Hedger Tech Review: Hedger insurance coin?

![]() Hedger Tech operates in the cryptocurrency MLM niche. Other than an email address, the company provides no contact information.

Hedger Tech operates in the cryptocurrency MLM niche. Other than an email address, the company provides no contact information.

Hedger Tech don’t provide management details on their website, but their whitepaper cites Leo Bathan as Chairman and CEO.

Bathan doesn’t have a digital footprint outside of the Hedger Tech whitepaper, which I’m flagging as highly suspicious.

Bathan doesn’t have a digital footprint outside of the Hedger Tech whitepaper, which I’m flagging as highly suspicious.

Either Bathan doesn’t exist or is being represented by someone with a different name (typically a stolen image or an actor is used).

The Hedger Tech website domain (“hedger.tech”) was privately registered on May 18th, 2018.

Hedger Tech also run Hedger Mining, through which affiliate investment is solicited through.

The Hedger Mining website domain (“hedgermining.com”) was privately registered on September 14th, 2018.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Hedger Tech Products

Hedger Tech has no retailable products or services, with affiliates only able to market Hedger Tech affiliate membership itself.

The Hedger Tech Compensation Plan

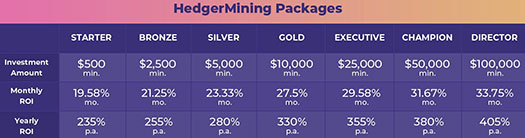

Hedger Tech affiliates invest funds on the promise of an advertised ROI.

- Starter – invest $500 or more and receive a 19.58% monthly ROI

- Bronze – invest $2500 or more and receive a 21.25% monthly ROI

- Silver – invest $5000 or more and receive a 23.33% monthly ROI

- Gold – invest $10,000 or more and receive a 27.5% monthly ROI

- Executive – invest $25,000 or more and receive a 29.58% monthly ROI

- Champion – invest $50,000 or more and receive a 31.67% monthly ROI

- Director – invest $100,000 or more and receive a 33.75% monthly ROI

Hedger Tech investment is coordinated through the company’s Hedger Mining website.

Although not explicitly clarified by Hedger Tech, I believe ROIs are paid in Hedger Coin.

Hedger Coin is an ethereum based erc-20 altcoin Hedger Tech created. It holds no value outside of Hedger Tech itself.

Referral Commissions

Hedger Tech pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Hedger Tech cap payable unilevel team levels at four.

Referral commissions are paid as a percentage of funds invested across these four levels as follows:

- level 1 (personally recruited affiliates) – 25% (payable 30 days from investment date)

- level 2 – 20% (payable 60 days from investment date)

- level 3 – 15% (payable 90 days from investment date)

- level 4 – 10% (payable 120 days from investment date)

Joining Hedger Tech

Hedger Tech affiliate membership is free.

Full participation in the attached MLM opportunity however requires a minimum $500 investment.

Conclusion

Hedger Tech markets their Hedger shitcoin as an “insurance coin”.

We will make Hedger as the go-to cryptocurrency hedge instrument, an“insurance coin,” for investors to manage its cryptocurrency risks.

The basic idea is you convert bitcoin into Hedger Coin (HDR) and are thus “insured” from bitcoin volatility.

Hedger Tech’s official explanation as to how this works is on the right. See if you can spot the glaring problem.

Hedger Tech’s official explanation as to how this works is on the right. See if you can spot the glaring problem.

As per the example, you exchange 0.073120 BTC into HDR on June 1st.

BTC declines throughout the month, but Hedger Tech still pays you the June 1st exchange rate when you exchange back into BTC on June 24th.

This works on the assumption Hedger Tech locks away deposited BTC and simply returns it when the time comes.

That’s not the case though. And even if it was, the investor still takes a loss because their BTC isn’t worth what it was on June 1st.

In summary: Hedger Tech’s “insurance” claims are a load of baloney.

On top of that Hedger Tech are committing securities fraud via their Hedger Mining investment scheme.

Hedger Tech affiliates invest funds on the promise of very specific ROI amounts.

The company claims to generate external ROI revenue via

an established business model used by industry experts in insurance and hedge funds.

Naturally Hedger Tech fails to provide evidence of any such business models existing.

What you’re left with is new investment being the only verifiable source of revenue entering Hedger Tech.

The use of newly invested funds to pay existing affiliates a ROI makes Hedger Tech a Ponzi scheme.

Not withstanding securities fraud by way of Hedger Mining passive returns.

On their website Hedger Tech provides no indication they have registered their Hedger Mining securities offering with regulators in any jurisdiction they operate in.

Cagayan Economic Zone Authority (CEZA) is touted as a regulatory partner on the Hedger Tech website.

From what I can tell CEZA is just a free trade economic zone being set up within the Philippines.

While CEZA has ties to the Philippine government, it is not a securities regulator. Nor does CEZA have any jurisdiction outside of the designated zone itself.

The only “insurance” Hedger Tech offers is to themselves, by way of internal manipulation of their HDR shitcoin.

Naturally Hedger Coin is pitched to affiliates as having an ever-increasing value.

Naturally Hedger Coin is pitched to affiliates as having an ever-increasing value.

In reality Hedger Coin, which costs Hedger Tech little to nothing to generate, is used to manipulate what it owes to investors on paper.

And when it all goes to crap (invested funds are exhausted), Hedger Tech’s anonymous owners exit-scam by either

- dropping the internal value of Hedger Coin to zero and doing a runner; or

- getting HDR listed on some dodgy public exchange and doing a runner.

Either way invested funds are lost. All Hedger Tech’s bagholder affiliates will have to show for their investments are worthless HDR.

Seeing as Hedger Tech can’t be straight about its management or even from where the company is operated from, it appears to have been built from fraud in mind from the ground up.

This ensures maximum losses for the Hedger Tech’s investors. It also leaves them with little to no recourse for recovery on collapse.

Update 6th February 2021 – Hedger Tech was part of Kristijan Krstic’s $70 million dollar+ Ponzi empire.

Krstic was arrested in Serbia on behalf of US authorities in mid 2020.

This company is owned by conmen and crooks Felix Logan and Willem Adlebert. They also own hedgermining.tech.

This is a total scam. Please stay away and dont buy anything.

This web site and coin was advertised by Tommy The fuzzy hat Yater or Yates and Alex Villa…..they were paid to promote this on youtube.

How you can say something bad about this company, i invested with them and i am more then satisfied.

if you don’t like what they are offering just stay away. Don’t lie on public places and write bad things, if you didn’t taste it !!!!

Whether you are satisfied with a Ponzi scheme is neither here nor there.

The only lies here are in Hedger Tech’s business model. You not liking the facts doesn’t make them lies.

I agree with Paul. This company (if it actually exists) is run not just by Felix Logan & Willem Adelbert but also by Benedict Pettit, Oliver Turner, Philip Van Dijk, Tony Rivas, Sasha Bjelov and Ivan Ivanov. Obviously all aliases.

These names are link to the following scam companies:

Dragon Mining

Start Options

Bitcoin Trading World

BTC Mining Factory

Hedger Mining

Trinity Mining

and the scam coin B2G

If you have spoken on the phone to a man with a european accent then chances are you’ve lost your money. They may pay you a little at the start if you’re lucky but you will never get your money back.

Everything about this is a SCAM.

They claim they’re partnered with 37 mining companies. Apparently these 37 mining companies gave them mining contracts in return for insuring their assets and yet they can’t show any proof that this is true.

They can’t show any proof because these contracts don’t exist. SCAM!

Hedger Tech is another Ponzi and Scam Company owned by Kristijan Krstic (real name) a Serbian National, now operating in Serbia, Australia, USA, Philippines and China.

see also: Behindmlm site and search for Option Rider Review, Banc de Options Review, Start Option Review, B2G Bitcoiin Next Gen Review, Dragon Mining Review, Hedger Mining Reviewand now Hedger Tech Insurance coins?

Like any other Ponzi Scheme registered to Kristijan Krstic no real owners were presented, and no real place of operation and base were disclosed to online investors. All is one big charade of criminal activity.

All of these Ponzi Companies were banned in Texas, New Jersey and Tennessee for violation of securities Trading Law. All Victimizing mostly American Investors with their get-rich-quick Investment Schemes.

Last known Address of Kristijan Krstic was in Makati City and Philippines and Nathan Road Hong Kong.

GET YOUR MONEY AND STAY AWAY FROM THESE CRIMINALS!

Joseph Rotunda, FBI, Interpol, NBI in the Philippines, AFP in Australia and the Security Intelligence Agency in Serbia have all been notified.

If we can’t get our money back at least lets send these scumbags to jail. There’s only one place for scammers…..BEHIND BARS!!

Finally they have been arrested!

thestar.com.my/aseanplus/aseanplus-news/2020/07/26/filipino-among-11-arrested-for-international-online-scam-group–in-serbia

Hedger Tech isn’t mentioned in that article?

I note the involvement of the FBI, I’ll have a poke around tomorrow morning and see if I can get to the bottom of it.

edit: Hang on, this article is from July (???)

edit2: Had a quick look around, this seems related to some binary options scam group that had been running since 2011.

Will leave this up overnight in case you can confirm this has anything to do with MLM. Failing which I’ll be nuking this and your comment when I wake up.

edit3: Ohhh boy this is complicated. I think I’ve got enough information to put together an article. The arrests are indeed related to Hedger Tech through Kristijan Krstic.