Corsair Group’s Finland recycling ruse comes undone

What’s left of Corsair Group has rallied around a recently signed agreement with Shell.

What’s left of Corsair Group has rallied around a recently signed agreement with Shell.

As outlined on Shell’s website;

September 2024

In Europe, Shell and Corsair sign supply agreement for pyrolysis oil from post-consumer plastic waste produced at Corsair’s chemical recycling facility in Jämsä, Finland. Shell will process the pyrolysis oil at its Chemicals Park in Moerdijk.

And as per an accompanying 6th September press-release on Corsair Group’s website;

Plastic waste recycling firm Corsair has signed an agreement to supply Shell Chemicals Europe B.V. with pyrolysis oil, a mixed plastic waste feedstock.

Under the agreement, Corsair, a company that converts daily household plastic waste into oil through pyrolysis, will deliver pyrolysis oil from its plastic waste chemical recycling facility in Jämsä, Finland, for Shell’s facility in Moerdijk, The Netherlands.

Corsair Group first announced “great progress” at its Kaipola facility in October 2023.

We are happy to inform you that the installation process of the first plastic waste chemical recycling unit at the Kaipola facility in Finland is moving along nicely.

In the meanwhile, piping works are taking a big step forward as well.

Stay tuned for further developments!

Corsair Group’s “Kaipola facility” operated as Kaipola Circular. As explained by a Finnish journalist who researched the matter;

In spring 2023, a company named Kaipola Circular announced its application for a pilot operation permit for plastic oil production in area of Kaipola, city of Jämsä, Finland.

At that time, my colleagues investigated the backgrounds of the company’s decision-makers and discovered that they are key figures in Corsair’s operations as well.

For instance, Andre Tops and Onno Ruiter, who hold positions as Corsair’s Chief Operating Officer and General Manager Europe, were on Kaipola Circular’s board.

In spring 2023, Andre Tops, representing Kaipola Circular, claimed to Yle that Corsair was not at all involved in Kaipola Circular’s operations in Finland.

However, after some time, Corsair began prominently promoting the Finnish project on its own channels. Subsequently, Kaipola Circular admitted that Corsair was involved in the project as a “collaborative partner.”

Now, less than two mo[n]ths ago, Kaipola Circular changed its name to Corsair Finland, and Corsair’s CEO, Jussi Saloranta, became the chairman of the board.

Two months prior to Corsair Group’s “great progress” update, Kaipola Recycling, a similarly named recycling company operating from the same Jämsä site, filed for bankruptcy.

The bankruptcy trustee in charge of the Kaipola Recycling’s bankruptcy sought to terminate proceedings in January 2024.

According to the liquidator, the company’s assets are not sufficient to cover the costs of the bankruptcy proceedings, and none of the company’s creditors are taking on the costs to cover them.

The costs of cleaning up the waste left behind by the company in the former factory area of Kaipola are estimated to be over two million euros.

The company’s debt, excluding capital loans, is approximately seven million euros.

A month later, in February 2024, another company, Cindrigo, revealed plans to commence operations at the site.

The multinational renewable energy company Cindrigo has signed a letter of intent covering a 50-year lease right to the waste-to-energy plant in Jämsä Kaipola.

Cindrigo doesn’t appear to have anything to do with Corsair Group – putting a question mark on claimed Kaipola Circular’s/Corsair Finland’s operations.

Nonetheless, our cited Finnish journalist reports;

To our knowledge, Kaipola Recycling is not related to the operations of Kaipola Circular and Corsair. Kaipola Recycling eventually went bankrupt, leaving behind large waste piles, but we have no reason to believe that Corsair or Kaipola Circular have anything to do with the waste problem.

Based on current information, Corsair is not responsible for this waste.

Finnish authorities announced an ongoing “classified” investigation into Kaipola Recycling in May 2024.

The District Court of Central Finland has today ordered the assets of three people who were influential in Kaipola Recycling Oy to be seized. For all three suspects, a maximum of one million euros will be confiscated.

The district court confirms that two persons are suspected of gross dishonesty of the debtor and one of aiding and abetting gross dishonesty of the debtor.

The suspects are the company’s CEO, the chairman of the board, and an individual smallholder.

The crimes are suspected to have occurred in Jyväskylä from 1 February 2021 to 8 August 2023. The company is based in Jyväskylä.

Corsair Group announced its Jamsa facility in June 2023 – evidently at the tail end of Kaipola Recycling’s fraud.

According to [crime commissioner Toni] Peuha, the investigation is also currently incomplete.

It is not yet known whether there will be more investigation requests, who the final parties and witnesses will be.

As far as Corsair Finland’s recycling operations go, our Finnish journalist source states;

By far, according to local authorities, Kaipola Circular and Corsair have operated in compliance with regulations in Kaipola, Jämsä. Plastic oil production began in January and has continued since.

As per a May 2024 article from Yle, Kaipola Circular/Corsair Finland is operating on a trial basis.

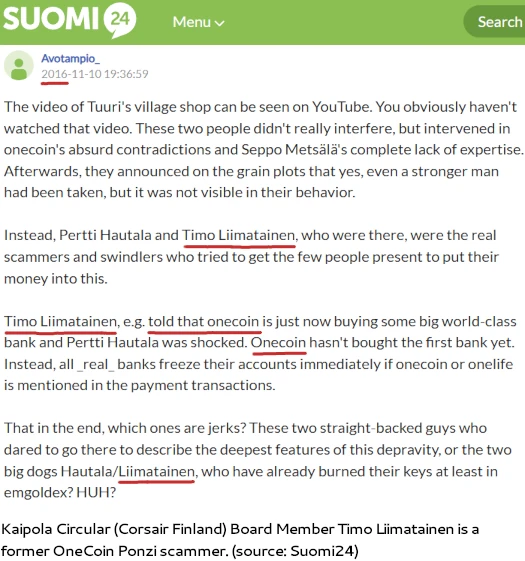

Yle cite Timo Liimatainen as a Kaipola Circular Board Member.

Circa 2016, Liimatainen was scamming Finland residents as a OneCoin Ponzi promoter.

Questions that remain unanswered is why Corsair Finland was initially registered as Kaipola Circular, and why the initial denial.

I suspect the answer is tied to Corsair Group’s fraudulent investment scheme.

Since 2021 Corsair Group investors have been led to believe long promised Ponzi profits are just around the corner. To date however those profits haven’t materialized.

Notably, Corsair Group isn’t registered to offer securities in Finland. Securities in Finland are regulated by the Financial Supervisory Authority.

Outside of Finland, Corsair Group has not registered with financial regulators anywhere. And this has lead to legal troubles in Italy, Corsair Group’s primary source of new investment.

Corsair Group was launched by convicted fraudster Frank Ricketts as Cloud Horizon in early 2019.

Today Corsair Group is headed up by CEO Jussi Veikko Saloranta, an Italian national and associate of OneCoin Ponzi scammer Staffan Liback.

Today Corsair Group is headed up by CEO Jussi Veikko Saloranta, an Italian national and associate of OneCoin Ponzi scammer Staffan Liback.

For some reason Kaipola Circular still has a two-page website up. There is no disclosure of the attached Corsair Group investment scheme or Saloranta.

As of September 2024, SimilarWeb tracked around five thousand monthly visits to Corsair Group’s website. 79% of Corsair Group’s monthly website traffic originates from Italy.

Italian authorities declared Corsair Group an illegal investment scheme in January 2022. A month later Italian authorities targeted local Corsair Group promoters.

As of October 2024, SimilarWeb was tracking ~2100 monthly visits to Corsair Group’s website. 94% of Corsair Group’s website traffic originates from Italy, followed by 6% from France.

Whether Shell is aware of Corsair Group committing securities fraud and certification as an illegal investment scheme in Italy is unclear.

Update 20th November 2024 – This article originally cited Kaipola Recycling as being associated with Corsair Group, with Kaipola Circular being unknown to us (owing to the Corsair Finland name-change).

With additional input from a Finnish journalist forwarded to us by a reader, we’ve edited the article to better reflect events at the Jamsa facility and associated criminal investigation.

Thank you for this update 😉

Limocoin, the african wing of Corsair:

youtube.com/watch?v=9OUczclvqxc

Big surprise at 1h03.

Putting aside Indians scamming Africans, lol @ “US KYC”.

Corsair Group has no presence in the US. Also why do Africans care about the US?

“Ahah! Usually we are the low hanging fruit at the end… now we get to rinse Americans!”

Sounds like after Finland collapsed the US is Corsair Group’s new bogus recycling marketing ruse.

Corsair is now in the USA with L. Mack khurram president of sales of Corsair in North America !!!

ibb.co/TcPMVt4

youtube.com/live/9OUczclvqxc?feature=shared&t=3787

In Italy they continue to illegally carry out financial activities by selling their CSR token and promising amazing profits, despite the bans imposed by Consob (SEC in the USA)

They have recently become more active on social networks with a few pics of 3 bins in Thailand :

instagram.com/corsair.international/

instagram.com/csrplasticcreditofficial

Recruiting New Age priestesses & influencers, Bali-based life coaches and crypto traders to expand their market with the glamour of a luxurious lifestyle to a gullible and highly malleable public.

Combining spirituality, ecological awareness, wellness, empowerment and benevolence with slogans such as “business and money from the heart”, only to sell a token that has lost 60% of its value since its launch.

The French branch seems motivated with a nebula of enthusiastic gourmets in this line-up, the same people who were already involved in promoting the Healy device some years ago :

warning-trading.com/marketing-multi-niveau/amplivo-corsair-csr/

The ecological cause is noble but these people make it look ridiculous.

Jussi is not happy about the article… see his video.

but he doesn’t say anything about the victims that purchased the CSR and are now unable to withdraw anything !!!

youtu.be/3f2TOo81tFI?si=laI53db2p3iDL-rz

We’re not even the source of the research, Finnish journalists were.

But uh yeah, a 30 minute video from butthurt scammers. Rent free.

Where is Corsair Group’s legally required audited financial reports filed with regulators? Anything else from Jussi Saloranta is noise.

This includes asserting “having nothing to do do” with the company that owns the facility at which you claim to be operating from.

YouTube videos are not a substitute for legally required audited reports filed with financial regulators.

Also reminder: SimilarWeb tracked just ~5000 monthly visits to Corsair Group’s website for September 2024. 79% of that traffic (what’s left of Corsair Group), originated from Italy.

Corsair Group is a certified illegal investment scheme in Italy. Promoters have been subject to criminal proceedings.

Oh and just so we’re clear, here’s the timeline all of this is based on:

June 2023 – Corsair Group announces its Jamsa Recycling facility, then run by Kaipola Recycling.

August 2023 – Kaipola Recycling files for bankruptcy.

October 2023 – Even though nothing is happening on site due to Kapola Recycling’s bankruptcy, Corsair Group publishes “great progress” update.

January 2024 – It is confirmed the only verifiable operations that have taken place at the site of Corsair Group’s purported operations in Jamsa is generating millions of dollars in waste that must be disposed of.

February 2024 – Cindrigo, which has nothing to do with Corsair Group, secures a 50-year lease to the Jamsa recycling facility.

May 2024 – Finnish authorities confirm ongoing criminal investigation into Kaipola Recycling.

In violation of securities laws in any regulated country, to date Corsair Group has failed to provide authorities, its investors or the public with audited financial reports pertaining to its claimed recycling activities in Finland.

I’m sure you can figure out why that is.

Many explanations but it does not clarify why in Italy its promoters, without registration in the National Register of Financial Promoters, continue to sell financial products to people without any authorization from Consob.

I remember that the appeal made by Corsairgroup against the Consob provisions was withdrawn by Corsairgroup itself, therefore their operations in Italy are illegal.

consob.it/web/area-pubblica/-/delibera-n.-22182

Frank Ricketts is not yet in jail. His sentence must be approved by a higher court and that takes time in Germany.

“A leader leads by example not by force.” – Sun Tzu

and

“The best way to shut down detractors is by being an achiever.” – Priyanka Chopra

@Martin

Thanks for pointing that out. I think it’s come up before.

I’m used to sentencing –> prison.

Sentencing –> few decades pass –> go to prison (maybe). Germany things…

They also said they went public 1 and a half years ago. Obviously this never happened either.

youtube.com/watch?v=-g85gAYF6QM

Article updated with additional input from a Finnish journalist, forwarded by a reader. I’ve revised the originally published article to better reflect the current situation.

It can be difficult to track financial fraud in non-English speaking jurisdictions. This is especially true when dealing with similarly named companies and deliberate intent to hide fraud.

It’s true ?

eventbrite.com/e/corsair-international-usa-official-launch-tickets-1061806855889

Is what true? You can already sign up as a Corsair Group affiliate investor from the US.

Original CSR token look like total scam. Google csr usd. None of the work is audited.

I confirm. So many people bought csr following corsair promises.

Nothing happened. No-one buy any. Ño trade..

Price is so decreasing And no machines, no plastic cleaning. Only words.

The SCAMMERS at Corsair are trying to raise 5 million !! BEWARE .

Corsair Capital Holding..Netherlands.. Plastic Waste Recycling

Date of Issue: 2025-11-01 .Issue Price: 0.01.Currency:EUR

Min Subscription: 10,000 shares or €100

Status: Live . Target amount: 5,000,000.