Alan Friedland’s CFTC fraud settlement coverup

![]() On January 31st Alan Friedland’s CompCoin fraud trial kicked off.

On January 31st Alan Friedland’s CompCoin fraud trial kicked off.

After three days of the CFTC presenting its evidence against Friedland, which included calling up five witnesses, Friedland settled the charges.

Friedland’s CFTC settlement has yet to be finalized and approved by the court.

Despite that Friedland is already sweeping his settlement under the rug.

With BuilderDefi’s launch and Friedland’s CFTC settlement happening simultaneously, there are investors asking uncomfortable questions.

Upon hearing Friedland explain BLDR’s coin price will fluctuate and losses are possible, one potential BuilderDefi investor remarked;

Listen I’m sorry, I’m not trying to be disrespectful in any way, shape or form. I was just allowed into this room so I’m not going to try and be…

But from that statement that was just made, coming from somebody who just said twenty, maybe fifteen minutes ago, that he had just dealt with the CFTC or some court case, and then he’s like, “Hey man, don’t risk anything that you might lose, this might fluctuate.”

And then, “Oh but we’re totally, y’know, confident that this is gonna work”. That scares the living fuck out of me as an investor.

While Friedland was rambling on about BuilderDefi, webinar participants raised questions about his CFTC settlement.

There’s some chatter about my recent settlement for a case that was brought against my firm and then myself, in regards to a very promising blockchain project that started in 2014, that I founded.

I am an entrepreneur. I’ve been in the financial industry. We ran into some very, very unfair regulation because, y’know I was a proponent of cryptocurrency.

We filed, we met many times with the regulators. Unfortunately they made it impossible for us to operate and so, as part of it, I agreed, for business decision [sic], to settle.

For the record, the CFTC went after Friedland for soliciting $1.6 million in investment into CompCoin.

The CFTC didn’t invent any new laws to charge Friedland under. The Commodities Exchange Act has been around since 1936.

Friedland represented to CompCoin investors that revenue would be generated via ART, an AI trading platform.

Friedland began soliciting investment into CompCoin based on ART’s “success”, failing however to disclose that ART had only been tested in a hypothetical environment.

The CFTC sought to have Friedland return the $1.6 million stolen from investors, plus interest and a civil penalty.

The case had nothing to do with Friedland being an entrepreneur or early crypto adopter.

When NRGY launched Duane Noble, one of Friedland’s business partners, was touting TradeGenie.

[21:20] Our first app is coming out, it’s an algorithm that connects to people’s TD Ameritrade account and it trades stocks automatically.

[22:14] It’s gonna be called TradeGenie.

TradeGenie is believed to be the rebranding of ART.

TradeGenie however never materialized. If it’s still part of NRGY and/or if it’s being relaunched through BuilderDefi, details are under wraps.

Friedland revisited his yet to be approved CFTC settlement later in the two hour plus webinar;

It was very unfair. Very, very unfair.

Regulators are called regulators for a reason. They’re trying to regulate, they’re trying to stop the change and people like me are innovating and creating the change.

And I’m not the first person to be attacked, right… because they’re trying to make change in this world.

At the same time, um, it’s done. I just settled it.

I had enough time fighting with the government. They got a lot smart lawyers. They had nine lawyers, with the staff.

They know how to roll people. They know how to bulldoze people. Okay?

And I fought with them, and I… y’know, in the end I think I earned their respect.

In the middle of the trial they said, “Hey, do you want to settle?”

And I was just like, y’know it’s just what’s best. It was a business decision.

I need to spend my time and spend my efforts and my energies that I have in my life creating things, building things – not fighting with the government.

That’s just not worth it. Not over money.

There’s a bit to unpack there.

Let’s start with investor losses not being some revolutionary “change” as Friedland puts it.

Illegally soliciting $1.6 million on the fake representation of theoretically generated returns that you failed to disclose to your investors, doesn’t make you some entrepreneurial maverick.

It makes you a scammer in violation of the Commodity Exchange Act.

The CFTC filing a lawsuit against Friedland wasn’t “attacking” him, it was holding him accountable for breaking the law.

As for fighting the government. The CFTC filed suit against Friedland in April 2020 – almost two years ago.

Friedland very much fought the government every step of the way. Having then prepared for trial and spending the money on lawyers who prepared a defense for the jury, Friedland pulled the plug.

Prior to the trial Friedland stated US regulators had “botched this up very, very badly.”

All that changed after that was the CFTC had three days to lay their case out in front of a jury.

Friedland had already fought the government. All he had to do was sit back and let his lawyers present his defense.

Instead, after listening to the evidence against him over three days, Friedland jumped at the first opportunity to settle.

If you’d been fighting a case for two years that had finally progressed to trial, would you pull the plug if you felt confident?

The reality of Friedland’s CFTC settlement is in stark contrast to the marketing bravado he’s pitching to potential BuilderDefi investors.

I get why Friedland’s doing it, evidently just admitting you broke the law and copping on the chin is too much for some people, but why put on this show when everything is publicly verifiable?

The only thing I’ve left to speculation above is why exactly Friedland settled at the eleventh hour – literally on the eve of his defense presenting his case to the jury.

Everything else is pulled from publicly available court filings.

Personally I suspect TradeGenie has been quietly dropped (or temporarily shelved), to throw off the CFTC.

Friedland remains unregistered with the CFTC, meaning there’d be nothing stopping the regulator from filing an identical lawsuit over the same conduct (Art to CompCoin is what TradeGenie would be to NRGY/BuilderDefi).

BuilderDefi offering a passive 5% a week ROI opportunity however, brings it under the SEC’s jurisdiction.

BuilderDefi and Friedland aren’t registered with the SEC and, based on representations of his partners, doesn’t plan to.

Instead they’re going to deploy pseudo-compliance:

Meeting with the attorney, I just want to let you know this right, because before I would say a whole lot of things, right?

A whole lot of things, before we created this whole project, and we met with the attorney and the legal team there, and they said, “Hey, you better be careful what you say. You can’t use the word investment.”

And I guess because the SEC have purchased that word and have ownership to that word for some reason, so we can’t say it. But you can say, “You can buy some coins”.

You can’t guarantee any return. And that’s the reason why, even though Alan and his team have created a program that can potentially earn more than 5% a week – but guess what?

We can’t say (that), we have to say, “Target five percent.” Right?

So there’s a lot of things that we have to change and that same verbiage has to be utilized by the entire community.

Just to make sure that we can keep the Securities and Exchange Commission, the SEC, on the other side of the wall and they are never going to come into our yard.

With respect to regulation, while what you call a passive investment opportunity can add additional charges, it is the act of offering unregistered securities itself that is a violation of the Securities and Exchange Act.

BuilderDefi’s 5% a week passive returns MLM opportunity is a securities offering, regardless of how it’s phrased, whether it’s through cryptocurrency or how it’s marketed.

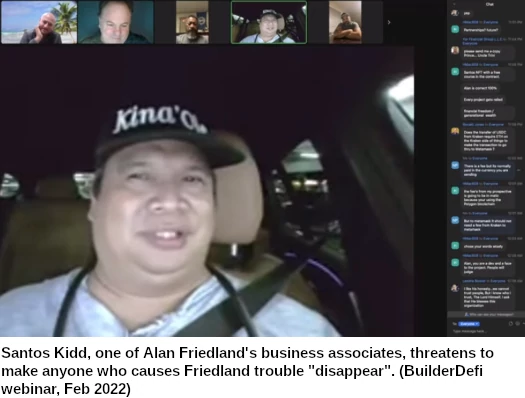

Friedland’s business partner Santos Kidd ended the webinar by comparing Friedland’s CFTC case to Jesus Christ’s crucifiction.

Whoever makes trouble to you I can make them disappear. I know people in (indecipherable).

BuilderDefi begins soliciting investment from the public on February 10th.

Update 7th April 2022 – Alan Friedland’s CompCoin fraud settlement has been approved.

Probably nothing but BuilderDefi’s website has been “down for maintenance” for two going on three days now.

BuilderDefi’s website back up.

Website promises “full transparency” but still doesn’t disclose BuilderDefi is owned by Friedland.

BLDR price chart link is broken.