TelexFree’s redundant argument against prelim injunction

![]() In a nail-bitingly suspenseful hearing yesterday, Judge Landis ordered TelexFree’s Chapter 11 bankruptcy application be moved from Nevada to Massachusetts. And in the meantime, the Nevada bankruptcy court will abstain from making any further orders regarding the case.

In a nail-bitingly suspenseful hearing yesterday, Judge Landis ordered TelexFree’s Chapter 11 bankruptcy application be moved from Nevada to Massachusetts. And in the meantime, the Nevada bankruptcy court will abstain from making any further orders regarding the case.

In short, pending the move to Massachusetts (where it is likely to be heard and subsequently rejected by the same Judge hearing the SEC complaint), TelexFree bankruptcy application is currently dead in the water.

The next big court date for TelexFree is now a hearing for the granting of a preliminary injunction against the company, key insiders and top promoters, to be heard in Massachusetts today.

Filed on May the 2nd, here’s the opening statement of TelexFree’s argument against the injunction:

After intentionally disregarding the preexisting bankruptcy proceedings involving TelexFree and racing into this Court instead on an ex parte basis to obtain a temporary restraining order, the Securities and Exchange Commission (“SEC”) now asks this Court to convert the ex parte temporary restraining order issued on April 16, 2014 (the “TRO”) into a preliminary injunction.

Oh my!

Granted TelexFree’s response to the preliminary injunction motion was filed on the 2nd and on the presumption their bankruptcy application wouldn’t get tossed out Nevada, nonetheless it sets the stage for the judicial walloping coming the company’s way later today.

Built on the foundation of the now non-existent Nevada bankruptcy proceedings, the rest of TelexFree’s arguments are equally amusing.

The Debtors-in-Possession contest the allegations in the SEC’s Complaint and do not believe that the SEC can demonstrate that it likely to succeed on the merits.

(TelexFree) also believe(s) that the SEC overlooks a key fact that requires the denial of its request for a preliminary injunction with respect to some of the requested relief: the voluntary Chapter 11 bankruptcy petitions previously filed by the Debtors-in-Possession (and other related entities) in the United States Bankruptcy Court for the District of Nevada on April 13, 2014.

The Chapter 11 Cases provide the proper framework for administering all of the assets and overseeing the business operations of (TelexFree), in order to maximize the ultimate recovery for all creditors.

In both the motion filed by the SEC seeking the TRO and the now pending Motion for a Preliminary Injunction, Order Freezing Assets, and Order for Other Equitable Relief, the SEC asks this Court to upend that entire process (the bankruptcy) based on the SEC’s skewed versions of events, the most egregious of which is its continued refusal to accept that the Debtors-in-Possession undeniably replaced their entire senior management and ceased engaging in the activities complained of before either the Chapter 11 Cases or the case before this Court were commenced.

Yo, TelexFree replaced their Ponzi ringleaders and installed some clueless stooges to take over… surely that counts for something?!

I mean, Stuart MacMillan and William Runge didn’t start the Ponzi scheme fire, so surely that means anything TelexFree did prior to their hiring doesn’t count. That’s how the law works, right?

As utterly ridiculous as TelexFree’s preliminary arguments against the injunction are, as one reads through their thirty-two page response, things only get worse.

(TelexFree) are neither operating nor honoring the Pre-Petition Comp Plans.

By motion filed on the Petition Date, the Debtors moved pursuant to Section 365 of the Bankruptcy Code to reject all agreements between

the Debtors and Promoters under both the Original Comp Plan and the Revised Comp Plan.

So uh, file for bankruptcy to negate the Ponzi liabilities you’ve racked up… and we’re cool?

In addition to the 99TelexFree VoIP service, TelexFree Nevada and TelexFree Massachusetts released a mobile phone “app” for iPhones and Google phones in March 2014.

The Debtors believe the sales of the 99TelexFree product, the TelexFree “app,” and other new products will ultimately prove successful and profitable.

Based on what exactly? It’s an open-secret that the only people using 99TelexFree were Ponzi participants. Moreso under the revised compensation plan, because they were defacto required to in order to qualify for their weekly ROI.

It should be noted that when pressed on the origin of his belief in TelexFree’s yet-to-be-released products, Stuart MacMillan told the bankruptcy court a

network marketing exec working with (him) said he was excited about (the) product. MacMillan (is) optimistic because this exec is optimistic.

Sounds solid to me!

Meanwhile Skype costs less than half of 99TelexFree, and delivers service to more countries.But uh yeah, so long as this “exec” is excited…

(TelexFree) believe that the direct selling model can be a powerful sales tool if structured and managed correctly. It effectively utilizes the individual brands of

people and pays them to refer and sell products and/or services, thereby eliminating the need for costly advertising spend or middlemen in the distribution chain.Many iconic companies in the United States and around the world, including Mary Kay, Avon, Amway, Tupperware, and Shaklee, successfully utilize a direct selling model.

Yeah but… one small problem: None of those companies offer fraudulent Ponzi ROIs via an AdCentral investment scheme.

Oh and what’s all this crap about “direct selling is great if structured and managed correctly”? Does that mean Wanzeler, Merrill and Labriola simply cocked it up these past two years?!

“No harm, no foul guys… we didn’t know what we were doing or how to run the business. But that still means we get to keep the millions in revenue we took in doesn’t it?”

In their core arguments against the preliminary injunction, TelexFree identify a four-part prong test as follows:

1. The Public Interest Would Be Adversely Affected by an Injunction

Although a bit unorthodox, the Debtors-in-Possession address first the effect that would inure to the public by the issuance of a preliminary injunction because that effect would be so adverse.

Wait what? You’re arguing that unspecified adverse effects as a result of the yet-to-be-granted preliminary injunction affect the public interest? Huh?!

The public interest is best served by enabling the Debtors-in-Possession to continue their reorganization efforts under the auspices of the Bankruptcy Court, so as to maximize recovery for creditors while protecting their existing and seeking to recover additional assets previously transferred.

For the record, let me just repeat what TelexFree submitted only a few paragraphs earlier in the same document:

By motion filed on the Petition Date, the Debtors moved pursuant to Section 365 of the Bankruptcy Code to reject all agreements between the Debtors and Promoters under both the Original Comp Plan and the Revised Comp Plan.

So basically what you’re arguing is that the shafting of your creditors (affiliates) is in their best interests?

…

…yeah, so exactly how much crack was smoked during the authoring of this document?

The rest of TelexFree’s argument under this prong is hilarious, considering the Nevada bankruptcy court punted the case over to Massachusetts:

Contrary to the dire picture painted by the SEC, the very fact that the Debtors have filed the Chapter 11 Cases makes the grant of preliminary injunctive relief entirely unnecessary and contrary to public policy.

By commencing the Chapter 11 Cases, the Debtors have voluntarily submitted all of their assets to the exclusive jurisdiction of the Bankruptcy Court. All of the

Debtors’ assets that the SEC seeks to freeze by way of the preliminary injunction are now property of the Debtors’ bankruptcy estates pursuant Bankruptcy Code section 541, subject to oversight by the Bankruptcy Court and the Department of Justice (through the Office of the

United States Trustee).The Bankruptcy Code and Rules impose significant requirements on debtors that are designed to create transparency in the reorganization process and protect the interests of creditors, the estates and the public. A debtor seeking to reorganize under Chapter 11 is required to file detailed Schedules and Statements of Affairs under penalty of perjury, and to file monthly debtor-in-possession operating reports for the entire period of the case.

See, e.g., 11 U.S.C. § 521; Fed. R. Bankr. P. 1007, 1008, 2015. In addition to complying with all of their obligations under the Bankruptcy Code, Chapter 11 Debtors-in-Possession must also operate their business in accordance with all applicable non-bankruptcy laws.

Notwithstanding the relief sought by the SEC, the Debtors’ assets are already (and were as of the date of the TRO) under the exclusive jurisdiction of the Bankruptcy Court, with all of the protections and safeguards in place to protect and maximize the value of those assets for constituents.

The Bankruptcy Code further provides detailed processes and procedures to resolve and manage creditor claims.

Yes, yes – don’t grant the preliminary injunction because, due to the Chapter 11 application, it’s entirely unnecessary.

Oh wait…

Crying about not being able to meet the production scheduling set by the Massachusetts District Court and the FBI having seized their checks and infrastructure, TelexFree conclude

The real harm would be to allow the SEC to choke off and truncate the entire bankruptcy process that is expressly intended to provide transparency to the public and a comprehensive array of protection and accountability to creditors.

The entry of a broad preliminary injunction that would maintain the existing freeze on all of the property of the Debtors’ estates would completely frustrate the

ongoing reorganization efforts in the Chapter 11 Cases, and is unmistakably not in the public interest.

Can I get a thumbs up for TelexFree’s “reorganization efforts”?

2. Denial of the Preliminary Injunction Would Cause No Irreparable Harm to the

Public

Denying the preliminary injunction would cause no irreparable harm to the public. The SEC tacitly acknowledges this, arguing only that the purported violations of the TRO discredited above constitute irreparable harm.

How strange that TelexFree don’t consider the attempt to hide funds that will ultimately be used to pay back net-loser affiliates “irreparable harm”…

But uh please Mr. Court, do consider taking TelexFree at their word:

There is no risk of any future harm to the public by conduct of the Debtors-in-Possession.

The Bankruptcy Court has oversight over the business activities and assets of the Debtors. The individuals against whom the SEC has made serious violations are either no longer affiliated with the Debtors, or have been neutralized to the extent the Debtors could not sever ties entirely.

New, outside management has been brought in to oversee the reorganization. The compensation plans that were the primary focus of the SEC were terminated prior to the filing of both the Chapter 11 Cases and the instant action in this Court.

The Debtors-in-Possession have asked the Bankruptcy Court to approve the rejection of those plans. There is no potential irreparable harm to the public that needs to be enjoined.

It’s not like TelexFree are known to lie or anything…

3. Both the Public and the Debtors-in-Possession Would Be Injured By An Injunction

The issuance of an injunction would harm both the public and the Debtors-in-Possession, as neither would benefit from a failed Chapter 11 reorganization.

Wouldn’t benefit TelexFree sure, but as an alternative to TelexFree nullifying any money owed to affiliates, in no way shape or form are affiliates benefiting from TelexFree’s now-dead bankruptcy application.

Although the Debtors-in-Possession vigorously contest the merits of the allegations that SEC has made, or that their business was a Ponzi or pyramid scheme, even such a finding would not warrant the broad scope of the injunctive relief requested here. Given the nature and scope of such schemes, the Bankruptcy Court is the ideal forum to adjudicate all of the competing demands via the tools at its disposal for alleged Ponzi schemes.

Sorry, “not a Ponzi scheme”?! Lolololol.

“And now Mr. TelexFree, please explain to the court how, under the operation of a legitimate enterprise, TelexFree took in $1 billion in revenue and now owe depositors $5 billion dollars.”

“Well uh… you see… we have this app and uh I’m not really sure what it does but uh… did I mention one our execs is excited?”

4. The SEC Has Not Shown a Likelihood of Success on the Merits

After considering all of the overwhelming evidence regarding the severe detrimental effect that a preliminary injunction would have on the Debtors-in-Possession, their creditors, and the public, if the Court looks at the factual dispute between the parties, there is no possible way at this stage to find that the SEC has established a likelihood of success on the merits.

Well yeah, if you totally discount the fact that the SEC are accusing you of being a pyramid scheme and that, due to your business model that’s exactly what TelexFree is.

But uh sure, not “likely” to be proven in court. Good one guys.

The SEC has filed a Complaint; that is a claim that the parties will litigate. The case will proceed to some sort of adjudication that will then, if a judgment is rendered in favor of the SEC for a liquidated amount, be treated appropriately by the Bankruptcy Court.

But even at this early stage of the proceedings, it is patently apparently that the Debtors-in-Possession have significant defenses and that the SEC has not shown any likelihood to succeed on satisfying all of the required elements of its claims.

You guys couldn’t even hoodwink the Nevada bankruptcy court with your silly “defenses”. Cut the crap.

The bankruptcy court aren’t going to hear anything. Massachusetts will either outright reject the application, abstain from the case as soon as it’s moved over or order a Chapter 11 Trustee as the bankruptcy code calls for in cases of fraud.

It’s done, the fat lady has sung and she’s not coming back out for an encore.

Still part of prong four, now comes the crème de la crème of TelexFree’s arguments:

The SEC has not shown any likelihood to succeed on satisfying all of the required elements of its claims.

For instance, an investment contract consists of (i) the investment of money, (ii) in a common enterprise; and (iii) with an expectation of profits derived solely from the efforts of others.

Yeah… otherwise known as the TelexFree AdCentral investment scheme. What’s your point?

None of the required elements to constitute an investment contract are satisfied here, and therefore there was no sale or offering of “securities” that could lead to a violation of the securities laws.

Here, promoters did not “invest” anything, and did not receive a “financial interest.” Instead, they bought wholesale VoIP Products for re-sale. Promoters also did not invest in a “common enterprise.”

The First Circuit applies a “horizontal commonality” test to a common enterprise, which requires “the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise.”And promoters had no reasonable expectation of profits from the efforts of others.

In addition, even if the ad packages were securities (which they are not), for a statement or omission to be actionable under the securities laws, they must concern a material fact or omission.

All of the statements attributable to the Debtors identified by the SEC are either (i) accurate (and not a misstatement), or (ii) do not concern a material fact.

Moreover, the Debtors-in-Possession did not “make” the statements of its Promoters, including statements promising payments for ad placement.

For securities fraud liability under Section 10(b) and Rule 10b-5 thereunder, the Supreme Court has held that “the maker of a statement is the person or entity with ultimate authority over the statement, including its content and whether and how to communicate it . . . . One who prepares or publishes a statement on

behalf of another is not its maker.”The SEC also points to “reassuring” statements made by Messrs. Wanzeler, Merrill and Labriola in June 2013 concerning the company’s future after the State of Acre, Brazil took regulatory action. These opinions are nothing more than non-actionable puffery.

As these selected defenses and the holes in the SEC’s allegations show, the SEC has certainly not shown a likelihood of success on the merits of its securities claims.

ARE YOU FUCKING KIDDING ME GUYS?!

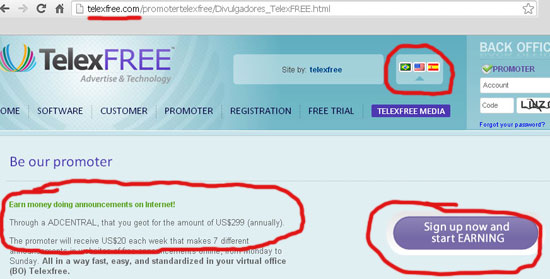

Exhibit A, TelexFree’s website:

Invest $299 and get paid $20 a week!

Exhibit B, TelexFree’s affiliate contract:

“Ongoing investment in the network marketing program”!

Bloody hell. Does TelexFree really think these Gerry Nehra style statements are going to hold up in court?

Protip: This crap didn’t work in the AdSurfDaily and Zeek Rewards cases and it’s not going to work here. Ask Nehra yourselves!

Rounding out the response is TelexFree’s closing argument:

There is no risk that “any remaining investment funds or proceeds thereof would be further depleted” where the Bankruptcy Court is required to oversee those funds.

Nor is there any indication that the Debtors-in-Possession would dissipate or conceal assets.

A debtor in a bankruptcy files its petition and does the exact opposite: it opens itself up to disclosure obligations and potential discovery.

If anything, its business becomes more of an open book. The SEC just ignores this and relies on transfers that primarily happened months ago. There is no reason to discredit the bankruptcy process.

“Look guys, we pulled shifties “months ago”, but of course that’s not going to happen again, cmon!”

The balls on these TelexFree lawyers… granted hindsight is 20/20, but even discounting the fact the bankruptcy application is effectively over, there’s still enough bullshit in TelexFree’s response to fill any stadium Botafogo have played in several times over.

In support of their complaint, TelexFree has filed a whopping 177 pages of declarations, most of which seem to be regurgitations of what was declared in the bankruptcy case.

Mr. MacMillan has over twenty-five years of management experience, the last fifteen of which have been in the direct selling industry, and extensive experience in the telecommunications industry.

His full employment background can be found in detail in his Second Declaration.

What MacMillan’s employment history or resume have to do with proving TelexFree is not a Ponzi scheme and thus not deserving of a preliminary injunction being slapped against it, I have no idea.

Of note is the fact that the only declarations presented are those from Stuart MacMillan and William Runge, neither of which were involved with TelexFree during the running of the AdCentral Ponzi scheme. Supporting declarations from any of the named defendants, specifically TelexFree owners James Merrill and Carlos Wanzeler, are conspicuously absent.

MacMillan and Runge’s “we know nothing about the Ponzi scheme” declarations failed to have any impact in the Nevada bankruptcy case and I imagine will have a similar negligible impact in the injunction hearing. So useless were Tweedledee and Tweedledum’s “we know nothing” testimonies in Nevada, that Judge Landis remarked yesterday:

While (the) credentials of MacMillan and Runge not subject to question, (the) court finds they have little knowledge related to business administration of (TelexFree) LLC and (TelexFree) Financial. (They) couldn’t (even) identify (TelexFree’s) competitors.

Stay tuned for a followup announcement on the pending preliminary injunction hearing later today…

Hi OZ, any idea if at some point the telexfree website will go down as result of the injuction?

Those sound like reasonable arguments but when judgement comes I suspect these arguments will be swept aside. Justice is about more than legalities.

Well the FBI raid already took the website down. As I understand it TF are now running a backup through Amazon.

I think it depends on the scope of the preliminary injunction, with two possible outcomes:

1. the SEC will attach the court order to a letter to Amazon asking them to pull the site or

2. TF themselves will pull the site out of worry the continued operation will put them in breach of the preliminary injunction.

They uploaded to Amazon because they were counting on that “TRO violates the Chapter 11 automatic stay” motion they filed in Nevada, which has now been shelved for the foreseeable future.

The only reason they even bothered to upload a neutered version of the site (VOIP functionality) was to try and present to the bankruptcy court some semblance of a legitimate business. That didn’t work out too well.

I get a funny feeling we’ll be treated to some courtroom theatrics when the MA BK case gets underway.

Everything from… “He couldn’t make it today due to an illness in the family” to “Oh, Mr. MacMillan and Mr. Wanzeller bought a lottery ticket recently and hit the Mega Jackpot numbers in the exact order. They’ll now be able to pay all creditors and associates owed money to as soon as they collect their winnings. We just don’t know the exact date they’ll collect the award. One of them lost the ticket stub.”, to crying uncontrollably.

1) They’re claiming the VOIP users are more important than the promoters. (Hilarious, man, hilarious)

2) If 1 goes, so does this excuse.

3) Now they’re just repeating themselves… This is same as 1

4) Standard “You have NOTHING! NOTHING!” talk.

Guess they have to make a “reasonably rigorous” defense to justify their fees. Though their defense doesn’t have to be true. 🙂

There’s a difference between saying something that’s not borne by the facts, vs. something that’s totally outrageous to warrant contempt of court charges though. 🙂

(Complete sidenote: Jordan Maglich’s Ponzi tracker has a case where a guy tried to f*** with the SEC.

The short of it: the guy ran a 10 million Ponzi scheme in Massachussetts, SEC shut him down ordered him to sell off his assets and turn over the money AND a 10-year sentence. Instead he transferred all his fancy cars (MB, Land Rover, etc.) to his wife, who then pledged the vehicles as collateral to secure a 200K loan.

The guy’s gonna face additional contempt of court charges.

http://www.ponzitracker.com/main/2014/5/6/convicted-ponzi-schemer-faces-federal-charges-for-violating.html

It must be ongoing now… Started 3 pm. No live reporting from there, no? 😀

I mean, 3.30 – http://www.mad.uscourts.gov/inet/today.pdf

I particularly like the “We didn’t call it an investment, but our associates did.”

Why didn’t they insist upon Zeek Rewards-style pseudo-compliance before they got shut down and claim that it’s not an investment because they told everybody to not say it’s an investment?

I would avoid distractions and focus on the real problem: the originators of the scheme. Do a round-up and follow them to make sure:

1. All money (hidden) or not is frozen

2. All first-tier front men below San R. and others are investigated and subject to the clawback clause.

3.Focus on the schemers rather than only on the case itself and the bankrupcty.

The above appears to be already happening. BY INSTALLING NEW MANAGEMENT and Filing for Bankruptcy, IMO, TelexFree Ringleaders and others hoped to escape with SOME money and go live happy ever after, all under Chapter 11 protection and with some stooges taking the heat for the scheme instead of those who started the entire operation.

That mocks the U.S. justice system and guess what? the justice system WILL NOT BE MOCKED.

Furthermore, wait until the U.S. immigration service gets involved into this and finds out that many of the 1st tier goons under san rodrigues are in the country illegally or on expired visas!!!

Concerning today’s hearing in Boston, “Cali Bou” from TF Legal News (FB) went there, and reported to the group that:

– The current TRO on Telexfree has been extended to Friday;

– Judge gives them 48 hrs to come back with stipulation covering all bases. Says he is less inclined with corporate defendants than with individual defendants. They are to come back by noon on Friday

– Judge ruled that under 362 4b TF is not exempt the automatic stay is not violated; he will allow a memorandum if anyone thinks he is wrong

– Labriola, Craft and Merrill seem to have all made agreements respecting their TROs;

– Atty for Craft says he will assent to TRO as long as language regarding Craft was responsible of wrongdoing is removed. Judge allows. Atty for Labriola wants judge to allow same consideration for his client.

– Wanzeler traveled to Brazil despite the asset freeze, and his att. is arguing about his opposition to repatriating funds from Singapore and breach of the 5th Amendment;

– Rodrigues and Sloan are remaining defendants who have not reached an agreement and also TFElectric and TFMobile who do not have counsel currently – Ref. Doc#78-3 for Rodrigues, Doc#78-4 Sloan and Doc#78-2 for TFElectric and tfmobile;

– Merrill was there, looking somber.

Just finished reading the above article, I didn’t scroll out of one green box with the Telex lawyers yadda yadda in it without slapping myself in the forehead. OMG!!!! (have to get some ice for the welts…lol)

I guess this is what lawyers are paid for ….coming up with the best arguement they can for a defense. Really…. In this case there’s not much to work with. And when defending a boob you’re going to sound like a boob.

How ever, a team of someones came up with the dirty trick to submit the bankruptcy in Nevada at midnight on a Sunday night. Hmmmm, Wonder if the legal team and the new Telex mangement team are going to regret attatching their names to this caper. (not only because they’ve put themselves in the position of looking foolish but …hey man, are we going to get paid?)

Waiting with anticipation on the outcome of today.

Oz, the name of the team is Botafogo.

But funny history, their rented stadium, Engenhão, has the capacity of 45000 seats, but it never get in full attendance. Oh, lets not forgot about the fact the stadium is in Rio de Janeiro, but it is mounted in a way the grass doesn’t get any sunlight due some very good engineering.

While in the Dominican Republic the top promoter of telexfree carlos vanderpool says that he will eventually comeback from THe USA to face the charges against him but hes afraid of his life.

http://www.listindiario.com/movil/article?id=321026

Wanzeler is NOT a U.S. citizen so the 5th does not apply to him.

Furthermore, are you guys waiting for the day where the originators and indicted promoters will take the stand to be cross-examined?

Wanzeler has fled to Brazil while his lawyers file documents asserting there’s no risks associated with these guys?

So it begins…

I ‘ve seen a variation of this ploy before and I tell you it was done with the concurrence of all bankruptcy committees and every attorney involved. The judge even turned a blind eye.

When we found out and objected to this midnight filing she said “its too late.” Not coincidentally it charged the creditors with enormous fees that were used to pay the “professionals.”

It was a total judicial sellout. It was in Las Vegas and Augie Landis was the US Trustee at the time.

“Abandon hope all creditors who enter here” should be writ large above the entry to every bankruptcy court.

They are shark pools, no exceptions.

Thanks for the pickup, I even Googled that one as I wasn’t 100% sure at the time. Strange!

@Hoss

What a disheartening case. I’ve been there and know what a “game” the legal system can be. I’ve won some and lost some big one’s that morally I should have won. But it’s about “laws”.

I’ve learned that most lawyers are just blowing smoke up your ass when they tell you.. “awe you have a great case and we’ll win it for ya”. I’ve also met lawyers that have done amazing gifts of kindness and have let their clients out of the entire bill they owed them because they knew they didnt do what they said they “could”.

I still have great hopes in our legal system here in the USA.

Reading about the history of Mass. dealing with this type of scheme and knowing we have Galvin an Irish Boston kind of guy….I’m feeling good about what’s going to come down on the Telex clowns. Don’t f*** with an Irishman….

When I found the cases he’s done before …I thought….Not really a good state to fuck with.

I forget some times that this blog is read by people from all over the world. I would say to all.. be patient… you have the best person in your court…

Wrong.

Otherwise the gov would summarily throw immigrants in America (legal or not) in jail on trumped up charges with no problem.

Trumped up charges (accusations) do not involve self-incrimination.

The 5th amendment is not limited to citizens.