Bitcoiin securities fraud cease and desist issued by New Jersey

![]() New Jersey is the latest state to enter the cryptocurrency cease and desist fray.

New Jersey is the latest state to enter the cryptocurrency cease and desist fray.

On March 7th the New Jersey Bureau of Securities slapped Bitcoiin with a securities fraud cease and desist.

Bitcoiin bills itself as ‘a superior or more advanced version of Original Bitcoin‘.

Bitcoiin 2Gen, will in fact address current issues that are slowing down the Bitcoin eco-system and the limited opportunity for the enthusiasts to be able to earn by mining either with 1 machine or 1000.

BehindMLM reviewed Bitcoiin in early February and concluded it was just another MLM pump and dump altcoin.

According to the New Jersey Bureau of Securities, Bitcoiin ‘is fraudulently offering unregistered securities in violation of the Securities Law‘.

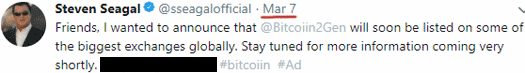

One of the more peculiar aspects of Bitcoiin was its partnership with Steven Seagal, who signed on as Bitcoiin’s “ICO Brand Ambassador”.

“I endorse this opportunity wholeheartedly,” Mr. Seagal told the participants at a recent meeting in B2g’s executive offices in Asia.

“I am excited about the management, and especially about the secure blockchain, underlying mining technology, and safeguards.”

The New Jersey Bureau of Securities has taken Bitcoiin to task over the endorsement, stating the company has failed to

disclose what expertise, if any, Steven Seagal has to ensure that the Bitcoiin investments are appropriate and in compliance with federal and state securities laws.

Additionally, there are no disclosures as to the nature, scope, and amount of compensation paid by Bitcoiin in exchange for Steven Seagal’s promotion of the Bitcoiin investments.

Respectively, I’m gonna go with “no expertise” and “a truckload of money”.

Bitcoiin’s pump and dump altcoin is also attached to a pyramid recruitment model, which didn’t escape the attention of the Bureau of Securities.

Bitcoiin uses (a) pyramid-shaped diagram to describe the commission structure.

When potential investors create new accounts, the first piece of information requested from Bitcoiin is a “Referral Id.” to identify the “affiliate” that referred the investor.

(Bitcoiin) “affiliates” are agents as defined by N.J.S.A. 49:3- 49(b).

These “affiliates” are not registered as an agent with the Bureau or exempt from registration.

In light of

- The Bitcoiin ICO and Staking Program securities not being registered with the Bureau, nor “federally covered”, nor exempt from registration

- Bitcoiin not being registered with the Bureau as a broker-dealer or in any capacity

- Bitcoiin using “affiliates” to offer securities in New Jersey who are not registered with the Bureau as agents

- BitCoiin failing to disclose the identity of its principals

- Bitcoiin failing to disclose a physical address and its principal place of business

- Bitcoiin failing to disclose its assets and liabilities, or financial information about the business

- Bitcoiin failing to disclose the persons or entities that developed B2G, including the number of coins owned by these persons or entities, and the amount of B2G owned by the principals of Bitcoiin

- Bitcoiin failing to disclose that the Bitcoiin securities are not registered as required

the Bureau of Securities concludes ‘Bitcoiin is engaging in fraud in connection with the offer for sale of securities‘.

As per the March 7th order, Bitcoiin has been ordered to immediately cease and desist from operating and promoting unregistered securities in New Jersey.

The same applies to Steven Seagal and the company’s affiliates.

BitCoiin have fifteen days to write to the Bureau of Securities to request a hearing to lift the cease and desist.

If no communication is received, the cease and desist will be deemed a “Final Order” and permanent.

Perhaps I wasn’t the only one to call the SEC on Mar. 6 to report the XM radio commercial advertising Bitcoiin. I know it wasn’t the NJ SEC, but still..

Seriously though, I wonder if the commercial hastened the order?

March 6th was the first time I had heard the commercial, and this was issued on March 7.

You’re not going to get an answer out of them on that, and unfortunately all we can do is speculate 🙁

lol Segal still has his involvement with Bitcoiin pinned on his twitter!

Now that’s commitment to justify a payoff 😛

Doesnt matter really. Just happy to hear the news.

Part of me does hope their brazenness accelerated their impending demise though.

For what it’s worth, on February 16th we received this comment from “John Williams” on our BitCoiin review:

I marked it as derail spam for obvious reasons. IP address was Nevada, US.

I’ve got people emailing this “opportunity” to me already. I sent the link to this website showing the cease and desist order. Another one bites the dust LOL!