TeaMiner Review: Another Juan Reynoso MLM crypto Ponzi

TeaMiner operates in the MLM cryptocurrency niche.

TeaMiner operates in the MLM cryptocurrency niche.

The company represents it’s “main office” is in Wyoming in the US. Another corporate address for the shell company Teaminer S.A. in Panama is provided.

TeaMiner’s “main office” address in Wyoming is attached to the shell company TeaMiner Inc. The address itself belongs to Opus Virtual Offices.

It is unlikely TeaMiner has any ties to Wyoming beyond registering a shell company there.

TeaMiner’s Panama address is random office space for rent. Again it is unlikely TeaMiner has any actual ties to Panama beyond registering a shell company there.

Heading up TeaMiner we have an executive team led by Luis Rodriguez:

Rodriguez (under a different name) pops up on a few Chinese language websites. Juan Reynoso Jr. is a former promoter of the OmegaPro Ponzi scheme.

I wasn’t able to put together an MLM history on TeaMiner’s other two executives.

A major red flag with Tea Miner is the involvement of Juan Carlos Reynoso.

Reynoso (no idea if he’s related to TeaMiner’s Juan Reynoso Jr.), is a notorious MLM Ponzi scammer.

Update 26th March 2024 – Juan Reynoso Jr. is in fact the son of Juan Carlos Reynoso:

/end update

The earliest record BehindMLM has of Juan Reynoso’s Ponzi scamming is iComTech circa 2018.

US authorities arrested iComTech’s founder David Carmona and four accomplices in late 2022. Although he was CEO of iComTech, Reynoso was not among those apprehended.

After iComTech collapsed, Reynoso signed on as an OmegaPro executive circa 2019.

OmegaPro is suspected of being a multibillion dollar MLM crypto Ponzi scheme.

The scam collapsed in late 2022, after which Reynoso signed on a CSO for the Go Global reboot.

Next we heard of Reynoso was March 2023. Reynoso was arrested in Mexico on money laundering and drug trafficking charges.

In June 2023, Reynoso was released due to “irregularities with evidence collected” against him.

Today there is no mention of Reynos on Go Global’s website. Any mention of him on Go Global’s social media has been scrubbed.

Promotion of TeaMiner began in November 2023. It’s high likely Reynoso, either directly or by proxy, is actually running TeaMiner.

Both OmegaPro and Go Global was/is based out of Dubai. Reynoso is assumed to be hiding in Dubai and/or Central America.

Read on for a full review of TeaMiner’s MLM opportunity.

TeaMiner’s Products

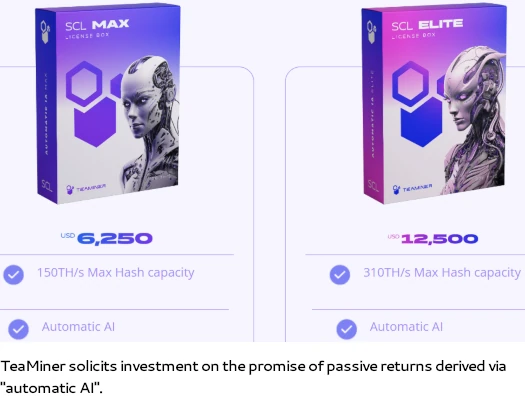

TeaMiner sells 12 to 36 month investment plans:

- SCL Starter – $250

- SCL Plus – $625

- SCL Pro – $1250

- SCL Ultra – $3125

- SCL Max – $6250

- SCL Elite – $12,500

TeaMiner’s Compensation Plan

TeaMiner affiliates invest funds on the promise of a passive return:

- SCL Starter – $200

- SCL Plus – $500

- SCL Pro – $1000

- SCL Ultra – $2500

- SCL Max – $5000

- SCL Elite – $10,000

Note these are the same investment plans offered to retail customers but at a 20% discount.

Specific return rates aren’t public but TeaMiner pays returns on invested funds over 12 to 36 months. The more a TeaMiner invests the higher their return rate.

TeaMiner hides specific MLM compensation details from the public.

What is disclosed is TeaMiner’s compensation plan is made up of:

- retail commissions

- fast start bonuses

- residual unilevel commissions

- check matching bonuses

- leadership bonuses and

- rank achievement bonuses

Joining TeaMiner

TeaMiner affiliate membership is $30.

Optional TeaMiner Academy membership is $50 every 4 weeks. TeaMiner Academy provides access to a crypto education digital library.

TeaMiner Conclusion

As is typical of MLM cryptocurrency companies, TeaMiner combines securities fraud with an MLM compensation plan.

The external revenue used this time around is cryptocurrency mining. Tacked on to this is an additional AI grift.

Our AI evaluates and determines the most profitable mining pools, automatically and manually adjusting to the pool of your choice.

TeaMiner fails to provide verifiable evidence it is generating withdrawal revenue via cryptocurrency mining of any kind.

What TeaMiner does claim is that it’s “adhering to stringent US regulations to ensure immutable integrity and fairness”.

I suspect this ties into TeaMiner’s offered retail investment plans. The problem is TeaMiner’s retail offering is pseudo-compliance that makes no sense.

Why would anyone investing in TeaMiner not just pay the $30 one-time fee to get a 20% discount?

Secondly, and more importantly, TeaMiner operates in violation of US securities law.

As per the Howey Test, TeaMiner’s passive returns MLM opportunity constitutes a securities offering.

This requires TeaMiner to register with the SEC, which it has not. The SEC warns consumers that securities fraud and Ponzi schemes go hand-in-hand.

Thirdly, TeaMiner’s failure to disclose specific information about its purported mining operations and compensation plan constitute potential violations of the FTC Act.

If the majority of TeaMiner investors are also affiliates (i.e. they paid $30), this would also make TeaMiner a pyramid scheme – another violation of the FTC Act.

In summary, when approached from any angle TeaMiner operates in violation of US laws and regulations. Lying about this to consumers could be deemed part of a conspiracy to commit securities and wire fraud.

As it stands, the only verifiable source of revenue entering TeaMiner is new investment.

Using new investment to pay affiliate withdrawals would make TeaMiner a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve TeaMiner of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.