BioLimitless charging up to $250,000 investment fee

BioLimitless has announced an up to 250,000 tether (USDT) investment acess fee.

BioLimitless has announced an up to 250,000 tether (USDT) investment acess fee.

The fee disclosure was made on a September 25th marketing webinar hosted by BioLimitless co-founder Jeremy Roma.

As per the marketing slide above, the BioLimitless investment fee allows an investor to invest up to 400% of the fee paid. E.g. Payment of a 100,000 USDT access fee allows for an investment of up to 400,000 USDT.

BehindMLM first reported on BioLimitless’ passive returns investment scheme on September 14th. Naturally with neither BioLimitless or Roma being registered with the SEC, our primary concern was securities fraud.

Two days later, on September 16th, BioLimitless filed a Form D with the SEC through Biolimitless Centers of Excellence, Inc., a Delaware shell company.

A Form D is notification of a securities offering to the SEC that the offeror believes qualifies from registration exemption.

Of note is BioLimitless’ filed Form D stating the “minimum investment accepted from any outside investor [is] $20,000 USD”. This is at odds with BioLimitless marketing, which specifies a minimum 100 USDT investment.

Use of the cryptocurrency tether is not disclosed in BioLimitless’ Form D filing.

As to the exemption, BioLimitless is seeking exemption under Rule 506(c).

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that:

- all purchasers in the offering are accredited investors

- the issuer takes reasonable steps to verify purchasers’ accredited investor status and

- certain other conditions in Regulation D are satisfied

Purchasers in a Rule 506(c) offering receive “restricted securities.” A company is required to file a notice with the Commission on Form D within 15 days after the first sale of securities in the offering.

BioLimitless addresses the issue of accredited investors in a second marketing slide:

“Restricted securities” essentially means the BioLimitless investment positions can’t be shared.

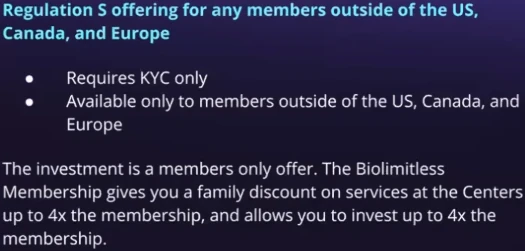

Curiously, outside of most of the western world (US, Canada and Europe), BioLimitless is letting anybody invest.

It should be noted that if BioLimitless’ securities offering isn’t registered in countries with regulated financial markets outside of the US, Canada and Europe, that constitutes securities fraud.

To date BioLimitless hasn’t indicated it has registered its “clinic” investment scheme in any country outside of the US.

Between securities fraud outside of the US, Canada and Europe and accredited investors, I’m going to go out on a limb and suggest “Phase 1” of BioLimitless’ investment scheme disqualifies 99.99% of Daisy AI Ponzi victims.

Roma’s answer to that is a pending second investment offering;

We are registering a Reg D offering. That will be completed before our official launch in Dubai.

And once that is completed we will be able to open up the crowdfunding to retail investors as well.

BioLimitless’ Dubai launch is scheduled for sometime in March 2025.

With BioLimitless passive returns investment scheme quite obviously constituting an investment contract as per the Howey Test, I’m not seeing how it can legally open up investment to retail investors. Not through a Form D exemption as stated anyway.

Pending further information on BioLimitless’ Phase 2 scheme, we’ll keep you posted.

On the subject of Daisy AI Ponzi losses, there have been no updates since Daisy AI’s final collapse in December 2023.

While millions in Daisy AI investor funds remain unaccounted for, Roma and wife Umida appear to be doing fine.

SimilarWeb tracked just ~12,700 monthly visits to Blockchain Sports’ website, Daisy AI’s direct Ponzi successor, for August 2024. And that was up 33%, with monthly visits for July dipping below 10,000.

Time to lock Jeremy Roma up and throw away the key.

As of May 2025, it appears that Roma’s grand plans for Biolimitless have evaporated. Dr. Eric is back to selling his supplements online. No mention of centers of excellence or investors.