IM Mastery Academy Review: iMarketsLive rebooted

![]() Christopher Terry launched iMarketsLive back in 2013.

Christopher Terry launched iMarketsLive back in 2013.

BehindMLM reviewed iMarketsLive in August the same year. Our analysis revealed iMarketsLive bundled a securities offering with pyramid recruitment.

Four years later we revisited iMarketsLive. This was roughly about a year after Terry told new recruit Alex Morton ‘he had been through hell and back and his company at the time was barely surviving’.

While a retail option had been introdcuced, iMarketsLive’s securities offering, now with an auto trader, was just as illegal as ever.

Our review was published in September 2017. In March 2018 iMarketsLive discontinued auto-trading.

By this time two fraud related regulatory warnings had been issued in Colombia, Curaçao and Sint Maarten.

The UK warned of iMarketsLive “scammers” in July 2018.

Two months later we learned the CFTC had also been investigating iMarketsLive, which likely prompted the company to drop its auto-trading service.

Of their investigation findings the CFTC stated;

iMarketsLive affiliates were receiving automated returns from an entity run by individuals who were not registered and thus authorized provide such a service.

Rather than defend the CFTC’s claims iMarketsLive settled. The settlement imposed a $150,000 fine and acknowledgement that the CFTC’s findings were “true and correct”.

Things were relatively quiet over at iMarketsLive for the rest of 2018 and for most of 2019. Then, out of the blue, in September 2019 Terry announced iMarketsLive was rebranding as IM Mastery Academy.

Whereas iMarketsLive was very much a Christopher Terry affair, IM Mastery Academy sees Isis De La Torre credited as co-founder.

Torre was also credited as a co-founder of iMarketsLive, in addition to being both companies’ CFO, but like I said, iMarketsLive was very much the Christopher Terry show.

In any event, today we revisit iMarketsLive for a third time as the newly relaunched IM Mastery Academy.

Read on for a full review of IM Mastery Academy’s MLM opportunity.

IM Mastery Academy’s Products

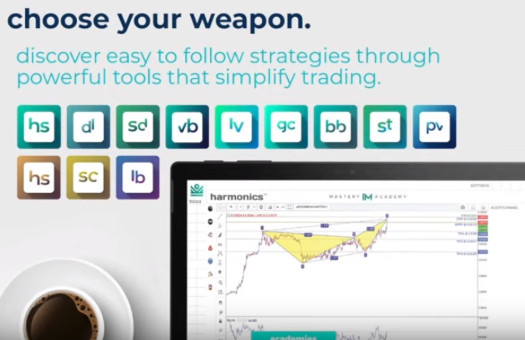

Forex and cryptocurrency themed products featured on IM Mastery Academy’s website include:

- Harmonics – “patterns in the forex markets help you identify potential reversals in the market” (also offered in a cryptocurrency variant)

- Delorean – “an algorithm that gets you in the right place at the right time with hundreds of market opportunities”

- Steady – “this algorithm looks for long term, swing trade ideas that you’ll be able to set and forget”

- Vibrata – “provides multiple strategies that look for trade ideas for you – no analysis needed on your end, ever”

- Levels – “an algorithm that identifies entry points, stop loss and take profits one level at a time in the markets”

- GoldCup – “a combination of strategies that correlate with one another and look for high probability trade ideas”

- BounceBack – “this tool searches for and identifies the best entry points for you to get into the markets”

- SwipeTrades – “access real time forex trade ideas and market analysis & education sent straight to your phone” (also offered in a “SwipeCoin” cryptocurrency variant)

- Pivots – “this algorithm takes the guess out of finding market opportunities by identifying key reversal zones on many time frames”

- Liberty – “this tool focuses on finding high pace trade ideas for Binary Options”

If you scroll up there’s also several “academy” variants on offer:

- FRX Academy – “gain mastery over trading currencies”

- HFX Academy – “lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt. lorem ipsum dolor sit amet, adipiscing elit, sed do” (verbatim)

- DCX Academy – “gain mastery over trading digital currencies”

- IBO Academy (not a retail product) – “discover how to take advantage of a $180 billion industry and learn the step-by-step blueprint to building a successful home based business”

IM Mastery Academy’s products are bundled with Platinum and Elite Starter Packs.

The cheaper $225 Platinum Starter Pack comes with “the mastery academy, goLIVE, the exclusive harmonics scanner and piptalk.”

I’m assuming “goLIVE” is the Harmonics product detailed above, however there is no indication of this on IM Mastery Academy’s website. PipTalk isn’t referenced or explained either.

The $325 Elite Starter Pack is pitched as the “all in” option, providing full access to IM Mastery Academy’s products.

Upon proceeding to sign up as an IM Mastery Academy retail customer however, things quickly fall apart.

Actually signing up as an IM Mastery Academy retail customer does away with the simple two options presented on their website.

Instead new customers are bombarded with seven poorly explained upfront payment options, and four monthly residual payment options.

Instead new customers are bombarded with seven poorly explained upfront payment options, and four monthly residual payment options.

And I say poorly explained, because products featured in these bundles are not referenced on IM Mastery Academy’s public-facing website.

In addition to the two simple retail membership options presented, here are the confusing actual options retail customers have –

- Prime 3 Month Plan (appears to be Elite Starter Pack equivalent) – $825 every 3 months paid in bitcoin

- Prime 6 Month Plan (appears to be Elite Starter Pack equivalent) – $1600 every six months paid in bitcoin

- Prime 12 month Plan (appears to be Elite Starter Pack equivalent) – $3150 every 12 months paid in bitcoin

- Elite Starter Pack – $325 and then $274.95 a month

- Platinum Starter Pack – $199.95 (different price on the public-facing website) and then $164.95 a month

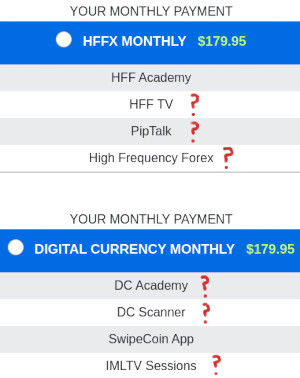

- HFFX Monthly – $189.95 for four products not featured on public-facing website and then $179.95 a month

- Digital Currency Monthly – $189.95 for cryptocurrency related products and then $179.95 a month

Rather than detail initial and ongoing monthly package costs, IM Marketing Academy splits them – allowing retail customers to mix and match (which makes no sense).

E.g. I can sign up with an Elite Starter Pack and make my monthly payment for Digital Currency Monthly, losing access to nearly all my Elite Starter Pack products.

IM Mastery Academy’s Compensation Plan

IM Mastery Academy fail to provide a copy of their compensation plan on their website.

The following analysis is thus put together from various affiliate presentations, which reference what appears to be official IM Mastery Academy compensation documentation.

IM Mastery Academy Affiliate Ranks

There are eleven affiliate ranks within IM Mastery Academy’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Platinum 150 – have a downline of 3 subscribers and generate 435 GV a month

- Platinum 600 – have a downline of 12 subscribers and generate 1740 GV a month

- Platinum 1000 – have a downline of 30 subscribers and generate 4350 GV a month

- Platinum 2000 – have a downline of 75 subscribers and generate 10,875 GV a month

- Platinum 5000 – have a downline of 225 subscribers and generate 32,625 GV a month

- Chairman 10 – have a downline of 500 subscribers and generate 72,500 GV a month

- Chairman 25 – have a downline of 1250 subscribers and generate 181,250 GV a month

- Chairman 50 – have a downline of 2500 subscribers and generate 362,500 GV a month

- Chairman 100 – have a downline of 5000 subscribers and generate 725,000 GV a month

- Chairman 250 – have a downline of 15,000 subscribers and generate 2,175,000 GV a month

- Chairman 500 – have a downline of 30,000 subscribers and generate 3,350,000 GV a month

Subscribers are either retail customers or recruited affiliates who have purchased an IM Mastery Academy package.

GV stands for “Group Volume” and is sales volume generated by the sale of packages to IM Mastery Academy retail customers and/or affiliates.

Note that up to 40% of required GV is counted from any one unilevel leg.

Retail & Recruitment Commissions

IM Mastery Academy affiliates earn $35 on the sale of a Platinum Starter Pack and $50 on the sale of an Elite Starter Pack.

The same commission is paid out irrespective of whether a pack is purchased by a personally enrolled retail customer or recruited affiliate.

Residual retail and recruitment commissions down an additional two levels (2 and 3), are available to Platinum 600 and Platinum 1000 ranked affiliates.

- Platinum 600 ranked affiliates earn a residual $10 Platinum Starter Pack and $12 Elite Starter Pack commission on level 2

- Platinum 1000 ranked affiliates earn a residual $5 Platinum Starter Pack and $7 Elite Starter Pack commission on level 3 (on top of level 2 commissions)

Joining IM Mastery Academy

IM Mastery Academy affiliate membership is $16.71 a month.

Conclusion

The long and the short of it is IM Mastery Academy is a compliance step backward from our last 2017 review.

What IM Mastery Academy is offering today is more aligned with their initial offering, which we stated in our initial review was “so out of compliance it was comical.”

Whereas in 2017 iMarketsLive had mandatory retail volume qualifiers, they are gone in IM Mastery Academy.

It’s entirely possible to sign up as an affiliate and focus only on recruitment of affiliates who purchase packages.

And if this is where the majority of IM Mastery Live’s company-wide sales revenue is originating from, the company is operating as a pyramid scheme.

On top of that potential securities fraud has returned, by way of offered algorithms.

An algorithm suggests automation, or when put into regulatory terms, the generation of a return via the efforts of others.

Those familiar with securities regulation will recognize the above from the Howey Test.

With respect to securities regulation in the US, the Howey Test is used to determine the existence of an investment contract.

An investment contract is found when

a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.

The use of an algorithm qualifies as pooled money, as it’s collectively under control of IM Mastery Academy’s algorithms.

Promoters of such schemes sometimes set up the investment contract to operate from individual accounts, however the use of a central algorithm deems this pseudo-compliance.

That said, the SEC or CFTC are yet to go after an MLM company with this setup.

If IM Mastery Live winds up being the first company they decide to make an example of, expect a repeat iMarketsLive CFTC outcome.

I have to caveat here in that I’m assuming that’s how IM Mastery Live have set up their algorithm offerings.

The company’s website doesn’t go into specifics for any of the algorithm products, which feels like an intentional decision.

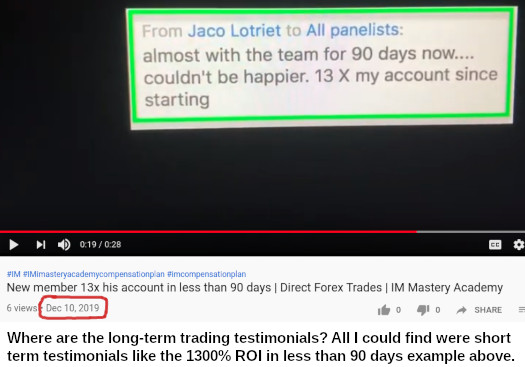

Another aspect to consider is that iMarketsLive has been around since 2013. The company has had six years to generate trading success stories – yet I couldn’t find one referenced on IM Mastery Academy’s website.

An external search revealed some testimonials, but as far as I can tell these are all from affiliates.

Shouldn’t IM Mastery Academy, following on from iMarketsLive, be swimming in retail customer trading success stories by now?

That of course assumes IM Mastery Academies algorithms and what not actually work long-term.

Based on the lack of ranting and raving from satisfied retail customers, I have my doubts.

The rest of IM Mastery Academy’s products fall within regulatory compliance. That is either education, or signals a retail customer or affiliate has to manually act on.

Automation trading of any kind is where securities fraud comes in, anything manual is fine.

Something else I want to touch on goes back to iMarketsLive’s CFTC settlement.

If everything was above board, why didn’t iMarketsLive pay the settlement fine and then register FX Signals Live with the CFTC (and SEC if required)?

Ditto IM Mastery Live’s current offering, which requires subscribers to agree to the following pseudo-compliance:

I fully understand that iMarketsLive [sic] is NOT an investment company offering financial advice.

Honestly, how are you going to sell trading information, offer multiple automated algorithm and manual signal trading services and state you’re not offering financial advice?

Puh-leese.

And look, just so we’re clear here; here’s an official IM Mastery Academy marketing video literally equating trading with the Delorean trading bot to an investment.

Yeah that video is probably going to disappear shortly after this review goes live – but that doesn’t change the nature of IM Mastery Academy’s algorithm bot investment opportunity.

Update 20th September 2021 – IM Mastery Academy has removed the referenced video above.

As such I’ve disabled the previously accessible video link. /end update

It’s not illegal to offer passive algorithm returns through an MLM opportunity in the US, but it is if you do so without registering the opportunity with regulators.

Doing so requires a company to provide periodic audited financial reports, so make of that what you will.

All I’m saying is iMarketsLive and IM Mastery Academy seem more concerned with what they can get away with, rather than making sure everything is regulatory compliant from the get go.

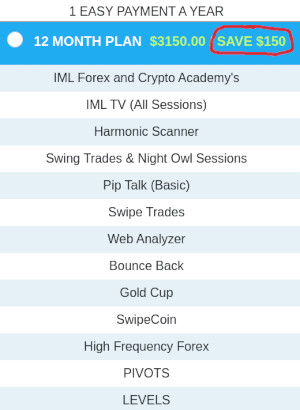

And speaking of regulation, why is bitcoin the only payment option for Prime subscriptions?

If you sign up as an affiliate IM Mastery Academy offer a credit card option, so it’s not like they don’t have a processor.

So why is the big subscription money being funneled through cryptocurrency?

Had bitcoin of been an option along side typical processor options, that’d hardly raise suspicion. Bitcoin being the only payment option however is highly suspicious.

On a less nefarious note, it also makes advertised savings disingenuous.

Take, for example, IM Mastery Live’s 12 month plan on the right.

Take, for example, IM Mastery Live’s 12 month plan on the right.

Advertised savings are $150 annually, which hinges on bitcoin not decreasing $150 in value from the time of payment.

It may or it may not, but the point is IM Mastery Academy don’t know where bitcoin will go.

Thus advertising a $150 comparative discount to fiat on an annual payment required in bitcoin comes across as false advertising.

Also if you’re going to sell multiple subscription packs, these need to be detailed accurately on IM Mastery Academy’s public-facing website.

It’s completely unprofessional to present two subscription options and then hit retail customers with a confusing smorgasbord.

Even more so when half the products listed have no explanation or reference point on the public-facing website.

Again, iMarketsLive has been around since 2013. And given the September reboot was now almost three months ago, it’s just not good enough.

The one positive I’ll give IM Mastery Academy is their seven day refund policy. This applies to initial pack subscriptions and ongoing monthly payments.

As advertised, if a subscriber isn’t happy, they are able to claim a subscription payment back within 7 days (this doesn’t include previous payments beyond seven days).

Something else that’s not good enough is an MLM company failing to provide the public a copy of their compensation plan.

This leads to the question of why on Earth does IM Mastery Academy have eleven affiliate ranks when only to pertain to the compensation plan?

I imagine there’s hidden components IM Mastery Live aren’t making public (for whatever reason), but every public reference to IM Mastery Live’s compensation plan I found only referenced the three-level deep commission structure.

Ultimately however the takeaway here should be algorithmic trading concerns and a potential response from the CFTC and/or SEC.

Or the FTC if, as I suspect, IM Mastery Academy retail subscription revenue is dwarfed by affiliate subscription sales.

Update 2nd May 2025 – The FTC has sued Iyovia (formerly IM Mastery Academy) for over $1.2 billion in fraud.

Seeing as IM Mastery Academy fail to address this on their website, anyone want to clarify whether the algorithm bots do trading or are strictly providing signals that must be manually acted on?

If it’s the latter (for all of the algorithms), I’ll update the conclusion.

Not necessarily.

If I say that you can make consistent returns if you buy the S&P 500 when markets open on Monday, sell it on Tuesday, buy it on Wednesday, and so on forever, that’s an algorithm (a deliberately simplified one but still an algorithm).

Suppose I charge 100 people $100 a month to send them emails which say “Buy” on Monday and “Sell” on Tuesday.

This is not a pooled investment because at no point can I take money from investor #1 and use it to pay a return to investor #2. They may all be doing the same thing but it’s still 100 separate accounts.

If however I get investors #1-#100 to send me their money and then I start trading with that money according to my algorithm, now it’s a collective investment / security.

Fundamentally it doesn’t matter because my algorithm is clearly worthless and over time will lose investors’ money in trading costs until it’s all gone.

If I’m selling my algorithm via an MLM, once the pool of suckers willing to lose their money on magic trading algorithms is exhausted, the pyramid will collapse.

Once it’s collapsed no-one is going to care whether the punters were using the algorithm individually or via a pooled fund.

This I think is how iMarketsLive, and a host of similar MLMs revolving around get-rich-quick forex trading or share trading or crypto trading, mostly avoid regulatory scrutiny.

Share tips, or “signals” as the kids call them, are not financial advice. Sending a newsletter to so many thousand people and saying “Tesla is a good bet” is not advice. Saying to one person “I think you should buy Tesla” is advice.

If all you’re doing is send out a newsletter you’re in the clear, but if you facilitate the investor acting on your share tip, it starts to look a lot more like regulated stockbroker activity. This is the grey area IM are in.

The million-dollar question here is – do you get paid commission based on how much your downline invests, or you do you just get a share of the subscription fee they pay? (Oz’s review suggests the latter.)

If it’s the latter unregulated securities shouln’t come into play. It’s just a vanilla pyramid scheme where the product is a share tips service. It’s no different from a pyramid scheme selling a subscription newsletter containing magic weight loss tips.

If it’s the former you’re looking at a Ponzi-pyramid hybrid a la BitConnect and all the rest.

I’ll rephrase the above to get to the point a bit quicker:

Telling people to buy shares X and Y is not in itself a regulated activity, it’s share tipping, something every daily newspaper does. It can become a regulated activity in three main ways:

1) You take money off the investor and buy X and Y on their personal behalf. This is stockbroking.

2) You take money off multiple investors and buy X and Y on their collective behalf. This is a collective investment / security.

3) You give them a personalised recommendation they should buy X and Y, not just “I think X and Y is a good investment” sent to thousands of people en masse. This is financial advice.

If iMarketsLive are staying away from 1-3 (it’s easy to avoid 1-2 by partnering with a stockbroker / trading platform that does have the necessary authorisations) then securities legislation doesn’t come into it.

What you have is simply a pyramid scheme flogging a worthless product. Worthless because there are no magic algorithms that consistently beat the market. If you had one you wouldn’t flog it for $180 via MLM.

From an MLM compliance perspective the question is how many retail clients they have. Because anyone who does not participate in the MLM opportunity is going to start losing money and cancel their subscription within months.

You have to remember within the context of trading MLMs, an algorithm is in actuality a programmed bot.

Who controls the bot? The company. Thus funds under the control of the bot are under control of the company.

The company trades on behalf of its customers – the company itself is the collective enterprise. Where the funds are stored is irrelevant, they are part of the collective pool of funds under company control through the bot regardless.

I remember I think it was last year one such company used their algorithm bot to clean out everyone’s “lulz nobody can touch my funds” accounts through rigged trades in favor of the company.

This was done without anyone suspecting, although the code was obviously embedded into the bot. Can’t recall the company name (I’d have to go searching) but it was one of the Asian scams IIRC.

You can’t assume MLM companies running trading bots have legit programming. There’s no regulatory oversight, because they’re operating illegally and haven’t registered.

None of this of course matters if IM Mastery Academy’s algorithm bots only send signals, which we’re still waiting on confirmation of.

Correct – if the money is under the control of the company it’s a collective scheme, regardless of where it’s stored. (UK regulation for one is explicit on this point and I imagine it’s no different in any other jurisdiction with securities regulation.)

Whether IM just sends signals or has control over the funds is the issue.

And the FCA warning strongly suggests they at least have form for running illegal collective schemes.

Correct me if I’m wrong but most of these trading bot Ponzis seem to pay commission on funds invested (for which it has to have control over the funds), whereas IM only pay commission on fixed subscriptions according to your review.

If you’re not going to steal investor funds (just take $180 a month and let them lose their money) then there’s no point in running an unregulated collective scheme.

It’s like breaking and entering into somebody’s house just to leave unsolicited junk mail. It’s both an unnecessary risk and a missed opportunity.

This was well written and the comments have been sound.

One additional question. If a company or individual who is recommending the purchase of a security and they do not disclose that they are being paid to recommend such said security, isn’t they also a potential violation of the Security Acts?

Also Oz you might dig a little deeper as to why BTC. Ow seems to be a payment of choice for payments. I would be interested in learning more. This might be the wave of the future for service based companies doing business in foreign countries.

Thanks Troy.

I believe failing to disclose payment to promote a security is a violation. IIRC the SEC made a big deal about ICO celebrity endorsements earlier this year/last year.

There’s nothing wrong with accepting payment in countries where you can’t otherwise setup traditional payment channels (which countries but?).

I see a red flag when a company only accepts bitcoin for payment, more so if they evidently have traditional payment channels set up.

If IM Mastery can accept process non-annual payments through processors, why not the (much larger) annual Prime payments? Seems fishy.

@Malthusian

When a bot controls funds they can be stolen. This type of exit-scam sees the admin invest in some bullshit coin, the bot when triggered remotely then sets up trades for whatever’s in the subscribers account for the bullshit coin.

Thus the affiliate is left bagholding the bullshit coin and the admin makes off with bitcoin/eth/whatever.

Not saying this will happen in IM Mastery Academy, but it’s incorrect to state funds can’t be stolen in bot algorithm trading schemes.

Hi, been a member. They are not trading bots instead they provide trading ideas which, as an individual, you decide how to act upon them.

In conclusion, no bots.

Fishy? You are way too kind Oz. We know we’re dealing with MLMers here.

And is this the same Troy Dooly who was an iMarketsLive consultant, and pimp for the scams Lyoness and Global Verge?

What on earth makes him think he can analyze your review, as though he concurs, like he’s some expert?

The statement, “This was well written and the comments have been sound”, is hilarious coming from someone with such a sketchy past.

Now that’s a fishy statement. Sounds like he’s planting an explain-it-away seed for his next scam (or excusing this one) for using Bitcoin on those larger payments.

Oz,

What you wrote makes sense to me. I’m always concerned and try to educate individuals and executive teams to disclose any potential endorsements.

After my personal experience in this type of screw up, I explain its better to error on the side disclosure, than risk a violation.

I can see where taking crypto payments in other countries can make sense. It would be interesting to know how the company is paying the reps as well. Are the commissions now also paid in Crypto or the currency of the country… this could also cause some interesting tax challenges for any 1099 issued to US Citizens or the company if the W8s or KYC isn’t followed correctly since IML is purportedly still a US corporation.

Oz maybe you or some of the community with far more international experience than I have can answer this question.

If a company; IML in this case isn’t officially registered to do business correctly in each of the 100 plus countries they claim to be operating in, couldn’t any payments in or out be seen as a violation of the company as well as the reps who promote and operate in those countries?

Char,

I know you, Oz and the whole community is focused on facts and truth, so you might want to dig just a little deeper on my position in regards to Global Verge.

You will find no positive coverage of that company and I believe that was the first CiD lawsuit we had to defend.

@Frink

I saw “trading ideas” in the product descriptions a few times for the non-algorithm products. Can you confirm it’s only signals for all the algorithm products?

@Troy

If you’re referring to securities then yes, not being registered is securities fraud. That applies to both the company and affiliates.

This goes for any additional financial/trading licenses that may be required.

I must have checked in when GV were OFF your list. I’ll admit, I could’ve confused this with your involvement in the Zeek Rewards Ponzi scheme, which I forgot to mention above, but I don’t think so.

NTL, happy to retract and focus on those other scams you pimped.

The same SEC sanctioned Adam Troy Dooly from the Zeek scam?

What a class act…….

sec.gov/litigation/admin/2013/33-9460.pdf

behindmlm.com/companies/zeek-rewards/sec-fines-troy-dooly-for-pimping-zeek-rewards/

In keeping with facts and truth, please permit me one last post on the GV subject Oz. I knew I wasn’t crazy and “dug even deeper” per the request.

Yes slightly off-topic, but it shows a consistent lack of credibility for these iMarketsLive MLM pimps.

And I quote:

Everyone can win? How wonderfully positive.

Happy Holidays Oz 🙂

mlmhelpdesk.com/mlm-help-desk-moves-global-verge-from-mlm-scam-to-legitimate-mlm-company/

P.S. I take back my retraction.

Troy Dooly was a MAJOR reason people got sucked into ZeekRewards. He should be VERY ashamed for his involvement!

The thing with going after people for unrelated matters is it leaves them less inclined to participate in the future.

I see it as the more sources of information the better. If Dooly was defending the shortfalls of IM Mastery Live then by all means have at it.

I’ll leave it at that.

Troy Dooly is the main reason me and over 50 of my family and friends lost money in ZeekRewards.

I met him at a ZeekRewards event and he said history was being made. He was paid by the company to pimp it out and make it look legal.

I trusted him and lost over 50k alone plus got audited by the IRS and had to pay back over $5000.00 to the receiver.

Worst decision I ever made and a huge lesson learned. Troy your name is ruined. Quit acting like an expert and leave it up to BehindMlm to provide expert advice…

That’s what really rubbed me wrong. As I wrote in my first post, it’s as though he thought he was in a position to approve/concur with this review. What a joke!

It’s one thing if he was a reformed MLMer after Zeek, Lyoness, et al., but he was also an iMarketsLive consultant. When you consider the source’s history, his “information” probably has ulterior motives.

I do view his posts as entertainment value though, and I suppose that is worth something. BUT THEN, I am reminded of the money he scammed from others to line his own pockets. That’s not funny.

The criticism should follow him everywhere. And, it should be pointed out to new readers that he has zero credibility, and is not on par with Oz – like Dooly tried to make it seem.

This is the best interactive review i have read all day.

A friend of mine just introduced me to IM. I have been reading some reviews to know if i should continue on it. my question now is, If IM is not the best option. which one would you suggest @Oz.

I am totally new in trading business and I really want to start trading from home. Thank you.

We’re not here to suggest one trading platform over another. Do your own due-diligence and act accordingly.

I recently was offered to be an IM member. This article is very helpful to take into consideration for making decisions about it. Thank you.

Since this article was written Dec 2019, I do have many friends involved with IML since their apparent re launch in early 2020.

It was expressed that MANY enhancements were made for IML to be complaint and hence why they have not been approached by the SEC.

I’m not a member, nor do I plan to be, however I do feel that they have stuck around for 7 years, even with a name change without facing a lawsuit…is there anything current to report in this review since their relaunch? THank you.

1. Feel free to cite any enhancements that might change this review. The fact that you didn’t is telling.

2. Nobody at IM Mastery can speak on behalf of the SEC.

“But we haven’t got shut down yet!” is not a confidence inspiring marketing pitch.

From the history given, they haven’t stuck around for 7 years. To me, it reads like Christopher Terry has been running a succession of different, fairly short-lived, schemes since 2013, but in the same general vein and reusing the same name.

In one case, CFTC intervention forced him into abandoning what he was doing, paying a fine, and acknowledging that what he had been doing was illegal.

Yes, that means no actual lawsuit was needed, but nobody does that unless they know they’d lose that lawsuit and it would cost them even more.

There definitely is no continuous activity with the same business model over the past 7 years, and there seem to be gaps suggesting Terry (or his “company” – that’s rarely a meaningful distinction in such businesses) wasn’t doing much of anything for quite a bit of that time.

Very Well written. Brilliant.

Hello all! I’m just catching up on this subject. Has anything changed? I see they are still going and I have a few friends in the business.

I want to get into trading but I want a legit place to learn etc. I’m not into mom and wouldn’t promote it but I am interested in trading. TYIA!

No updates on my end.

Quote from today’s newsletter:

share-your-photo.com/99ef308c59

direct-selling-magazine.de/delta-team-mit-250-000-mitgliedern-wechselt-von-imarketslive-zu-bydzyne/

Hello! I was wondering if there is any updates yet.

I have been told it’s just an educational platform and you have to manually trade. No bots.

Algorithms = bots.

If you’re putting your money under control of a third-party, and expecting a return solely on the efforts of a third-party (IM Mastery Academy’s bots), that’s an investment contract (securities offering).

AFAIK the pyramid scheme issue is still there.

From experience this is what ive learned or what i believe is what IM Academy is really about, so they do have an educational platform basically from each educator breaking down there strategy so that then you (the affiliate) can go and trade on your own.

But the problem with that is that’s easier said than done. So thats where there most popular strategies come in. Which are basically done for you trading signals that make people feel like they’re actually traders.

Yes, it is up to you (the affiliate) to decide whether to take that trade signal but thats the magic, make people feel as if they’re becoming traders, show others how easy it can be for them as well, and so those steps repeat, which builds the pyramid.

What i can say about IM is to just look at the people at the top of it all and check their resumes.

Just heard that since this week they are under heavy fire in Belgium.

Apparently some investigators from the government services “economic affairs – finance and fraud” went during some months undercover inside the IM network and their findings were detrimental.

Target market especially youngsters with easy money claims such as “become a Millionaire doing absolutely nothing from your mobile phone”, video’s with Lamborghini’s and gold Rolex watches etc.

They have material from inside the meetings and training towards new reps plus facts that 95% from the money comes from recruiting new people with packs and monthly fees, not the trading !

Nothing new I guess to most of us. Vemma was completely destroyed because of targeting College students mainly and the guy behind that is in charge now at IM. So copy cat approach.

Let’s see how this progresses if anyone has more news, shoot.

So I was thinking about joining IM ACADEMY because 2 of my closest friends are already in it and everyone’s getting older and you just have to start working full time or the bag somehow.

So it’s trading currency, what could so bad about that? They’re gonna give you the answers, it’s just copy and pasting, simple as that.

If it was just that, then I’d quit my job for it. But the recruiting parts telling another story. A story that they are hiding, I believe.

So after buying the packet, you have a monthly fee for the program. That monthly fee can be free if you get 2 friends, family, or whoever you know to sign up under your name and if they do the same thing, then they get don’t have a monthly fee. so there a cycle, something going from the top downwards at this point. /\

But the part I like and can be possible is actually learning and processing the trading industry or at least in the currency market.

I’d pay for that but it’s not as easy as you think.

Honestly still undecided atm about IM Academy hopefully I’ll get more details.

LMK if you got more info to help me the process is shit down, thx.

If you’re interested in “learning and processing the trading industry”, ask your friends to give you an example of what they’ve learned from IM Academy.

Get them to speak to you for 7 minutes on the topic. If they can’t, your friends are only interested in recruitment.

And your takeaway would be looking elsewhere for the education you’re after.

What said Oz is right ask to friend or people what they had learn (most of them nothing but recruiting).

Some people are attracted by trading but other only want bigger and faster result by recruiting and at some point almost everyone see their downline leave, so you have to recruit more and more.

About bot and algorithm is not the same things, bot is a software that performs automated task (in ex. bot “viewer” or “follower” on social media or “auto-trader”…) an algorithm is like the one used by IM that give you an input like harmonic scanner but here its up to you trade or not, how much, broker choice and bla bla.

Another thing is what you call “signal”, they tell you are not trade advisor and in the mean time you can copy what educator do at your own will and risk.

Personally: its a grey area? I dont know, maybe.

Do I think is Puffery? yes like every commercial, every company but is legal.

Coffeezilla and IM Academy: youtu.be/_JTuoWWeFOM

Good discussion about their promotors trying to suppress any commentary thats critical/calling them a pyramid scam.

Some of the guy they are chatting to “AlwaysMarco”‘s videos on IM are quite good too, like

youtube.com/watch?v=ObsAU9QJhQU

Thanks for sharing that. Three thoughts:

1. This is why you don’t mix personal life outside of MLM with MLM, if you’re going after MLM fraud.

2. Alex Morton’s brand of millennial pyramid bros are insufferable.

3. If the FTC don’t investigate IM Markets Live and litigate the blatant FTC Act violations, gonna be a whole lot of disillusioned young people.

The next “eVeRyThInG iS a PyRaMiD sChEmE!” generation, which will probably become my problem at some point.

It appears HFX 300, which stands for High Frequency Trading is tied up in this with Dr Joshua Lee and Brandon Boyd heading this in the UK and USA

Apparently have an online event coming up with 400 plus people looking at it.

Not sure whether you can access this link, Oz?

(you might want to disable the link!)

meetup.com/how-to-make-a-substantial-income-online/events/275933689/

Not sure about you, Oz, but I am completely confuddled by yet another acronym – HFX – being added to anything to do with forex or crypto.

Shocking sound quality here:

youtube.com/watch?v=pGapFCUfxa0

Seen mention of Teamworld Marketing International – why does TMI ring a loud bell?

and a load more videos:

youtube.com/user/RONAVIE58/videos

The money in ImarketsLive/IM Mastery Academy/insert future name here has always been in recruitment.

Paging FTC to aisle three, FTC to aisle three.

Page all you like, Oz – they are not listening on this one.

And I doubt Meetup are either.

Reported that event over 8 hours ago – remains up.

Took a while but IM Mastery Academy finally deleted the Delorean trading bot investment video.

I have spoken to plenty of distributors from IM and it confirms completely, the money is in recruiting and monthly fees never in the trading.

The trading gains exposed are to attract especially youngsters, to show them how easy it is to make a couple of hundred dollars a day.

While plus 95% of each leaders back-office I saw is based on new blood and subscriptions.

The moment the recruiting slows down in a certain market, they need to move to a new country where normally you would think people that make a few hundred dollars a day trading they will keep subscribing and being motivated.

Not at all. Like any gambler or player, they only show you their wins, rarely their losses.

IM Mastery Academy is spreading through New Zealand and local media has taken notice:

NZ regulators asleep at the wheel.

nzherald.co.nz/nz/warnings-over-finance-course-spreading-in-maori-pasifika-community/YJILJOSQSJMWQEPDPJQW675P24/

Spain says no more IM academy

twitter.com/criptokenizados/status/1506582031169376261?t=y7LnyGR0S8I5CJfaC3xzTw&s=19

Damn, usually they hold rahrah events and then we see arrests.

Kudos to Spain for taking preemptive action.

And we should not be in the least bit surprised!

I don’t think Chris Terry nor Alex Morton will set a foot in Spain after these latest announcements. Their Barcelona event next month is the perfect spot to get them arrested.

There’s a new push to promote IM Mastery Academy in the US. It’s going by “Quick Turn” or “Quick Turn Strategy”.

Serial scammer Scott Morris (FireTeam1) and his cronies are behind it.

Apparently 8 Minute Trader and Youngevity didn’t work out.