Daxio adds NFT metaverse grifts to securities fraud

![]() Late last year Daxio launched an “automated sports trading” Ponzi scheme.

Late last year Daxio launched an “automated sports trading” Ponzi scheme.

No word on how many bajillionaires have been created so far. But now Daxio has gotten into NFT metaverse grifting.

Oh and Daxio has also launched two shitcoins. Because of course it has.

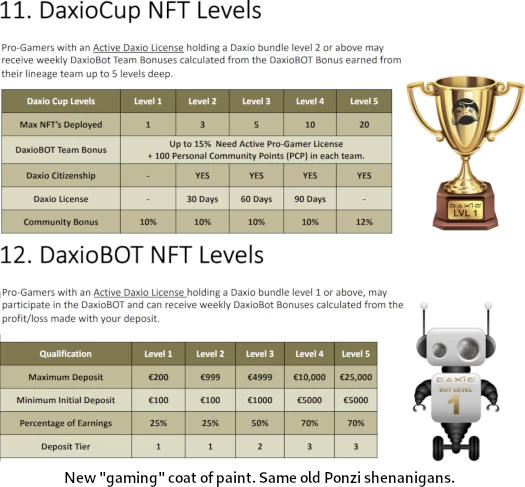

Sometime over the past eight months Daxio has rebranded itself as a gaming company. Daxio’s Ponzi origins lie in gambling, but this time around it’s crypto and NFT gaming.

To that end SportsBot has been renamed “DaxioBot”, and it’s now a “play to earn trading game”:

This is all of course just marketing. Nothing has actually changed between SportsBot and DaxioBot – it’s the same Ponzi ruse.

On the right you have PlayDAX, one of Daxio’s new NFT gaming grifts.

PlayDAX is a play-to-earn fantasy trading game which simulates real world trading.

Yeah, it’s a trading bot – wrapped up in crypto fad jargon. Outdated crypto fad jargon at that.

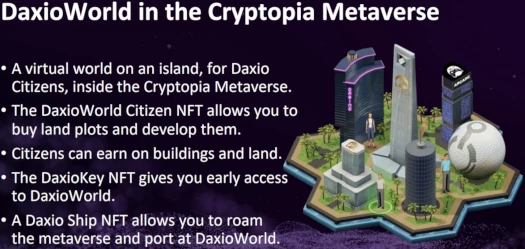

Alongside PlayDax Daxio also has plans for an obligatory metaverse grift.

Some shitty real-estate game that doesn’t exist yet, offered through Cryptopia. Think buying an island in Animal Crossing off Nintendo, and running your own scam through it.

Except instead of Nintendo Daxio has partnered with some blockchain bro company.

Cryptopia is an independent city-state society based on the blockchain, where citizens can buy, sell, vote, and perform other essential activities using a safe, secure, and transparent system.

If that sounds like a terrible premise for a game, it’s because it is. Like every crypto game, it’s a grift to sell you NFTs – which nobody except a shrinking pool of “we’re still early” crypto bro shills will sign up for.

Not because they care about the game. But because they hope they can flip their NFT investment positions onto greater fools.

In summary, Daxio’s metaverse grift is a yet-to-be-realized dead-end.

While you wait for that though, Daxio offers plenty of other affiliate link NFT grifts to lose money on:

And of course Daxio has its own owl JPG NFTs for you to invest in:

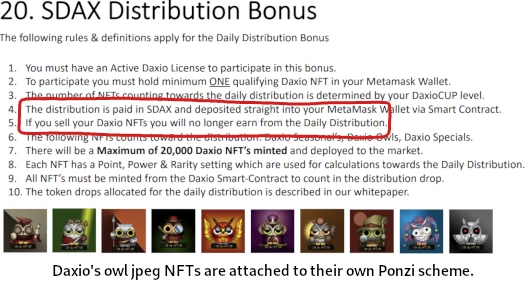

With respect to Daxi’s new shit tokens, you have SDAX and GDAX.

GDAX represents ownership & voting rights.

SDAX is a utility token used everywhere inside of the Daxio ecosystem.

GDAX sounds like a nothingburger but SDAX appears to be a token exit-scam in the making. As I understand it both are ERC-20 tokens.

ERC-20 tokens can be created on the ethereum blockchain in minutes, at little to no cost.

If they haven’t already, watch for DAXIO switching withdrawals to SDAX only.

SDAX and GDAX can be swapped and traded on external platforms.

Here’s how that’s going…

On the MLM side of things, Daxio is now charging €10 EUR a week for membership.

There’s a 10% referral bonus and 10% to 12% residuals, paid out via a binary team. A matching bonus on residual commissions is also available.

Ten affiliate ranks, tied to recruitment of Daxio affiliate investors.

Underneath that, you’ve got the same old Daxio Ponzi scheme:

And naturally Daxio’s own NFTs are attached to their own Ponzi scheme:

Around the time Daxio rebranded as a gaming orientated Ponzi scheme, crypto gaming died.

All the current “play to earn” crypto gaming grifts are variations of Axie Infinity – which collapsed in late 2021.

Desperate people in third-world countries trying to make a living, slave lords hiring players to farm in shifts around the clock, a speculative in-game economy built around NFTs – all ending in a $620 million exit-scam. Y’know, gaming.

The first NFT grift was artwork. Now it’s gaming and the metaverse. Same driving force behind both grifts: give us your money.

Daxio is a bit more nefarious than your simple monkey JPG grift, as it’s a purpose-built Ponzi scheme.

Daxio is run by co-founder Frode Jorgensen (right)

Daxio is run by co-founder Frode Jorgensen (right)

Jorgensen is believed to be a Norwegian citizen based out of Thailand.

Last month the Norwegian Lottery Board revealed it was investigating and had raised pyramid scheme concerns with Daxio.

In the meantime, Daxio and Jorgensen were ordered to immediately cease business operations.

Daxio operates through a shell company incorporated in the British Virgin Islands.

BVI is a scam-friendly jurisdiction that immediately raises red flags for any MLM company representing ties to it.

This month Daxio is being kept afloat by recruitment of new victims in Vietnam.

Daxio operates from the domains “daxio.com” and “mydaxio.com”.

Last month BehindMLM noted SimilarWeb tracking top sources of traffic to “daxio.com” as Malta (36%), Vietnam (30%) and Sweden (15%).

“Mydaxio.com” traffic originated from Sweden (45%), Hungary (18%) and Moldova (17%).

“Daxio.com” website traffic from Malta is down 13% month on month, suggesting recruitment there is in decline or has collapsed. Sweden is up but overall traffic hasn’t grown. Vietnam is where new gullibles are being recruited, coming in at 56% (up 229% month on month.

“Mydaxio.com” website traffic shows recruitment in Sweden, Hungary and Malta has collapsed. Once again Vietnam is driving investment at 18%, up 294% month on month.

(Daxio’s) REFUND POLICY

We do not offer ANY refunds on purchases made on this website.

LIMITATION OF LIABILITY FROM HARM OR LOSSES CAUSED BY THE PRODUCT

Buyer expressly agrees that no matter what may happen because of his or her purchase of this product, or no matter what damage may be allegedly or actually caused by the use of this product, or no matter the harm or damage that may result directly or indirectly from the purchase of this product, for any reason whatsoever, that the seller has no financial liability related to financial damages or losses related to the purchase of this product and that the seller (Daxio) cannot be held accountable in any financial way whatsoever.

RIGHT TO STOP SELLING OR SERVICING PRODUCT OR MEMBERSHIP

Buyer agrees that Seller has the right to discontinue the product, the service, the membership at any time without notice. Buyer understands that the Seller may discontinue customer service on a product or service at any time without notice.

Once Vietnam runs its course, Daxio will need to find new countries to pillage if it wants to put off a fifth collapse.

Update 21st February 2022 – Following Daxio’s collapse, Cryptopia has informed investors it

will temporarily remove all references to Daxio from our domains, our website, our socials, etc.

When we are absolutely sure that Daxio comes out of this 100% clean, we will reinstate all references.

Turns out Cryptopia was fine with being associated with a Ponzi scheme, but drew the line at a collapsed Ponzi scheme.