Throne Legacy Capital Review: 24 month forex trading fraud

Throne Legacy Capital (TLC) operates in the forex MLM niche.

Throne Legacy Capital (TLC) operates in the forex MLM niche.

The company claims it was “founded in 2019 and headquartered in Hong Kong”.

I can’t speak to Hong Kong but TLC’s website domain was privately registered on January 29th, 2019.

Photos of TLC’s Hong Kong headquarters on their website are that of empty furnished office space.

TLC is headed up by CEO Carl Ronny:

TLC marketing material claims Ronny

graduated from Leiden University with a degree in Business Management and held management positions in many investment groups in the USA and Europe.

He has been involved in the development of several investment projects and has successfully generated substantial profits for that companies.

During his more than 10-year career in finance, Mr. Ronnie [sic] has multiplied capital gains for many investors and significantly exceeded the S&P 500 accumulative net yield index.

Predictably, Ronny doesn’t exist outside of TLC marketing. This makes him a prime Boris CEO candidate.

The image below is from TLC’s Hong Kong office opening ceremony held in mid 2019:

These gentlemen were seated at the front row of the event and are grouped together with flower lapels.

One of the individuals is identified as Kwanky Tse, Asia CEO of TLC:

It is highly likely that Tse and his cohorts are the actual owners and operators of TLC.

Other than a barren Facebook profile, Tse doesn’t exist outside of TLC marketing either.

At [1:40] into the linked video above, Carl Ronny takes to the stage with a distinctly Australian accent.

In September 2019 TLC held an event in Malaysia. Ronny is nowhere to be seen in the video footage.

Read on for a full review of Throne Legacy Capital’s MLM opportunity.

Throne Legacy Capital’s Products

TLC has no retailable products or services, with affiliates only able to market TLC affiliate membership itself.

Throne Legacy Capital’s Compensation Plan

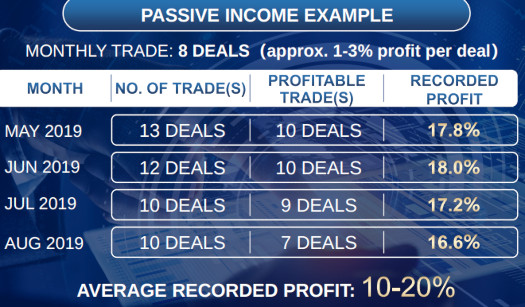

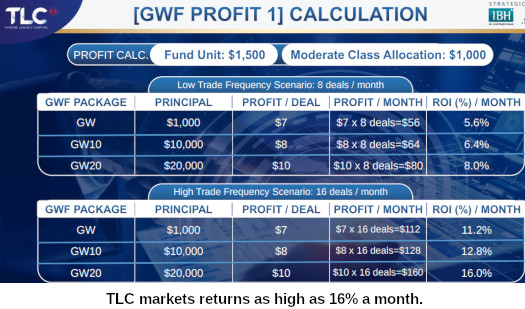

TLC affiliates invest in $1500 units on the promise of “stable profits easily every month.”

The more a TLC affiliate invests, the higher the represented returns. Once invested, funds are locked inside TLC for 24 months.

As per TLC’s compensation plan material;

Withdrawals can be done after 24 months.

If the principal is withdrawn during the validity term, the premium will be forfeited.

Note that TLC withholds 10% of all paid commissions and bonuses. This amount can only be reinvested back into the company.

TLC Affiliate Ranks

There are seven affiliate ranks within TLC’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- IB – personally invest in one $1500 unit

- IB1 – maintain a $1500 unit investment and generate ten downline unit investments

- IB2 – maintain a $1500 unit investment, recruit and maintain two IB1s and generate fifty downline unit investments

- MIB1 – personally invest in two $1500 units, recruit and maintain two IB2s and generate three hundred downline unit investments

- MIB2 – personally invest in five $1500 units, recruit and maintain two MIB1s and generate one thousand downline unit investments

- SIB1 – personally invest in eight $1500 units, recruit and maintain two MIB2s and generate three thousand downline unit investments (no more than 500 from any one recruitment leg)

- SIB2 – personally invest in ten $1500 units, recruit and maintain two SIB1s and generate ten thousand downline unit investments (no more than 1000 from any one unilevel leg)

Commissions are paid per recorded automated trade in downline TLC affiliate’s backoffices.

- IBs receive $2 per recorded trade

- IB1s receive $3 per recorded trade

- IB2s receive $5 per recorded trade

- MIB1s receive $8 per recorded trade

- MIB2s receive $10 per recorded trade

- SIB1s receive $13 per recorded trade

- SIB2s receive $15 per recorded trade

TLC’s compensation material suggests 10-13 trades are recorded each month.

Generation Bonus

TLC pays a Generation Bonus via generations tracked through unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

A generation within the unilevel team is defined when an IB2 or higher ranked affiliate is found in a leg.

This ranked affiliate caps off the first generation for that leg, with the second beginning immediately after.

If no second IB2 or higher ranked affiliate exists deeper in the leg, the second generations extends the full depth of the leg.

Using this generational structure, TLC pays the Generation Bonus from the IB2 rank as follows:

- IB2 to MIB2 earn 5% on one generation per leg

- SIB1s earn 5% on up to two generations per leg

- SIB2s earn 5% on up to three generations per leg

Note the 5% is paid as a percentage of commissions earned by unilevel team affiliates within a generational leg.

GW Referral Bonus

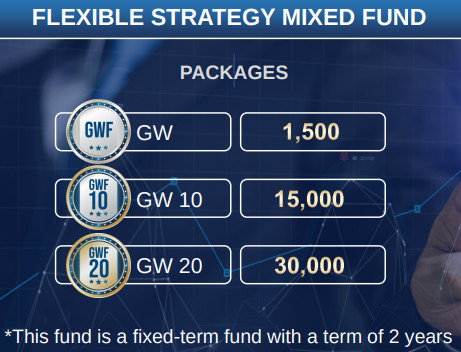

TLC affiliates who invest in a GW Package ($1500, $15,000 or $30,000), qualify for three level deep referral commissions.

These referral commissions are paid out via the same unilevel team used to calculate the Generational Bonus (see above).

The GW Referral Bonus pays

- 50% on the first generation per leg

- 15% on the second generation peg leg

- 10% on the third generation per leg

The GW Referral Bonus is paid on generated backoffice trades.

Joining Throne Legacy Capital

Throne Legacy Capital affiliate membership is attached to at least one $1500 unit investment.

GW Package investment is also available at $1500, $15,000 or $30,000 tiers.

GW Package investment increases a TLC affiliate’s income potential as detailed in the “compensation plan” section of this review.

Conclusion

Throne Legacy Capital claims to be

the world’s leading tech-driven investment management platform.

That’s quite a statement to make, considering TLC is relatively unknown outside of its own marketing circles.

By their own admission, TLC offer passive returns.

MLM companies marketing passive returns are offering securities.

In order to operate legally, MLM companies offering securities must register said offerings with financial regulators.

TLC provide no evidence they have registered themselves with financial regulators in any jurisdiction.

This means, irrespective of anything else, at a minimum TLC is committing securities fraud and operating illegally.

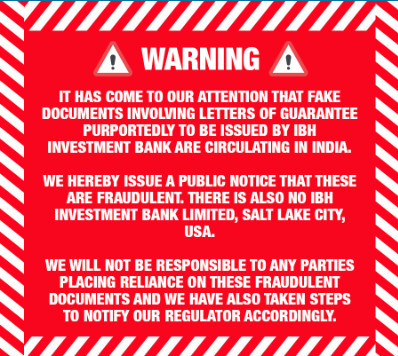

What TLC do claim to have is “strategic partnerships” with IBH Investment Bank and Aplex V.A. Limited.

What TLC do claim to have is “strategic partnerships” with IBH Investment Bank and Aplex V.A. Limited.

Before we continue, I want to stress that neither of these claimed partnerships have anything to do with TLC’s regulatory legality.

Let’s start with IBH Investment Bank.

The first thing you’re presented with on a visit to IBH Investment Bank is a COVID-19 warning, as directed by the Malaysian Government.

If you click that message away, you next see a warning about IBH Investment Bank related fraud in India:

The India related fraud, although notable, doesn’t pertain to TLC. What’s far more relevant is IBH Investment Bank being Malaysian.

Malaysia is notorious for MLM forex fraud schemes. That TLC has ties to Malaysia is not surprising.

I’d even go so far as to say the Hong Kong song and dance is smoke and mirrors. TLC is probably being run out of Malaysia by Malaysian scammers.

Moving onto Aplex VA Limited… well there’s not much to move onto.

Aplex Limited claims to have “24 years of experience”, yet its website domain was only registered on March 3rd, 2020.

Aplex Limited’s website naturally contains no ownership information. The one photo used to represent company management is a stock photo.

Based on this marketing copy from Aplex Limited’s website;

Aplex V.A. Limited is a global finance advisory institution that was established in Wellington, New Zealand, on 9th March 2020. We have licenses from several financial services authorities.

I’m going to go with money laundering. The bank accounts TLC has set up to launder invested funds through outside of Malaysia, have likely been set up through Aplex Limited and related shell companies.

One such shell company appears to be Limestone FX Pty Limited, the only company other than TLC featured on Aplex Limited’s website as a partner.

Limestone FX Pty Limited, is a foreign exchange broker established in Australia. LIMESTONE FX is regulated by ASICS and is wholly owned by Aplex V.A.

This is pretty common with dodgy forex schemes. And New Zealand and Australian shell companies used to fool banks is nothing new.

So why go to all this effort instead of just registering in Malaysia as a legitimate financial provider?

TLC isn’t doing what it says it is.

As it stands the only verifiable source of revenue entering TLC is new investment.

Using new investment to pay existing affiliates returns under the guise of convoluted forex virtual trading makes TLC a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dies down so too will new investment. This will starve TLC of ROI revenue, eventually prompting a collapse.

24 months is plenty of time for Kwanky Tse and his accomplices to squirrel away invested funds through shell companies.

Neither Malaysia, Australia, New Zealand or Hong Kong are known for timely regulation of MLM forex scams.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Hello,

What can we do if our fund are lockup by TLC and IBH as both claimed to be strategy partner. Our money seem still with IBH under the MT4 trading platform .

Is there any channel that we can claimed back our fund from IBH instead since it still in the account?

Thanks.

Throne Legacy Capital is a Ponzi scheme. Your money was stolen the second you invested.

You could ask Carl Ronny for your money back. Don’t think it’ll do you any good though.

This is what happens when you invest in Ponzi schemes. Sorry for your loss.

Fma scam warning.. fma.govt.nz/news-and-resources/warnings-and-alerts/aplexva/

Thanks for the heads up!

Hi..

When did the TLC collapsed ?

I just wrote to my introducer, but could not reach the person .

I am one of the unfortunate investors . The friend who introduced me into this investment did not tell me about 24 months money cannot be withdrawn ( I came to know about it only after money given)

Thanks

The new website domain owners took possession in April 2021. I’d estimate Throne Legacy Capital collapsed either late 2020 or early this year.