Oro One Review: Gold themed cycler Ponzi

Oro One operates in the precious metals MLM niche.

Oro One operates in the precious metals MLM niche.

Oro One’s website domain (“oro.one”) was first registered in February 2019. The private registration was last updated on July 9th, 2020.

In an attempt to appear legitimate, Oro One provides a UK incorporation number for Oro One Limited.

Oro One Limited was incorporated on March 9th, 2019.

UK incorporation is dirt cheap and effectively unregulated. It is a favored jurisdiction for scammers looking to incorporate dodgy companies.

For the purpose of performing MLM due-diligence, UK incorporation is meaningless.

Oro One is headed up by CEO “Max Lawrence”.

Oro One is headed up by CEO “Max Lawrence”.

Lawrence doesn’t exist outside of Oro One’s marketing. A Facebook profile was created for him in October 2020.

This strongly suggests Lawrence is being portrayed by an actor.

I wasn’t able to place Lawrence’s accent. If I had to guess though it’s somewhere in Europe.

In this Oro One marketing video Lawrence is interviewed by Lily Wilson, who has a distinct Russian accent.

Lawrence’s last Oro One marketing video appeared on Facebook on February 27th.

For the most part he’s been replaced by Ksenia Eskont (right).

For the most part he’s been replaced by Ksenia Eskont (right).

Eskont is credited as Oro One’s Marketing Director in Africa. Eskot’s personal Facebook profile was only recently created in December 2020.

Like Max Lawrence, Eskot has no digital footprint outside of Oro One marketing.

Unlike Max Lawrence, Eskot has a much thicker European accent.

Recently Eskot has been joined by Lily Wilson in Oro One marketing videos. Wilson is credited as an Oro One Ambassador.

Max Lawrence, Ksenia Eskont and Lily Wilson are all prime Boris CEO candidates.

That said, Max Lawrence is certainly more hands on then your typical Boris CEO.

There are several detailed presentations on Oro One’s official YT channel featuring Lawrence. Typically a Boris CEO is only used to front a company and placate investors.

Oro One’s official Facebook page is primarily managed from Spain, Russia and the Ukraine.

This provides a more accurate picture of where those behind Oro One are operating from. Spain might also explain Max Lawrence’s accent.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Oro One’s Products

Oro One has no retailable products or services, with affiliates only able to market Oro One affiliate membership itself.

While Oro One’s website does list some precious metals for sale, these have nothing to do with the MLM opportunity.

Oro One’s Compensation Plan

Oro One operates a six-tier 2×2 matrix cycler.

To qualify for commissions, each Oro One affiliate must recruit two new affiliates.

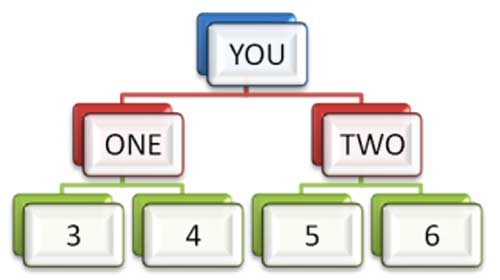

A 2×2 matrix places an Oro One affiliate at the top of a matrix, with two positions directly under them:

These two positions form the first level of the matrix. The second level of the matrix is generated by splitting these first two positions into another two positions each (total 6 positions).

Positions are filled via direct and indirect recruitment of Oro One affiliates.

When all six positions in a matrix are filled, a “cycle” is generated. A cycle triggers a commission payment.

- Silver – positions cost €200 EUR, pays out €405 EUR

- Gold – positions cost €740 EUR, pays out €1575 EUR

- Platinum – positions cost €2800 EUR, pays out €6165 EUR

- Palladium – positions cost €9850 EUR, pays out €22,050 EUR

Cycle commissions are paid as the second level of the 2×2 matrix is filled. Once all positions are filled an additional payment is made.

To keep things simple I’ve provided the combined totals above.

Across each of Oro One’s six matrix cycler tiers, one position can cycle through three positions before it expires.

Note that the third cycle is paid out as grams of gold. Whether the third “gold” cycle can be cashed out or not is unclear.

Once expired reinvestment in a new cycler position or positions is required to continue earning.

Leadership Bonus

Oro One’s Leadership Bonus allows affiliates to earn a cut of filled matrices in across their downline.

The Leadership Bonus is rank-based and tied to generating downline cycles. There are fifteen Oro One affiliate ranks to qualify for.

The more cycles, the higher an Oro One affiliate’s rank and the more they can potentially earn through the Leadership Bonus.

Beyond that however, no specifics are provided.

Joining Oro One

Oro One affiliate membership is tied to an initial cycler position purchase:

- Silver – €200 EUR

- Gold – €740 EUR

- Platinum – €2800 EUR

- Palladium – €9850 EUR

Conclusion

Oro One is a typical Ponzi cycler, barely masked behind the ruse of gold acquisition.

The matrix structure is simple, paying those who invest in positions with subsequently invested funds.

This is straight up Ponzi territory. The third gold cycle appears to be an attempt to reduce returns paid out.

According to Oro One acquired gold is held in a “safe depository”.

This ruse typically allows an affiliate to cash out a reduced percentage (the actual third cycle commission rate), or have gold shipped to them with prohibitive shipping costs.

Seeing as Oro One don’t disclose anything about the third-cycle gold payments, assume the worst.

One last note on Oro One’s compensation is that, while I originally was working off an official presentation from mid 2020, I ended up using data from an official Oro One Hindi presentation dated March 2nd, 2021.

The presentation is voiced in Hindi but uses English language marketing slides.

The major difference between the mid 2020 presentation and the recent one is there doesn’t appear to be any lower tier cyclers any more.

Mid 2020 Oro One had €25 EUR “first step” and €70 EUR “pre-silver step” cycler tiers.

Also overall cycler commissions have been slashed. Palladium back in mid 2020 paid €98,000 EUR (three cycles). Now its €44,100 EUR plus the gimped gold payment.

Oro One initially launched in early 2020. Apart from a brief spike in interest mid 2020 Oro One flopped.

Oro One initially launched in early 2020. Apart from a brief spike in interest mid 2020 Oro One flopped.

I believe the original target was India and south-east Asia, aided by Max Lawrence speaking Japanese.

Today Oro One has seen renewed promotional efforts in India and Africa. This coincides with the introduction of Ksenia Eskont.

As with all cycler Ponzi schemes, once affiliate recruitment dries up so too will position purchases.

This will see Oro One’s matrix cyclers begin to stall. Eventually enough matrices will stall to trigger an irreversible collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Why is that so far the two Eastern European actresses playing directors from the southern hemisphere featured have difficulty apparently opening both eyes to the same level?

Not their fault. In Russian acting school they don’t teach you how to hide your disbelief.

Thanks for confirming my suspicions, Oz.

I shall keep my eyes open for more.

BTW the retail side does sell gold at 200 euros higher than if bought direct, rather than at a discount.

The gold on Oro One’s website is there for show. Has nothing to do with the MLM opportunity.

All that glistens is not Gold, Oz. :o)

ORO ONE is back with Lily Wilson talking about version 2. It seems like she has a good number of sheeps following from India and South Africa.

How do they intend to return the amount invested by investors before they disappeared and their site went down without any notice or explanation and now launching again looking to extract more.

By the way their Oro One website is still down.

Lily is back again with a bang and it seems like this year 2022 is her year because the flock that she has gathered in South Africa is massive.

but I guarantee you that she is not staying for long. She has to be reported though.

Yes, reported and arrested. Max Lawrence too. Fake people ruining peole’s lives.