Daxio adds SportsBot to its securities fraud offering

![]() A reader recently tipped me off to an update to Daxio’s MLM offering.

A reader recently tipped me off to an update to Daxio’s MLM offering.

Daxio, as reviewed on BehindMLM in May 2020, is the fourth reboot of the Global Game Arena Ponzi scheme.

Six months or thereabouts after that review was published, Daxio added “SportsBot” to its unregistered securities offering.

SportsBot, originally going by “DaxioBot”, is your typical trading bot Ponzi ruse.

SportsBot, originally going by “DaxioBot”, is your typical trading bot Ponzi ruse.

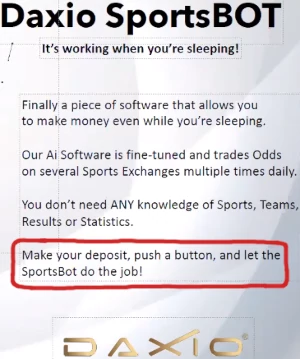

Whereas most trading bots are attached to forex or cryptocurrency, Daxio represents SportsBot “trades odds on several sports exchanges multiple times daily”.

This is otherwise known as arbitrage.

You don’t need any knowledge of sports, teams, results or statistics.

Make your deposit, push a button, and let the SportsBot do the job!

The above is from an official Daxio marketing presentation. It clearly spells out an securities offering.

Access to SportsBot is tied to Daxio membership, spanning €99 to €1999 EUR.

- Starter – €99 EUR to sign up and can invest up to €999 EUR in SportsBot

- Business – €599 EUR to sign up and can invest up to €4999 EUR in SportsBot

- Business Pro – €1999 EUR to sign up and can invest up to €10,000 EUR in SportsBot

Funds invested into SportsBot are tied up for 26 weeks.

Returns, purportedly derived from bot activity, are paid weekly.

How much of a return is paid out is tied to how much a Daxio affiliate has invested into SportsBot:

- invest €10 to €999 EUR and receive 25% of the purported SportsBot daily revenue amount

- invest €1000 to €4999 EUR and receive 50% of the purported SportsBot daily revenue amount

- invest €5000 EUR or more and receive 70% of the purported SportsBot daily revenue amount

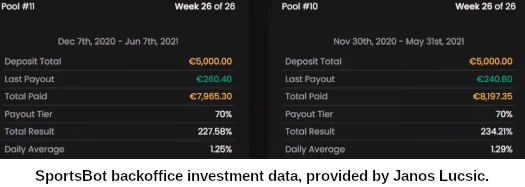

SportsBot promoter Janos Lucsik claims SportsBot has “made about nine percent profit in every single week”.

Lucsik also claims SportsBot has not generated a single loss day over the past year.

On the MLM side of things, Daxio pays a matching commission on returns paid to downline affiliates.

These commissions are paid via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Daxio caps payable unilevel team commissions at five:

- level 1 (personally recruited affiliates) – 5%

- level 2 – 4%

- level 3 – 3%

- level 4 – 2%

- level 5 – 1%

Note that while fees and investment amounts are quoted in euro, Daxio solicits investment in bitcoin. Returns and commission payments are made in tether.

From a surface level regulatory perspective, Daxio is committing securities fraud. This is illegal in practically every country on the planet.

Given SportsBot is technically the fifth reboot of Global Game Arena, it’s also likely a Ponzi scheme.

Given SportsBot is technically the fifth reboot of Global Game Arena, it’s also likely a Ponzi scheme.

Daxio’s launch model was a straight continuation of BetPlay365, the third Global Game Arena reboot.

That model had already flopped, prompting SportsBot’s introduction ~6 months into Daxio.

With heavy payout restrictions and funds locked up for half a year, SportsBot hasn’t unravelled yet.

Even if you take the claims at face value; a trading bot generating ~9% a week that hasn’t generated a loss in a year, soon adds up to infinity money.

In any event it’s certainly not something you’d sell access to for a couple of euro.

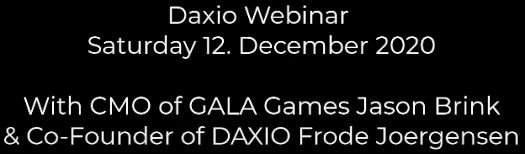

The only name publicly attached to Daxio is co-founder Frode Jorgensen.

Jorgensen, originally from Norway, relocated to Thailand some years ago.

Update 25th August 2022 – Daxio has rebranded its securities fraud offering around NFT gaming.

I am extremely skeptical as always, and don’t care for this site, nor will I ever use it. The only thing that caught me however, was the bit about “infinity money” regarding an arbitrage program.

It’s definitely a possible thing to create, considering I have a friend who has been running his one for around 5 years now, getting at least 10% monthly.

Out of everything from this site, that’s the only thing that looked at all legit to me, lol. But maybe I’m just naive and I could get enlightened.

If your friend actually had a bot generating “at least 10% monthly” for five years, with compounding they should have all the money in the universe by now.

The reason you “don’t care for BehindMLM” is because you’re full of shit. Best of luck with the scamming.

Maybe yes or maybe no. Who knows? (I think only a few of them knows the true). There are strange things, really. (but a “community-base company” looks different than a classic, this should already be noticed, isn’t it?)

But I think an update would be fair.

They sell a lot more other things on the platform as well.

Which is completely optional.

So these are REAL revenues (if the others are not).

So even if you have a ponzi part of the Daxio, they don’t have to fulfill exit scam.

… and if they stay on their feet for a few more years, they will even be removed from the list of companies suspected of fraud. 🙂

If you want to make financial claims about Daxio please provide audited financial reports.

Marketing claims are not a substitute for registration with financial regulators.

This is beyond me how grown men and womens can ape into this kind of shit in 2021? Mate you learned about this in low grade.

Everyone wants easy money, but that dosent exist. A Bot that makes a steady 1-2 % aday and never loses…And ppl think that are real.

IF that would be legit, this page woudnt be one of the first to pop up if you googled on the company name.

Lets be real. It would be so much more exposure. Not fat sweaty indian guys doing rew on youtube…

Well, I beg to differ. Daxio IS legit. My best friend makes about 1.500€/month. I make around 1.200€/month right now and will reinvest and start up bigger Sportbots and in 1.5 years I can withdraw 70.000€.

Daxio has recently teamed up with Skysports and announced ownership in Boxing Boyz, a new blockchain-game. And that fact, right there makes me think this is a company not afraid to show its name.

I do NOT however, like the fact that the recruit-a-friend-and-make more exists. I’m not interested in that. The good thing is that i don’t HAVE to recruit more people in order for the money to keep coming in for me.

bUt I’m MaKiNg MoNeY! isn’t due-diligence. Nor is it a substitute for compliance with securities law.

Legitimacy via association isn’t a thing.

Someone does though. Otherwise Ponzi go boom.

Now that Daxio is launching a new play to earn platform soon, releasing two tokens onto exchanges, the daxiobot is still earning revenue, huge public official events – time for another update?

If this was a ponzi, it’s been going on very, very long now. And the discord is growing fast, more and more things happen there. Including generous giveaways. Also a member raffle which pays a weekly pot of more than 25.000€. Total prizes paid since the beginning over 1.2 million €. I’ve personally won 500€ once.

When will Daxio become legit in your eyes? When does it become a valid strategy for earning money? Yes, Frode has been involved in some questionable things in the past. But Daxio seems real.

Daxio was the fourth reboot of the thrice collapsed Global Game Arena Ponzi scheme.

Daxio itself collapsed and was then rebooted with a SportBot scheme. That’s not even a year old and they’re adding new shit tokens to exit-scam through?

You can shill all you want but anyone with half a brain can see that for what it is.

SimilarWeb shows a steady decline in website traffic over the past 3 months. ~21,000 visits a month.

Scammers in Vietnam and Norway are recruiting. Malta has stalled and Daxio is dead everywhere else.

You can’t legitimise fraud. Sorry for your loss.

Daxio has not collapsed, are you even aware of things you talk about? The traffic to the website goes via MetaMask now. For increased security.

The sportsbot has been running since October 2020. Daily profit.

Here’s how it’s grown since the last week. Stalled? Not quite.

It didn’t say it’s collapsed, I said launching shitcoins is what it is.

There have been four recorded collapses so far, with Sportsbot being the fifth GGA reboot.

And? How long a Ponzi pays out for is irrelevant to it being a Ponzi scheme.

Daxio’s web traffic is down. Unless new suckers are found soon that’s the end.

That’s exactly what you said. But nevertheless. Daxio has changed my life for the better, and lot of others as well. And I am not complaining about that.

Have a nice day.

Yes. Daxio’s original offering collapsed and was rebooted with SportsBot. That’s exactly what I said.

Why would you?

It takes a certain person to be comfortable with stealing money through Ponzi schemes. Having a moral backbone doesn’t fit the profile.

A few more things before I go.

1. Neither me or anyone needs to recruit more people. Fact.

2. The money isn’t stolen or funneled from anyone. It’s profit from the money people deposit into the weekly pools.

The company keeps a certain percentage, as you know from your review. There’s the profit they make, no need for an exit-scam.

3. The sports trading is not illegal or shady in anyway. And it’s not a reboot. It’s a feature within the Daxio platform. You can even join for free.

4. I do have a moral backbone. A pretty big one at that. That is maybe true for others but not for me.

5. I will return in a year and comment again. Let’s see where Daxio is then.

Someone does. See previous four collapses.

1. Money is stolen through Ponzi schemes. I don’t sugar coat facts.

2. If you want to make financial representations about external revenue please provide evidence Daxio has registered with financial regulators and filed audited financial reports confirming the existence of said external revenue.

Securities fraud is illegal.

MLM + securities fraud = Ponzi scheme.

You can say what you want. You’re a Ponzi scumbag running around trying to defend theft.

When it comes to fraud you have no morals. You are what you are.

Daxio was a Ponzi scheme in 2020. Daxio is a Ponzi scheme now. Daxio will still be a Ponzi scheme in a year.

Your personal finances are neither here nor there.

To all you guys who are rooting for Daxio.. How do you feel about people not being able to withdrawal anything for 4 months now? That doesn’t sound legit to me.

t is a f*cking scam – and people are being treated like shit – no information, not allowed to question anything in discord (damn you if you do – then you are kicked from the server).

its not compounding, you get like 0.4 percent average on youre investment, the profit gets separatet every day.

i got my roi already so i dont care to much about the possible exti scam rn.if they leaf i still made profit lol. but still wouldnt recommend investing into it, its too late i think 🙂

Not sure what you’re expecting boasting about stealing money through a Ponzi scheme.

I’m sorry your parents failed you.