Sosana Review: Crypto manipulation securities fraud

Sosana operates in the cryptocurrency MLM niche.

Sosana operates in the cryptocurrency MLM niche.

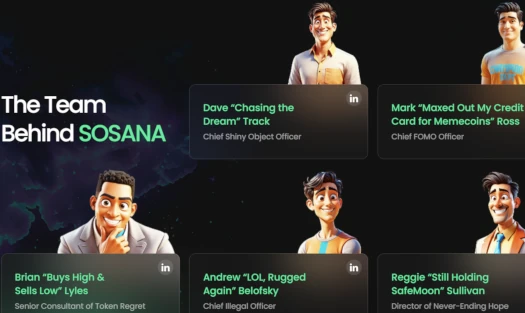

Four co-founders, represented by AI-generated avatars, are named on Sosana’s website:

- Dave Track – Chief Shiny Object Officer

- Mark Ross – Chief FOMO Officer

- Brian Lyles – Senior Consultant of Token Regret

- Andrew Belofsky – Chief Illegal Officer

- Reggie Sullivan – Director of Never-Ending Hope

Dave Track, aka David Track, first popped up on BehindMLM’s radar as founder and President of PrepayCPA in 2011.

Circa 2019 Track was Senior Vice President of Tryp, an MLM pyramid scheme with an illegal unregistered stock offering.

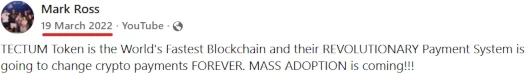

Track reinvented himself as a crypto bro in 2020. Crypto fraud inevitably followed; Bitlocity in 2020 and Tectum in 2022.

Mark Ross appears to be a random crypto bro who followed David Track over from Tectum:

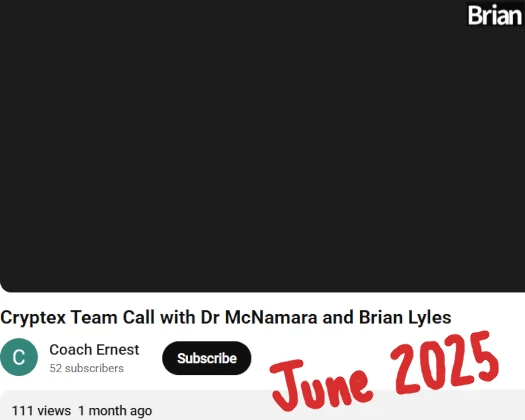

Brian Lyles was appointed Sales Director for North America for Cerule in 2020.

Apparently that didn’t work out and sometime after Lyles turned to crypto fraud. A month ago Lyles was promoting Cryptex, an MLM crypto Ponzi scheme:

Andrew Belofsky and Reggie Sullivan appear to keep a low-profile, I wasn’t able to find anything definitive.

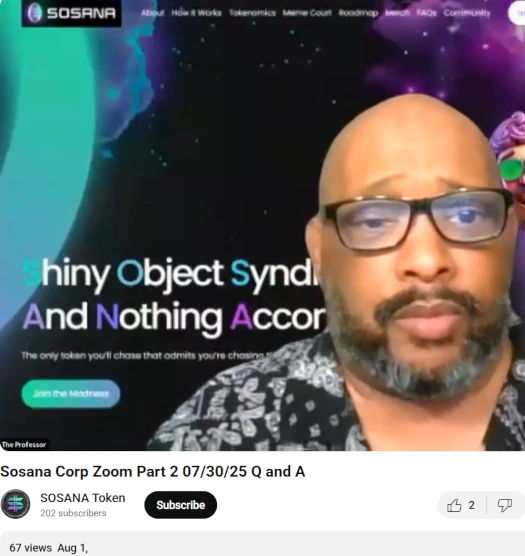

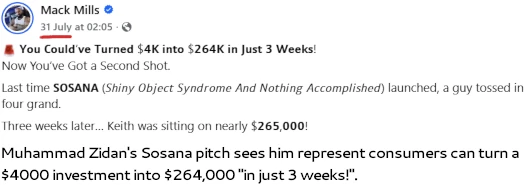

Promoters of Sosana to note are Muhammad Zidan (aka Mack Zidan, Mack Mills), Tracy Le Mont Silver (aka T. Lemont Silver, “The Professor”), Mark Hamlin and Peter Ohanyan.

Muhammad Zidan is a serial promoter of fraudulent MLM schemes, dating back to at least 2012 with Empower Network.

Mills continues to defraud consumers through various schemes, primarily through AI-generated slop content.

Tracy Le Mont Silver is another long-time fraudster. Silver made a name for himself as a top promoter of the Zeek Rewards Ponzi scheme.

Instead of manning up when he was caught and facing a $2.3 million clawback, LeMont uprooted his then young family and fled to the Dominican Republic.

For the past thirteen years Silver has continued to defraud consumers through various fraudulent schemes. BehindMLM last came across Silver about a year ago with Billion Dollar Mind.

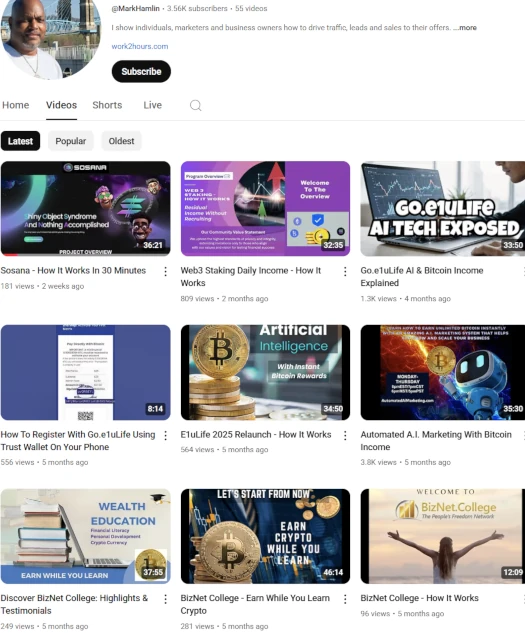

In his capacity as a promoter of the Forsage series of MLM crypto Ponzi schemes, the SEC charged Mark Hamlin with securities fraud in 2022.

Hamlin settled the SEC’s charges in August 2022. As part of Hamlin’s Forsage settlement, he was prohibited from committing further violations of federal securities laws.

Over on YouTube Hamlin has continued to promote fraudulent MLM schemes:

E1ULife is an MLM gifting cycler. BizNet College is an MLM pyramid scheme.

Peter Ohanyan is… you guessed it, another serial fraudster.

BehindMLM last came across Ohanyan a few months ago as a Corporate Leader at Booster.

Sosana’s operates from the website domain “sosana.io”, privately registered on November 26th, 2024.

Sosana’s website footer suggests Sosana is being operated through Nosey Pepper Inc., a purported Wyoming shell company.

Finally we’re noting that Sosana originally launched around April 2025.

Sosana’s original launch flopped, prompting it’s co-founder to reboot with an MLM compensation plan earlier this week.

Read on for a full review of Sosana’s MLM opportunity.

Sosana’s Products

Sosana has no retailable products or services.

Promoters are only able to market Sosana promoter membership itself.

Sosana’s Compensation Plan

Sosana promoters invest in Sosana’s SOSANA token. This is done for two reasons:

- on the expectation of a passive return (SOSANA tokens value going up); and

- to participate in an in-house crypto token manipulation scheme.

“Every other Sunday”, Sosana puts up a nominated shit token for its promoter investors to vote on.

Nominating a shit token requires a $500 investment in SOSANA. Voting requires a $50 investment in SOSANA.

Once nominations are in voting is held for two weeks.

At 7pm EST on the following Sunday, Sosana promoters who nominated and/or voted are shown the most voted for shit token.

The rest of Sosana’s promoters are shown the token an hour later.

The Sosana promoter who nominated the most voted for token receive $500 in SOSANA token (split evenly if there are more than one nominee promoters).

Sosana charges a 3% fee on all SOSANA token investments and withdrawals. A third of this 3% fee is placed into a “Degen Voter Bonus”.

Prior to announcing the most voted for token, Sosana purportedly uses the the Degen Voter Bonus to buy up the most voted for token.

After the most voted for token is revealed, Sosana distributes purchased tokens equally among Sosana promoters who nominated and/or voted.

The MLM side of Sosana pays on recruitment of promoter investors. Note that all MLM commissions are paid out in SOSANA tokens.

Sosana Promoter Ranks

There are four ranks within Sosana’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Unranked – sign up as a Sosana promoter

- Degen – recruit three Sosana promoters

- Hodler – recruit ten Sosana promoters and generate a downline of one hundred Sosana promoters (no more than thirty promoters counted from any one recruitment leg)

- Whale – have three recruitment legs with one Hodler or higher ranked promoter in each

Referral Commissions

Sosana pays referral commissions on recruited Sosana promoter fees ($99 per recruit).

Sosana pays referral commissions down three levels of recruitment (unilevel):

- Unranked promoters receive 20% on level 1 (personally recruited promoters) and 15% on levels 2 and 3

- Degen ranked promoters receive 25% on level 1, 15% on level 2 and 25% on level 3

- Hodler ranked promoters receive 25% on level 1, 15% on level 2 and 30% on level 3

- Whale ranked promoters receive 2% on level 1, 20% on level 2 and 3% on level 3

Bonus Pools

Sosana takes an undisclosed percentage of SOSANA token investment and uses it to fund two Bonus Pools.

Sosana’s bonus pools are distributed among Hodler and Whale ranked promoters.

Note that as per the screenshot above, as of July 2025 Sosana’s Bonus Pools are designated “coming soon”.

Joining Sosana

Sosana promoter membership is $99.

Full participation in the attached income opportunity requires an additional $50 and/or $500 payment in SOSANA tokens.

Sosana charges promoter joining fees in USD equivalents of the solana cryptocurrency.

$50 and/or $500 payments to participate in the attached income opportunity are made in USD equivalent’s of Sosana’s SOSANA token.

Sosana Conclusion

Sosana combines pyramid recruitment with securities fraud.

As part of Sosana’s MLM opportunity, nothing is marketed or sold to retail customers.

100% of commissions and bonuses paid out through Sosana’s MLM opportunity are tied to recruitment. This is an obvious pyramid scheme.

Sosana’s securities fraud is layered.

At the base-level we have Sosana creating 88,888,888 SOSANA tokens out of thin air. These tokens are sold by the company to consumers on the promise of a passive return.

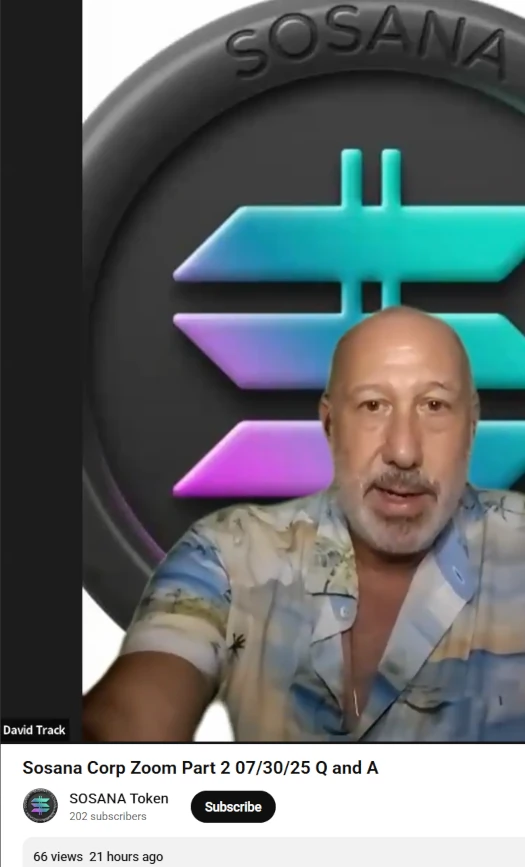

From a July 30th official Sosana corporate webinar, this is Brian Lyles spelling out the only reason anyone would invest in SOSANA token;

We gotta do some stuff for these guys because they’re the people who go out and they kill it, and they get the word out and they build up the value.

So you can sit back and relax and say, “I can’t believe how high this SOSANA price is going. And how much my portfolio is worth”.

Number goes up because new investors sign up to lose money. Early SOSANA investors cash out, creating a typical closed Ponzi loop flow of funds.

As per the Howey Test, Sosana base token offering is a securities offering.

Sosana promoters invest in SOSANA token (an investment of money), which was created and managed by Sosana (a common enterprise).

As per Sosana co-founder Brian Lyles above, this is clearly done on the expectation of profits. Said profits are derived via the efforts of others (recruitment of new investors).

Then we have the whole crypto token manipulation scheme.

Sosana promoters (or corporate through shell accounts) nominate shit tokens. One is picked every fortnight, Sosana invests in it and then dumps the tokens on its promoters.

The hope here is that Sosana’s buying activity causes third-parties to invest, allowing Sosana’s promoters to cash out a passive return.

This is literally spelled out on Sosana’s website;

Why does SOSANA pay voters in the winning token instead of SOL?

Because we’re tired of seeing degens sell their rewards instantly. This way, you actually own what you voted for—and if you picked right, you get in before the real pump.

As it stands neither Sosana or any of its US resident co-founders or promoters are registered with the SEC. This constitutes securities fraud.

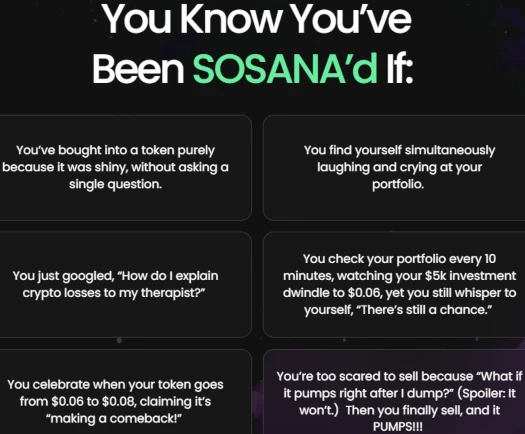

Sosana can be summed up as a rather sad collection of middle-aged grifters, targeting individuals who’ve already lost money in cryptocurrency schemes.

Sosana uses humor as a tool to turn financial losses through fraud into a joke.

This is a common marketing tactic used by crypto scammers.

From Sosana’s website;

That’s why SOSANA exists. Not just as a meme, but as a way to help ourselves, help the community, and protect the survival of Solana itself.

Because let’s face it—if we don’t fix the problem, we’re all just playing a losing game.

Don’t kid yourself, by investing in Sosana’s you’re still playing a losing game.

- Sosana’s co-founders and other insiders hold 27.8% of all SOSANA tokens;

- prior to the 7pm EST “most voted for” early token reveal, there’s nothing stopping Sosana’s co-founders and insiders from investing first in anticipation of cashing out their promoter’s money; and

- there’s nothing stopping Sosana’s co-founders from creating shit tokens each voting run and nominating them, increasing insider trading profits – at the expense of non-insider Sosana promoters (i.e. 99.9% of Sosana promoters)

Math guarantees that when recruitment of Sosana promoters slows down, Sosana will inevitably collapse.

As with every MLM crypto scam before it, Sosana’s collapse will see promoters will left bagholding yet another worthless Ponzi token.

Add Jeff Aman to the list of ponzi thugs.

More trash that Wayne Nash is promoting as an investment through telegram and his own site cryptotechinvestor. These soulless scums of the Earth need to be stopped!

Canadian serial fraudster Wayne Nash (aka “Crypto Tech Investor”) wrote in an email on January 3, 2026 (partial quote).

postimg.cc/TyzpjvT9 + postimg.cc/G97V2Lz3

app.getresponse.com/view.html?x=a62b&co=I7DJiQ&m=BZHMBQ&mc=JO&s=B0YmY5n&u=BFBJw&z=E9nwQjq&

Why this company still stealing money from people it should be closed down.