Wealth Generators Review: Wealth Engineering goes MLM

Wealth Generators was founded in 2013 by Ryan Smith, Annette Raynor, Chad Miller, M. Arthur Romano.

Wealth Generators was founded in 2013 by Ryan Smith, Annette Raynor, Chad Miller, M. Arthur Romano.

The company operates out of the US state of Utah, with Kevin Gull (right) named as President.

The company operates out of the US state of Utah, with Kevin Gull (right) named as President.

As per Gull’s Wealth Generators corporate bio;

Most recently, Kevin was President of Symmetry Global, where he led the company to its highest levels of growth in several years.

Prior to that, as a leading consultant in the direct selling industry, Kevin has successfully launched over 12 networking startups in a 10 year period, and has created marketing and business development strategies for over the past 20 years.

He also has vast experience working with leading direct selling focused companies including: NuSkin Intl, Ariix, iCentris, Red Mat Media and more.

Of Wealth Generators’ Founders, I was only able to put together an MLM history for Chad Miller. Miller was an affiliate with Yoli (health and wellness).

None of the Wealth Generators Founder bios contain any information about prior involvement in any MLM companies.

Read on for a full review of the Wealth Generators MLM business opportunity.

The Wealth Generators Product Line

Wealth Generators helps anyone ─ from trading experts to those who’ve never been in the markets before ─ to implement a simple, affordable, proven system for success that doesn’t require you to spend your days watching the market.

Wealth Generators operate in the financial services MLM niche, with a specific focus on stock market trading.

The company offers trading tips to subscribers for $49.99 each, or bundled in two packs for $99.99 a month.

One pack provides a subscriber with three weekly trade strategies, the other three monthly trade strategies.

Wealth Generator’s trading tips appear to be provided through Wealth Generator Founder M. Arthur Romano’s company, Wealth Engineering (note that Annette Raynor is also the COO of this company).

On the Wealth Engineering website (“wealtheng.com”), Wealth Generators is listed as one of the companies Wealth Engineering has equity in.

The Wealth Generators Compensation Plan

The Wealth Generators compensation plan sees affiliates purchase and sell $49.99 tips and $99.95 a month subscriptions.

Commissions are paid out residually through a unilevel compensation structure, with additional performance based bonuses available.

Commission Qualification

As per the Wealth Generators compensation plan:

You must be active (100 PV) and have 3 active personally enrolled Generators to participate in the Bonus Plan.

PV stands for “Personal Volume”, and is generated either via the sale of a $99.95 a month subscription to a retail customer, or by a Wealth Generators affiliate signing up for a subscription.

“Generators” are what Wealth Generators refer to someone who has an active $99.95 subscription (be it affiliate or customer).

Therefore in order to qualify for commissions, every Wealth Generators affiliate must be generating at least 100 PV a month in sales volume (which can be their own purchase), and have sold at least three $99.99 a month subscriptions.

Wealth Generators Affiliate Membership Ranks

There are nine affiliate membership ranks within the Wealth Generators compensation plan.

Along with their respective qualification criteria, they are as follows:

- Copper – maintain 100 PV a month in sales volume and have a downline generating at least 400 GV a month in sales volume

- Bronze – maintain 100 PV a month in sales volume and have a downline generating at least 1000 GV a month in sales volume

- Solid Bronze – maintain 100 PV a month in sales volume and have a downline generating at least 3000 GV a month in sales volume

- Silver – maintain 100 PV a month in sales volume and have a downline generating at least 5000 GV a month in sales volume

- Solid Silver – maintain 100 PV a month in sales volume and have a downline generating at least 10,000 GV a month in sales volume

- Gold – maintain 100 PV a month in sales volume and have a downline generating at least 25,000 GV a month in sales volume

- Solid Gold – maintain 100 PV a month in sales volume and have a downline generating at least 50,000 GV a month in sales volume

- Platinum – maintain 100 PV a month in sales volume and have a downline generating at least 100,000 GV a month in sales volume

- Solid Platinum – maintain 100 PV a month in sales volume and have a downline generating at least 250,000 GV a month in sales volume

Note that from the Solid Bronze rank, no more than 50% of qualifying GV can come from any one recruitment leg.

Residual Commissions

Residual commissions in Wealth Generators are paid out via a unilevel style compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any of these level 1 affiliates go on to recruit new affiliates of their own, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Wealth Generators cap payable unilevel levels at 7, with commissions paid out as a percentage of the sales volume (PV) generated by affiliates in the unilevel team.

How many unilevel levels an affiliate is paid on depends on the Wealth Generators affiliate rank:

- Copper – 5% on levels 1 and 2

- Bronze – 5% on levels 1 to 3

- Solid Bronze – 5% on levels 1 to 4

- Silver – 5% on levels 1 to 5

- Solid Silver – 5% on levels 1 to 6

- Gold or higher – 5% on levels 1 to 7

Unilevel Infinity Bonus

The Unilevel Infinity Bonus allows a Wealth Generators affiliate to earn beyond the first seven levels of their unilevel team.

The bonus pays out a percentage down each individual unilevel leg, until an affiliate at the same or higher rank as the affiliate who’s team it is is found.

Once an affiliate at the same or higher rank is found, the bonus only pays up until that affiliate (from the 7th level onwards).

If no equal or higher ranked affiliate is found, the bonus is paid out on all affiliates in that particular unilevel leg.

How much of a percentage is paid out depends on an affiliates rank:

- Solid Gold – 1%

- Platinum – 2%

- Solid Platinum – 3%

Note that for the purpose of Unilevel Infinity Bonus calculation, each unilevel leg is independent from the rest.

Wealth Club Bonus

The Wealth Generators Wealth Club Bonus pays a monthly bonus to affiliates who have productive downlines.

- recruit and maintain three commission qualified affiliates = $100 a month

- recruit and maintain three commission qualified affiliates who each generate at least 400 GV a month = $600 a month

- recruit and maintain three commission qualified affiliates who each generate at least 1300 GV a month = $1500 a month

Prosperity Pools

Wealth Generators’ Prosperity Pools are bonus pools in which affiliates can qualify for shares in.

There are five Prosperity Pools in total, each made up of 1% of Wealth Generators total monthly sales volume.

Starting from the Silver rank, each rank has an individual Prosperity Pool associated with it.

Wealth Generators affiliates obtain shares in a pool by qualifying at the Silver and higher ranks.

Upon qualifying for a Silver or higher rank, an affiliate is awarded two shares in that particular pool.

As an affiliate is promoted in rank, they maintain their shares in the lower ranked pools.

Additional shares can be obtained when personally recruited affiliates also qualify for Prosperity Pools at one of the applicable ranks.

Eg. If a personally recruited affiliate qualifies at the Gold rank, their immediate upline will receive an additional share in the Gold Prosperity Pool.

Via rank promotion of the same affiliate, they would have already received a share in both the Silver and Solid Silver pools as well.

Qualified Generators Bonus

In order to qualify for the Qualified Generators Bonus, a Wealth Generators affiliate must purchase a $105 Qualified Wealth Generators pack.

This pack provides access to training materials and access to a monthly webinar.

The Qualified Generators Bonus follows a pass-up commission structure, wherein an affiliate is paid between $40 to $90 on personal sales of the Qualified Wealth Generators pack they make.

The commissions on the first, third and fourth of these sales is passed up to an affiliate’s upline, with the rest of the commissions generated by other numbered sales kept.

In turn, an affiliate’s downline must also pass up commissions numbered first, third and fourth – ditto their downlines and so on and so forth.

$90 is the maximum payout allocated, but only to affiliates who have recruited ten or more Wealth Generators Pack purchasing affiliates.

For affiliates who have not reached this goal, the difference between what they are paid (either $40 or $75) and the maximum payable $90 is passed to their upline (if not the immediate then the first qualified upline).

The same is true of qualification between the $40 and $75 payout level.

Joining Wealth Generators

How much does having my own Business cost to set up?

A: It costs $124.99, with a $25.00 annual fee, and $99.99 for your first month’s subscription to either the weekly or monthly trade alerts.

As per the Wealth Generators FAQ above, the total cost for Wealth Generators affiliate membership is an initial $224.98 and $25 a year thereafter.

Conclusion

Combining stock market trades and MLM is problematic in the sense of how the service is marketed.

In the case of Wealth Generators, they openly market the Wealth Engineering trading tips as investments delivering returns:

From January 2013 through September 2014 the performance has been as follows:

Weekly Performance = The return on investment across our weekly strategies was 1266%.

Monthly Performance = The return on investment across our monthly strategies was 860%.

These percentages are based on Return on Investment (ROI) which means it is based on how much you put into each trade, not how much money you have in your total account.

This is not in and of itself a red-flag, nor is it illegal. However within the context of an MLM business opportunity, it’s definitely a grey area.

I acknowledge that Wealth Generators themselves aren’t accepting payments (securities) and then offering a ROI. They, through Wealth Engineering, are selling trading advice.

What you do with that is up to you.

The implication in attaching an MLM opportunity to this advise however, is that you join Wealth Generators and then will generate significant ROIs.

Whether the vehicle this achieved through would be separated from the MLM opportunity by a regulator I can’t say. I don’t recall though a regulator ever separating components of an MLM business opportunity upon investigation.

Again, I’m not saying the MLM side of Wealth Generators has anything to do with securities, ROIs or stock advice, but it’s hard to separate the two when the service is offered directly through the MLM opportunity.

Wealth Generators offer a guarantee on trades made:

We are so confident in what we do that we offer a Triple Your Money Back Guarantee stating that if you trade one of our 3-Pack Strategies for six months and LOSE money overall for the six month period, WE WILL REIMBURSE YOU 3X YOUR SUBSCRIPTION FEES.

But whether or not that will work for or against them in a regulatory sense I’m not sure. Guarantees of income are usually frowned upon in the MLM industry.

This being a guarantee of profit via use of the service though, yeah… like I said earlier, definitely a grey area and I’m not sure which way it might go should it be investigated.

On the MLM side of things, the two most critical points of analysis of Wealth Generators compensation plan are

- Whether retail customers are purchasing subscriptions and/or single $49.99 tips and

- Are enough affiliates qualifying for commissions via retail subscription sales?

On the first count, this up to affiliates to market the subscriptions and single tips.

If there aren’t significant retail sales of the subscriptions and single tips taking place, then all you’ve got are affiliates pumping money into Wealth Generators, and getting paid to recruit.

The affiliate fee paid to join Wealth Generators isn’t commissionable, but if nobody but affiliates are paying $99.99 a month – then that’s pretty much a defacto recruitment commission.

And that brings us to our next point, that affiliates are required to generate 90 PV a month – which is conveniently obtained via the sale or purchase of one $99.99 subscription.

One thing I was surprised to see was the complete lack of mention of both retail commissions on personal sales made of Wealth Generators subscriptions.

If a Wealth Generators affiliate sells a $49.99 tip for example, as per their compensation plan material I have no idea how much they are paid.

The only commissions available appear to be sales volume based, which are only paid out residually (your unilevel team’s efforts).

As such there doesn’t appear to be any incentive to actually retail Wealth Generators’ subscriptions.

With affiliates required to recruit and generate 100 PV a month to qualify for commissions though, there’s a very real incentive to operate Wealth Generators as a simply autoship recruitment scheme.

You sign up, pay your $99.99 a month and then recruit other affiliates who do the same.

Whether or not they actually use the provided tips is irrelevant, as you yourself are simply paid to recruit new participants, who recruit new participants and so on and so forth.

That’s only negated by the existence of retail, which I can’t seem to verify even exists… based on the complete lack of retail commissions structure in Wealth Generators’ compensation plan.

On the off-chance that this is just an oversight by the company, as a prospective Wealth Generators affiliate I’d definitely check if your potential upline is qualifying for their commissions by their own purchase or that of a sale.

The catch-22 here is that people are unlikely to purchase a subscription from someone themselves not using it. As such you’d want at least one retail subscription sale on top of an affiliate’s own monthly subscription to demonstrate retail viability.

Wealth Generators could remove this doubt by requiring an affiliate to make and maintain at least one retail subscription sale to qualify for commissions, but instead we have the ambiguous “you can qualify yourself” criteria.

This only feeds into the strong possibility that a Wealth Generators affiliate is going to recruit three affiliates to qualify for commissions, over making three retail subscription sales.

All in all I’m still not 100% sure on the offering of trading advice as an MLM product.

It might be alright if there was a clear distinction between the MLM opportunity and the tip service itself, but with Founders of Wealth Generators owning the tip platform, that’s not the case here.

Definitely something to think over if you’re looking to get involved with the Wealth Generators opportunity.

Update 29th June 2018 – On around March 2018 parent company Investview renamed Wealth Generators to Kuvera Global.

With the high class reps from Wake Up Now, (with their extreme level of professionalism) flocking over to it… It is SURE to be run, built, and developed out, with the utmost ethics and integrity. 😉

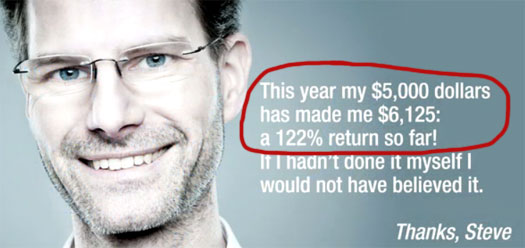

‘stock photo steve’ says that he made ‘122% ROI’, in over less than an year.

icahn enterprises, which is one of the worlds best trading firms had a return of 31%, in 2013, and the market thought this was very good. so, why isn’t icahn taking tips from wealth generators? he don’t like money?

studies show that most ‘day traders’ LOSE money. a ‘lucky few’ make good money. so, will an MLM full of people taking tips from WG, change these statistics forever?

never, because no one can make consistent profits on the stock market in continuum.

some investments perform, some fail [even with tips!], and you calculate you net loss/gain, and if it is close to the 31%, that icahn made, you pat yourself on the back.

because WG is LYING about it’s products, and the returns it will bring, it’s clear it is a ‘sham product’.

no one in WG, is going to use the tips for stock trade, everybody will be merrily buying and recruiting buyers, for the ‘tips’ packages, and taking their commissions and bonuses.

just like the neverused zeek bids. just like trading platforms/sports arbitrage/yadayada.

in WG too, you will find the percentage of people Actually Using the tips, in the 1% range.

most likely a ponzi/pyramid scheme.

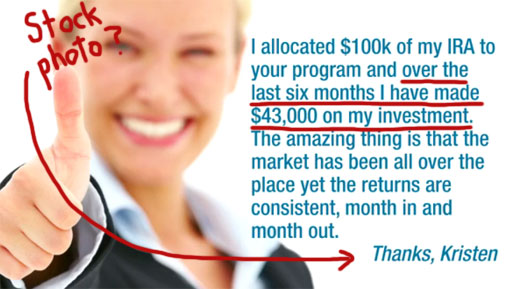

‘stock photo kristen’ says she allocated 100K of her IRA into WG and made amazing returns.

^^^scary shit!

IRA = Individual Retirement Account

see, how insidiously WG is ‘hinting’ at WHERE people may find the funds to invest with them? they want your Big Security Money, very dangerous !

did i say ‘most likely a ponzi/pyramid scheme’ in post#2?

that should be corrected to ‘most definitely a ponzi/pyramid scheme’!

there is something wrong with this. i’m finding it hard to believe, that wealth engineering, is not ‘investing funds’ on behalf of customers, and promising ROI’s.

WG could be an MLM ‘feeder’ where people can play the 99$ recruitment game and make some commissions and bonuses, but people [common people cannot set up day trading platforms, and start trading from home, just because they got tips], maybe investing funds through wealth engineering.

if WG was only about the 99$ package, ‘stock photo kristen’ would not have made the “IRA” suggestion.

i ‘feel’ the MLM participants of WG, may be investing through WE, making one company a pyramid and one a ponzi.

yup! found it on wealtheng.com/empowering-the-individual/:

all say ponzi!

If that Wealth Engineering service is available through Wealth Generators, then this is definitely a case of unregistered securities being offered.

wealth engineering has ‘equity interests’ in two companies:

1] Wealth Generators, LLC (www.wealthgenerators.com)

2] Wealth Generators Management LLC (www.wealthgenmgmt.com)

its comes as no surprise, that wealth generators management, relies on Form D [rule 506], and the idea of a ‘private investment firm’, to push its ‘compliance crock’.

they have just used some smart lawyers to bifurcate, the ponzi/pyramid elements.

wealthgenmgmt.com/compliance/

This Program is a Scam.

Wealth Generators YOU WILL GO TO JAIL 5 -7 YEARS MIN!!

Aw, Sal you beat me to it! Anyways…this is going to be bad for sure.

With the FTC and the SEC being hot on Wealth Generator’s tail I wonder how long they will last..

I see a lot of gray areas as well and watching that one video above by David he mentions 5-7 years jail time which is insane!!

I hope people in Wealth Generators start learning instead on how to not drop the soap because they may need it.

Here’s the corporate response.

(Ozedit: video removed)

That video is all very well, but the information in comment #6 would appear to negate the claim that Wealth Generators (Wealth Engineering) is a mere publisher of advice.

Wealth Engineering, no matter how they attempt to dress it up, take funds from investors, invest it and then pay out a ROI. This is the offering of a security, as nobody is investing with them on the expectation of a loss.

If Wealth Engineering is also registered as a mere publisher of advice, then I’m sorry but that’s just fraud.

And if this is being offered through Wealth Generators in any way shape or form, then quite obviously they too can hardly behind “we are just a publisher!”.

As it is Wealth Engineering pretty much own Wealth Generators, so it’s one and the same. The way I see it these guys are trying to exploit the grey.

Marrying this to MLM wasn’t a smart idea. As evidenced by the ROI testimonials Wealth Generators themselves have published. They’re just asking for trouble (and will likely receive it from a regulator at some point).

raynor is a smartmouth, going on about irrelevant stuff and avoiding the main questions.

it’s obvious that ‘wealth generators’ is not selling investments, and Don’t need to be registered with the SEC.

but is ‘wealth generator management’, registered with the SEC? as co founder of both companies, under the umbrella of ‘wealth engineering’, raynor should have clarified this.

only a blind person will not immediately see, that the WG, the MLM, is just a feeder for WGM investment company which pays 122% ROI.

and raynor does not comment on the ‘high’ ROI promised on WG website? or the invitation to members to dig into their IRA accounts?

this kind of selling is illegal, in the eyes of the SEC. this kind of advertising should have been backed by actual details of a trading account, showing exactly how such returns were achieved.

in zeek, we had the matrix, feeding the retail profit pool, where high ROI was promised.

what wealth engineering has done is just separate the matrix from the investment plan,[ which is similar to the RPP], by registering them as separate companies.

riiight. the SEC is so stupid, they wont notice this, just like raynor did not bother to explain this in her ‘corporate reply’.

one more video raynor! tell us about ‘wealth generator management’! tell us how much ‘overlap’ there is in member names on your MLM matrix [WG], and in your investment company [WGM].

if we don’t have a video from raynor, it’s obvious she does not want to disclose the truth!

‘wealth engineering’ may be registered as a financial services company:

a] ‘wealth generators’ then calls itself exempt from SEC registration because they are mere ‘publishers’

b] ‘wealth generators management’ then calls itself exempt from SEC registration because they are a private investment club of accredited members, under form D. when is the last time the form D excuse worked for ponzi investment companies? never?

Anjai, I don’t know where do you get off on calling Ms. Raynor a “smartmouth” when it comes to stock.

Now I know much about buying stock or how it works, but Ms. Raynor is a Registered Licensed Investment Advisor. Therefore, she knows a lot about the stock market than a wise-ass like you.

“Steve” is definitely stock photo:

cutcaster.com/photo/901922586-Smiling-man/

And so is “Kristen”

agefotostock.com/en/Stock-Images/Low-Budget-Royalty-Free/ESY-000746081

Does she have a clue about MLM though? That’s the pertinent question here…

Investments (including advice) + MLM = “Oh hai there Mr. SEC, how can I help you?”

then raynor should know better than using stock photo people to ‘encourage’ other people to buy her advice, and invest with WGM, on the promise of 122% ROI.

as a Registered Licensed Investment Advisor, if raynor really knew how to generate 122% ROI, she would be retired on a wholly owned island in the caribbean, and not trying to make ‘form D’ and ‘publisher excuses’, to the general public.

speaking of Registered Licensed Investment Advisors, take a look at the ‘achieve community thread’on behindmlm. ms kristi of ‘achieve’ is also a licensed investor advisor, who ran a ponzi scheme, and is currently facing civil and criminal charges.

tell ms raynor, that her WG is a pyramid scheme, paying commissions for recruitment, and her WGM is a ponzi scheme, for paying new investors with old investor money. nobody makes 122% ROI, except in ponzi schemes.

i know raynor has not spoken about WGM, but that’s just being cunning. WGM is just a sister concern of WG, so not mentioning it , doesn’t make it disappear.

Anjali didn’t mention anything about “when it comes to stock”?

Annette Raynor seemed to be making up some imaginary problems she could “solve”, while avoiding to address any real problems. Or as Anjali said it, “going on about irrelevant stuff and avoiding the main questions”.

It means that we don’t really believe that anyone have made statements like the one she’s mentioning at 1:06 into the video: “You need to be a Licensed Securities Specialist (i.e. series 7, 63, 24, etc.) to participate as a distributor, or you will be in violation of US Securities Law as governed by FINRA and the SEC”.

I believe Annette Raynor has made up that problem herself. I don’t believe anyone have posted anything like that on social media platforms.

I don’t think anyone have mentioned anything about her stock qualifications? You’re making up a false problem here.

We have identified Wealth Generators to be a pyramid scheme in itself, with a “publishing” component as a front. The publishing component may have a function in the business, but it isn’t the primary part of the business. Wealth Generators is simply a recruitment scheme with a publishing component attached.

In addition to that issue, people have pointed out some investment issues. I haven’t really looked into that part, but Wealth Generators looks very similar to a “feeder program” for something.

WGM has a subset ‘private fund’, Wealth Generators Trading LP which is a delaware limited partnership that provides accredited investors the ability to invest in the limited partnership.

wealth generators trading LP, has filed form D with the SEC;

sec.gov/Archives/edgar/data/1595003/000114420414000667/xslFormDX01/primary_doc.xml

these guys have set up their ‘companies’ with a lot of ‘legal fine tuning’. but we have seen that when trouble comes, all the companies are are treated as defendants together, and this legal wordsmithing never helps, because ownership is the same.

in july 2013, the SEC revised the rule 506 of regulation D[form D].

this revision essentially allows for “solicitation or general advertising in offering and selling securities pursuant to Rule 506, provided that all purchasers of the securities are accredited investors”

so, tomorrow, if someone finds that the MLM WG was sending investors over to WGM, by word of mouth advertising, they can claim they are safe, under the new solicitation rule of the the SEC.

for accreditation, they will get investors to sign a bunch of papers, and blame them for providing wrong information, when push comes to shove.

but, if high ROI’s are being paid, in a ponzi scheme WGM, all these excuses will wither away.

david gibson, what is the average ROI paid by WGM, to its ‘accredited’ investors?

I may have misunderstood something, but …

The Wealth Club Bonus seems to be paying out more than 100% in some scenarios.

1 Me → Wealth Club 1500

3 family members → Wealth Club 600

9 family members → Wealth Club 100

27 members → no bonus

——

40 members total = $4,000 monthly fee

9 payouts of $100 = $900

3 payouts of $600 = $1,800

1 payout of $1,500 = $1,500

= total monthly bonus $4,200

raynor has a radio show called ‘The Financial U Radio Show’, which is ahem , sponsored by wealth generators LLC, on which she propagates about the opportunity, to ‘help’ people trade on their own, and ‘change world economy’.

then, in her ‘corporate reply’ video, raynor says they provide ‘trading tips’ to people, who may or may not use them.

it would have been nice if ms raynor, has given some info about how many people actually trade, using her tips, and how fabulously they all are doing. if shes changing the ‘world economy’ she must surely be watching all the ‘data’ [about trades] generated by her little army of ‘independent investors’.

when you’re giving a corporate reply to the public, give information that will actually ‘help’ people decide about your product and service. no?

Please go to FINRA.Org. Do a broker check on Mario Arthur Romano, and Annette Gaynor before you decide to do business with these people.

Buyer Beware..

Mario Arthur Romano, is not registered with FINRA.

annete raynor [not gaynor] is a registered investment advisor as of 2006. she applied for this registration while working for a small investment firm in new jersey, called SAFE investments LLC. there are no complaints to the SEC or FINRA about her.

raynor appears to have brought all these ideas over to her twin companies in wealth engineering ie wealth generators, and wealth generators management.

the difference is that now, she can deal with only ‘accredited’ investors as against the ‘non high worth’ investors she worked with before.

how raynor checks for ‘accreditation’ and the paper work associated with this, will be a very interesting read, in my view.

for those interested:

thus investment companies dealing with only accredited investors, need only file form D with the SEC, and are exempt from registering with the SEC.

several ponzi schemes, use this route to run their schemes, because, who is coming around to check whether all their investors are ‘accredited’ or not?

Beware though, some are telling their members to form “investment clubs” and pool their money together so the club can invest as a single accredited investor.

So if the money’s lost, who do you sue? 🙂

the SEC regulation on investment clubs, accredited investors, is a complex minefield. lots of if’s and but’s, and each case, needs individual study of the structure of the club, to determine whether it satisfies the SEC’s requirement of ‘accredited investor’.

suffice to say, that though the complexities of law involved here, makes it possible for ponzi investment companies to hide, once shaken, their fig leaf will fall off.

they are only safe, till someone starts asking the nasty questions.

Romano had multiple “disclosure events” from 1988 to 2000.

NOLINK://brokercheck.finra.org/Report/Download/34928670

* 8 Regulatory – Final (fines, short suspensions, C&D, injunctions, etc.)

* 3 Customer Dispute – Award/Judgment

– – – – – – – – – – – –

Gaynor has 1 “disclosure event” 2006 → now.

* No details available.

– – – – – – – – – – – –

Romano hasn’t been registered as a broker since 2001, so he has probably operated in a “non regulated market”.

It seems like some of the commenters here aren’t very business/investing sophisticated.

It’s great doing due diligence, but Wealth Engineering has WG as a subsidiary, and WE services only accredited investors who can make investments that the retail investor can’t.

It’s not likely, and highly improbable that accredited investors are being funneled to WE through WG. It just wouldn’t be necessary for an accredited investor to make a pit stop at WG.

WG is for the retail investors, many who are just learning for the first time.

I agree that it’s highly challenging to be in both the investor space and MLM space simultaneously as you have two sets of regulatory agencies to contend with, but that in itself isn’t illegal.

You better have all the “t”s crossed for sure, and of course using stock photos with any sort of ROI or income claims is foolish, so hopefully they will discontinue that.

It would be much better to have a Julian K. talk about how the newsletters and tips have helped out, or other members who are new to the game.

It’s also not illegal to form a “trading club” for retail investors who want to do that following the set legalities as retail investors. It’s not illegal to form a “trading club” for accredited investors either, by following the rules…it’s called a hedge fund.

Disclaimer: I’m not enrolled or involved with WG in any way and the opinions I have published here are solely my own.

Annette Raynor’s disclosure event was a Chapter 7 bankruptcy filed in 2010. Her statement in the report reads:

Among the company names she was associated with in this timeframe one was Wealth Engineering and Development which offered, among other things, real estate investment education.

Mario Romano is a little more interesting. He no longer has an investment adviser license and as M_Norway pointed out above he has a longer list of disclosure events. Two of which stem from when he was working for LCP Capital.

Mr. Romano’s Linkedin profile:

linkedin.com/in/marioromanocoltsneck

I post that to substantiate Wealth Generator’s Mario Romano’s interest in and involvement with Pop Warner football in Colts Neck New Jersey.

silive.com/news/index.ssf/2007/10/dad_accused_of_clocking_sons_f.html

I’m an American football fan and I’m pretty sure I speak for all of us when I say the urge to beat the crap out of and spit on football coaches is not all together uncommon but it’s generally considered good form to suppress that urge, especially when dealing with youth league football.

But that isn’t why I posted that link. From that article:

Bolding mine.

At least two of Mr. Romano’s disciplinary events where from when he worked for LPC Capital. This does perhaps explain why Wealth generator’s Mario Romano no longer has an investment license.

Buyer Beware… People need to go to FINRA.Org. Do a broker check on Mario Arthur Romano and Annette Gaynor before you decide to do business with these people.

I recently attended and event at a local college campus for “Wealth Generators”. The whole time at the seminar i knew something was shady about the whole thing.

Firstly all of the people attending the meeting were under the age of 25 and were boasting about there ROI of 1440% that is exactly what they told me and what i saw on there “Trading App”.

Many of these young people around my age didnt seem to be above average when it came to intelligence which was a huge red flag.

I personally know people who work with FOREX and they are all advanced level programmers who write their own programs to calculate algorithms to get an idea of future fluctuations in the market and would never dream of a ROI any where close to 100% much less in the 1000’s.

After digging alot deeper makes no sense at all i would like to talk to someone who knows more about this i am very unfamiliar with investing (as you can probably see) and fraud, thankfully i had enough common sense to delve a bit deeper before coming to any conclusions.

I am very confident know after reading all of this that there is without a doubt in my mind some serious fraud going on here i have already reported them to the FTC and will file a report to the SEC later today.

They are now offering a PASSIVE earnings module! Here is the latest email from Ken Russo:

They must really be cash strapped.

No one wants to work for wealth it just has to be automatic.. How many times have we heard this before.

why do they need money – the never before seen technology just prints it up for you.

Its putting me to sleep just thinking of the time people will waste on this.

Sounds like they’ve gone full Ponzi and dropped the “we’re just a publisher of advice” pseudo-compliance crap then.

Hacking is offtopic, even if OneCoin are baiting. Let’s stick to the MLM side of things please.

Hi, any new updates on this one, it’s on the move in Europe now, with big ambitions in becoming big.

No updates on my end.

Problem in México, many people on their facebook’s accounts are saying they didn’t receive the last 2 payments.

Many audio messages trough whatsapp about the same problem.

there is a re launch going on. 350 dollars to join. 200 dollars monthly fees. and will double your money ..

when it sounds to good to be true it usually is.

The irish Promoter Hugh Paul Ward has a bad MLM name. Join and find three and you are free.

What happened then?

It seems you know a lot about this company. I’m doing some research about them. Can I contact you?

Hey guys!

I’m doing some research about Wealth Generators. If you have some knowledge about this company or you know some victims please comment here. I would be really grateful!

carefull, they are now starting in the “mining” crypto currency scene, check out this profile from a “Top leader” soon they will Follow Mr Garza…. we all know who that guy is…. Don’t ever do cloud mining, you will loose big time..

facebook.com/livelikelogan?hc_ref=ARTkDkvkUR_zUHH1XCsOjzhDi9NzZK69rZD40yePqnHkzQUe8R-Td9t3NnoexxD4kyg

For those who don’t know garza: news.bitcoin.com/josh-garza-held-liable-9-million-usd-wire-fraud/?utm_source=OneSignal+Push&utm_medium=notification&utm_campaign=Push+Notifications

Jesus Christ, who jizzed in Logan Shippy’s hair?