Ponzi and pyramid scams aren’t an American problem

Despite every Ponzi scheme professing to offer its own unique spin on the model, the underlying mechanics of the scam remain the same.

Despite every Ponzi scheme professing to offer its own unique spin on the model, the underlying mechanics of the scam remain the same.

New money enters the scheme, primarily through new investors, which is then used to pay off those who have already invested.

With this a Ponzi scheme in its simplest form and easily identifiable, today scams go to great lengths to disguise the flow of money.

None of that however changes the end-result of a Ponzi scheme however, which is rooted in mathematical certainty.

That being no matter how much is or isn’t promised, a Ponzi scheme can only pay out as much money is invested. Once that runs out it’s time for excuses, those running the scam to do a runner or any number of cliched Ponzi collapse ruses.

The constant underpinning all of them however remains the same: mathematics guarantees the majority of investors lose money.

A disturbing trend I’ve noticed over the last few years is the dismissal of the financial devastation a Ponzi scheme can create, solely based on jurisdiction.

Though it had probably been simmering outside of the US for some time, I believe the first public instance I came across the idea that math wasn’t math outside of the US was from Ted Nuyten.

Nuyten publishes and runs BusinessForHome, one of if not the most widely read MLM news websites.

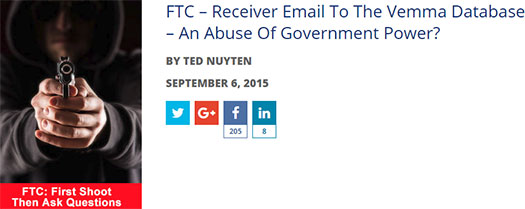

Nuyten’s immediate reaction to the FTC shutting down Vemma for being a pyramid scheme was toxicity towards the regulator.

A large part of this was due to his wife’s involvement in Vemma, however that was never disclosed to BusinessForHome readers. Instead Nuyten chose to solely frame the FTC’s regulation of pyramid schemes as “an attack on the industry”.

At the height of his rhetoric, Nuyten combined an image of a cocked gun with claims the FTC was abusing government power.

Today the association of pyramid scheme regulation with gun violence is just as distressing as it was back then. Nonetheless coming from such a prominent voice within the MLM industry.

Ironically in his article Nuyten complained about the conduct of the court-appointed Receiver, which has nothing to do with the FTC.

As above however, that didn’t stop him from using the opportunity to fire shots at the regulator (no pun intended).

At this point I wish to address that Vemma wasn’t a Ponzi scheme. The FTC shut Vemma down for being a pyramid scheme.

A pyramid scheme differs from a Ponzi scheme in that commissions are tied to recruitment of new participants.

MLM Ponzi schemes by the very nature of being MLM opportunities incorporate a pyramid scheme within their business model.

A pyramid scheme however does not equate to a Ponzi scheme, as it’s possible to pay recruitment commissions without an attached investment opportunity.

Nonetheless the outcome of a pyramid scheme is identical to that of a pyramid scheme. Upon collapse (when recruitment inevitably slows down), the majority of participants lose money.

This is either their initial buy-in, or the buy-in plus ongoing fees – as was the case with Vemma.

Among the many anti-government articles Nuyten was “Legit Direct Selling Companies, Ponzi’s, Pyramids And Our Opinion“, published a few months after the Vemma shutdown.

In it Nuyten opined;

What is not compliant in the USA, can be no problem in other countries.

Bill Ackman thinks Herbalife is a Pyramid, we do not think so. The FTC thinks Vemma is a pyramid, we do not think so.

The USA is not longer the Direct Selling Center of the universe, Asia is, and rules are there less strict.

Leaving aside Nuyten was wrong on both counts (Vemma and Herbalife were pyramid schemes that both eventually agreed to settle and change their fraudulent business models), this seemed to suggest the US, rather than the pyramid scheme business model, was the problem.

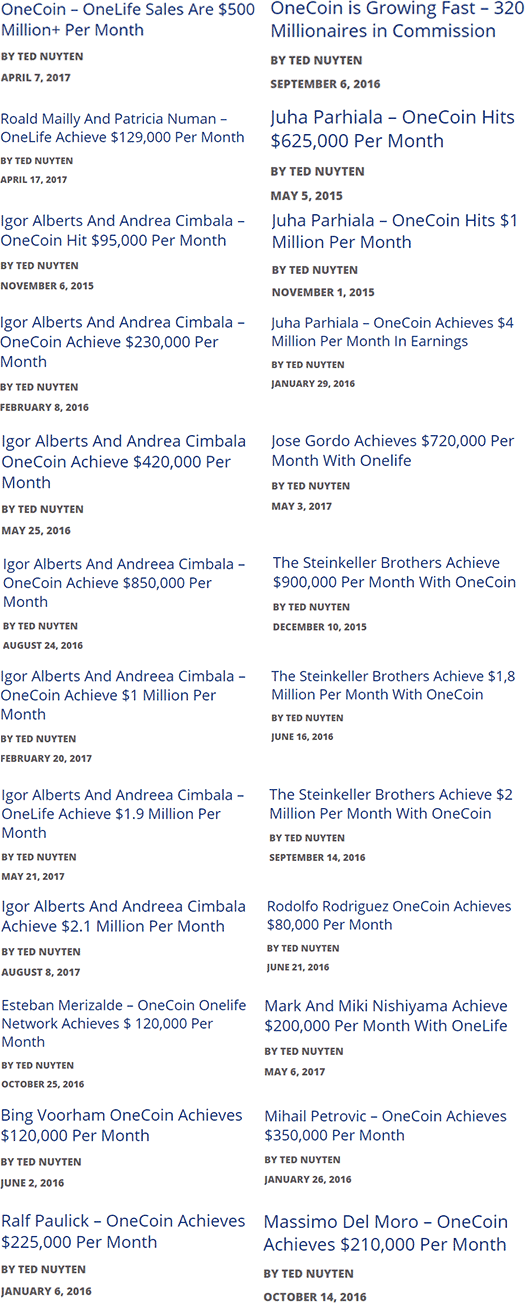

This has since, I believe, become the foundation of BusinessForHome’s publishing policy. Since the Vemma bust there’s been a marked increase in PR style “copy and paste” articles featured on BusinessForHome, with regulatory coverage appearing only when it’s too big to ignore.

And since the Vemma bust, that policy has seen Nuyten ignore a lot.

BusinessForHome readers are now more often than not presented with syndicated PR spin, over what used to be genuine content. Worse still Nuyten accepts cash for comment, however who pays and for what is not disclosed to readers.

In that sense the law in the US does appear to differ greatly from that of Amsterdam, where Nuyten is based. For good reason, the FTC require paid public endorsements of any kind to be openly disclosed.

But fair enough. Whilst I maintain that it’s highly unethical to present paid content as organic content, that’s between Nuyten, featured MLM companies and BusinessForHome readers.

As far as regulation of Ponzi and pyramid schemes go though, where they are regulated and to what extent don’t matter.

Ponzi and pyramid schemes aren’t devastating because a regulator does or doesn’t go after them based on local law. They’re financially devastating because of the mathematical certainty that the majority of participants will lose money in them.

And math is a language that knows no geographical boundaries.

Regulation of a Ponzi or pyramid scheme doesn’t definitively define an MLM company as one, rather it seeks to hold those doing the scamming accountable.

Regardless of where a Ponzi or pyramid scheme is operated, if it either pays recruitment commissions and/or uses newly invested funds to pay off existing investors, it’s a scam and should be reported on as such.

Yet because of his philosophy that where a scam operates from matters, you won’t see coverage of the vast majority of MLM Ponzi and pyramid busts on BusinessForHome.

Such has the level of integrity deteriorated, that it’s now common to find Nuyten, through an endless parade of “top income earner” articles, celebrating individuals responsible for hundreds of millions of dollars in losses.

Up until now the notion that regulation of scams in the US is a problem over the operation the scams themselves has publicly gone unaddressed.

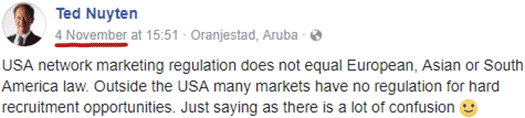

My own memory was rekindled by a November 4th post on Nuyten’s Facebook page:

Published within hours of addressing why he hadn’t covered news of the Ruja Ignatova’s alleged arrest, quite clearly Nuyten still has no problem with hard recruitment opportunities pyramid schemes.

Ultimately no matter where you’re scamming people from, a scam is a scam. The focus shouldn’t be on whether local regulators are competent enough to catch you (and feigned outrage when they do), but rather the act of scamming, be it through a pyramid or Ponzi model, itself.

That this is the mindset of someone with such a broad and widely-heard voice throughout the MLM industry leaves me alarmingly concerned.

it’surprising that ted nuyten has such enthusiastic, glowing coverage of onecoin, hiding behind the ruse that european/asian law is different than US law on pyramid/ponzi scams.

italy and germany both banned onecoin, does nuyten think they’re in europe or not?

here’s what italy, latvia, hungary, sweden [all EU countries] said:

^^ all refer to onecoin being a ‘pyramid’ scheme.

in case ted nuyten thinks asian laws on ponzi/pyramid schemes are different, here’s what happened to onecoin in china and india where it got banned:

^^^again classification as pyramid or ponzi scheme.

if there is a difference in the way the american SEC/FTC regulates ponzi/pyramid schemes vis a vis other countries, it may be in a stricter requirement of high retail sales of products for a scheme to be legitimate.

but, all over the world, widget overpriced ‘products’ used as a cover for ponzi/pyramid schemes, however complex the construction of the scheme may be, are recognized by regulators for what they are.

ted nuyten travels extensively, but is very poorly informed of the law around the world.

i guess if he’s paid enough to promote scams, he can announce that the state of the law is whatever HE claims it to be!

GREAT article Oz.

LOL, not used to editorial type posts here. I thought BMLM might have had a guest poster for a second. 🙂

Good article though.

Too bad logic and math lose out so frequently to emotion, desperation, and greed.

lol, i saw the representation of ‘math is universal’ with a photo of the universe [with a big bang going on somewhere in it], and i’m like – alien ponzi scammers ain’t going to like this!

oz was international, now he’s upped his game to universal! 🙂

Let’s not how much he got paid for touting ZeekRewards.

I’m semi-saddened the receiver didn’t go after him like he did with all the other perps like Troy and other mouthpieces, probably because Ted resides on the other side of the pond.