Kevin Grimes fired from R&R Law (prev Grimes & Reese)?

Eagle-eyed BehindMLM reader James Charles has noticed that all references to Kevin Grimes have been removed from the Grimes & Reese website.

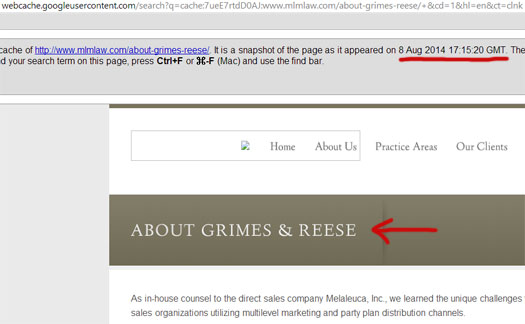

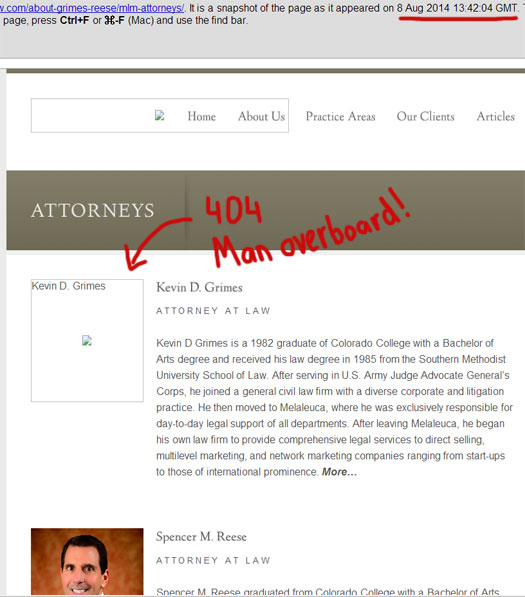

Now calling themselves R&R Law Group, the change appears to have taken place over the last few days. A Google cache snapshot reveals that Kevin Grimes still appeared on the site, and that the name Grimes & Reese was still in use as of August 8th.

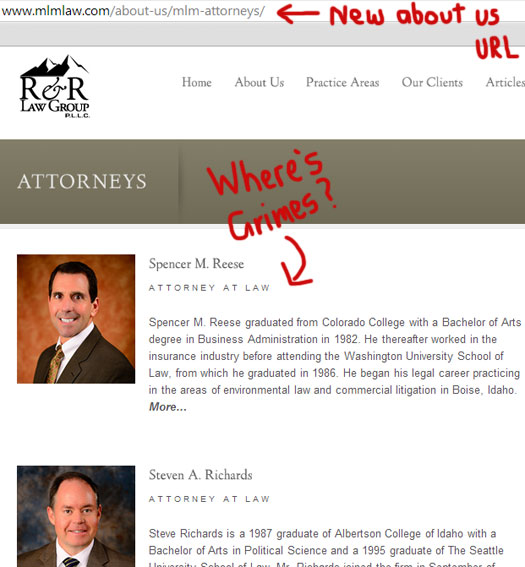

Since then, what was once Grimes & Reese have removed any mention of Kevin Grimes (right) from their mlmlaw.com website. The firm has also changed it’s name to R&R Law Group.

The “new” firm still lists itself as a DSA Supplier member, however now only two layers are listed on R&R’s attorneys page, Spencer Reese and Kevin Richards (hence the new name, R&R).

At the time of publication there’s no mention of why the recent change took place or an explanation as to Kevin Grimes’ abrupt disappearance.

Recently the Zeek Rewards Receivership filed a “legal malpractice” lawsuit against Kevin Grimes (right) for his involvement in the $800M Zeek Rewards Ponzi scheme. More recently, the Receivership has alleged that Grimes & Reese were paid over $840,000 in stolen Ponzi funds.

Recently the Zeek Rewards Receivership filed a “legal malpractice” lawsuit against Kevin Grimes (right) for his involvement in the $800M Zeek Rewards Ponzi scheme. More recently, the Receivership has alleged that Grimes & Reese were paid over $840,000 in stolen Ponzi funds.

The Receivership is demanding the money be returned so that it can be distributed to Zeek’s victims. As of yet neither Grimes or Grimes & Reese have filed a reply to the Receiver’s lawsuit, but given it’s come to a lawsuit – it appears Kevin Grimes doesn’t want to hand over the funds without a fight.

Perhaps Grimes’ partners Spencer Reese and Kevin Richards felt diffrently.

Is this the first major fallout we’re seeing as the Zeek Receivership targets MLM industry insiders who were neck-deep in Ponzi funds?

Inquiring minds wish to know!

Oz, it could just mean that Grimes is no longer the senior partner in the firm. In a lawfirm, IIRC, the senior partners get their names on the company name (usually the founders) and the juniors don’t.

Sounds like the limited law corporation (LLC) decided to dump Grimes’ name from the senior partner list and promoted that Richards guy to senior partner.

In other words, Grimes may still be there, as a junior partner.

Could be.

Richards appeared on the G&R attorneys list prior to the rename. That was when his name didn’t appear on the firm’s name. One would think Grimes would remain on it.

Also they’ve removed his bios etc. Basically anything about him has been removed.

After trading on his name for so long it’d seem weird to keep him on but remove any mention of him would it not? I mean what, are they going to quietly change everything back in a few years?

Looks like they only changed things up yesterday (Google Plus):

Ouch:

This was sent in by Patrick Pretty, Kevin Grimes was “deleted” by Reese and Richards on August 11th:

Hmmm, guess they had to get rid of the ugly dirt and grime somehow. It was starting to make their main page look bad.

One explanation can be that the 2 other Senior Partners didn’t like his “typical MLM ideas” about multiple income streams (a major claim from the Zeek Receiver was about his compliance course payments, received through his own private MLM compliance company rather than through Grimes & Reese).

The decision about deleting him as a partner / manager came extremely fast, shortly after the complaint was amended with those details. I haven’t read the whole complaint, but I focused on paragraphs 45 – 49 when I initially had a look at it.

It looks like the simplest explanation, at this point, is that Grimes was more of a liability than an asset- and that this was not going to change much for the foreseeable future.

And being lawyers themselves- they might well have had insights into how this case could effect their firm.

Time will tell for sure- but I think they dumped him before the dragged them all down with him.

R&R are well advised to distance themselves from Grimes. The entire firm could readily be pulled into this.

I wonder how much liability the firm will have, as going after the firm is deeper pockets.

There’s no way I know how to put a dollar amount on it, but over in Telexfree, Gerald Nehra’s partner, Waak has been named as a defendant in a couple of damage suits brought by Telexfree investors.

R&R is liable to face the same rough treatment from disgruntled Zeek investors now that Grimes has been named by the Zeek Receiver.

I am not saying that RR had anything to do with any of it (or Waak either for that matter) but dumping Grimes shows the firm takes any perception of guilt by association seriously.

As Posted on Patrickpretty.com (ALL CAPS MINE)

http://patrickpretty.com/2014/08/06/bulletin-mlm-attorney-and-companion-entity-received-843000-through-sale-of-bogus-compliance-course-that-served-as-window-dressing-for-ponzi-and-pyramid-scheme-receiver-says/

Well, getting your firm sued for $100,000,000 would be grounds for termination at most lawfirms- or so I would think.

Please accept my last post as a nod to Tex.

The firm have insurance to deal with this sort of professional liability. EVEN AFTER the company changed names, their insurer still have to cover it.

Though the receiver is correct, KG used “mlmcompliancevt.com” (or however that’s spelled) to market his “training courses”, but he did use his name and Grimes & Reese PLLC to market the courses, and personally appeared at some Zeek rallies.

It took only 5 days from the amended complaint was filed to they deleted him as a Senior Partner / Manager. It’s probably about the substance of the complaint.

It’s difficult to detect any major changes from the original complaint to the amended one. Most changes are near the end as new Claims For Relief.

QUICK COMPARE

7. Added a new defendant = MLM Compliance

45. Specifying the amount $843,000

78. Completely new Fourth Claim For Relief, 12 paragraphs about Fraudulent Transfers). The old 4th claim moved to 7th claim.

90. Added a new Fifth Claim For Relief, 9 paragraphs about Common Law Fraudulent Transfers.

100. Added a new Sixth Claim For Relief, 6 paragraphs about Unfair and Deceptive Trade Practices.

106. Seventh Claim for Relief, 5 paragraphs Constructive Trust

I wouldn’t count on it

Is there anything that typically is not covered?

While the scope of coverage afforded is relatively broad, it is not unlimited. Some activities, errors, and omissions either may not legally be covered, or are simply beyond the insurer’s interest. These uncovered areas are usually referred to as “exclusions” and are often delineated in a separate section of the policy. Examples of common exclusions include:

•Fraudulent acts

•Criminal acts

•Malicious acts

•Dishonest acts

•Services rendered to a business enterprise that is owned or controlled by the insured lawyer or law firm

•Services rendered as a fiduciary under the ERISA Act of 1974

•Bodily injury or property damage generated by the lawyer or law firm

•Claims involving one insured against another insured in the same law firm

•Claims arising from legal services rendered by the lawyer or law firm where the firm or lawyer knew of or should have foreseen the claim at the inception of the policy and failed to alert the insurer to the possibility

Then they’ll have a lawsuit, lawyers vs. insurance company. And insurance company will pay them a substantially smaller “go away” money.

It would not surprise me if Grimes ends up bankrupt and disbarred after this plays out.

Nehra should go first, IMHO of course.

Nehra deserves the same.

Hoss noted above that exclusions can apply. A well-known example of this involves Washington, D.C., attorney Brynee K. Baylor and her law firm: Baylor & Jackson PLLC.

Baylor’s experience may not be precisely on point in a discussion about Kevin Grimes and what kind of insurance coverage he has — or whether he has any at all. (Robert Garner, one of Andy Bowdoin’s lawyers at ASD, appears to have had no malpractice insurance.)

Baylor had coverage from two carriers. Both effectively ended up suing the firm.

The first carrier sued to get out from under covering the firm, alleging the firm failed to timely notify the carrier the firm was at risk of getting sued by a client for malpractice.

The second carrier sued, alleging the firm drifted to the carrier and did not reveal there were serious, unresolved issues with the first client and carrier. In short, the firm was accused of lying to the second carrier to obtain insurance.

The first doc below doesn’t get into these things, but a good number of other docs do. There are a couple of reasons I’m linking to the first doc below:

1.) It addresses the type of problems lawyers in the sphere of securities who do little or no homework on their client can experience. Baylor ended up vouching for the felonious operator of a prime-bank swindle who was the target of an FBI undercover operation. The agents posed as interested investors and even discussed things with Baylor.

2.) Judge Collyer — the same judge who presided over the ASD cases — also presided over the SEC’s case against Baylor. Here are some line from one of Judge Collyer’s rulings in the Baylor case:

From Justia.com:

http://docs.justia.com/cases/federal/district-courts/district-of-columbia/dcdce/1:2011cv02132/151429/181/0.pdf?1377598701

Also see:

NO LINK: sec.gov/news/press/2011/2011-254.htm

Also see:

NO LINK: ca4.uscourts.gov/opinions/Unpublished/121581.u.pdf

Also see from Leagle.com:

NO LINK: leagle.com/decision/In%20FDCO%2020120828B10

PPBlog

And a nod to you for digging up the facts.

PPBlog, sounds like my kind of judge.

In addition to which there is no requirement to carry “malpractice” insurance.

It appears from what Patrick posted that if a policy is in effect its incumbent on the carrier to sue the policyholder and allege the exclusions apply….. which here might be dependent on rulings and findings in the RVG v Riese Grimes, Compliance LLC action + Appeals.

Turn the page….this is going to take awhile.

This reminds me of more than one situation at various companies I worked for.

Someone is found to be doing something flagrantly illegal. The company is forced to either get rid of them (to show it does not tolerate this kind of thing as policy) or take a serious risk of a court later using the person’s continued employment used to prove a “de facto” policy of condoning such things.

Usually it is Discrimination or something like that- but I can see it applying here. Keep him as a partner- and risk showing the court this is something the law firm condones, or get rid of him and at least make a show of “cleaning house”.

An excerpt from R & R’s Motion to Dismiss the Zeek Rewards Receivership lawsuit against them might be hinting at what went down:

Sounds like Richards and Reese have closed ranks around Grimes.

It seems to me that R and R are only protecting their own interests here.

Of course R&R is protecting their interests, but you can’t avoid liability by claiming “but he wasn’t supposed to do that”. Nobody’s “supposed” to break the law or commit malpractice.

If they are claiming that Grimes had violated the terms of his partnership to the firm, then they’ll have to sue Grimes for the damages, rather than argue that the firm had no part in it.

That’s right, which is why R&R is arguing they can’t be held responsible if Grimes engaged in willful misconduct.

To wit:

“It is also a matter of well settled law that an attorney who acts in violation of the applicable rules of professional conduct is acting beyond the normal scope of his authority.”

If this indeed true and the partners were not complicit then the partnership should have no liability.

Sure, they can sue Grimes but for now they must address Bell.

Confirmed, Grimes was fired/terminated (whatever it is lawyers do) because of the Zeek fiasco:

The above is from a Kevin Thompson blog post, welcoming Grimes to his firm:

thompsonburton.com/mlmattorney/2015/01/08/kevin-grimes-joins-thompson-burton/