VTS Fund Review: Boris CEO MLM crypto Ponzi

The “VTS” in VTS Fund supposedly stands for “Vector Technology Solution”.

The “VTS” in VTS Fund supposedly stands for “Vector Technology Solution”.

VTS Fund fails to provide ownership or executive information on its website.

Further research reveals VTS Fund citing Stefan Herz as CEO and Andrew Skelzen as CFO:

Over on YouTube we find a rented office marketing video, in which Herz is played by a German-speaking actor in a wig with glasses:

Boris CEO MLM schemes are typically run by eastern European scammers (Russia, Ukraine and/or Belarus). To that end the actor playing Andrew Skelzen has a typical eastern European accent.

Update 14th April 2025 – The actor playing VTS Fund’s Andrew Skelzen has a history of playing fictional executives in Russian Ponzi schemes.

The same actor appeared as “Alex Kapperis” for Resonance Capital:

Resonance Capital was a Boris CEO MLM crypto Ponzi launched in 2017. Kapperis was presented as Resonance Capital’s “Chief Manager of Finance Projects”. /end update

In an attempt to hide its Russian origins, VTS Fund provides investors with a shell company certificates for the UK and Singapore.

Due to the ease with which scammers are able to incorporate shell companies with bogus details, for the purpose of MLM due-diligence these certificates are meaningless.

VTS Fund’s website domain (“vtsfund.com”), was privately registered on September 9th, 2024.

Despite not existing prior to September 2024, on its website VTS Fund falsely states it was “founded in 2023”.

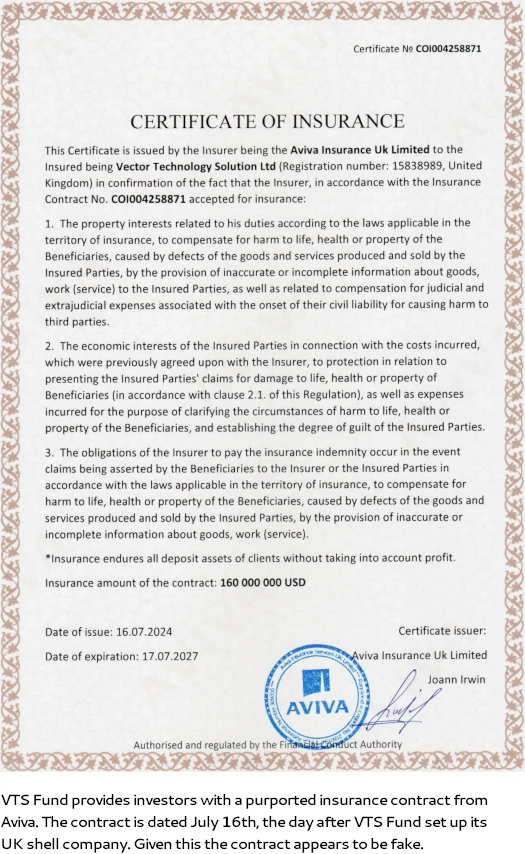

Of note is VTS Fund providing investors with a purported Aviva insurance contract;

Fake insurance contracts aren’t common but have been presented by Boris CEO Ponzi schemes before.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

VTS Fund’s Products

VTS Fund has no retailable products or services.

Affiliates are only able to market VTS Fund affiliate membership itself.

VTS Fund’s Compensation Plan

VTS Fund affiliates invest USD equivalent in cryptocurrencies. This is done on the promise of advertised returns:

- Simple Fund – invest $50 or more and receive 0.5% a day for 10 days

- Stable Fund – invest $500 or more and receive 1% a day for 120 days

- Crypto Fund – invest $5000 or more and receive 1.2% a day for 365 days

- Fundamental Fund – invest $10,000 or more and receive 1.5% a day for 365 days

- Crypto Fund Short – invest $2500 or more and receive 1.75% a day for 60 days

- Tech Fund – invest $1000 or more and receive 2% a day for 120 days

The MLM side of VTS Fund pays on recruitment of affiliate investors.

VTS Fund Affiliate Ranks

There are thirteen affiliate ranks within VTS Fund’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Rank 1 – sign up as a VTS Fund affiliate

- Rank 2 – generate $50,000 in downline investment

- Rank 3 – generate $100,000 in downline investment

- Rank 4 – generate $250,000 in downline investment

- Rank 5 – generate $500,000 in downline investment

- Rank 6 – generate $1,000,000 in downline investment

- Rank 7 – generate $2,000,000 in downline investment

- Rank 8 – generate $3,000,000 in downline investment

- Rank 9 – generate $5,000,000 in downline investment

- Rank 10 – generate $10,000,000 in downline investment

- Rank 11 – generate $15,000,000 in downline investment

- Rank 12 – generate $30,000,000 in downline investment

- Rank 13 – generate $50,000,000 in downline investment

ROI Match

VTS Fund pays a ROI Match via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

VTS Fund caps payable unilevel team levels at twenty. The ROI Match is paid as a percentage of daily returns paid out across these twenty levels based on rank:

- Rank 1 – 6% on level 1 (personally recruited affiliates), 2% on level 2 and 1% on levels 3 and 4

- Rank 2 – 7% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 and 5

- Rank 3 – 7% on level 1, 4% on level 2, 2% on levels 3 and 4 and 1% on levels 5 and 6

- Rank 4 – 7% on level 1, 4% on level 2, 2% on levels 3 to 5 and 1% on levels 6 and 7

- Rank 5 – 7% on level 1, 4% on level 2, 3% on level 3, 2% on levels 4 to 6 and 1% on levels 7 and 8

- Rank 6 – 7% on level 1, 4% on level 2, 3% on level 3, 2% on levels 4 to 7 and 1% on levels 8 and 9

- Rank 7 – 8% on level 1, 5% on level 2, 3% on levels 3 and 4, 2% on levels 5 to 7 and 1% on levels 8 to 10

- Rank 8 – 8% on level 1, 5% on level 2, 4% on level 3, 3% on levels 4 and 5, 2% on levels 6 and 7 and 1% on levels 8 to 11

- Rank 9 – 8% on level 1, 5% on level 2, 4% on level 3, 3% on levels 4 and 5, 2% on levels 6 to 8 and 1% on levels 9 to 12

- Rank 10 – 9% on level 1, 5% on level 2, 4% on level 3, 3% on levels 4 and 5, 2% on levels 6 to 9 and 1% on levels 10 to 14

- Rank 11 – 9% on level 1, 6% on level 2, 4% on level 3, 3% on levels 4 to 6, 2% on levels 7 to 9 and 1% on levels 10 to 15

- Rank 12 – 9% on level 1, 6% on level 2, 4% on levels 3 and 4, 3% on levels 5 and 6, 2% on levels 7 to 9 and 1% on levels 10 to 18

- Rank 13 – 10% on level 1, 6% on level 2, 5% on level 3, 4% on levels 4 and 5, 3% on level 6, 2% on levels 7 to 10 and 1% on levels 11 to 20

Business Account

VTS Fund affiliates can apply for a Business Account. VTS Fund does not disclose Business Account qualification criteria.

Business Account VTS Fund affiliates gain access to “monthly rewards” and “exclusive opportunities and offers”. No specifics are provided.

Joining VTS Fund

VTS Fund affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $50 investment.

VTS Fund solicits investment in various cryptocurrencies.

VTS Fund Conclusion

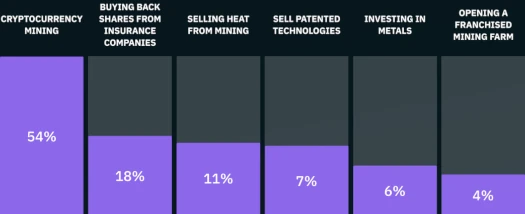

VTS Fund represents it generates external revenue via a number of ruses:

No verifiable evidence of VTS Fund generating external revenue of any kind is provided.

On the regulatory front VTS Fund’s passive returns investment scheme constitutes a securities offering. This requires VTS Fund to register with regulators and file periodic financial reports.

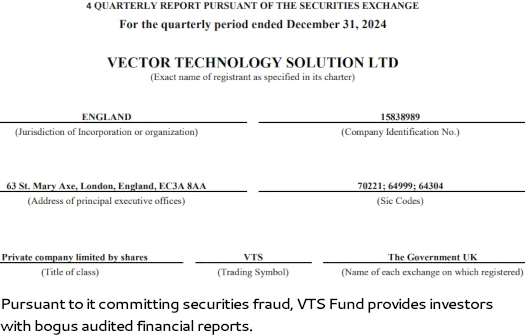

VTS Fund fails to provide evidence it has registered with financial regulators in any jurisdiction. This means that at a minimum, we can verify VTS Fund is committing securities fraud.

What VTS Fund does provide is fake financial audits, pursuant to “the securities exchange” in the UK:

There is no “securities exchange” regulator in the UK. Securities in the UK are regulated by the FCA. A search of the FCA’s Company Register reveals VTS Fund and/or Vector Technology Solution LTD is not registered with the FCA.

Additionally, the “company identification number” provided in VTS Fund’s purported “securities exchange” audit above doesn’t exist.

As it stands, the only verifiable source of revenue entering VTS Fund is new investment. Using newly invested funds to pay ROI withdrawals would make VTS Fund a Ponzi scheme.

Additionally, with nothing marketed or sold to retail customers, the MLM side of VTS Fund operates as a pyramid scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up to so too will new investment.

This will starve VTS Fund of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 19th April 2025 – VTS Fund appears to have collapsed. While the company’s website is still online, VTS Fund has deleted its official YouTube channel, Twitter and Telegram accounts.

Update 25th April 2025 – VTS Fund’s website has now been disabled.

Great Job OZ! Glad my recommandation led to this article. The fake CEO is hilarious with his wig. Hope it will help people Not fall in this scam.

@Oz, please delete the “t” in Hertz.

ThomasGunter-777 commented under a VTS video from February 1, 2025 with CFO Andrew Skelzen.

postimg.cc/K40qnVj7

youtube.com/watch?v=xmlSijF0hzk

The video linked by the commentator leads to the channel of the Resonance Capital scam from 2017. A man who calls himself Alex Kapperis speaks in the video.

postimg.cc/tY01mRs9

youtube.com/watch?v=vXaDxM__mh8

Does the commentator believe or know that Andrew Skelzen and Alex Kapperis are the same person?

In the Resonance Capital Review of October 26, 2017, the name Alex Kapperis was not mentioned, but Maris Landsbergis.

https://behindmlm.com/mlm-reviews/resonance-capital-review-20-professionals-generate-288-annually/

On Instagram, Alex Kapperis described himself as Director of Financial Products at Resonance Capital in November 2017. All 11 posts on Instagram were written in Russian.

postimg.cc/LnYjW04M

instagram.com/p/BbvltBZBhoC/

In a video from November 2017, Alex Kapperis described himself as Chief Manager of Investment Products at Resonance Capital. Which statement is correct and which statement is a lie?

youtube.com/watch?v=QJzXCTiR8YU

For direct comparison.

“Alex Kapperis” from Resonance Capital in November and December 2017.

postimg.cc/YjvyM7t4 and postimg.cc/tY01mRs9

youtube.com/watch?v=vXaDxM__mh8

“Andrew Skelzen” from VTS – Vector Technology Solution in November 2024 and April 2025.

postimg.cc/Jy9q6VJv and postimg.cc/LJmXZ24D

youtube.com/watch?v=iSHppnJdjMk

I recognize a clear resemblance between the two people. It should be noted that there are almost seven years between these four photos.

In addition to the vtsfund.com website, there is an identical vtsfund.net website. The domain was registered on November 9, 2024.

postimg.cc/bGskWFNf

Oop, thanks for catching that.

Good catch, that Left Ear (Right side from our perspective) and the uneven tilted mouth is a pretty good giveaway that they’re the same guy.

In this video from October 26, 2024, we can hear the original German voice of CEO “Stefan Herz” with an Eastern European accent.

postimg.cc/gLPSH6F5

youtube.com/watch?v=6T2B2Bi8gfY

The same video with English translation.

youtube.com/watch?v=vL7SEjm-mq8

Stefan Herz has been a Director of VECTOR TECHNOLOGY SOLUTION LIMITED in London since July 15, 2024.

postimg.cc/YGBkvHzx

find-and-update.company-information.service.gov.uk/company/15838989/officers

It is remarkable how much capital this company supposedly has at its disposal.

postimg.cc/yghK9bfC and postimg.cc/06fZwGpH

find-and-update.company-information.service.gov.uk/company/15838989/filing-history

I had to rush out yesterday but I concur, great research!

Yeah, the Russian guy playing Andrew Skelzen is the same guy playing Resonance Capital’s Alex Kapperis.

Sometimes after we publish a review they replace an actor or have multiple actors due to bad accents or some other reason. Like in this review I didn’t focus on Kapperis, only the main wig guy.

Thanks for the additional research, will add an update to the review.

Alright now I’m confused. I have no idea what German is supposed to sound like with an eastern European accent (lol). Is that what this guy has?

So basically we’ve got a Russian who learned German and English. That’s a new one.

Addition to comment #2.

I had linked to the following video on the YT channel VTS – Vector Technologies Solution, which is no longer available.

youtube.com/watch?v=iSHppnJdjMk

Addition to comment #5.

I had linked to the following videos on the YT channel VTS Vector Technologies Solution, which are no longer available.

youtube.com/watch?v=6T2B2Bi8gfY

and

youtube.com/watch?v=vL7SEjm-mq8

YouTube only shows the following:

Who are the 6,140 fools who had subscribed to the YT channel VTS – Vector Technology Solution? How do the 6,140 fools who had subscribed to this YT channel find out more?

On their websites vtsfund.com and vtsfund.net, the VTS scammers link to youtube.com/@VTSfund, but the channel does not exist.

I found one of the deleted videos with VTS CEO Stefan Herz with English translation on the YT channel of Dorin Vasile Ignat.

postimg.cc/qNvfdSnB

youtube.com/watch?v=lUWKV5JdxuE

On the YT channel Opportunity Space with 141 subscribers, 21 videos have been uploaded for the VTS scam since September 2024.

postimg.cc/TpXPh0Gb

youtube.com/@OpportunitySpace

In a 4-minute video on this channel from January 4, 2025, it is claimed that a VTS conference took place in Beijing (China).

postimg.cc/XXgpDgq4

There are a maximum of 15 people in the small room shown, and they are only shown from behind. Therefore, there is no way to tell if these people are really Chinese. Also, the VTS posters do not contain any Chinese characters next to the speaker.

The video contains only music, no one speaks. I am sure that this alleged event in Beijing never took place.

youtube.com/watch?v=DPo7Yb48sgk

The private Facebook group VTSFund Opportunity Space has existed since August 16, 2024 and has 243 members.

facebook.com/groups/opportunityspace

Aaaand it’s gone. VTS Fund has collapsed.

Melanie’s research was just too much lulz.

@Oz, let’s not get too excited. Five “news” items were published on vtsfund.com and vtsfund.net yesterday.

postimg.cc/9r2Gyxn2

vtsfund.net/?p=news

I quote the last article from yesterday.

postimg.cc/SX4sv5cQ

vtsfund.net/?p=news&article=249

CEO Stefan Herz is now called Stefan Heartz? That irritates me! 🙁

Socials gone, withdrawals disabled… don’t get too exited? I’m rock hard – RIP.

The updates from “Heartz” are prime recovery-scam bait. They’ll probably reboot once they find a new actor.

@Oz, you were right. The fraud portals vtsfund.com and vtsfund.net no longer exist. 😀

postimg.cc/1f8wdL5L

Confirmed. Thanks for the update Melanie