Dunamis Mining Review: Crypto mining unregistered securities Ponzi

![]() Dunamis Mining provides no information on its website about who owns or runs the business.

Dunamis Mining provides no information on its website about who owns or runs the business.

The Dunamis Mining website domain (“dunamismining.com”) was privately registered on October 26th, 2018.

Further research reveals Dunamis Mining affiliates naming Jeremie Sowerby (right) as CEO of the company.

Further research reveals Dunamis Mining affiliates naming Jeremie Sowerby (right) as CEO of the company.

According to Sowerby’s personal Facebook profile, he’s based out of Ontario, Canada.

Despite this, Dunamis Mining represents that it is an Arizona Limited Liability Company.

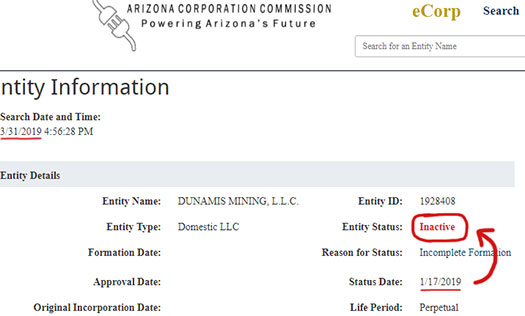

A search of the Arizona Corporation Commission does reveal an entry for Dunamis Mining LLC, however it as has been inactive since January 17th, 2019.

The stated reason for Dunamis Mining LLC’s inactive status is “incomplete formation”.

As such, outside of a non-active US shell company, Dunamis Mining doesn’t appear to have any registered business operations in the US.

Owing to Jeremie Sowerby being based out of Canada, it is assumed Dunamis Mining is also being operated out of Canada.

In 2017, Jeremie Sowerby was promoting My Trader Coin.

My Trader Coin touted $550 day returns through cryptocurrency trading. In reality it was a Ponzi scheme and collapsed around six months after launch.

Prior to getting involved in cryptocurrency scams, Sowerby was a Kyani affiliate through Team Fusion.

Read on for a full review of the Dunamis Mining MLM opportunity.

Dunamis Mining Products

Dunamis Mining has no retailable products or services, with affiliates only able to market Dunamis Mining affiliate membership itself.

The Dunamis Mining Compensation Plan

Dunamis Mining affiliates invest funds on the promise of a daily passive return.

- invest $1400 and receive a daily ROI for one year

- invest $3200 and receive a daily ROI for three years

- invest $4200 and receive a daily ROI for five years

Additional electricity fees are also charged after one, three and six months respectively.

The MLM side of Dunamis Mining pays affiliates who have invested to recruit others who do the same.

All returns and commissions in Dunamis Mining are paid out in bitcoin.

Dunamis Mining Affiliate Ranks

There are twelve affiliate ranks within the Dunamis Mining compensation plan.

Along with their respective qualification criteria, they are as follows:

- Affiliate – sign up as a Dunamis Mining affiliate and invest

- Prospector – generate 10,000 GV in downline investment volume

- Bronze – generate 25,000 GV in downline investment volume

- Silver – generate 50,000 GV in downline investment volume

- Gold – generate 100,000 GV in downline investment volume

- Platinum – generate 200,000 GV in downline investment volume

- Titanium – generate 300,000 GV in downline investment volume

- Executive – generate 500,000 GV in downline investment volume

- Director – generate 1,000,000 GV in downline investment volume

- Vice President – generate 2,500,000 GV in downline investment volume

- Senior Vice President – generate 5,000,000 GV in downline investment volume

- Chairman – invest 10,000,000 GV in downline investment volume

GV stands for “Group Volume” and is sales volume generated via investment of directly and indirectly recruited affiliates (collectively referred to as a downline).

Note that the Dunamis Mining compensation plan doesn’t disclose corresponding GV to invested funds.

Recruitment Commissions

Dunamis Mining pays recruitment commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Dunamis Mining cap payable recruitment commissions down four unilevel team levels.

Recruitment commissions are paid out as a percentage of funds invested across these four levels as follows:

- level 1 (personally recruited affiliates) – 15%

- levels 2 to 4 – 1%

Residual Commissions

Dunamis Mining pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Investment volume is tallied up on both sides of the binary team.

Dunamis Mining affiliates are paid a percentage of funds generated on their weaker binary team side.

How much of a residual commission percentage is paid out is determined by how much a Dunamis Mining affiliate has invested:

- invest $1400 and get paid a 10% residual commission rate

- invest $3200 and get paid a 12% residual commission rate

- invest $4200 and get paid a 15% residual commission rate

Note that Dunamis Mining’s compensation plan doesn’t state whether residual commissions are paid out daily, weekly or monthly.

Matching Bonus

Dunamis Mining affiliates are paid a 5% Matching Bonus on “total earnings” paid to personally recruited affiliates.

Enrollment Bonus Pools

Dunamis Mining takes 6% of company-wide investment volume and places it into three separate Enrollment Bonus Pools.

- Gold and higher ranked affiliates receive a share in one 2% pool

- Executive and higher ranked affiliates receive a share in two 2% pools

- VP and higher ranked affiliates receive a share in all three 2% pools

Rank Achievement Bonuses

Starting from the Prospector rank, Dunamis Mining affiliates receive the following Rank Achievement Bonuses upon qualification;

- qualify as a Prospector = $500

- qualify as a Bronze = $750

- qualify as a Silver = $1250

- qualify as a Gold = a “semi-annual all expenses paid dream trip in the continental US”

- qualify as a Platinum = $5000

- qualify as a Titanium = $5000 (not a typo)

- qualify as an Executive = a “one time all expenses paid island destination luxury vacation”

- qualify as a Director = a “new Tesla Model 3 luxury vehicle”

- qualify as a Vice President = a “new Tesla Model S luxury vehicle”

- qualify as a Senior Vice President = a “new Lincoln Navigator (black label edition)”

- qualify as a Chairman = a “new Bentley Continental GT (W12 engine)”

Joining Dunamis Mining

Dunamis Mining affiliate membership is tied to a $1400, $3200 or $4200 investment.

The more an affiliate invests the higher their income potential via the Dunamis Mining compensation plan.

Conclusion

By their own admission, Dunamis Ming and their affiliates are marketing a passive investment opportunity:

DUNAMIS IS “CRYPTO MINING SIMPLIFIED”

TOTALLY TURN KEY SYSTEM!

WHAT’S YOUR ROLE?

– BUY IT

– SIT BACK AND RELAX

– MAKE HUGE PROFITS

A MLM company offering a passive investment opportunity constitutes a security, which in the US requires registration with the SEC.

At the time of publication neither Dunamis Mining or Jeremie Sowerby are registered with the SEC.

By not registering with the SEC, Dunamis Mining, Sowerby and promoters of the scheme are committing securities fraud.

At the time of publication, Alexa estimates the US is the only significant source of traffic to the Dunamis Mining website (23%).

Furthermore Dunamis Mining is fraudulently representing it is an Arizona Limited Liability company, and that it is “authorized to conduct business throughout the United States”.

Dunamis Mining, LLC (“Dunamis”) is an Arizona Limited Liability Company that leases “H.C.S.M.S.” space a.k.a (High Capacity Secure Mining Space) and technologies for the sole purpose of mining cryptocurrencies.

Dunamis is authorized to conduct business throughout the United States of America and is in full compliance with all state and federal laws, statutes and regulations.

This is a flat-out lie. The Arizona company is inactive and Dunamis Mining is not registered with the SEC.

Note that even if the Arizona incorporation was active, that still does not authorize Dunamis Mining to offer securities in the US.

There is also no indication Dunamis Mining has registered with securities regulators in any other jurisdiction, meaning the company is operating illegally the world over.

As per Dunamis Mining’s marketing material, the company claims to generate ROI revenue through cryptocurrency mining operations.

Two properties Dunamis Mining claims to own in Arizona are owns are “6760 S. Clementine Ct, Tempe, Az 85283” and an undisclosed location in “Pine Top farm, in Pinetop, AZ”.

Note that these claims alone are not enough to satisfy securities regulations.

Nor are they a substitute for audited accounting, which Dunamis Mining would be required to file if they were registered with the SEC.

The same is true of social media marketing fodder, such as photos of purported mining hardware and/or farms.

Given Dunamis Mining LLC has been inactive in Arizona since January, they’ve had plenty of time to correct the filing and register with the SEC.

In fact this should have been done before investment was solicited from the public.

Instead we have Dunamis Mining soliciting investment illegally, on unsubstantiated promises and lies.

There is only one reason for Jeremie Sowerby to continue to operate Dunamis Mining as a fraudulent operation – and that is that the company isn’t doing what it says it’s doing.

As it stands the only verifiable source of revenue entering Dunamis Mining is new investment.

Using newly invested funds to pay existing affiliates a daily ROI makes Dunamis Mining a Ponzi scheme.

Commissions paid on downline invested funds also adds a pyramid layer to the scheme.

Pay to play is also evident, with how much an affiliate investing directly impacting MLM commissions paid out.

As with all Ponzi schemes, once affiliate recruitment slows down so too will invested funds.

This will starve Dunamis Mining of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 16th December 2023 – Dunamis Mining and Dunamis Global Tech owner Jeremie Sowerby has been indicted.

This article is entirely false. It is obviously written by a piss poor excuse of a journalist because they did no research at all.

The company name is NOT Dunamis Mining. It’s Dunamis Global Technologies.

They are indeed a registered business which you can see here: ecorp.azcc.gov/BusinessSearch/BusinessInfo?entityNumber=1928389

Dunamis Mining was Jeremie himself mining solely. It was his business for himself not a business for anyone else. It’s where he figured it all out.

Dunamis is a licensed hosting company for mining equipment and offer leases within their facilty for customer owned machines. The leases cost $1400, $3200 and $4200 and people are paid a commission when they sale a lease.

They do no earn residual from this at all. Nor does the purchaser of the lease earn any residual. This is a lease for the space only.

They buy a machine and host it in that space. Their machine pays them directly 1000% of the time. There is never any co-mingling of funds, no profit share nor is this a mining pool.

This article is so poorly written you would think it was your first one. Furthermore the comp plan is not even correct . Please at least do some due diligence before you assume and slander a company.

The correct URL is (Ozedit: derail removed)

There is no mention of Dunamis Global Technologies on the Dunamis Mining website. Nor is it the opportunity being promoted.

This is what is on the Dunamis Mining website:

I do not care what Dunamis Global Technologies is (lulz shell company compliance lulz), this is a Dunamis Mining review.

Not that it matters, because the Dunamis Global Technologies domain you tried to linked to redirects to Dunamis Mining.

Why is the MLM crypto niche populated with the dumbest shit for brains fucktards the world has ever seen?

Ponzi scheme that is not registered to offer securities in the US.

My source material is Dunamis Mining’s own compensation plan material.

PS. How did the BitClub Network, Ormeus Global and Crypto World Evolution scams work out for you?

Stop dickriding Ari Maccabi and making excuses for Ponzi scammers.

I just told you that Dunamis Mining is not the name of the business nor are you looking at the correct website for the business you are writing about. You are talking about two different companies and one website that forwards to another.

Dunamis Mining does not exist any longer. Dunamis Global Tech does.

Furthermore you do not need an SEC license to sell Hosting…. (Ozedit: offtopic derail attempts removed)

Ey, dumbass. Did you try visiting the Dunamis Global Technologies domain you tried to link to? It redirects to Dunamis Mining.

It’s the same scam run by the same person. The SEC won’t give any fucks and neither do I.

Anyone can visit the Dunamis Mining website and verify you are full of shit.

Dunamis Mining isn’t selling hosting. It’s selling a passive investment opportunity, which constitutes an unregistered security.

From a regulatory perspective, the vehicle through which an unregistered securities offering is made is irrelevant.

This close to perma spambin…

There is no passive income opportunity. (Ozedit: sure there is, see review. Bullshit fantasy removed.)

Lulz, story keeps changing. GTFO.

Stick to scamming Philippine villagers hey. Your BS excuses for fraud won’t work on anyone with half a brain.

I just keep myself away, know exactly how Ari Maccabi works, full of junk all the time he sees the best I’ve seen and just talks, after 3-4 months the same thing again the best I’ve seen ….

Check out facebook to him you see… 😉 Bullshit fantasy…

Oh boy, I have a feeling “TheTruth” is in for a very rude awakening!

When you have the likes of scumbag, scamming, Steve Lawson on your side, you are in serious trouble!

Yes is 100%…

don’t tell Chunky Lardson that or he made a trip for nothing. LMAO!

don’t tell him that either or he won’t be able to rope in any marks. wait……….that’s why you’re here.

Ponzi slob Ari Maccabi – Besides all his cheezy ponzi pimping of ever increasingly ridiculous scams….

There is this: sexoffendersarchive.com/zipdirectory/IN/46038/Schlomo_Aryeh_Maccabi_661905

Their website says they host & maintain the mining equipment. It says that the machine is 100% owned by the purchaser while they maintain it for them at a certain rental rate.

Profits from mining is 100% paid to the machine owner while the referral commissions are paid from the rental income received for hosting the machine.

There is no investment plans discussed on the website. How is this a scam? Why do you need SEC’s permission to operate & maintain a mining facility?

Because “their website says” and not mentioning the word investment to describe an investment opportunity are not substitutes for securities law.

You don’t. Dunamis Mining needs to register its passive investment opportunity with the SEC.

Which part are you referring to as the passive income opportunity?

The part where you dump money into Dumanis on the expectation of a passive return.

If I own my machine 100% which is mining & giving me returns but they are just helping me host & maintain my machine & all I pay them is rental for doing that for me, how can that be a passive investment opportunity?

The machine is mine. Whatever crypto the machine is mining whether little or not, is 100% mine but I am just leasing their space for doing this.

I just think that it’s important for them to be a registered company to provide this service but SEC license is not needed as they don’t own the machines or hold the mining returns.

Whether you own anything is immaterial to the fact you deposit money into Dunamis on the expectation of a passive return.

That’s a securities offering and requires registration with the SEC.

There’s also the problem of you not being able to claim to own anything within Dunamis Mining, in the absense of audited accounting proving as much.

These accounting reports are part of SEC registration, and are legally required investor disclosures.

Otherwise Dunamis Mining can shoot a few social media videos, tell you what you want to hear and then you come on here parroting what you’ve been told.

…oh wait.

Wonder,

The original case that decided the Howey Test included a virtual carbon copy of the lease arrangement claimed by Dunamis.

Here’s the test:

-It is an investment of money

-There is an expectation of profits from the investment

-The investment of money is in a common enterprise

-Any profit comes from the efforts of a promoter or third party

Sound familiar?

It’s very clear to all but willfully ignorant Ponzi Pimps and the extremely illiterate that Dunamis is a security and must be registered with the SEC to be sold in the US.

consumer.findlaw.com/securities-law/what-is-the-howey-test.html

Not quite. I am paying for the machine. I get my machine. I plug it into Dunamis’ the hosting service. I am not buying a mining contract in expectation of promised profits. I am merely buying a machine & using their hosting service.

So it’s just a straight up take the machine, plug it into the mining facility & mine. Dunamis does not hold any of my money or crypto here. Whatever my machine produces, I receive it. Whereas if Dunamis sells a mining contract, that MIGHT indicate a passive investment opportunity.

I don’t know if the SEC even governs purchase of machines & hosting of mining facilities.

Cool. If you receive a physical machine and use it outside of Dunamis Mining then they aren’t operating an illegal investment scheme.

That’s not what happens though, so can it with the pseudo-compliance bullshit.

You dump money into Dunamis and they pay you a passive return. That’s a security and requires registration with the SEC.

Getting tired of repeating this but with respect to securities law how a securities offering is set up doesn’t matter.

Have you even looked into the Howey case and subsequent decision ?

That’s good – when Dumamis Mining collapses you won’t be disappointed.

And you can plug your Dumamis machine into someone else’s hosting and carry on earning.

Only question is, if you can plug your Dumamis machine into someone else’s hosting, then why not do that now, into a host which will be able to pay you much higher returns because they aren’t paying eye-bleedingly high MLM commissions?

That’s exactly the thing. You can choose to buy the machine from Dunamis OR you can choose to plug in your own mining machine which you might have bought before into Dunamis’ hosting facility.

What Dunamis is selling is a leasing contract for the space that you are occupying & electricity. They bill you every month for the electricity you consume & thats all.

If you fail to pay up your electricity then the leasing contract ends. So, i can buy my own machine & mine it on my own or choose to make use of Dunamis’ facility.

Either way its not an investment plan. Referrals are paid out of leasing contracts sold but not from cryptos mined as the cryptos mined purely belong to the person who owns the machine.

I don’t see anything wrong in paying referrals to those who recommend leasing contracts offered by Dunamis.

well, no you don’t. scammer chunky lardson has already proven none exist.

1. buying a machine and running it outside of Dunamis doesn’t negate or legitimize the alternative securities offering.

2. calling dumping money in Dunamis on the expectation of a passive return “plugging in your own mining machine”, doesn’t change the fact that it’s a securities offering.

You invest funds in Dunamis on the expectation of a passive return. That’s a securities offering, irrespective of the story attached to it.

You keep being told how an unregistered securities offering is set up doesn’t matter, and come back with even more “but I own my own machine!” irrelevant waffle.

And one thing you can’t prove without SEC registration and filed audited accounting, is that Dunamis is paying you with external revenue. Another reason securities regulation applies (investor disclosure).

Wonder,

Obviously you’re a willfully ignorant Ponzi Pimp since no passive investor having their own machines hosted would go to such silly lengths of spin.

Substance over Form also discussed in the link I posted above deals with scammer shenanigans like yours. As most if not all Dunamis investors will not be buying their own machines your argument is irrelevant.

There is zero information on the Dunamis site about the costs associated with plugging in ones own machines that I saw. Maybe they do that for free too, like Secret Santas of the Desert.

Doesn’t matter though since Dunamis is a common enterprise, soliciting money, and alleging profits that come solely from their efforts. Hence a security under the law in the US.

Hello everyone,

I’ve been recently introduced to Dunamis website which is still in a total mess as I think whoever is programming/hosting it knows nothing about IT rules and how websites exactly work on the Internet.

This is not why I am here, in brief I wanna know if I can really dump $4400 into this “company” or not, I’m lost and everything that has been said above makes sense (from both parties), as a US resident I DO NOT want to break any laws and later be chased by IRS.

They allowing those who wanna invest to pay a visit to their facility, this does not yet legitimize the business in general, as AZ is a US territory, now the guy who usually goes live on fb lives somewhere in the Philippines, the company’s address is in Canada, the programmer is indian! what is going on here???

all that doesn’t really matter, I’m quite sure that any business in the US Must be legitimate (unless it’s under the table), this company claims they’re legal, on the other hand they have no SEC license, forgot about all that, is this a real opportunity for me to start dumping my US dollars?

is there any other company that I can invest with (MINING) that is legitimate? I am a US resident, so companies operating in, for instance, Australia are not a choice.

Thanks guys, awaiting your prompt response !

The Unknown Warrior

It’s a “real opportunity” in the sense you can very much dump your money in it and receive a passive ROI by scamming others.

But Dunamis Mining or whatever they’re calling themselves now is an illegal unregistered securities offering. Which lends itself to Ponzi and pyramid fraud.

I’ve yet to see a single legitimate MLM crypto related company. The whole MLM crypto niche is basically a scam.

6760 clementine ct. Look it up at nowminingupdates.com.

Luis Ortega started Nowmining and VIPmining at this location, now he is on the run from the law. Magically all these machines are there ready for the next scammer to step in.

I can’t imagine waking up each day with my primary focus to be figuring out ways to not work, while putting together a scheme to steal other people’s money.

World is full of darkness and the evil schemes of wicked men will not go unpunished.

Guys, thanks a million for your feedback, it means the world to me,

I do feel sorry though 4 those who fell into their trap, I never will be part of their group/groups, but I’m sure there are some poor guys who already are.

ohhh, guess what! recently they posted a link which takes you to an INSECURE website that offers quick loans, what the hell does Mining have to do with loans?!

moreover, they’re asking applicants to put in their SSN !!!!! as I said, the link they posted is an http, not an https, I guarantee you that there’re millions of people who don’t even recognize the difference between the 2! they will simply click on the link and never notice it’s an insecure website.

I wish I could tell whoever fell into their trap about this, the US government Must throw their asses in jail, I will spare no effort to warn those who might think to spend their savings on an illusion created by a devil-driven minds like theirs.

Well, the question remains:

Theoretically, why can’t I do it myself no matter how much I’m gonna pay for Electricity ? logically, can I buy the machine and start mining on my own without utilizing anyone’s service for hosting my machine ?

Hi guys,

Can I buy FPGA or Z-Miner and operate it myself without the need of hosting it somewhere (like the above company Dunamis)?

Thx!

Sure. Why not.

Anyone can buy a FPGA or z-cash miner and start mining for whatever their current electricity cost is by the kWh.

Whatever info you got is not correct or is ‘outdated’ because that’s NOT what’s being promoted today.

I’ve personally been to their corporate headquarters & also to their hosting facility. The ONLY thing they’re selling is “Hosting Space & Maintenance”.

You can also provide your own Mining rigs because once again, their product is with “Hosting & Maintenance”.

Will you make an ROI on your mining rig? Maybe… or maybe not. That’s entirely up to the crypto market and has NOTHING to do with Dunamis.

Whatever coins you mine are 100% yours. No one else even has access to your wallet.

Sorry to burst your bubble, but there is no ‘security’ issue here. All that you’re buying is “Hosting & Maintenance”.

What you can and can’t do with your own rigs doesn’t negate that I can invest thousands of euros with Dunamis Mining, go jerk off in the corner and they’ll pay me a ROI.

MLM passive investment opportunities = securities offering. And in order to operate legally, companies offering securities need to register with financial regulators (the SEC).

Cryptocurrency investment opportunities are not exempt from the Securities and Exchange Act.

Late with mining payouts because the owner is swindling everyone’s money driving around town in a rolls Royce.

He’s a Canadian scammer and hasn’t the slightest clue of how to operate a business. His entire corporate team are a bunch of dummies with the strongest talents in idiocies.

Do a little digging around and I’m sure the final word is the company is stringing along hurting for cash.

Don’t mess with the greatest country, you’re in for a rude awakening pal!

The latest with this joke is a “merger” w Onyx Lifestyle.

There is a “would even village idiot believe this?” quality to this video.

youtube.com/watch?time_continue=1442&v=3Fc19vfDqh8&feature=emb_title

Well actually Jeremie Sowerby is a lying cheating scammer. Dunamis is a joke! He’s been taking payments for hosting as well as supplying the rigs. Except the rigs don’t exist, the facilities aren’t even in his name.

The crummy btc rigs they tried to offer ‘some’ of the people who have paid up (some big big bucks I might add) are crusty old shit electricity sucking low return rigs that aren’t worth Jack so guessing from reading above they were apart of another failed venture and left at the facilities.

Its all an elaborate scam care of Jeremie & crew… If you have been played by this con artist report to the FBI & report to the SEC ASAP…

Facilities and what rigs there need to be locked down, his original sidekick is trying to onsell to the first in best dressed. Dont get played a second time!

If the guy was legit he’d be reporting it to the FBI himself!

Jeremie is a big girls blouse who’s hiding behind mummas apron strings and hasn’t even got the balls to answer his phone…

People have started lawsuits against him, but it’s not civil go to the FBI what hes done is a crimimal matter, theft & fraud left right & center… If you see the slimeball on the street call the FBI to come & pick him up before he blows it all up his nose or down some strippers panties.

This son of a missionary will be bringing daddy and his entire parish to shame… his wife has already given him the arse so its been said… half the companies used for this scam are in her name!

Hes scammed retirees out of their life savings, people have mortgaged their homes, disability pensioners you name it the guy will stop at nothing to feed his own greed.

Try and hide behind the church this time you jerk!! It’s not just the innocent people hes robbed blind but decent innocent leaders, mentors & figureheads conned into introducing it to their friends & social circles.

People who have been to the facilities, seen all the videos, believed all the lies.

It’s all one big can of bullshit created by Jeremie Sowerby but his days are numbered the fool he might have put on a good con but we are coming after you you slime ball!

A few months and good lawyers can achieve wonders! Verified intel says that Sowerby was scammed out of $4 Mill personally, along with many investors, by a thief involved in Dunamis who continues to operate the Dunamis Pinetop AZ facility.

That scammer grabbed the Tempe AZ facility too, but Sowerby sued his ass off and won.

The scammer has no money and continues to cheat people, Sowerby was and remains totally legit and clean and is making former Dunamis investors whole! Big time kudos to him! Many others are going after the Pinetop scammer, not just Sowerby. Hope this helps.

And what was the source of this money? If it was through Dunamis itself or a past Ponzi then Sowerby didn’t lose anything, his victims did.

Cool. Lawsuit details please.

People who promote and launch Ponzi schemes aren’t “legit and clean”. Whole comment reeks of bullshit TBH.

A person’s sources of personal wealth are just that, personal.

Those who were made whole know all the details and are grateful.

Do your own DD, anything I say will be insulted over and over. Put simply, it’s the truth.

Yes he does.

Thank you for confirming you have no supporting evidence to back up your claims.

Best of luck with the scamming.

Jeremie is Lee Smith. Talking just like him self.

That’s the thing about Jeremie he plays savior and then victim it’s how he operates over and over again. Scam after scam.

He comes up with “a plan” when the money cuts off and drags it out until people just feel too stupid to keep fighting for their money.

He has and continues to ruin so many lives. He doesn’t care who he hurts. He’s been involved in a handful of crypto scams.

He knows the drill and repeats it over and over with new people, same scam different names. STOP GIVING THIS MAN YOUR MONEY!

Wow, you guys must be paid posters, paid by the competition. Truth doesn’t change with the telling, I was made whole. Ask any Dunamis investor – we were all made whole!

Do your own DD, otherwise stop yapping false information for personal gain!

How exactly were you “made whole”? Only if you were paid in CASH, not IOUs, can you be “made whole”.

If you were paid in worthless “new” tokens/whatever in the NEW scheme, then it’s just MOTS: more of the same, just to string you along another year or two.

You know what’s the definition of insanity? Doing the same thing over and over and expect different results.

Whether you managed to steal back what you invested in Dunamis after it was sold off to another Ponzi scheme is neither here nor there.

You weren’t all “made whole” through Dunamis, because math is math.

How come Perennial Ponzi Pimp Ari Maccabi tells everyone:

“The Owner stole the money”?

SD

Now someone is telling porkies. You see Ari Maccabi was in Dunamis and he said and I quote:

Only a very few people got their money out as they were at the tippy-top. So that means you were one of the top people if you really did get paid as you claim.

So want to run that story by us again how EVERYONE was made WHOLE?