cash of the invested amount to buy a subscription to a fintoch chain node.

I know many people who have joined Fintoch and still believe in their claims of creating a new metaverse system called FinSoul.

Most of them have blindly overlooked the red flags in their avarice and FOMO. I can only hope that justice is served even though it seems this criminal organisation cannot be dismantled easily.

Can anyone who is familiar with Fintoch help me understand if people who have invested with Fintoch are able to withdraw their money or not?

Fintoch disabled withdrawals when it collapsed (see article above).

Now there’s some inhouse token bullshit which will stall the exit-scam.

If you are scammed in the Philippines let us know who was the scammer, we will expose report and sue them (SEC NBI PNP).

PH Fintoch serial scammers:

Their (Facebook) Names:

Mentor Chris (Sandoval)

Sissy Garcia (Sandoval)

Arlyn Paderes

Albert Benliro

Nora Ngan-oy still Hiding in Dubai

These serial scammers also where involved in:

Mavie/Ultron

QZ

Monarch

GSPartners

LYDIAN.WORLD

Algotech

Football click button Ponzi

Xifra

Decentra

Omega pro

Validus

Hi Juan,

To file a complaint against Fintoch with Dubai, one might consider the Dubai Financial Services Authority (DFSA).

I have filed a complaint in Dubai but if the authorities are swarmed with other matters, it would be helpful for more people to file complaints to draw their attention to Fintoch.

Also, the authorities are looking for evidence of wrong-doing: Fintoch’s marketing material, promoters encouraging people to join, backups & screenshots of incriminating chats and group chats will be helpful.

As per my understanding, in developed countries, there are financial laws against:

1. MLM schemes. And surely, Ponzi scams are outright illegal.

2. Unlawful selling of equity (equity = shares or ownership in a company) to the general public. The spirit of this law is to protect the financially illiterate.

It takes significant financial knowledge and domain knowledge to be able to make an informed decision whether or not to be a shareholder of a company that is being run by others (because essentially a shareholder has ownership of the company).

3. Unlawful provision of financial services. Fintoch provides a high-yield lending program without a licence in many countries.

The more evidence people can provide the authorities with, the more likely the authorities will decide that it is worthwhile mounting a legal case against Fintoch, and for the police to spring into action.

I hate to break it to you but working at the DFSA is one of the easiest jobs on the planet.

Rock up, do nothing, go home.

Dubai’s authorities are under orders not to do anything about white collar crime because sheltering criminals is the UAE’s entire business model.

Hi Oz,

Thanks for weighing in about DFSA. While I too am suspect of the “business model” of certain countries that are popular safe havens for scammers, filing complaints (and keeping a records) can aid in further acts down the road.

Of particular interest to academics, political analysts, and financial regulators in other countries: how many of such filed complaints did the DFSA and the Dubai authorities ignore in order to continue their business model of providing a safe haven for scammers?

With records of filings and inaction, people can begin mounting, at the very least, well-substantiated opinion pieces that when widely distributed will have financial implications for (even legitimate) Dubai businesses and citizens.

If Dubai’s authorities, are by design, set up to shield their own, entities outside Dubai will naturally perceive heightened risk when dealing with Dubai entities and this perception will manifest in ways that financially punish Dubai’s entities (e.g., higher interest rates demanded on borrowed capital due to heightened risk of loaning money to Dubai businesses).

The crafting of legislation itself, the enforcement of it, and the inaction of the authorities to certain aspects of it, is in most situations, designed by society.

Different cultures emphasize different norms by which they expect those around them to conform to (some of these are formalized into law).

As such, laws that are antiquated, plain silly (in UK, the Metropolitan Police District Act of 1839 forbids the carrying of wood planks along a pavement unless it is being loaded or unloaded from a vehicle), or unprofitable (e.g. a country cracking down on itself being a haven for scammers) are deliberately overlooked by the authorities.

As such, in reality, society needs to impress upon the authorities the importance (sometimes via palpable incentives or disincentive) to actively enforce certain laws.

I submit that while it may not appear effective to file complaints with regulators in certain countries, complaints should still be filed for the reasons detailed above.

Should the authorities be slow to take action or avoid taking it at all, society can go, “Hey, I’ve done my part, how come you didn’t do yours?”

Case in point is the US SEC’s inadequate action in Bernie Madoff’s Ponzi scheme (by the way, there is a Netflix documentary that appears to cover this quite well if I might add).

After successful conviction of Madoff, The US SEC had to explain in a public hearing before a panel of congressmen [1] why SEC investigators failed to take adequate measures to investigate Madoff despite a complaint-filer, Harry Markopolos, having filed multiple SEC complaints over several years, that armed the SEC with direct evidence of Madoff’s wrong-doing. Post-Madoff, the SEC introduced improvements and revamps [2].

[1] A series of hearings before the House Financial Services Subcommittee on Capital Markets, Insurance, and Government Sponsored Enterprises.

[2] sec.gov/spotlight/secpostmadoffreforms.htm

Dubai’s authorities aren’t going to share this information with anyone.

Also comparing Dubai to the US with respect to regulatory accountability is pointless. Dubai’s authorities are beholden to its Sheik scamlords, not the general public.

Appreciate your enthusiasm but I’m a realist when it comes to Dubai being a crime haven.

Just a bemused bystander here – I guess because they are using North American Actors – but they have gone “Full Boris” in their Latest video – Fake Office, More people clearly reading from a prompt and Mike/Bobby is back!

youtube.com/watch?v=X5isEOr2CGk

I wonder when that video was shot to feature Mike Provenzano again. Joel Fry hasn’t done anything new since Fintoch collapsed.

This “new” video pertains to FTC token, which was announced back in March. Must have filmed it just before Provenzano dipped.

This is concerning. The masterminds behind the Fintoch scam appear intent on continuing their scam. Perhaps the story of Fintoch doesn’t end with the $31M rug pull?

Hi there. I’m one of the deceived NORTH AMERICAN ACTORS USED IN A VIDEO. TO PROMOTE THE SCAMMERS THOMAS LAI and MARYANNE LAI. Ceo of HOLLYWOOD GLOBAL FILM FESTIVAL.

They did a festival in Bali Indonesia using actors in attendance saying FINTOCH was the sponsor. LIARS THEY WERE FINTOCH!!!!

Interesting, how were you hired? What did they say the gig was for?