Iqonic Review: Eaconomy collapses, AI trading reboot

Iqonic fails to provide ownership or executive information on its website.

Iqonic fails to provide ownership or executive information on its website.

Iqonic’s website domain (“iqonic.life”), was privately registered on March 1st, 2025.

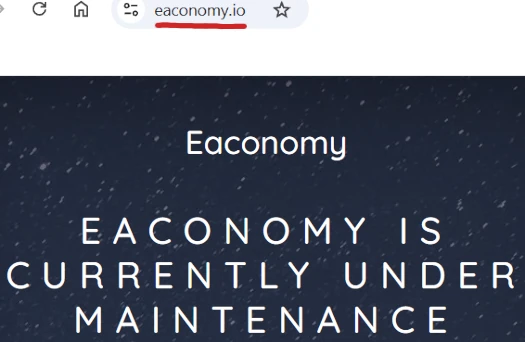

A BehindMLM reader noted Eaconomy had disabled its website earlier this month.

As at time of publication, April 14th, 2025, that remains the case:

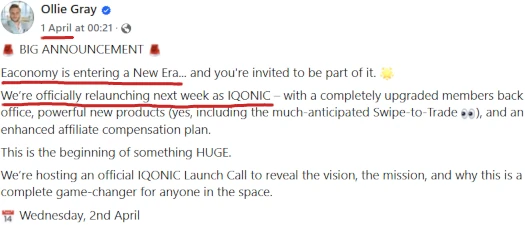

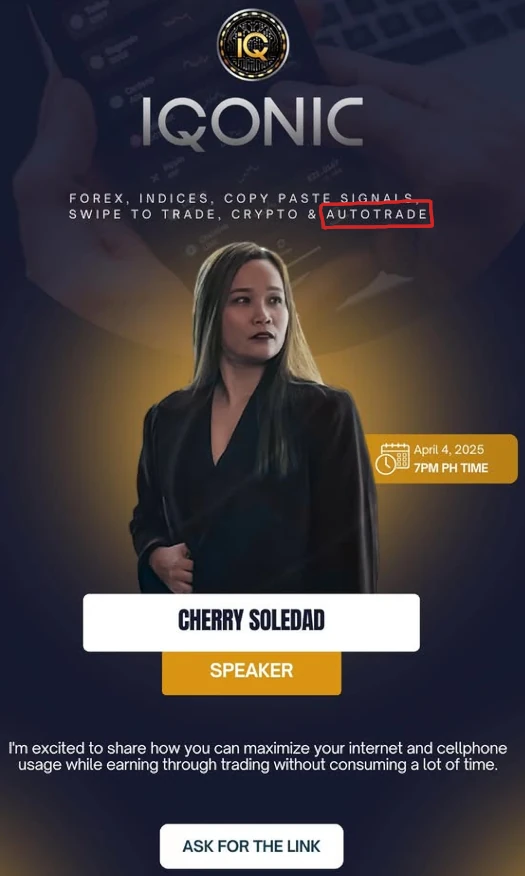

This prompted me to take a closer look, revealing Eaconomy promoters touting an Iqonic reboot circa April 1st;

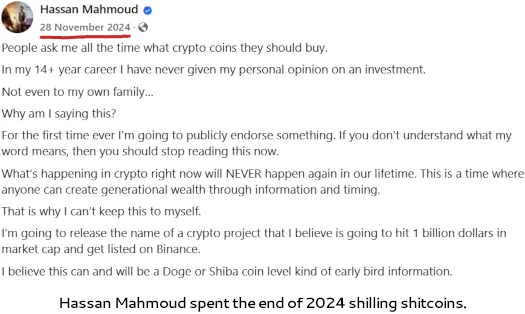

Eaconomy social media accounts were was abandoned January 2025. Eaconomy owner Hasan Mahmoud’s last FaceBook post is dated November 28th, 2024.

In the post Mahmoud shills some crypto coin:

As far as I can tell, there doesn’t appear to be an official Iqonic reboot announcement.

Nonetheless, Iqonic marketing confirms Mahmoud is still running the company:

- Hassan Mahmaoud [sic] – founder and CEO Iqonic

- Edwin Hayes – President Iqonic

- Jarrod Wilkins – VP of Business Development

Mahmoud made a name for himself promoting Enagic water filters. His first appearance on BehindMLM was in 2019, as co-owner of SilverStar Live.

SilverStarLive was an unregistered MLM trading scheme. A CFTC investigation into SilverStarLive found the company and Mahmoud

acted as commodity trading advisors (“CTAs”) without being registered with the Commission as such, by exercising discretionary trading authority over the forex trading accounts of U.S. customers who were not eligible contract participants (“ECPs”).

Mahmoud settled the CFTC’s fraud allegations in 2019 for $75,000.

After SilverStarLive came Eaconomy, another trading themed MLM company. Eaconomy went on to collapse multiple times. A third and final reboot was launched in 2021.

Since launch, Eaconomy has received regulatory fraud warnings from Canada, Norway, New Zealand, Slovakia, the UK and Czechia.

In the lead up to Iqonic’s launch, Mahmoud sued My Daily Choice and owner Josh Zwagil back in January.

Zwagil retaliated by teaming up with Candace Ross, Mahmoud’s ex-wife and Eaconomy co-founder, to accuse Mahmoud of fraud.

Both lawsuits were dismissed on February 24th, suggesting a settlement was reached. No details have been made public.

Edwin Haynes popped up on BehindMLM’s radar in 2022, as founder and CEO of Axxces.

Axxcess was an MLM trading scheme built around crypto buzzwords and automated “social trading”.

Today Axxces’s website domain is parked. The company’s social media accounts were abandoned in February 2024.

Jarrod Wilkins is an Eaconomy executive carryover:

Considering Eaconomy ownership was a contention point in both January 2025 Eaconomy lawsuits, it remains unclear whether Candace Ross and Josh Zwagil have an ownership stake in Iqonic.

I was able to tie Zwagil (right) directly to Iqonic through the company’s apps. Iqonic uploaded its app to Google Play and Apple Store earlier this month.

Iqonic’s app developer is MLM Protec LLC, a Delaware shell company owned by Zwagil.

Zwagil isn’t disclosed as the owner of MLM Protec LLC on its website. Instead, somewhat deceptively, Zwagil features as a customer testimonial:

Whether Zwagil has an ownership stake in Iqonic or just owns the company developing its app is unclear. It’s extremely likely whatever the case, the details are part of the settlement reached in the January 2025 lawsuits.

Read on for a full review of Iqonic’s MLM opportunity.

Iqonic’s Products

Iqonic markets subscriptions to various trading services:

- Manara – “AI scanner” that provides trading signals

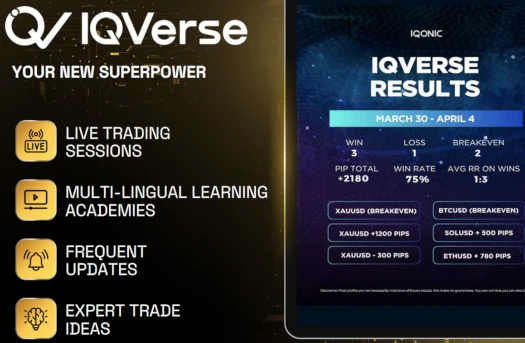

- IQverse – crypto trading

- Solexx – forex education

- Swipe to Trade – trading signals app

- IQ Academy – trading video training

- Stock Options – stock options training

- Ploutos – trade ideas

Access to the above Iqonic services is available across four price-points:

- Elite Pack – $149.99 and then $99.99 a month (IQ Academy, Manager, Solexx, Stock Options)

- IQverse Pack – $149.99 and then $119.99 a month (IQverse)

- IQverse Pro Pack – $199.99 and then $150 a month (IQverse, IQ Academy, Stock Options, Manara)

- Elite Pro – $199.99 and then $149.99 a month or $1499 annually (IQ Academy, Manara, Solexx, Stock Options, Swipe to Trade, Ploutos)

Iqonic’s Compensation Plan

Iqonic affiliates sign up and pay fees. Commissions are paid when they recruit others who do the same.

Iqonic Affiliate Ranks

There are thirteen affiliate ranks within Iqonic’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Apprentice – recruit four affiliates, placed two on both sides of the binary team

- Influencer 500 – maintain four personally recruited affiliates and generate a downline of twelve affiliates

- Influencer 1000 – maintain four personally recruited affiliates and generate a downline of thirty-six affiliates

- Influencer 1500 – maintain four personally recruited affiliates and generate a downline of sixty affiliates

- Prodigy 3K – maintain four personally recruited affiliates and generate a downline of one hundred and twenty affiliates

- Prodigy 6K – recruit six affiliates and generate a downline of three hundred affiliates

- Icon 12 – maintain six personally recruited affiliates and generate a downline of six hundred affiliates

- Icon 24 – recruit eight affiliates and generate a downline of one thousand two hundred affiliates

- Icon 60 – recruit ten affiliates and generate a downline of three thousand affiliates

- Icon 120 – recruit twelve affiliates and generate a downline of six thousand affiliates

- Icon 240 – recruit fourteen affiliates and generate a downline of twelve thousand affiliates

- Icon 580 – recruit sixteen affiliates and generate a downline of twenty-four thousand affiliates

- Legend – recruit eighteen affiliates and generate a downline of forty-eight thousand affiliates

Note that recruited affiliates must active with monthly fees to count towards rank qualification.

Downline affiliates must be split equally across two sides of a binary team.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Recruitment Commissions

Iqonic pays a commission on personal recruitment efforts:

- recruit an Elite Pack tier affiliate and receive $30

- recruit an IQverse Pack tier affiliate and receive $30

- recruit an IQverse Pro Pack tier affiliate and receive $50

- recruit an Elite Pro tier affiliate and receive $50

- recruit an Elite Pro Annual tier affiliate and receive $100

Residual Commissions

Iqonic pays residual commissions based on rank:

- Apprentices earn $25 a week

- Influencer 500s earn $125 a week

- Influencer 1000s earn $250 a week

- Influencer 1500s earn $375 a week

- Prodigy 3Ks earn $750 a week

- Prodigy 6Ks earn $1500 a week

- Icon 12s earn $3000 a week

- Icon 24s earn $6000 a week

- Icon 60s earn $15,000 a week

- Icon 120s earn $30,000 a week

- Icon 240s earn $60,000 a week

- Icon 580s earn $145,000 a week

- Legends earn $290,000 a week

Joining Iqonic

Iqonic affiliate membership is $29 and then $15 a month.

Iqonic Conclusion

Iqonic is more of the same found in Eaconomy, with a question mark on automated income.

Taken at face value, I didn’t see anything resembling automated trading in Iqonic’s marketing materials. This raises the question of why Iqonic’s promoters are marketing automated trading as part of the opportunity.

Iqonic and Hassan Mahmoud are based out of California in the US. Neither are registered with the SEC.

If Iqonic is offering automated trading on any level, it would be doing so in violation of US securities law.

“Swipe to trade” does offer some level of automation, however one can still argue that manual consent is provided by the user. It’s effectively no different to a trader receiving signals and then using those signals to conduct their own trades.

If the trades were executed automatically, that’d be a different story. Also if you’re wondering what differentiates “swipe to trade” from your typical “task scam”, I’m running on the assumption that an actual trade takes place after swiping.

Where Iqonic definitively run afoul of US regulations is the Commodities Act and FTC Act.

Iqonic offers trading training, advice and signals pertaining to various commodities:

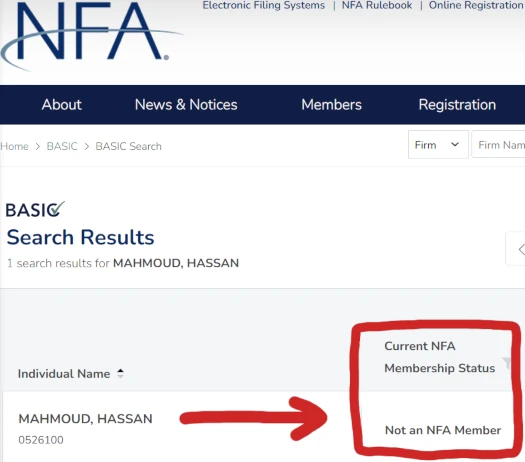

This requires registration with the CFTC, through the National Futures Association (NFA). Specifically, Iqonic should be registered as a Commodity Trading Advisor – which the NFA defines as;

an individual or organization that, for compensation or profit, advises others, directly or indirectly, as to the value of or the advisability of buying or selling futures contracts, commodity options, retail off-exchange forex contracts or swaps.

Advising others on commodities trading in exchange for compensation (fees) is Iqonic’s primary business model.

A search of the NFA’s BASIC database reveals neither Iqonic or owner Hassan Mahmoud are registered with the CFTC.

There’s also the possibility the CFTC might see Iqonic’s “swipe to trade” scheme as being too hands off. This is from the CFTC’s SilverStarLive enforcement order against Mahmoud;

The order finds that from at least July 2018 to March 2019, on behalf of SSL and, later, SSLS, Ross-Mahmoud and Mahmoud solicited customers to open discretionary trading accounts (or supervised other persons who did so), and offered to trade in customers’ retail forex accounts through a “forex autotrader.”

The autotrader used an algorithm to trade multiple currency pairs, automatically entering and exiting trades without customer intervention.

The autotrader also purportedly automatically hedged losing trades to mitigate losses. By virtue of the autotrader, SSL and SSLS exercised discretionary trading authority over retail customers’ forex accounts.

Based on this, the CFTC concluded SilverStarLive and Mahmoud violated the Commodities Act.

In Iqonic’s “swipe to trade”, the act of swiping grants Iqonic “discretionary trading authority over retail customers’ forex accounts”. The customer doesn’t actually set up the trade.

This could also be the “autotrade” Iqonic promoters tout in their marketing.

The FTC Act comes into play if the majority of Iqonic service subscribers are also affiliates. If Iqonic has more affiliate subscribers over retail subscribers, it’s operating as a pyramid scheme.

Historically Eaconomy has failed to retain a retail customer subscriber base – refer to Eaconomy’s multiple collapses.

The good news is establishing whether you’re about to join an MLM pyramid scheme is easy.

Ask your potential Iqonic upline how many of their personally referred service subscribers are also paying affiliate fees. If it’s over 50% (give or take a few percentage points), that affiliate is running their Iqonic business as a pyramid scheme.

Iqonic for its part does nothing to discourage pyramid recruitment. Iqonic could require a retail subscriber threshold across its ranks but doesn’t.

Given Mahmoud’s history with the CFTC and multiple Eaconomy regulatory fraud warnings over the years, a follow up from US authorities seems long overdue.

In the meantime one can only wonder, what with so much of Iqonic carrying over from Eaconomy, if the signals and trade ideas are profitable over the long-term – why did Eaconomy collapse?

Update 1st November 2025 – Iqonic has or appears to be on the verge of collapsing. Previously undisclosed Iqonic owner Brian McMullen has filed a lawsuit against Hassan Mahmoud.

@Oz, the website iqonic.life exists. The domain was registered on March 1, 2025 and updated on March 25, 2025.

postimg.cc/rDgRRrcf

An address in Delaware is given on the website.

postimg.cc/qtyRX6df

Video from April 4, 2025 on Coach Jimro‘s YT channel.

postimg.cc/Bt63JPwq

youtube.com/watch?v=y57NSMBL3Xk

You didn’t just sit there trying every possible domain combo did you? I did .COM, .IO, .AI then bailed :D.

Thanks, I’ll add the domain to the review.

No, the website was recognizable in the video I linked.

Hey Oz,

I’m not sure if this is the same company, but I think it is. A top leader from NVision U, who was just terminated, brought his team to IQONIC.

Not sure what the story is but this leader posted on social media that he had been terminated because NVision U had asked him to invest one million dollars in the company, and because he had inquired about the financials, they terminated him. He took the post down, but screenshots were shared.

If anyone can get to the bottom of the drama, I know you can Oz. Any inside scoop you can share with your followers? Inquiring minds want to know.

I haven’t heard anything. Not much to go on and sounds like you’ve gotten to the bottom of it?

The only person who would be able to confirm anything would be the “top leader”. And unless they want to go public, nothing for me to report on.

Hey Oz. You might want to start tracking the nasty lawsuit between Brian McMullen and Hassan Mahmoud. Seems like things are going to get bad for Iqonic and Hassan’s new company NOA.

Thanks for the heads up! Wasn’t aware of this one, added to BehindMLM’s case calendar.